Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) has had a very nice run from oversold levels, but its Troilus Gold project remains meaningfully undervalued compared to mines owned by Agnico Eagle, IAMGOLD/Sumitomo, and Artemis Gold.

Yes, there’s a BIG difference between being in production today vs. planning to be in production by 2029…

However, given current gold (“Au“) & copper (“Cu“) prices, I believe there’s a strong likelihood that Troilus, or an acquirer, will get the 13.0M Au Eq. oz Troilus project across the finish line.

Management, led by CEO Justin Reid, has been saying that final terms for a debt package of ~US$700M will be announced this year. That would be a very significant de-risking event.

In addition, a royalty transaction totaling US$300-$400M should be signed. Some have complained that the royalty deal is taking too long. However, if Au, Cu & silver prices remain stronger for longer, the terms for Troilus will keep getting better.

Even after a debt + royalty package there’s significant risk of cost overruns and/or delays that require US$100s of millions in equity issuances. For now the plan is to keep project equity to about $100M.

Regarding permits, I presume the Province of Quebec will not be difficult to deal with. Several Quebec institutions have, or will likely end up with, direct economic interests in the Troilus project.

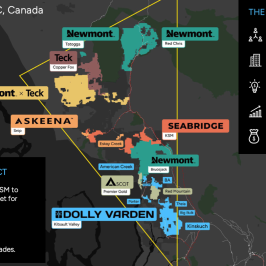

50/50 JV with Alamos Gold in center of property holdings

No special consideration or cutting corners, but relatively smooth sailing is a reasonable expectation.

There’s substantial execution risk in building & commissioning a large Au/Cu mining complex, even in mining-friendly Quebec.

To reduce & manage those risks, CEO Reid & the board have recently hired highly experienced senior execs, and are looking to retain more.

Readers are reminded that the Troilus project is on a past-producing mine site with over US$500M of regional infrastructure in place. Notice in the above map that Alamos Gold has a 50/50 JV with Troilus less than 20 km away.

Also supporting relatively smooth sailing towards production (post funding being wrapped up), is a strong ESG approach dating back years.

The following slide from the latest corporate presentation demonstrates why Quebec’s government bodies & agencies should have comfort in awarding permits & approvals for the Troilus Gold project.

Strong ESG credentials are also attractive to potential acquirers & strategic partners. Make no mistake, plenty of risk remains, but much of it revolves around funding, and funding is being addressed in the context of strong underlying metal prices.

YTD Au is +29%, Cu +24% & silver +24%. In comparing the Troilus project to operating mines like Agnico’s Detour Lake, Artemis Gold’s Blackwater, or IAMGOLD’s 70%-owned Cote, one must account for time to market & higher execution risk.

The following comparisons are indicative in nature, it’s impossible to provide more than a rough approximation of what Troilus Gold’s project is truly worth. Still, this valuation exercise is instructive as it demonstrates a healthy margin for error.

How much are other large, bulk-tonnage, Canadian mines worth? Detour Lake’s production profile from 2024-2027 is guided by Agnico to be ~20% of total production.

I believe a reasonable estimate for Detour’s valuation is 15% of Agnico’s enterprise value, or $12.8B. Artemis Gold’s enterprise value is $6.2B. It’s a single-project company, so Blackwater is objectively worth $6.2B.

The world-class Cote mine in Ontario makes Iamgold’s 70% interest worth half of its entire enterprise value. Adjusting that 70% interest to 100% yields a valuation of $4.9B. The average of those mines is $8.0B.

By contrast, Troilus Gold is four years from commercial production. To be conservative, I discount that $8.0B figure by four years at a 10% discount factor to get a prospective value today of ~$5.3B.

I assume 100% equity dilution over the next several years, resulting in ~800M pro forma shares. Finally, I haircut the discounted $5.3B value by 50% for execution risk (above & beyond the 100% equity dilution) to get $2.6B.

Backing out ~$1.0B in debt leaves $1.6B, which divided by the pro forma share count is $2/shr. Although I feel my assumptions are fairly conservative, C$2 per share is a lot higher than the current C$0.64. Readers are free to take bigger haircuts.

On the other hand, my 800M pro forma share estimate could end up being overly punitive. Perhaps (hopefully) it will be more like 600-700M pro forma shares.

In addition to comparing Troilus Gold to producers, one can also compare it to companies with promising pre-production projects.

In the following chart are six juniors with (low-grade) projects around the world, most in locations more risky than Quebec. All have fewer booked Au Eq. ounces than Troilus Gold’s 13.0M, albeit some have higher grades.

If Troilus achieves first pour by 12/31/28, I believe it would be sooner than four or five of the six peers, as five are pre-BFS stage.

As Major & mid-tier producers see valuation increases, they need to build production pipelines. From 2022-2024, Newmont’s EBIT averaged $2.7B/yr, and from 2025-27 the consensus is $7.6B/yr, a gain of +182%.

Barrick Mining in 2022-24 averaged $3.4B/yr, with a 2025-27 forecast of $8.1B/yr, a gain of +140%.

I’m not suggesting Newmont or Barrick will necessarily buy Troilus, but they will acquire mid-tier producers, and those mid-tiers will buy companies like Troilus to grow before being taken out themselves.

Six months ago there were 13 Canadian, U.S., and Australian-listed gold producers valued over C$10 billion. Today there are 16. That number will continue to grow.

Troilus has little-to-no reason to be valued at a steep discount to the peer avg. in the chart. Yet, at $18/in-situ Ag Eq ounce, it trades at an 85% discount to the peer avg. of $119/oz.

Even removing highest valued Dakota Gold & Perpetua Resources would leave Troilus 76% undervalued. Updates on funding (debt & royalty) could make a big difference in how the market sees this company.

There simply are not many Canadian Au/Cu projects at PFS or BFS stage in mining-friendly countries like Canada that can be in production by 2029 and be producing over 400k Au Eq. ounces/yr. in the initial years.

Prospective acquirers of Troilus no doubt notice the maximum annual production of 536k Au Eq. ounces. If the operation can sustain that production level in a single year, why not for multiple years (with additional investment in plant & equipment)?

Bottom line: Troilus Gold’s 13.0M Measured, Indicated & Inferred ounces are worth A LOT MORE than $18/oz to a producer.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER], and Peter Epstein owned shares in the Company bought in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply