Reliable comparisons among gold (“Au“) project developers, and to producers, is fraught with risk of being overconfident in the analysis. Each project, company, jurisdiction, mine plan, permitting regime, cost structure, etc. is unique.

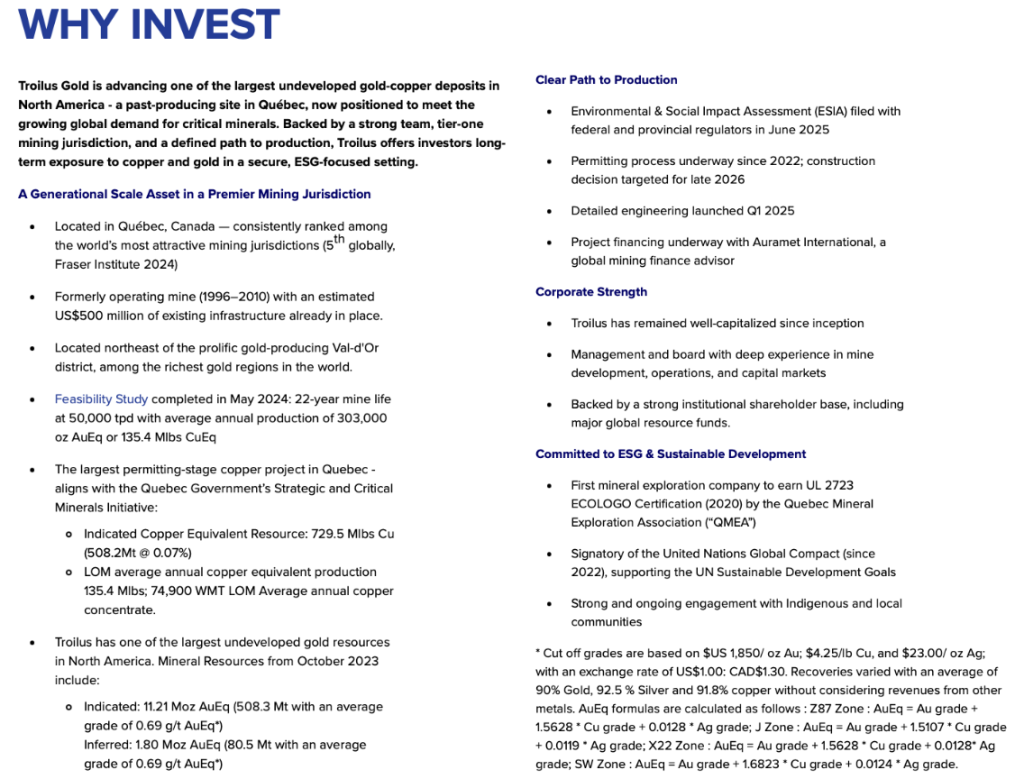

Access to power, water, workers, roads, rail, services, and acceptance by local communities differs greatly around the world. With those and other challenges in mind, I have been trying to compare Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) to pre-construction stage juniors + producers like Artemis Gold.

I also compare Troilus to Agnico Eagle’s Detour Lake mine. How can one justify making these apples to oranges comparisons? Simple, meaningful haircuts are taken to level the playing field.

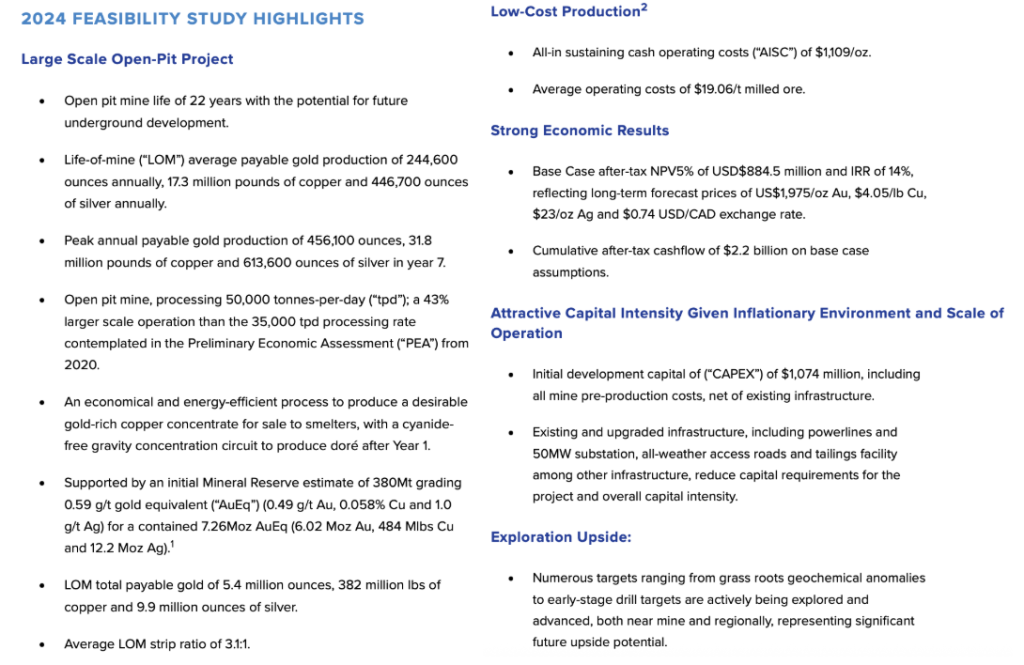

Why bother making comparisons at all? Au futures are at an ATH. In May 2024 Troilus delivered a Bank Feasibility Study with a long-term price assumption of US$1,975/oz, a level some said was $50-$75/oz too high. Today’s price is +80% higher!

Assuming spot prices, the post-tax NPV of Troilus Gold’s 100%-owned project in Quebec is ~C$4.0 billion (including +10% cap-ex hike & + 10% higher op-ex). Troilus is valued at just ~8.5% of its NPV.

By contrast Skeena Gold & Silver (1-2 years ahead of Troilus, funding lined up), is valued at ~38% of post-tax NPV, Perpetuated Resources (BFS) at 53%, and Integra Resources (PFS) at ~20%.

Artemis entered production in early 2025, yet Troilus is ~3.5 years from first Au pour. Artemis’ Blackwater is a great mine for Troilus to emulate. Like Blackwater, Troilus expects > 300,000 Au Eq. ounces/yr, and the projects have roughly the same resource grade.

Note, Blackwater has a much higher margin than Troilus is expecting, so I take that into account in my analysis by cutting the valuation further. Permitting remains on track to be completed by 2H 2026.

Importantly, CEO Justin Reid believes there’s considerable upside to both annual production and the 22-yr mine life, especially if a strategic investor gets involved or Troilus is acquired.

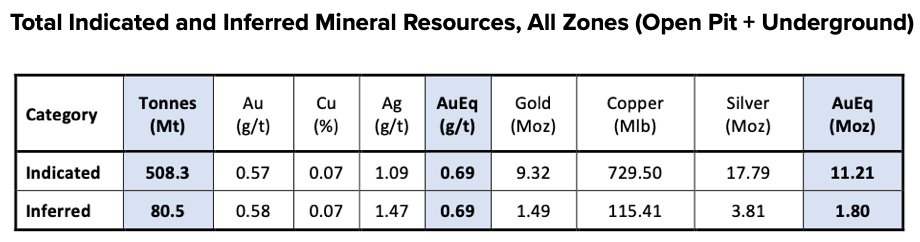

Maximum annual production at Troilus is expected to be 536K Au Eq. ounces, (averaging 430k in years 4 to 8) so logistically the mine could get a lot bigger. Only about half the Company’s 13.0M Au Eq. ounces are in the mine plan.

Upfront cap-ex for the Troilus Project was estimated at ~$1.1B. Management plans to raise ~$1.3B to account for working capital, cost inflation + possible delays. In a recent CEO interview, Reid said concentrate sale terms came in better than expected in the BFS.

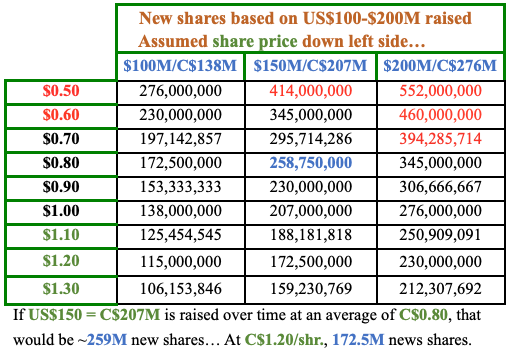

Perhaps the biggest factor impacting the upside potential in Troilus Gold shares is equity dilution. CEO Reid has stated that the goal is to keep equity dilution between now and the end of next year around $100M.

Sticking with the conservative valuation narrative, one can assume $150M in equity will be needed. Management has spent the last year lining up funding, (expected to be finalized by 12/31/25) including $700M in debt + up to $400M in royalties.

How much are other bulk-tonnage, Canadian mines worth? Detour Lake’s production profile from 2024-2027 is guided to be ~15% of total company production.

I believe a reasonable estimate for Detour’s valuation is 15% of Agnico’s enterprise value, or ~C$15.0B. Artemis Gold’s enterprise value is ~C$7.6B. It’s a single-asset company, so Blackwater is objectively worth C$7.6B.

How about the world-class Côté mine in Ontario, 70% owned by Iamgold. Assuming that asset is worth half of Iamgold’s enterprise value, adjusting 70% to 100%, yields a valuation of C$6.2B. The average value of those three mines is C$9.6B.

To be conservative, I discount the C$9.6B back four years at a 10% risk factor to get a prospective value today of C$6.6B. Then, I haircut the C$6.6B figure by 33.33% for execution risk (above & beyond $150M of equity dilution) to get C$4.4B.

Finally, I cut an additional 33.33% to C$2.9B due to the peer mines (presumably) being better, (but mgmt. has three years to identify mine plan enhancements). Compare that C$2.9B to the post-tax NPV(spot) of C$4.0B…

Backing out C$1.1B in debt leaves C$1.8B, which divided by a pro forma share count of 675M (US$150M raised at an average of C$0.80), is C$2.67/shr.

In my view, the biggest risk is not that a mine won’t get built, but that management will be forced to issue 400M+ shares below the current share price, which seems increasingly unlikely with the share price currently in the mid-C$0.80s.

Yet, assuming royalty funding comes in, the vast majority of share issuance will not be necessary for quite some time.

As long as Au remains above $3,000/oz, I think Troilus is in tremendous shape and that next year’s share price (post finalization of funding commitments + permitting) could be meaningfully higher than today’s C$0.87.

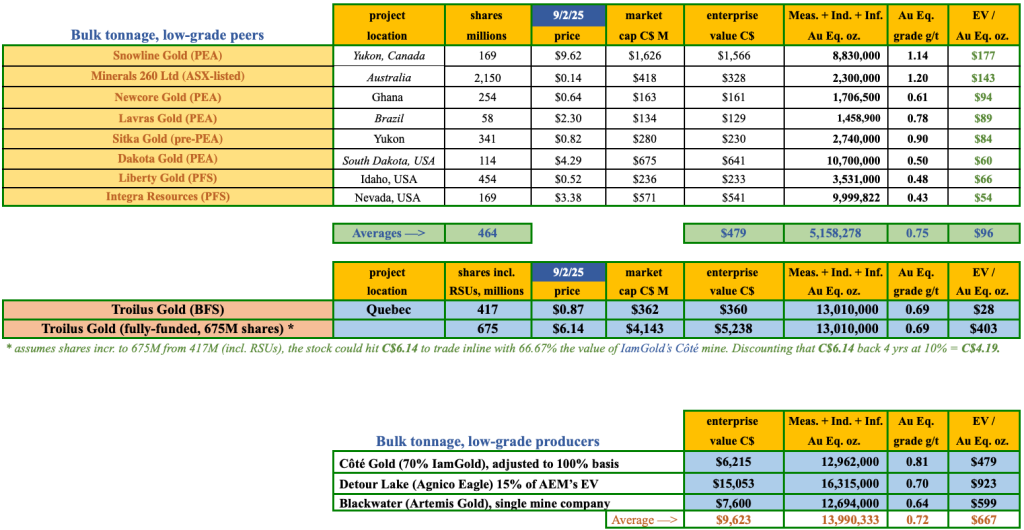

In another comparison attempt, look at the pre-construction, PFS-BFS-stage companies in the chart below. Troilus is valued C$28/oz for its 13.0M Au Eq. ounces vs. peers at an average of $96/oz.

I tried to find as many low-grade, bulk-tonnage projects, no matter stage of development, with at least a few million ounces. Troilus at 0.69 g/t is close to the peer average of 0.75 g/t. Yet, Troilus has 2.5x the number of Au Eq. ounces as the peer junior average.

Note that Troilus is a year beyond delivery of its BFS, with first Au pour expected in 2H/2028 or 1H/2029. By contrast, peers are at PEA/PFS stages, still facing huge equity dilution, and no production before 2030. I prefer Quebec to many peer jurisdictions.

In the bottom portion are Côté, Detour & Blackwater. Notice their EV/oz valuations average C$667/oz. If Troilus issued ~259M shares at C$0.80, for a total of 675M pro forma, and had C$1.1B in debt, it would be valued at C$403/oz upon entering production.

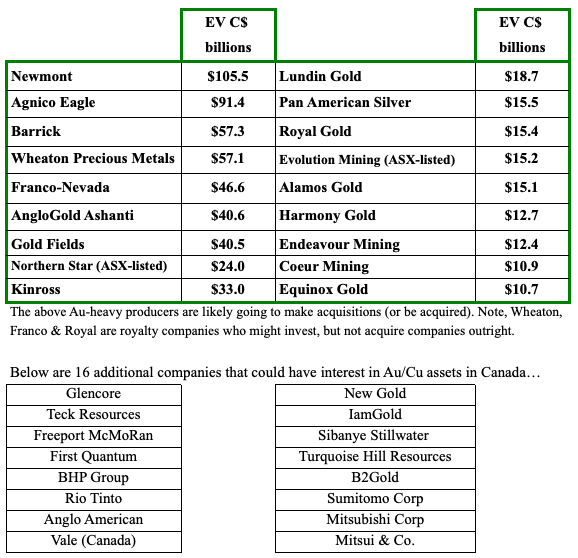

Next 2-3 years of M&A will be MASSIVE!

As Major & mid-tier producers valuations soar, they need to build production pipelines. From 2022-2024, Newmont’s EBITDA averaged $3.0B/yr, but from 2025-27 the consensus is $11.7B/yr, a prospective gain of +290% (Newmont acquired Newcrest…).

I’m not suggesting Newmont will buy Troilus, but it will acquire mid-tiers, and those mid-tiers could buy companies like Troilus to beef up before being taken out themselves.

A royalty for up to US$400M remains on track to be announced this year. The 2-yr & 3-yr trailing average Au & Ag prices continues to trend in the right direction, which can only be good news for royalty transaction terms.

Regarding permits, I presume the Province of Quebec will not be difficult to deal with. Several Quebec institutions have, or will end up with, direct & indirect economic interests in the Troilus project. Permits are expected by the end of next year.

To reduce & manage development risks, CEO Reid & the board have been hiring highly experienced execs, and appointing advisers such as Rob Doyle. Mr. Doyle has > 25 years’ in intl. mining finance, corporate strategy & project development.

See extensive, talented management team here, Board of Directors here.

He’s best known as CFO of Pan American Silver, a company he helped grow from inception to a multibillion-dollar producer. Most recently, Mr. Doyle served as CFO of Silvercrest Metals, acquired by Coeur Mining in a $1.7B transaction.

If one’s bullish on Au & Cu, sticking with very safe jurisdictions, surrounded by much larger players + mid-tier companies & regional infrastructure — taking on incremental risk in an earlier-stage opportunity — offers a compelling investment proposition.

Further news on Project funding, and/or another leg higher on Au/Cu prices, could propel Troilus Gold’s share price meaningfully higher. C$28/oz seems too low vs. peer developers.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER], and Peter Epstein owned shares in the Company bought in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply