In my initial article on Westgate Energy (TSX-v: WGT) / (OTCQB: WGTFF), I conveyed excitement on the Company’s positioning in the Mannville Stack in Alberta, Canada, and especially its US$25M credit facility (US$10M drawn).

At that time, three wells were soon to be drilled. Now, those wells are done and are being put online over the next month. So, in my view, the operating risk profile has improved, but the valuation remains attractive.

The Mannville Stack hosts well defined medium & heavy oil resources. Three or four shallow horizons (~300-900 m depth), result in low drilling costs, low technical risk, reduced “spud-to-on-stream” times, leading to rapid paybacks.

High porosity & permeability allow wells to flow without the need for stimulation such as hydraulic fracturing. Therefore, the Mannville Stack offers a cheaper entry than the Montney & Duvernay.

Westgate has ambitious plans to grow from a few hundred barrels of oil equivalent (“boe“) per day to ~1,000 by 1Q/26 and ~2,000 boe/d a year later, and continued growth thereafter — subject to obtaining additional land.

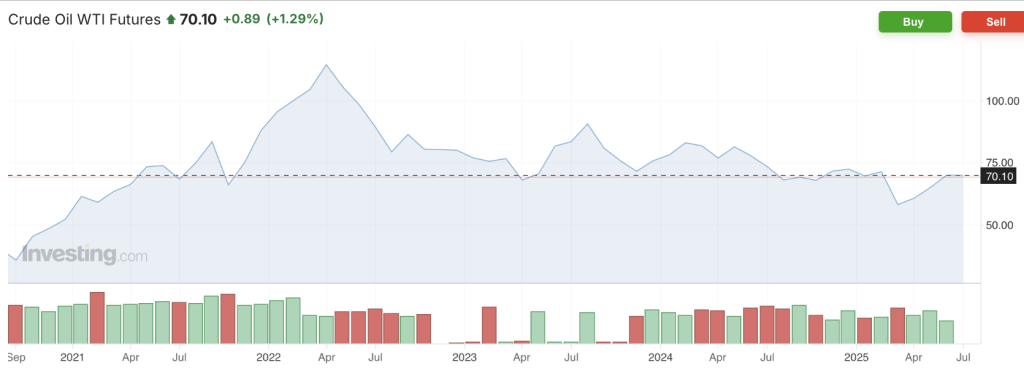

In my view, investors are getting a free option oil going higher (from time to time) in the next several years. Imagine how much 2,000 boe/d might be worth with WTI at $80-$100+/bbl? It was $78 a month ago, currently ~$70/bbl.

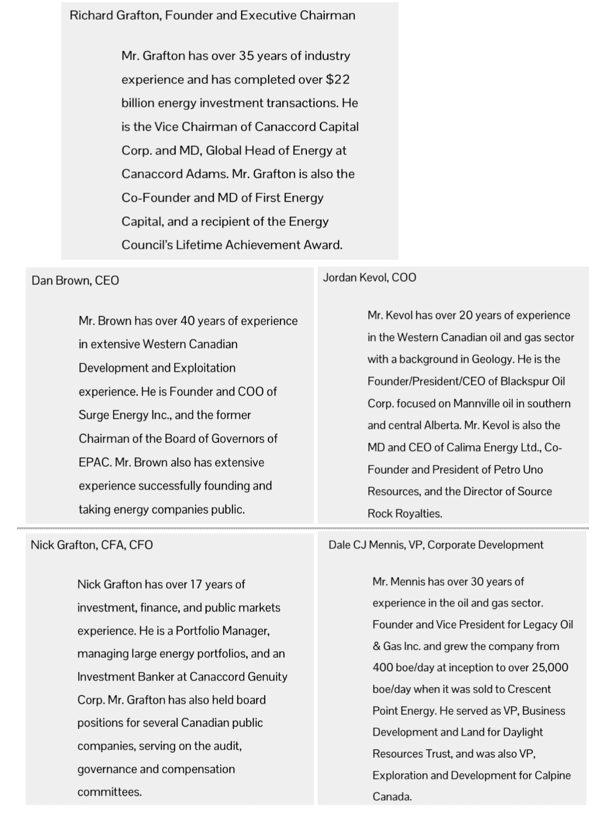

Management, led by Founders Rick Grafton (Exec Chair) and Dan Brown (Pres. & CEO), has big ambitions. So far the team has advanced at a rapid, but prudent pace towards lofty long-term goals with no major setbacks.

The recently completed program involved a multi-well pad, drilling a stratigraphic test, and three horizontal wells targeting distinct Mannville Stack horizons. The first targeted the McLaren zone and came in under budget.

The second & third targeted the Colony & General Petroleum horizons, respectively, and were done on time, on budget. The overall program was an operational success as wells hit targeted zones, and there were oil shows throughout all lateral sections.

From the July 15 Press Release,

“We are very pleased with the operational success of our three well program. The stratigraphic test well confirmed key zones of interest, and our team delivered results on or under budget. We’re excited to bring these wells online, establishing first production in our new Beaverdam area.“

The first well was a multi-leg, fishbone-style horizontal. IP30 rates for this type of well, in this area, are estimated to be ~120-130 boe/d. The other two were single-leg horizontals.

Single-legs have lower IP30 rates, but are less expensive and have slower decline rates. The expectation for single-leg wells is an IP30 of ~90-100 boe/d.

The team is working hard to study existing & upcoming operating data to determine which kind of wells to drill next. Westgate is constructing production facilities to have the new wells up-and-running around mid-August.

As the team continues to execute, the goal of ~1,000 boe/d by 1Q/26 seems increasingly achievable. In last month’s article I did not talk much about the potential to secure more land, but discussions are underway.

There’s no rush, Westgate has plenty of operational runway with existing holdings. Follow up wells later this year are in the planning stages.

Readers are reminded that just a few months ago, many WTI oil pundits & analysts were saying it was headed to the mid-US$50’s, or even the low-$50’s/bbl. There had been doom & gloom due to OPEC increasing quotas & weak global economies.

Yet today WTI is ~$70 and monthly futures through 12/31/28 do not fall below $64/bbl. On July 14th, China reported solid 2nd qtr GDP growth of +5.2%, leading some to believe that its multi-yr slowdown is nearing an end.

New sanctions + stronger enforcement of existing sanctions, on Iran & Russia, could meaningfully offset OPEC supply additions.

Meanwhile, the world’s sixth largest producer, Iraq, has been the subject of over 20 drone attacks on its oil fields, some owned by Western companies, which could trigger a U.S. response on the perpetrators — believed to be Iranian-linked militias.

Therefore, Westgate is benefiting from a greater chance of reaching production milestones / goals, plus stronger oil prices than feared. This could drive the share price. It traded as high as C$0.31 several months ago, but is now at $0.14/shr.

Please note, it would not take a lot of buying to send shares meaningfully higher. Management will be in Canada & the U.S. in Sept./Oct. to tell the new & improved Westgate Energy story.

Importantly, there are precious few tiny market cap oil producers that are well funded and growing rapidly. If Westgate can reach ~2,000 boe/d by 1Q/27, I believe it would be one of the fastest growing, publicly-traded producers in N. America.

This year’s blockbuster loan commitment is worth its weight in gold. Despite producing 259 boe/d in 1Q/25, and the Company having a market cap of ~$10M ($0.14/shr.), Westgate received a secured loan of up to US$25M = C$34.2M (US$10M drawn, maturing April-2029).

One can hardly imagine the hoops Westgate’s team had to jump through to obtain such a meaningful loan based on a few hundred boe/d!

A second tranche of US$10M is approved & available for drawdown. Why should readers care about Westgate Energy? Led by a strong team, it’s in a great jurisdiction, is growing very rapidly, and is fully-funded into at least 2H 2026.

Since it’s so small, land acquisitions would truly move the needle. Numerous mid-tier & larger oil/gas companies have non-core properties (some with producing wells) that could potentially be farmed out to Westgate.

Texas-based Cibolo Energy Partners, LLC is an expert in oil/gas investing & operations, managing ~US$500M in assets. Its loan to Westgate is a huge vote of confidence.

This is not exploration drilling. Everyone knows the oil is there — it’s a question of costs, flow rates, and decline curves, (payback periods, IRRs). Will the economics be good, very good, or excellent at $60-$80 WTI?

With Russia, Iran, Iraq & China among the top 7 oil producers, Westgate’s Alberta, Canada production will find eager homes in the U.S., and/or India, Japan, S. Korea, and Europe.

Larger Canadian producers are valued (Enterprise Value, market cap + debt – cash) at ~C$30K per boe/d with WTI crude at ~$70/bbl.

WTI averaged ~US$76/bbl over the past four years, and the CAD$ is ~11.5% weaker since late July 2021… For those fearing OPEC production increases, remember OPEC’s end game is to curtail the higher-cost segment of U.S. shale oil –> good news for Canadian players.

All roads lead to WTI in the $60s to $70s/bbl, with periods above that, and numerous Canadian producers, including Westgate Energy, remaining in the bottom (better) half of the US$-based global cost curve.

If this non-aggressive narrative plays out, producers that can grow anywhere near as fast as Westgate’s potential trajectory will do quite well.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Westgate Energy, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Westgate Energy are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Westgate Energy was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply