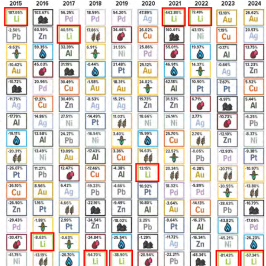

I’ve written several articles on Seabridge Gold (TSX: SEA) / (NYSE: SA). While the share price is +27% in the past month, it’s flat over the past year, while producers are up quite significantly, rising along with the gold price (+48%, past year).

Their margins have expanded to all-time highs. Every investor should own gold (“Au“) producers. But hugely undervalued large project developers are where serious money could be made.

The enterprise values of Newmont, Barrick, Freeport, Agnico, AngloGold, Wheaton Precious Metals, Kinross, and Gold Fields are up (an average of) +87% since mid-2022.

Imagine the size of these companies in 10 years. Depending on the underlying Au price, they could easily double, some might triple upon robust M&A.

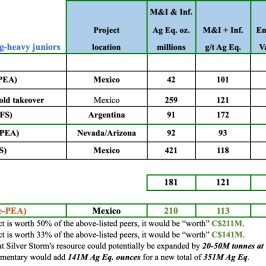

Very few large projects have been initiated, especially in N. America. Yet, by 12/31/25 most of these eight will have zero or negative net debt. Investing US$10K into Seabridge gives one leverage to 1,853 (in-situ) Au Eq. ounces.

Compare that to 128 in-situ ounces for the four Majors. Of course, Seabridge is years from production, but the Majors would benefit greatly by acquiring Seabridge. For instance, Agnico’s EV/oz. metric could be slashed in half from US$455 to $233/oz.

The ability of the Majors to fund truly massive projects like KSM has never been greater. The next stage in their evolution needs to be increasing production, not just riding higher prices.

Perhaps KSM’s 2022 PFS cap-ex of US$6.4B was an issue three years ago, but not now, even if the new cap-ex estimate is up +25% to $8.0B.

KSM is immensely more valuable than it was three years ago and Major miners could fund it from cash flow or use debt comfortably supported by the Project’s massive profits & rapid payback of capital.

Seabridge Gold has 100.5M shares outstanding and C$163M in cash + short-term deposits on March 31st. Readers are encouraged to visit Seabridge’s website for highlights of the flagship KSM project, and also Courageous Lake, Iskut, 3 Aces & Snowstorm.

With that introduction, my latest interview with Seabridge’s Chairman & CEO Rudi Fronk appears below. After reading the interview, please consider reviewing Seabridge Gold’s excellent June, 2025 Corporate Presentation

Seabridge’s 100%-owned KSM project is not 1, but 2 orders of magnitude larger than the vast majority of gold/copper projects. How do you convey KSM’s massive scale & critical importance?

Good question. With ~12 billion tonnes of mineral resources, KSM is the largest undeveloped Au project in the world. And, if you ignore KSM’s Au, it’s the world’s 3rd largest undeveloped copper (“Cu“) project.

NOTE: At spot pricing, Seabridge has ~275 million (company-wide) Au Eq. ounces, (not incl. molybdenum).

The 2022 Preliminary Feasibility Study (“PFS”) showed an initial mine life of 33 years, capturing less than 20% of KSM’s booked resources. This mine could produce over a million ounces of gold annually + 178M pounds of Cu!

At a 195,000 tonne-per-day processing rate, KSM’s mine life could extend over a century. Importantly, due to the huge quantity of Cu, (~59 billion pounds), KSM checks the box as a significant critical metals project.

KSM will be an economic & social cornerstone of NW British Columbia in terms of jobs, GDP & taxes generated.

Please give readers an update on the goal to entice a Major miner as a financial / technical partner.

Over the past several years, JV discussions with some of the world’s largest mining companies have advanced.

All the while, we continued to de-risk KSM. A recent development was the grant of a “Substantially Started” designation ensuring that our environmental approvals remain in full force & effect for life of mine.

With this key designation, and near record Au/Cu prices, the window is fully open to secure a partner on acceptable terms.

You know, Peter, we received offers when the project was less developed, but they were not sufficient and came at a time when we knew we could add a lot more value.

What do you say to readers that fear the large cap-ex burden facing KSM?

In mining — as in everything else — you get what you pay for. If you look at current cash flows generated by the largest gold & copper companies, funding US$6+ billion in initial capital at KSM (spread over 5 or 6 years) is certainly doable.

Moreover, at today’s metal prices, recoupment of initial capital would take less than three years on a mine life of many decades.

With an estimated US$20+ billion in cash flow over just the first 5 years, KSM possesses significant debt capacity should a strategic partner choose to use leverage to help fund construction.

The real challenge is not necessarily funding, but retaining the technical talent to build & operate a mega project. Not many management teams offer that skillset. Companies we’ve shortlisted have what we need to move forward.

Despite having extraordinary leverage to BOTH Au & Cu, Seabridge’s shares have lagged behind Majors like Newmont & Agnico Eagle. How do you explain this?

Higher Au/Cu prices have an immediate impact on producing companies, thus you would expect a positive impact in their share prices first.

Since we formed Seabridge 26 years ago, our share price is up over 5,000% compared to an increase in gold of ~$1,000%.

We believe that as Western investors return to the gold market, Seabridge will again take a leadership position, potentially outperforming Au & Au mining stocks.

Are there misconceptions about the investment merits of KSM/Seabridge that you would like to address?

Some investors look at KSM’s Au/Cu grades and deem them to be low. This thinking ignores several advantages that make up for the grades.

Advantages like our pristine metallurgy, cheap green energy, an unbelievably low waste to strip ratio, and key infrastructure provided by the BC government.

KSM’s revenue/tonne on recoverable gold, copper, silver & molybdenum vs. projected operating costs, place it in the most profitable quartile.

Projected all-in-cost of production, (inclusive of capital costs, net of base metal credits) is < $500/Au Eq. oz. Compare that to current all-in costs for the gold industry of nearly $1,600/oz.

Please describe the opportunity at Seabridge’s Courageous Lake project?

Yes, in addition to KSM, Seabridge holds other meaningful projects including 100% of Courageous Lake (“CL“) in the Northwest Territories. CL hosts > 11 million ounces at 2+ g/t, in an open pit configuration.

In January 2024, Seabridge completed an updated PFS for CL that demonstrated an initial 13-year mine life producing an average of over 200,000 ounces/yr, at ~$1,000/oz all-in costs.

CL is generating little-to-no value for shareholders. We intend to fix this. We’re actively assessing options to unlock CL’s value, including spinning it out to shareholders in a publicly-listed vehicle.

Talk about the prospects for Iskut, and the recently announced drill program there.

We purchased Iskut in 2016 — a year in which gold averaged US$1,250/oz — thinking it could be another KSM.

Work completed at Iskut over the years has only strengthened this view. Last year we discovered a very large copper-gold deposit named Snip North within what we call the Bronson Trend.

We think this huge structure hosts a nest of copper-gold porphyry deposits and have initiated a $15M drill program designed to collect the data required for a Maiden Resource Estimate (“MRE“) in Q1 2026.

Readers are reminded that the initial drill campaign at KSM in 2006 resulted in a MRE at the then newly discovered Mitchell deposit of 13M ounces, plus 2.2B pounds of Cu. We see similar potential at Snip North.

Please reiterate the investment catalysts in the next 6-12 months.

Investment catalysts? How about a reconnect in gold equity valuations commensurate with gold up nearly 50% in the past year? The entire sector is severely lagging the underlying price.

Investment banks like Goldman Sachs are now recommending gold & gold stocks to their institutional clients. This will drive up prices of the Majors. Then, buying should move to the biggest developers like Seabridge.

Gold has lower volatility than Treasuries with comparable trading volumes. Therefore, I believe this bull market is just getting started.

Another catalyst would be the naming of a JV partner for KSM, a group that possesses the technical, financial & social/ESG skills to build & operate a mine with the massive scale of KSM.

Finally, drill results at Iskut confirming a large deposit, and advancing our plan to unlock value for shareholders from CL, are catalysts worth watching for.

Thank you Rudi, exciting times ahead. I look forward to these and other investment catalysts to unfold in the coming months!

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Seabridge Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Seabridge Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Seabridge Gold was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply