This article is part of a paid advertising agreement between Epstein Research [ER] & Dolly Varden Silver (TSX-v: DV)/(NYSE American: DVS). Details at bottom of page.

Precious metals are in the midst of a meaningful bull market. In the past three years, silver (“Ag“) is +80%, and gold (“Au“) +87%. Yet on average, people have < 3% of their net worths in physical metal and/or precious metal equities.

The S&P500 has one precious metals name, Newmont. No Barrick, Agnico, Franco-Nevada, or Wheaten Precious Metals — despite those four having an average market cap ~20% above the S&P500 median.

Ag & Au offer critical protection against inflation / currency devaluation, are true stores of value (bitcoin is ~4x more volatile than Au), and a safe-haven in times of geopolitical turmoil.

Ag has the added benefit of being crucial in several industrial end uses. For example, solar panels are consuming an increasing portion of Ag supply.

Subject to panel recycling (currently very limited), from ~20%, solar could soak up 25% of global Ag supply by the early 2030s.

Ag is often a tiny percentage of total end product cost — especially for EVs & humanoid robots — so price increases can be readily absorbed. Humanoids? Each might require 0.5 to 1.0 troy ounce. Musk says there will be over a billion in 20 years…

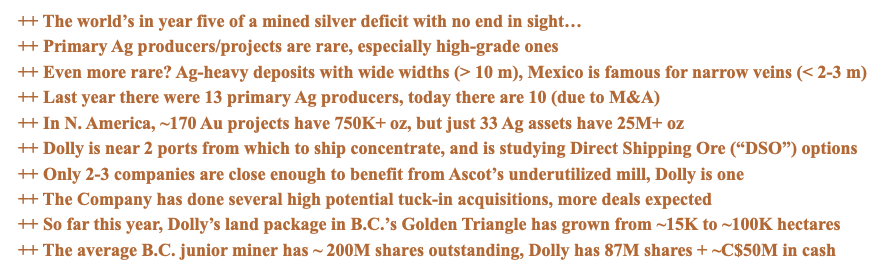

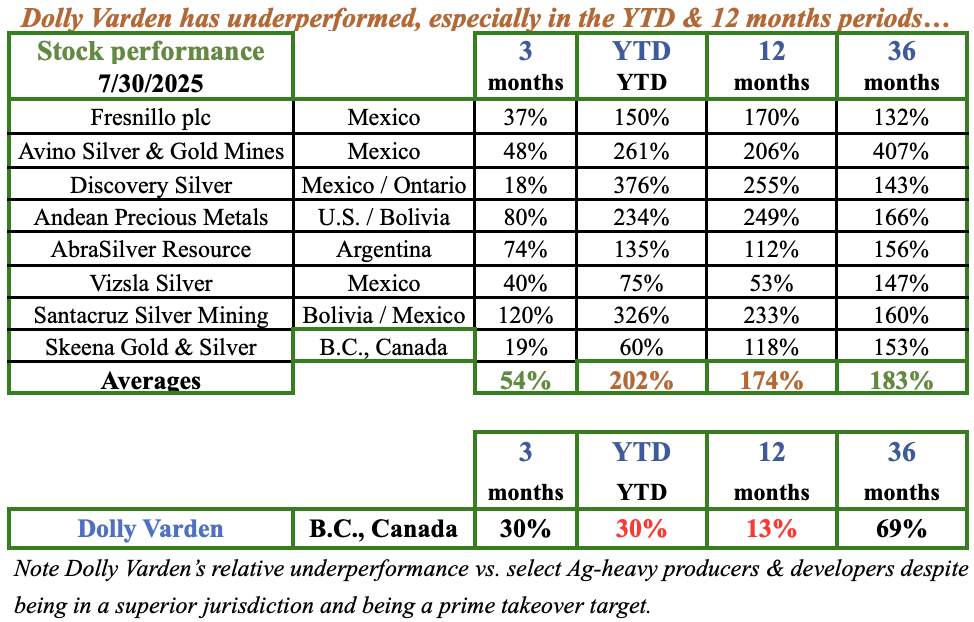

Surprisingly, there are not many Ag-heavy players to choose from, especially in N. America, and a lot of the bellwether names have already rallied substantially. Industry leader Fresnillo plc has nearly tripled from its 52-week low, and developer Discovery Silver is +508%.

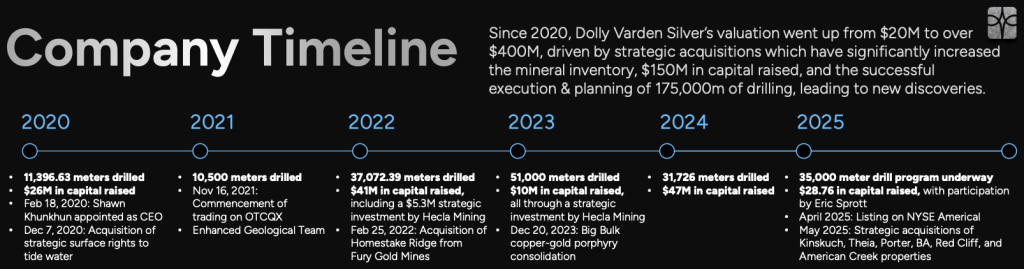

To turbocharge one’s leverage to precious metals, particularly to high quality, earlier stage, high-grade juniors. Advanced explorer Dolly Varden Silver (TSX-v: DV) / NYSE American: DVS) offers a compelling investment opportunity. [C$4.64/shr. August 1st).

Dolly has solid capital gain potential upon de-risking, aggressive drilling to spark resource growth, *potential* new discoveries, further tuck-in acquisitions, and delivery of a Preliminary Economic Assessment (“PEA“) in 2H 2026.

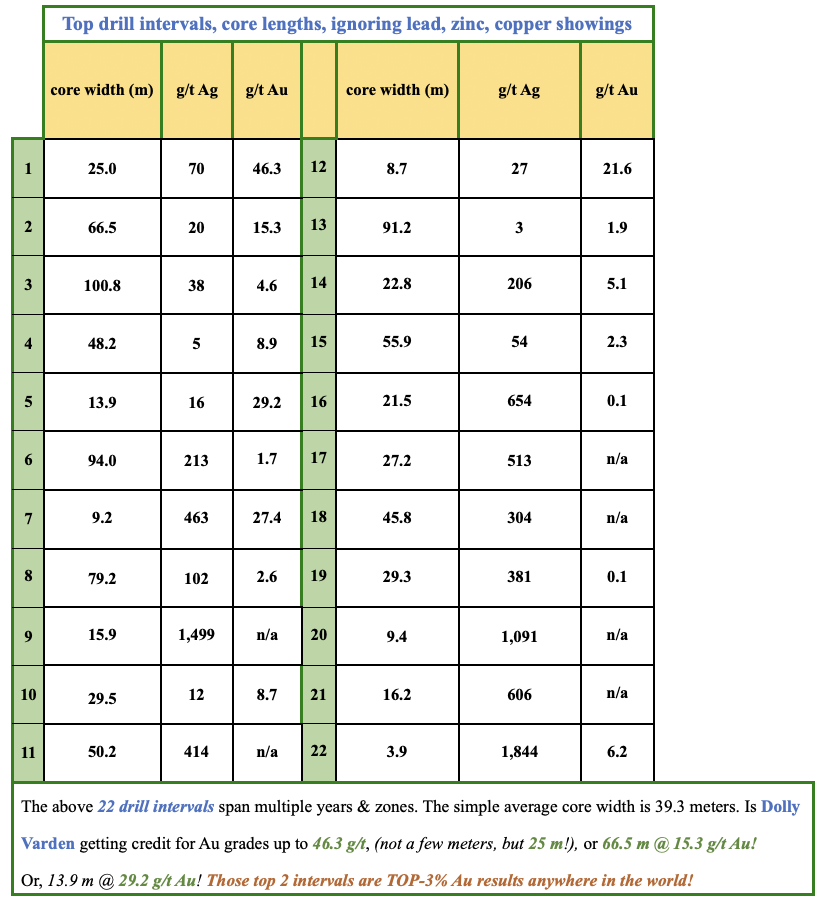

Dolly has a number of blockbuster drill intervals, see table below, high grades of BOTH Ag & Au, + wide widths. Is Dolly getting enough credit for these top two Au intervals?!?

On July 24th, management announced a very significant upizing of its 35,000 meter drill program to 55,000 m. Initial drill results are expected in 1H/Sept. From the press release,

“Drilling will prioritize the Wolf vein extension, where the Company continues to intersect mineralization on step outs and infill drilling as well as testing multiple silver, gold and copper exploration targets at the Kitsault Valley & Big Bulk Projects.”

Management is making this bold move due to a “strong start to the season.” They like what they’re seeing in the 18,000+ m drilled so far, testing the Wolf, Moose, Chance & Red Point targets.

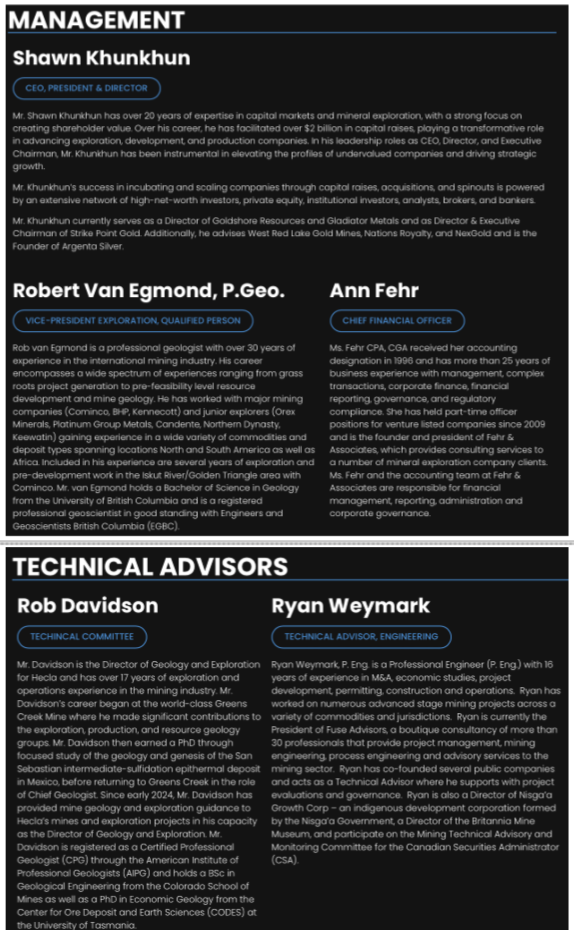

CEO/Pres./Dir. Shawn Khunkhun has done a few recent interviews. Highlights of his ongoing commentary are shown below…

Notice that Dolly’s share price has meaningfully underperformed, especially on a YTD & 12-month basis. In addition to those high flyers, another eight (not shown) is up an average of +200% in the past 36 months vs. Dolly at +69%.

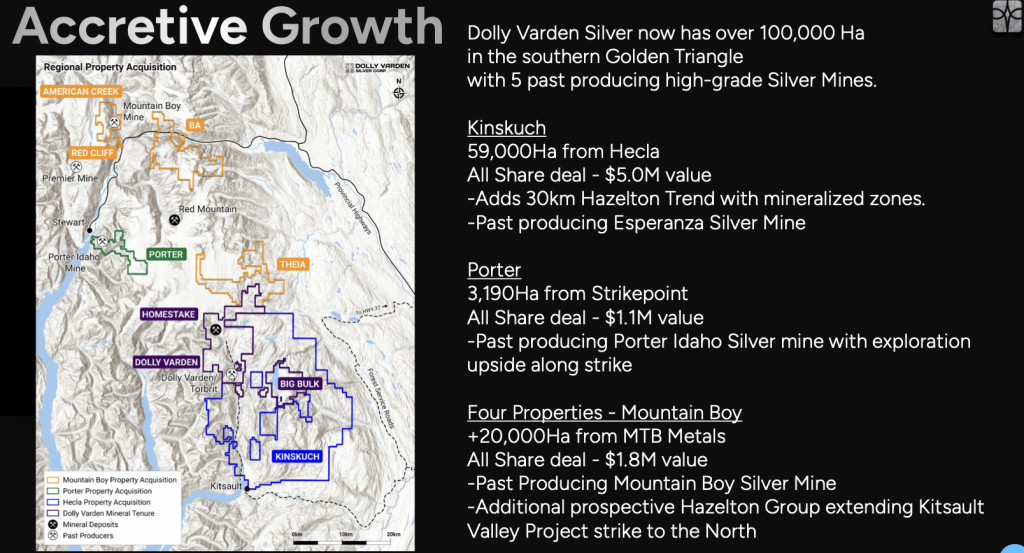

Some say Dolly has taken too long to produce a PEA, now expected in 2H 2026. I disagree. This year alone management has grown its land package from ~15K to ~100K hectares and a robust drill program is well underway that *could* deliver new discoveries.

Ag/Au have soared, the KVP project is advancing nicely. Next year’s PEA will be far better than one delivered this year would have been!

I’m not suggesting Dolly Varden will be a 3 or 4-bagger anytime soon, but I think a meaningful increase is possible with far less drama than most early-stage peers.

By less drama I mean less risk –> geopolitical, local communities / First Nations, rule of law, regional infrastructure, cost uncertainty, permitting timelines, sustainable (green) energy availability, etc.

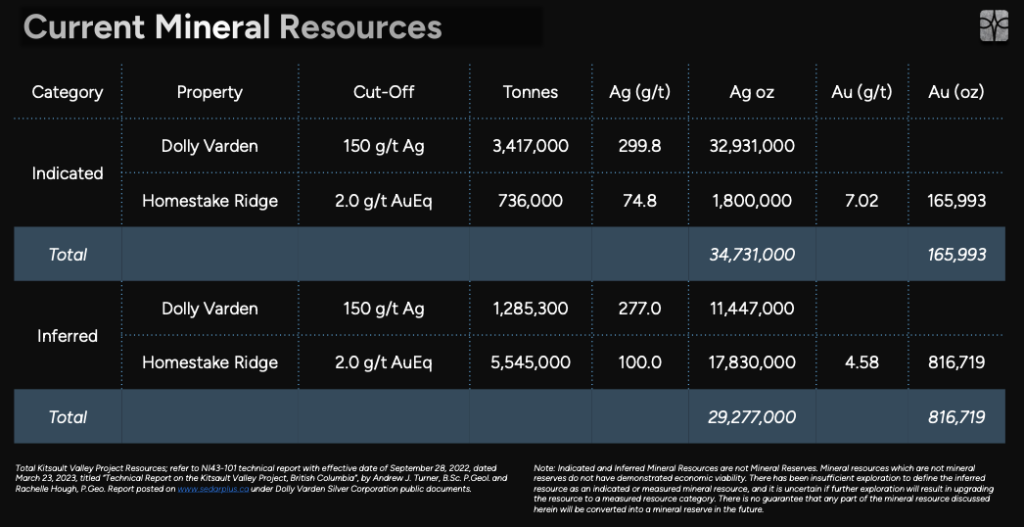

Dolly is pre-PEA, but has a robust, medium-sized, high-grade resource. Depending on relative Ag/Au pricing, Dolly is 40%-45% Ag and 60%-55% Au (currently ~43% Ag). Hecla Mining (~C$5.8B valuation) owns ~14% of the Company.

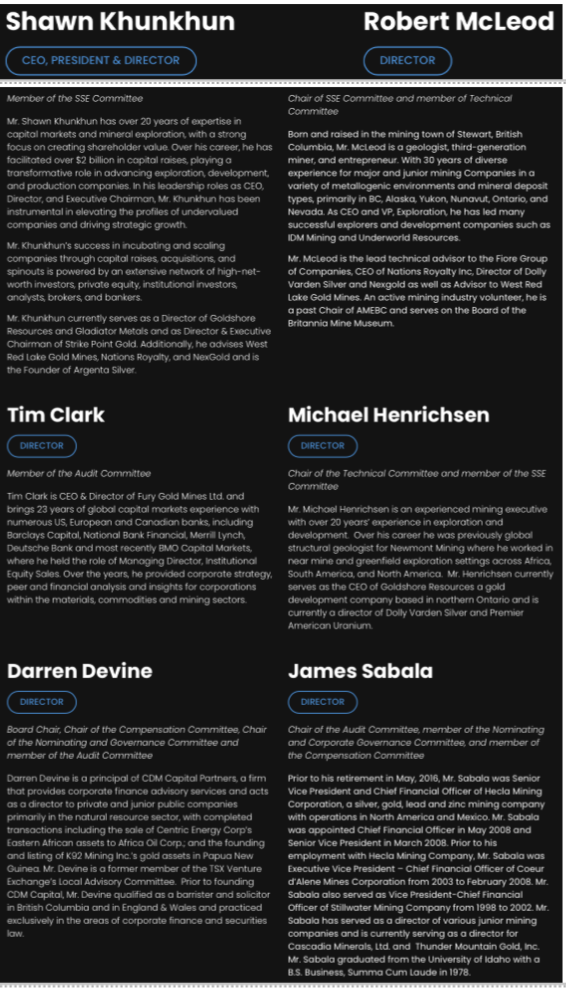

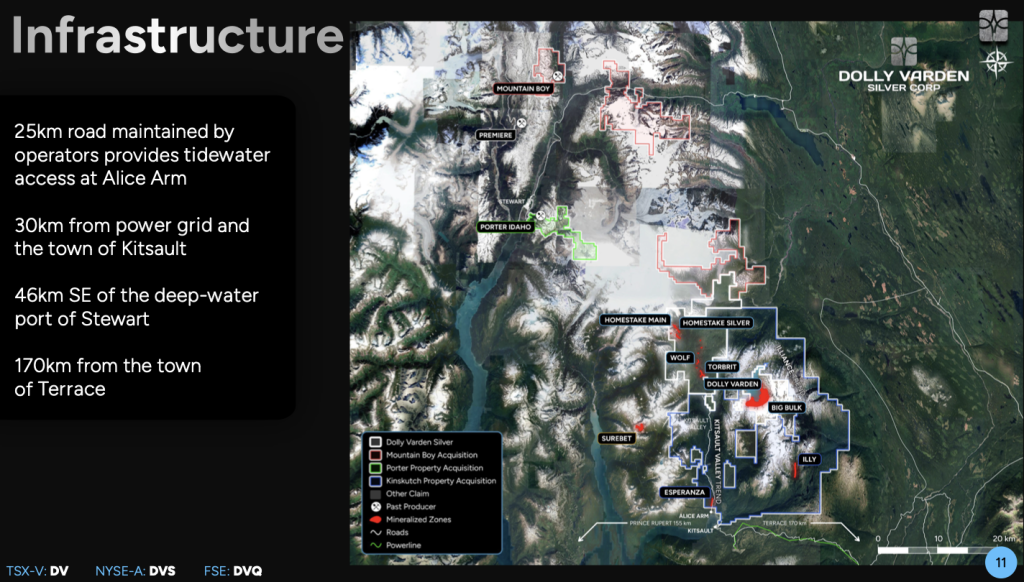

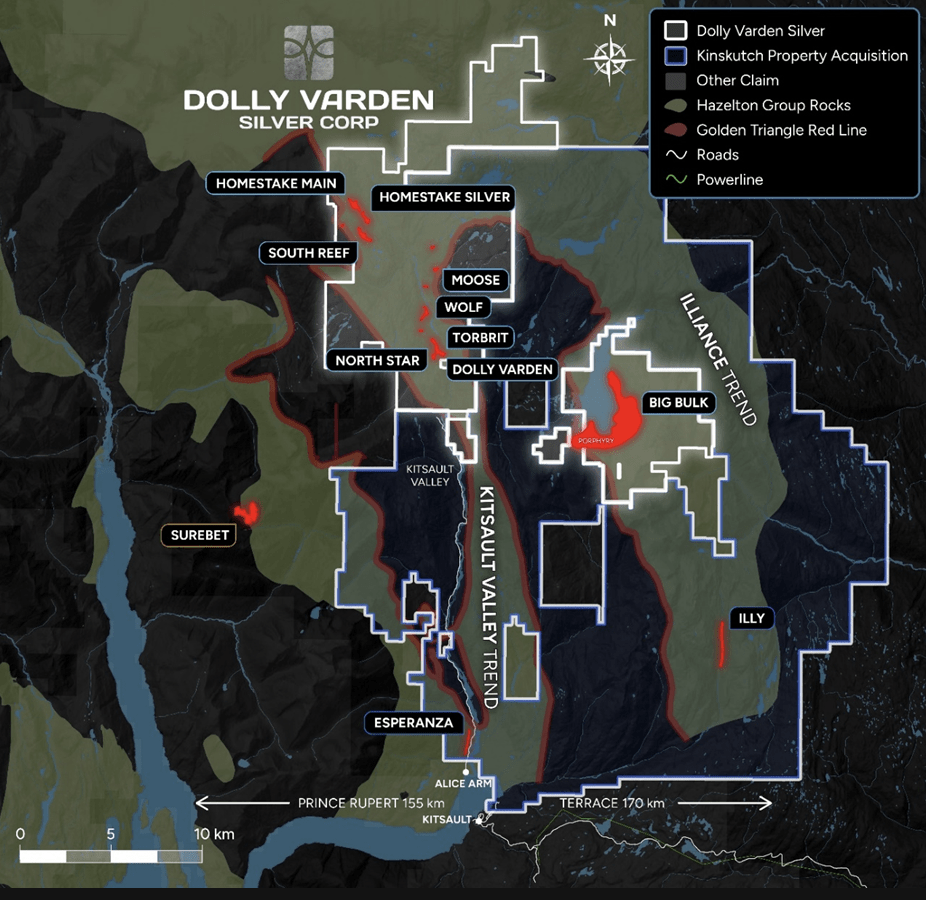

The Company’s 100%‑owned, 163 sq. km Kitsault Valley Project (“KVP”) sits at the bottom of NW B.C.s Golden Triangle—one of the world’s most active mining regions—with excellent road access, green power, water, workforce, mining services, and 46 km from a deepwater port.

The Province’s existing + future [streamlined] permitting regime, strong relationships with First Nations, with mines & major projects owned by Newmont, Teck & Freeport McMoRan, reduces project development risk.

With ongoing financial + technical backing form Hecla & Eric Sprott, a robust cash balance, and an incredible management team, board & advisors, this is a serious growth story in the midst of a bull market.

Compare Dolly Varden to Skeena Gold & Silver, AbraSilver Resource & Vizsla Silver, three world-class, pre-production companies likely to be acquired before this precious metals bull market ends.

Skeena is 5+ years ahead of Dolly, and ~70%/30% Au/Ag, but in the same NW B.C. area. Skeena provides a road map for Dolly to follow. Both have high-grade projects & strong regional infrastructure.

Its Enterprise Value (market cap + debt – cash) is ~6x Dolly’s, but I think that gap could fall to 4x or even 3x by 12/31/26, perhaps leading to a double in Dolly’s share price –> or more if Skeena & others continue to climb.

AbraSilver has an excellent project in a good mining province of Argentina. Diablillos hosts a large & growing resource that’s more advanced than Dolly’s KVP. Like Skeena, AbraSilver’s share price has significantly outperformed.

Yet, Dolly has a much higher Ag Eq. grade and twice the project size in sq. km. Many projects in S. America, are at high elevations, (3,500+ meters), making them logistically challenging, and potentially slower to commercialize.

Vizsla has a tremendous project in Mexico, the world’s top Ag producing country. However, there are concerns that Mexico’s President will slow new development due to environmental considerations.

Even if she loosens her stance, which is likely, a backlog of permitting has been building. As mentioned, Skeena, AbraSilver & Vizsla are likely to be acquired, and their share prices have responded.

To reiterate, Dolly benefits from local community & First Nation support in a Tier-1 jurisdiction, surrounded by major projects & operating mines owned by mid-tier & larger producers, is 46 km from a deepwater port, and will run mostly on green, low-cost hydroelectric power.

Investors might underestimate Dolly’s exploration upside. This year has seen the low-cost strategic acquisitions of the Kinskuch, Theia, Porter, BA, Red Cliff, and American Creek properties, boosting the footprint from ~15K to ~100K hectares, all 100% owned, most in contiguous blocks.

The newly acquired properties are promising, having been under-explored due to lack of capital. Dolly’s land hosts high-grade past production from a century ago of ~1,100 g/t Ag = 35.4 g/t Au Eq.

Then, in the 1950’s, ~18M ounces of Ag was produced at 466 g/t (Ag-only grade), very close to the grade in the latest resource estimate. Importantly, a robust 35,000 meter drill campaign began a few months ago, and management is considering adding up to 20,000 more.

Drill results (program start, late-May), could be investment catalyst

With a bite-sized valuation of ~C$410M, dozens of larger Ag and/or Au producers should be interested in Dolly Varden, not to mention PE, Natural Resource, and Sovereign Wealth funds. All eyes are on the first batch of drill results, expected in the next few weeks.

The following table shows companies & investment vehicles that should be eager to acquire Ag/Au assets in safe, prolific locations. This list is far from all of the possible suitors.

Any Company valued over C$2B could presumably make a run at Dolly Varden. I’m not ruling out Crypto players buying tangible Ag/Au mines/projects/companies to back their currencies/coins…

Wait, that’s already happening… Tether recently acquired ~32% of Altus Royalties. Seventeen cryptos now have market caps > US$10B…

How many truly world class primary Ag assets are there in the world not owned by producers? In my view, Dolly Varden’s KVP is a TOP-6 primary Ag, junior-owned opportunity.

It will only rise towards the top as peers get taken out and management grows the Company via aggressive drilling + M&A. KVP might not be the only significant project going forward.

M&A discussions are ongoing. There are 100+ companies, investment vehicles/funds looking for Tier-1 Ag/Au exposure. By contrast, there’s only a handful of undeveloped primary Ag projects.

A single Major could buy ALL of the world-class primary Ag projects… Dolly Varden is extremely well positioned, albeit at an early stage, to grow, de-risk and get acquired. As more advanced-staged developers get taken out, Dolly’s KVP will become even more scarce & valuable.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Dolly Varden Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dolly Varden are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dolly Varden was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply