If one’s bullish on precious metals despite a modest pullback, high-quality exploration & development plays are attractive at today’s levels, but still risky. The chasm between “a few years” from production and being IN PRODUCTION is wide and fraught with risk.

I like producer Guanajuato Silver (TSX-v: GSVR) / (OTQX: GSVRF). Admittedly, it hasn’t been smooth sailing. Keeping costs under control and a strong Mexican peso (until about a year ago) have been headwinds.

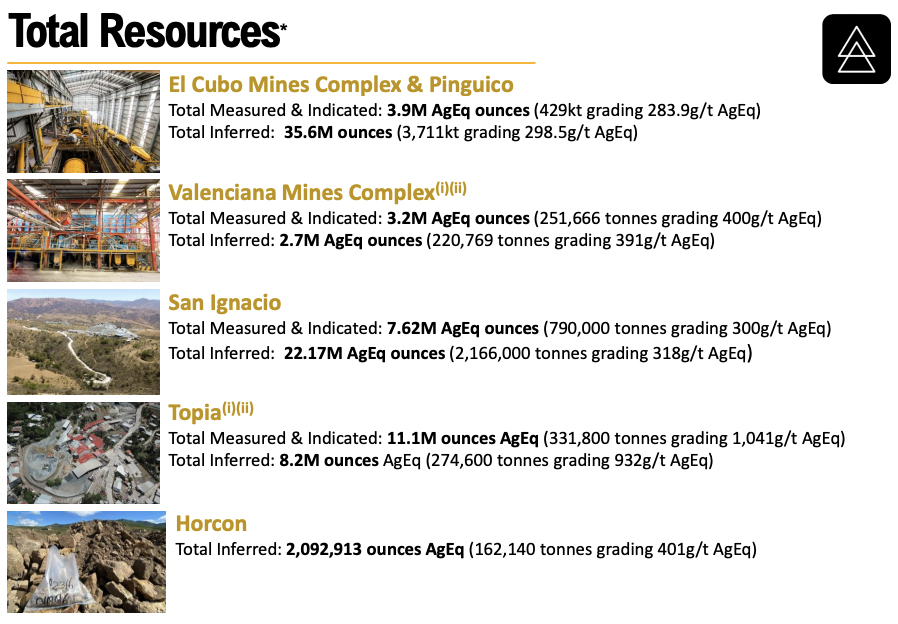

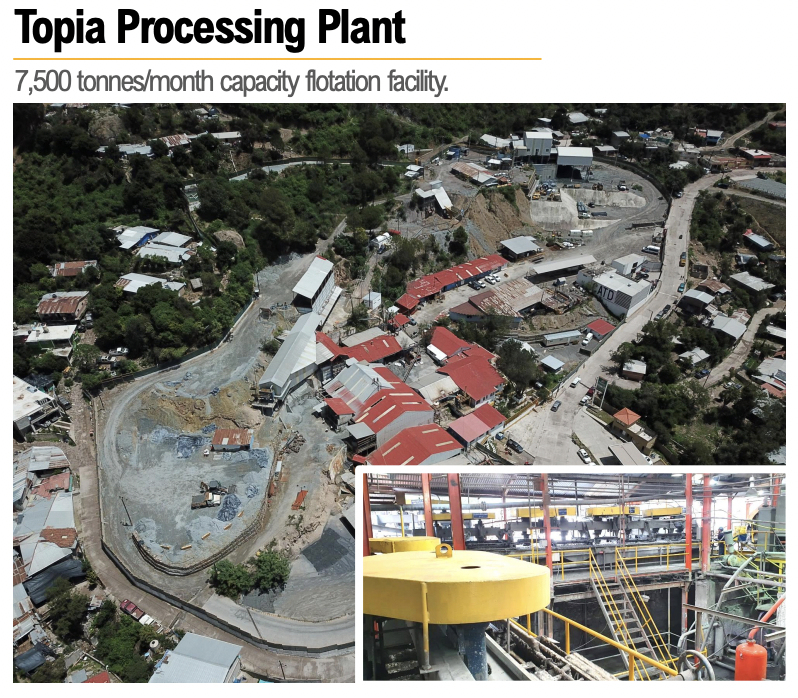

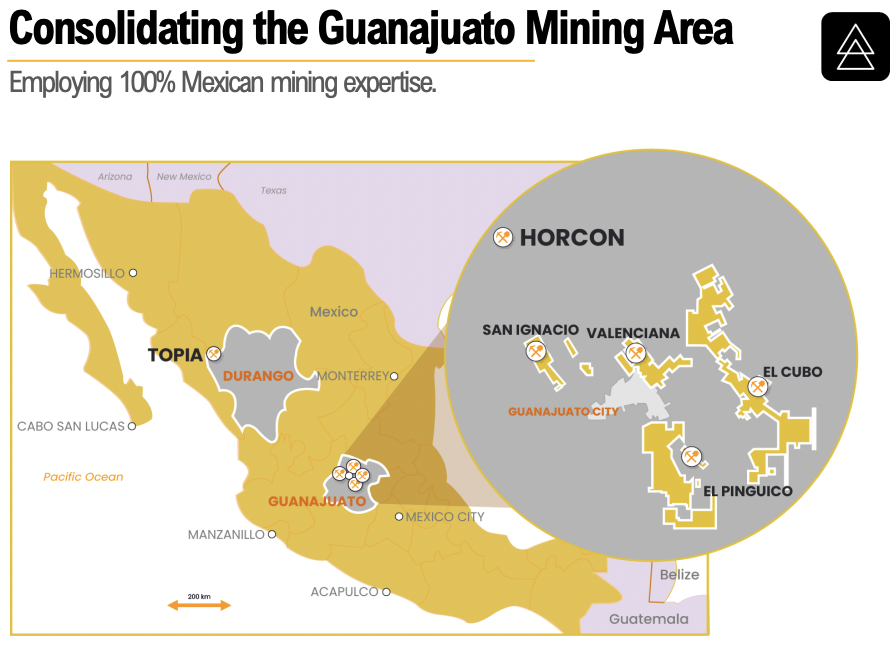

This is a Company with four mines + three mills, all in operation. Three have resource grades ranging from 280 to 410 g/t Ag Eq., roughly 2.8 to 4.1 g/t Au Eq. The fourth mine, Topia, has 19.3M ounces at nearly 1,000 g/t Ag Eq. That’s almost 10 g/t Au Eq.

Importantly, all four mines are open for resource expansion. CEO James Anderson teases readers about an upcoming press release on recent exploration efforts in the following interview.

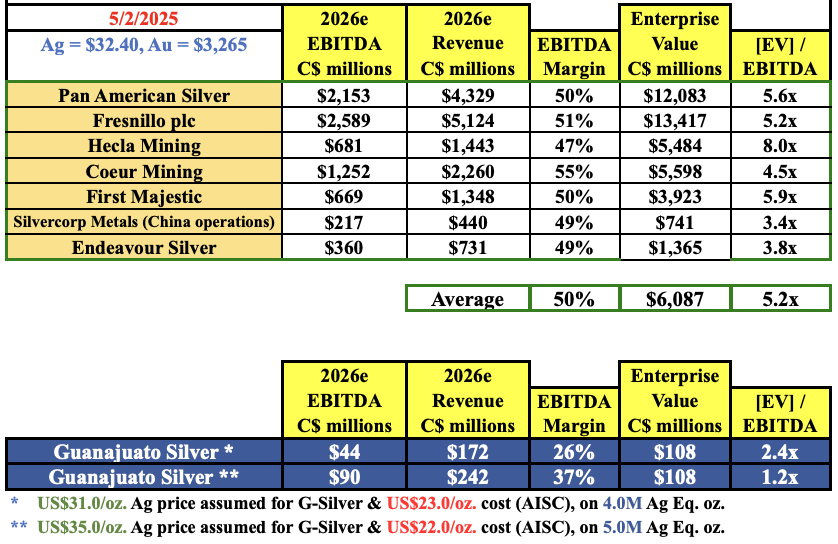

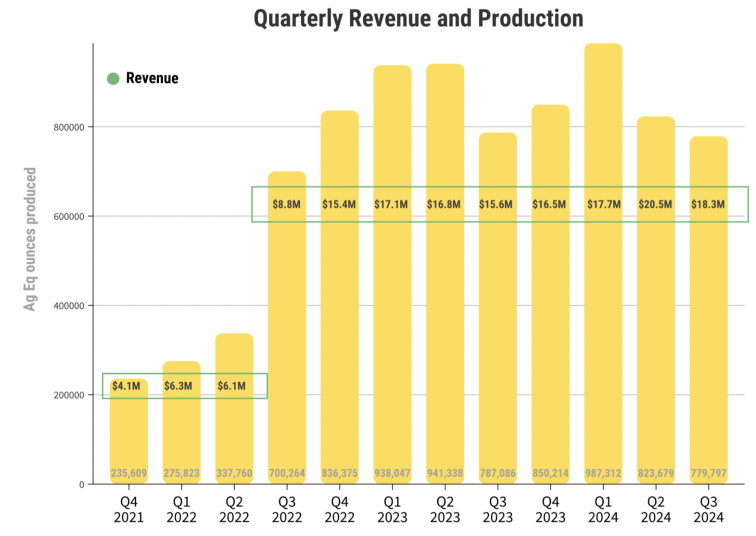

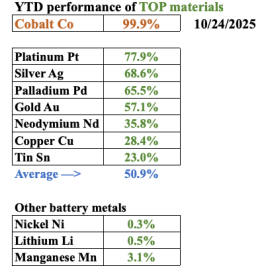

With Au around $3,265/oz (down from $3,500 late last month) & Ag ~$32.50/oz, Guanajuato has reported three profitable quarters. The Au: Ag ratio, currently around 100:1, has been this high or higher less than 2% of the time in the past 50 years.

The long-term average is ~61:1. If Au remains at $3,265, and the ratio falls to 80:1, we’re looking at $40.8/oz. Ag. The ratio was 73:1 in May 2024. That would launch Ag to $44.7/oz. Readers are reminded that the inflation-adjusted all-time high in 1980 is ~$205/oz in today’s dollars.

While not company guidance, I’m hopeful Guanajuato can exit 2025 at an annual run-rate of 3.50-3.75M Ag Eq. ounces and an AISC of US$22-$23/oz. I base that indicative AISC range solely on the benefits of an uptick in volume, which is not a sure thing.

By the end of next year, I hope to see M&A having increased annual run-rate production to > 4.0M Ag Eq. ounces, perhaps > 5.0M, but again, that’s not company guidance.

Debt is under control as the Company rescheduled its gold loan with Ocean Partners such that it now owes ~132 ounces/month (~10% of monthly Au produced) for 36 months.

Guanajuato Silver is valued at a significant discount to peer producers, albeit much larger ones. In the above chart, compare the Company’s 2.4x 2026e EBITDA multiple to peers at an average of 5.2x.

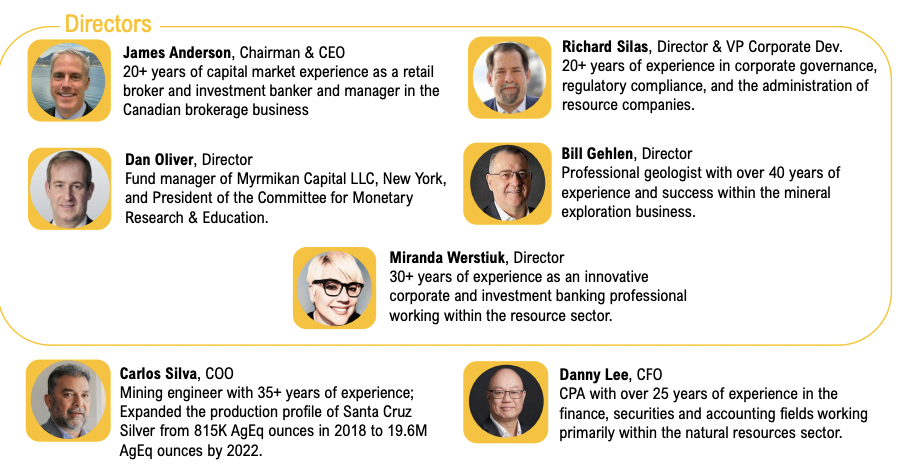

To learn more about the latest happenings at Guanajuato Silver, I caught up with CEO Anderson for a timely update. This interview was conducted on April 30th & May 1st.

In what ways have the U.S. President’s tariffs, economic uncertainty, and negative comments on Mexico impacted the operating environment for Guanajuato Silver?

We mine Au/Ag-bearing rock, process it into an Au/Ag concentrate, and sell the concentrate in the Mexican port of Manzanillo. We get U.S. dollars for our products, and most of our expenses are denominated in pesos.

We have experienced no direct impact, good or bad, from the new U.S. Administration’s tariffs/proposed tariffs. The economic uncertainty has driven Au prices higher (good for business) and driven the peso lower (very good for business).

The significant global uncertainty around trade, tariffs, and geopolitical alliances, not to mention conflicts like Russia/Ukraine, the Middle East, and now India/Pakistan, does not seem likely to go away anytime soon. Those factors are supportive of the strong move in precious metals.

Guanajuato Silver was Mexico’s fastest-growing producer for several years, but in recent quarters, growth has stalled. Why has growth stalled, and what can be done to fix the problems?

We have now announced three straight quarters (Q2, Q3, and Q4, 2024) of positive mine operating income. From a standing start in 2021, we have four operating mines feeding three processing facilities, and a host of ancillary operations.

We remain focused on growing our production both organically and through additional acquisitions. Despite higher Ag/Au prices in the past year, it remains a buyer’s market for mining assets in Mexico, especially stranded deposits in need of a mill.

Is Guanajuato Silver looking at tuck-in acquisitions? If not this year, perhaps next year?

Yes, absolutely. We have taken advantage of opportunistic moments in the marketplace to buy mining assets at pennies on the dollar. Looking for bargains and/or immediately accretive acquisitions is our forte; we are very interested in continuing to expand our gold & silver mining business in Mexico.

We are always looking at prospective transactions that could be a win-win-win for our shareholders, asset vendors, and local communities.

Has the Mexican peso been a problem in the past few quarters?

The Mexican peso’s weakness has been very helpful. In the last few weeks, we have seen a counter-trend strengthening of the peso, but we think that will reverse when the weakness in the U.S. dollar reverses.

Although a bit higher in recent weeks, the peso is down ~15% vs. the US$ since last summer.

Can you update readers on the status of various operational initiatives, some of which have yet to materialize?

Yes, we remain optimistic on several initiatives like accessing the Santa Niño area of our San Ignacio mine with the recently completed 430 Ramp, and accessing deeper, higher-grade material at the Villalpando vein at El Cubo.

Also at El Cubo, we are completing tunnelling past the Violetta fault to access the Villapando vein to the south, there called Cebolletas. This is a new area that can potentially add to production tonnage for years to come.

Please comment on the exploration potential across your portfolio, the organic growth of resource ounces.

Our mines have been in production for 14 years, 70 years, 140 years, and 450 years in the case of Valenciana! There remain incredible exploration & expansion possibilities at all four mines.

We drill continually at our Topia mine in Durango and our three mines in Guanajuato on a ‘rotational’ basis, with one or two of the mines being drilled at all times.

We will have an exploration news release out shortly highlighting several areas of success that we have enjoyed in the last several months.

Thank you James. It seems as if the Company has turned the corner and that 2026 could be a BIG year. Of course, I thought that 2024 and 2025 would be BIG years…

This time is different, most notably as operations have been, and continue to be, fine-tuned, and Ag/Au prices have soared. I look forward to the press release you mentioned and to the possibility of tuck-in acquisitions.

Disclosures/disclaimers: While Guanajuato Silver is not a current advertiser on Epstein Research, it was in the recent past and could be again. Peter Epstein of Epstein Research should be considered biased in favor of the Company. Mr. Epstein owns shares of Guanajuato Silver bought in the open market. This is a high-risk, high-reward investment opportunity. Readers should consult with investment professionals before investing in small-cap stocks like this one.

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Guanajuato Silver are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply