This article is part of a paid advertising agreement between Epstein Research [ER] & Dolly Varden Silver (TSX-v: DV)/(NYSE American: DVS). Details at bottom of page.

Yesterday, September 2nd, Dolly Varden Silver (TSX-v: DV) / NYSE American: DVS) reported strong drill results. How strong? I believe a Top 3% or 4% silver (“Ag“)-only [grade x meters] interval –> 21.7 m of 1,422 g/t Ag. That’s just the first hole of the season!

DV25-446 successfully tested a gap in drilling, intersecting high grades 105 m up-dip from DV24-421 on the Wolf Vein. While this outcome was not unexpected, the 21.7 / 1,422 was much higher than that of predecessor hole DV24-421. Press Release.

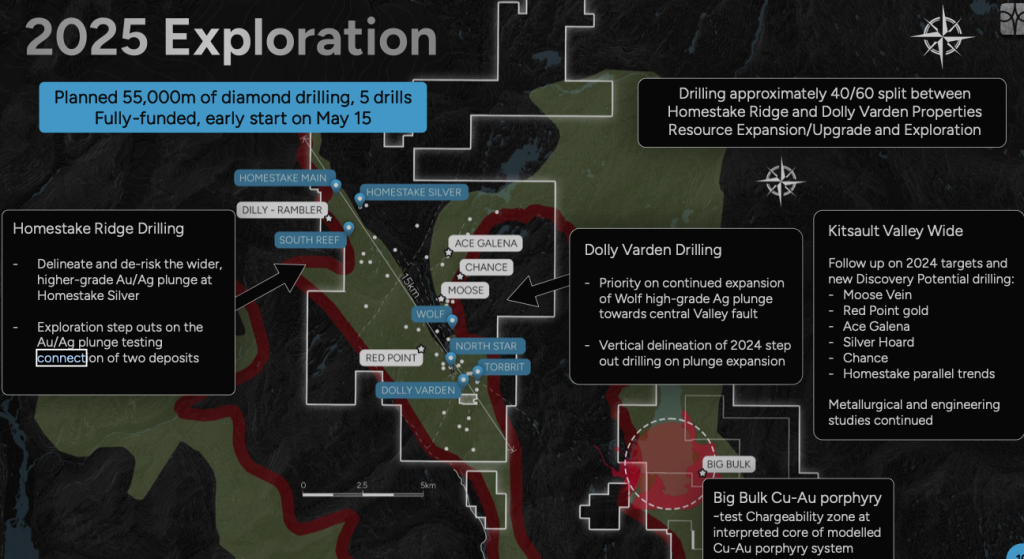

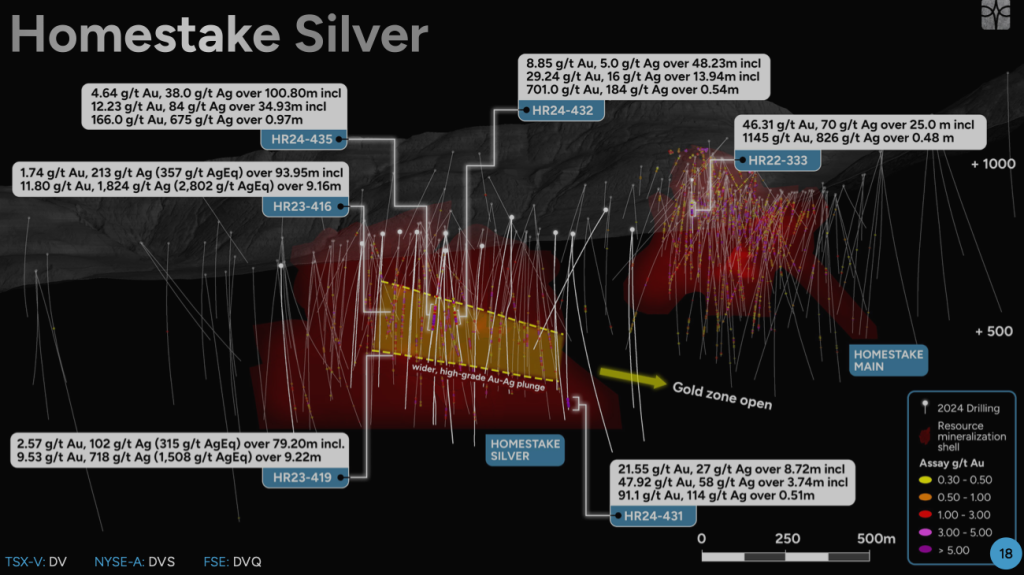

Exploration continues to test the extension of Wolf below the sediment cap towards the projection of a possible connection between the Wolf and Torbrit/Kitsol zones, and more broadly between the Dolly Varden properties & Homestake Ridge.

Precious metals are in a BULL MARKET making ATHs in gold (“Au“) and 14.3-yr highs in Ag. No one truly knows if we’re in the early, middle or late stages! In the past three years, Ag is +134%, and Au +111%.

Over the same period, the Top-18 performing precious metal names listed in N. America (C$100M+ market caps) are up an average of ~640%! Numerous others have at least quadrupled (300%+). Dolly Varden has kept pace with Ag, it’s up +142%.

With drill results like DV25-446: 1,422 g/t Ag, 0.51 g/t Au, 3.05% Pb + 1.42% Zn over 21.7 m, incl. 10,700 g/t Ag, 2.54 g/t Au, 4.33% Pb + 1.68% Zn over 1.0 m, Dolly has room to run.

Ag & Au offer critical protection against inflation / currency devaluation, are important stores of value (bitcoin is ~4x more volatile than Au), and a safe-haven in times of geopolitical turmoil.

The ascendency of Artificial Intelligence carries great promise, but also significant geopolitical challenges. In a world of heightened risk, precious metals should do quite well, and Ag has the added benefit of being crucial in several industrial end uses.

It’s often a tiny percentage of total end product cost — especially in solar panels, EVs & humanoid robots — so price increases can be easily absorbed and/or passed on.

Dolly offers a compelling investment opportunity. [C$5.32/shr. Sept. 3rd). In addition to yesterday’s blockbuster drill results, it has solid capital gain potential upon further de-risking initiatives.

Aggressive step outs & infill drilling should spark resource growth + *potential* new discoveries, additional tuck-in acquisitions, an updated mineral resource estimate, and delivery of a Preliminary Economic Assessment (“PEA“).

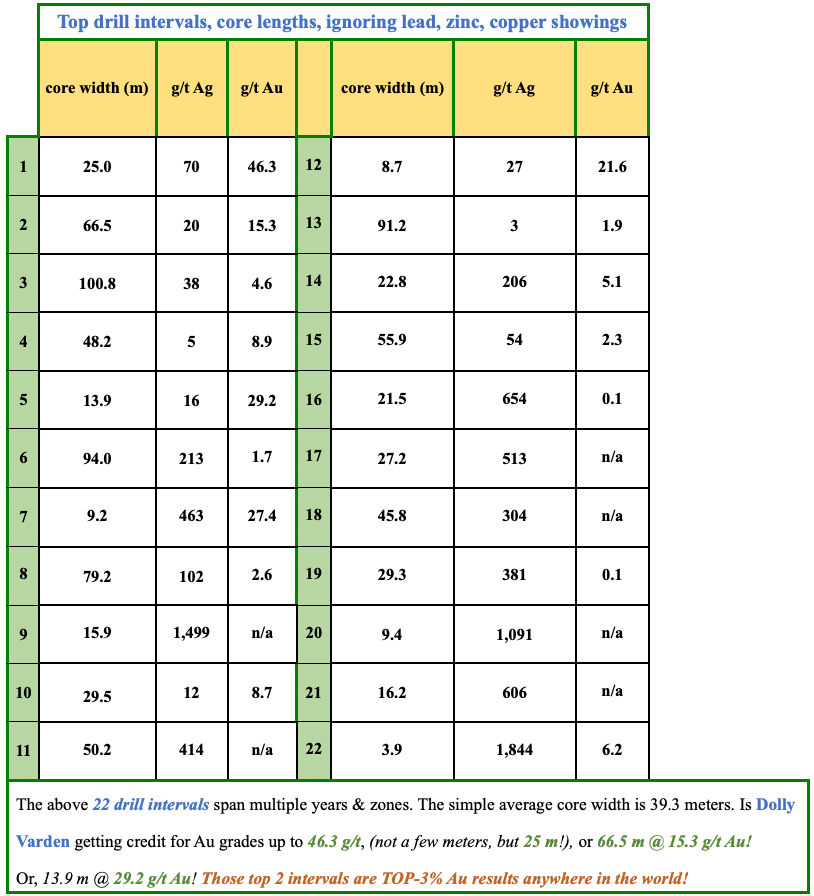

All of those steps are funded with ~C$48M in cash. Dolly has a number of blockbuster drill intervals, see table below, high grades of BOTH Ag & Au + some wide-to-very-wide widths. I estimate that yesterday’s interval would fit between #5 / #6 in the chart below.

On July 24th, management announced a very significant upsizing of its 35,000 meter drill program to 55,000 m. From the press release,

“Drilling will prioritize the Wolf vein extension, where the Company continues to intersect mineralization on step outs & infill drilling as well as testing multiple silver, gold & copper exploration targets at the Kitsault Valley & Big Bulk Projects.”

Management is making this bold move due to a “strong start to the season.” They clearly like what they’re seeing in the 46,000+ m drilled so far, testing the Wolf, Moose, Chance & Red Point targets.

Drilling for the season is expected to be finished by the end of this month, with drill results flowing for months to come.

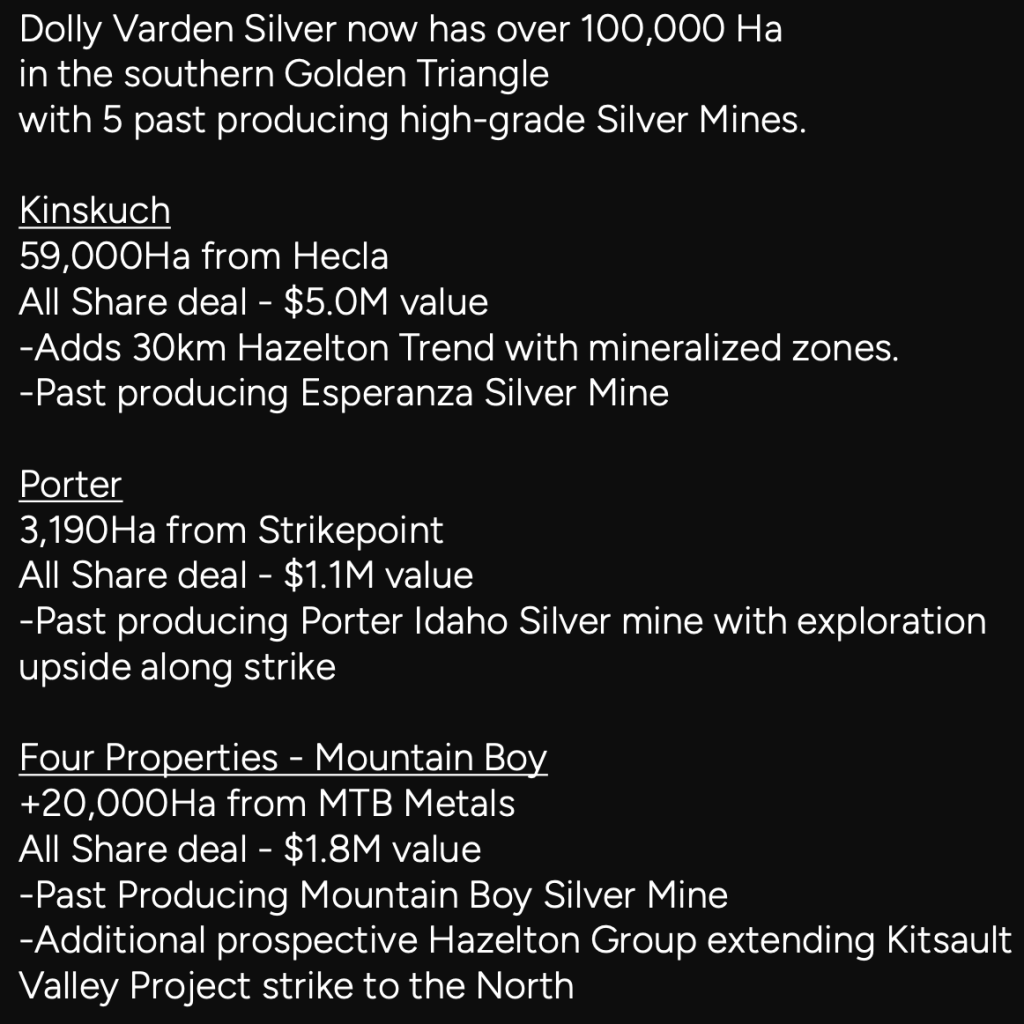

Some say Dolly has taken too long to produce a PEA, now expected in 2H 2026. I disagree. This year management increased its land package from ~15K to ~100K hectares and the robust drill program underway *could* deliver new discoveries.

Dolly has far fewer downside risks like; geopolitical, local communities / First Nations, rule of law, regional infrastructure, cost uncertainty, permitting timelines, low-cost, sustainable (green) energy availability, etc., making it a compelling risk-adjusted opportunity.

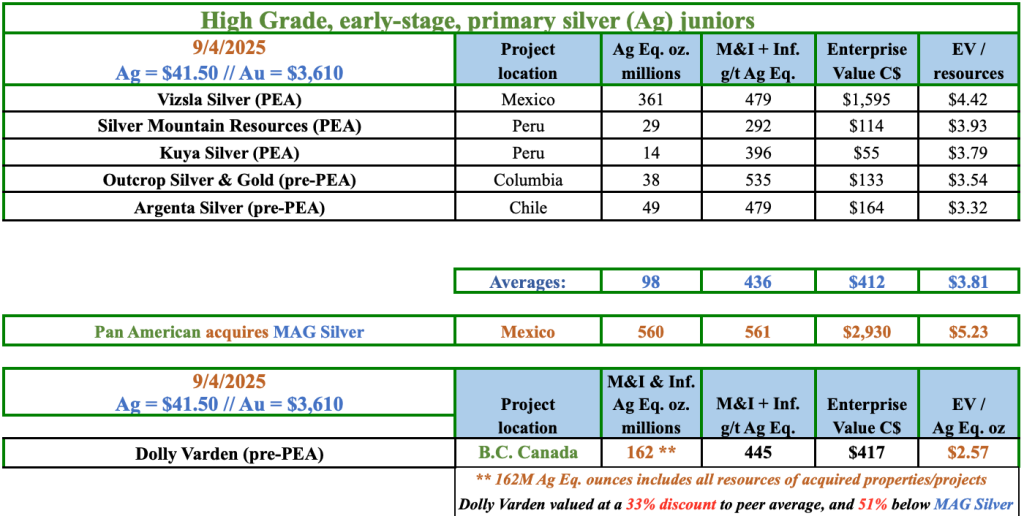

Dolly is pre-PEA, but has a robust, medium-sized, high-grade resource. Depending on relative Ag/Au pricing, Dolly is 40%-45% Ag and 60%-55% Au (currently ~43% Ag). Hecla Mining (~C$8B valuation) owns ~14% of the Company.

The Company’s 100%‑owned, 163 sq. km Kitsault Valley Project (“KVP”) sits at the bottom of NW B.C.s Golden Triangle—one of the world’s most active mining regions—with excellent road access, green power, water, workforce, mining services, and ~46 km from a deepwater port.

The Province’s existing + future [streamlined] permitting regime, strong relationships with First Nations, with mines & major projects owned by Newmont, Teck & Freeport McMoRan, reduces project development risk.

Like MAG Silver, these companies could be acquired @ $5+/oz

Over the next decade, the building of new roads, power lines &related infrastructure in B.C. will be remarkable — most paid for by government and/or much larger mining companies — for the benefit of the Majors, First Nations, but also Dolly Varden.

When might Barrick, Agnico, AngloGold Ashanti, Gold Fields, Kinross, etc. become more involved in the Golden Triangle? Could royalty/streaming companies like Franco-Nevada (invested in B.C.’s Scottie Resources prior to its maiden resource) be interested in Ag-heavy juniors like Dolly?

With ongoing financial + technical backing form Hecla & Eric Sprott, a very robust cash balance, and an incredible management team, board & advisors, this is a serious growth story in the midst of a notable bull market.

Dolly Varden compares well to other world-class, pre-production companies like Skeena Gold & Silver, AbraSilver Resource & Vizsla Silver, all likely to be acquired before this precious metals cycle ends.

In bull markets, M&A typically picks up considerably. In my view, and that of CEO Shawn Khunkhun, Dolly is one of just 3 to 5 must own primary Ag companies. The three I mentioned have an average valuation of C$1.76B vs. Dolly Varden at C$420M.

Just imagine how many players could easily afford to acquire Dolly at a 100% premium to today’s valuation? Many dozens, perhaps over 100?

Dolly’s project is in safe, prolific, B.C. Canada vs. large projects in S. America that can be at high elevations, (4,000+ meters), making them logistically challenging, more costly, and slower to build. Water scarcity & local community support are two other hot spots in S. America.

As mentioned, Skeena, AbraSilver & Vizsla are likely to be acquired, and their share prices are responding. In the past year those three are up an average of +131% vs. Dolly at +33%. By this time next year I image M&A will have driven valuations meaningfully higher.

Any Company valued over C$2B could presumably make a run at Dolly Varden. To reiterate, Dolly benefits from local community & First Nation support in a Tier-1 jurisdiction, surrounded by major projects, mines & past-producers owned by mid-tier & larger producers.

Investors might underestimate Dolly’s exploration upside. This year has seen the low-cost strategic acquisitions of the Kinskuch, Theia, Porter, BA, Red Cliff, and American Creek properties, boosting the footprint from ~15K to ~100K hectares, all 100% owned, mostly in contiguous blocks.

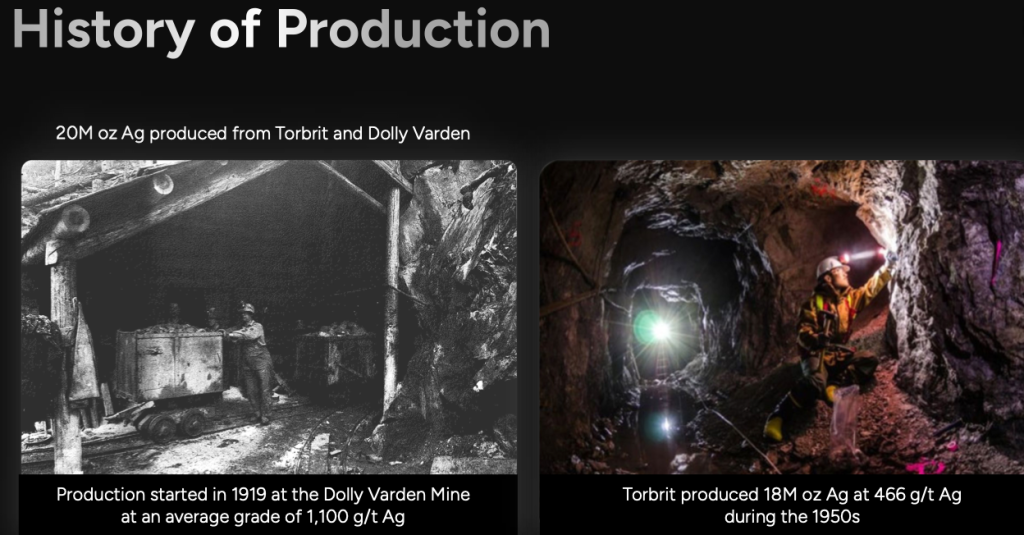

The newly acquired properties are promising, having been under-explored due to lack of capital. Dolly’s extensive land package hosts high-grade past production from a century ago of ~1,100 g/t Ag = ~35 g/t Au Eq.

In the 1950’s, ~18M ounces was produced at 466 g/t (Ag-only), very close to the grade in the latest resource estimate.

Management states that M&A & strategic investment discussions are ongoing. A single Major could buy ALL of the world-class primary Ag projects… Dolly Varden is extremely well positioned, albeit at an early stage, to grow, de-risk and get acquired.

As more advanced-staged developers get taken out, Dolly’s KVP will only become more scarce & valuable, rising to the top of M&A lists. Vizsla just announced a US$220M loan commitment to advance its project… It’s game on, and Dolly Varden is in the driver’s seat.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Dolly Varden Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dolly Varden are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dolly Varden was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply