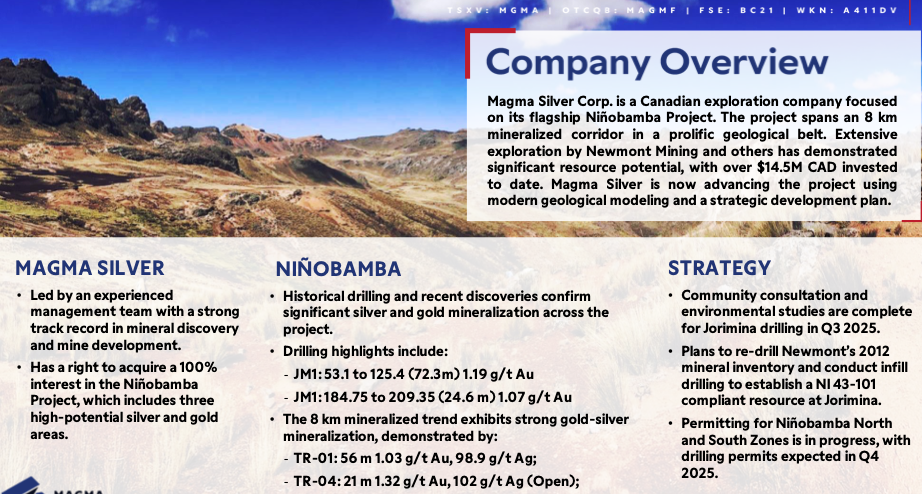

Magma Silver (TSX-v: MGMA) / (OTCQB: MAGMF) has an option to acquire 100% of the Niñobamba (+ Randypata & Jorimina) Ag/Au project spanning 8 x 2 km in the mineral-rich Ayacucho region of Peru. For this first time, this highly prospective, contiguous land package is under one roof.

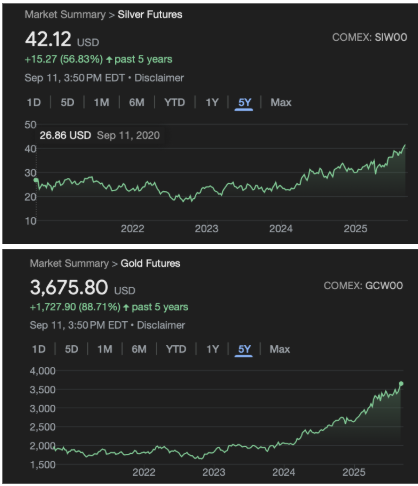

Magma’s enterprise value {market cap + debt – cash} is C$4M, far too low in my view given the following commentary… One look at gold (Au) & silver (Ag) — both up nearly +50% in the past year — tells you an EV of C$4M is silly, 50% below its 52-week high…

Niñobamba is 45 minutes from the city of Ayacucho with daily flights to Lima. The 4,100 hectare Project is 7 km from both a major highway & power grid. The Randypata zone was re-staked during COVID-19, as previously held Newmont concessions, and a 2% NSR lapsed.

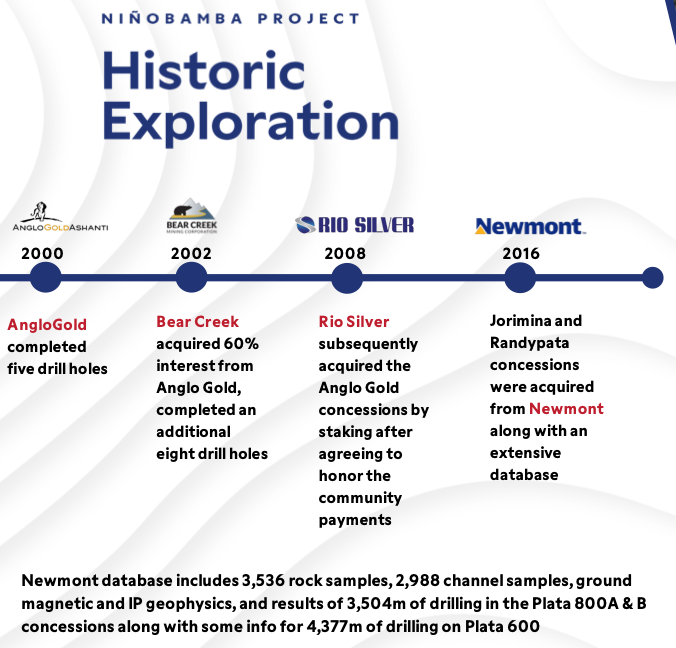

In today’s dollars, Magma’s properties have seen nearly C$20M in exploration. There’s evidence of a large-scale, shallow deposit, potentially amenable to open pit mining + high-margin, low technical risk, heap leach processing.

The Company is looking for one or two additional projects in Peru and/or Mexico and hopes to have further news on that front. Magma benefits from significant historical exploration work, including surface samples, trenching & drilling.

Importantly, much of the work was done by highly reputable companies including Newmont & AngloGold Ashanti. Drilling highlights include; [72.3 m of 1.2 g/t Au], [56.0 m of 1.0 g/t Au + 99 g/t Ag, ~180 g/t Ag Eq.], [21.0 m of 1.32 g/t Au + 102 g/t Ag, ~216 g/t Ag Eq.].

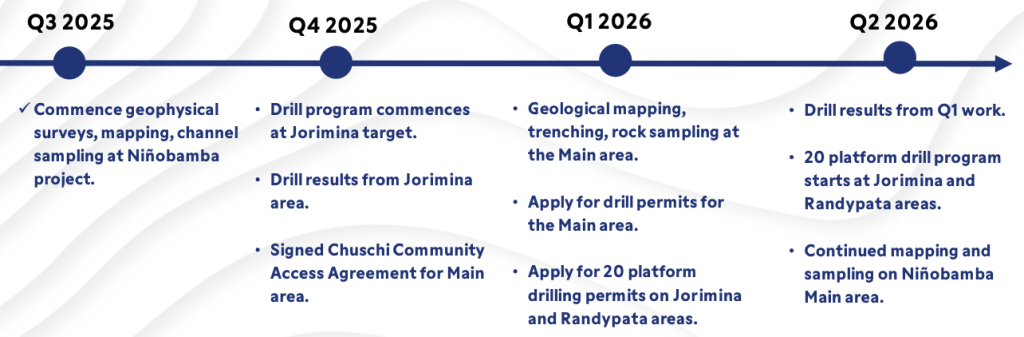

The Jorimina zone has a higher-grade channel sample of 17.4 m of 3.06 g/t Au. This quarter geophysical surveys, mapping & channel samples are being done at Niñobamba. Next quarter should see a *potentially* impactful drill program on the Jorimina target.

For a C$4M company, the mgmt. team, board & advisors are impressive. CEO/Exec. Chair Stephen Barley has over 40 years’ experience in corporate finance & securities law, having held several executive & director roles with natural resource companies with projects around the world.

Director Michael Townsend is one of the founding partners of Altus Capital Partners. He’s a Founder or co-Founder of several small-cap technology & resource companies. Both Barley & Townsend have considerable networks of peers & investment groups backing them.

Mr. Townsend owns directly & indirectly a total of 2.61M shares, which includes dozens of open market purchases in the past four months.

Independent Dir. Roehlig has served on numerous Canadian company boards, including as president & CEO of various companies. He has been a buyer of Magma as well, directly owning 1.16M shares.

Advisor Jeff Reeder, P.Geo has over 21 years’ experience in Peru and has spent a lot of time in Mexico. Advisor Joe Sandberg has 45+ years under his P.Geo belt, and is an expert in precious metals & copper porphyry systems.

In 2011-12, Newmont completed an internal Pre-Feasibility Study, meaning that metallurgical work and other critical mine planning metrics passed a test of reasonableness. US$1,200/oz Au was used vs. today’s price of US$3,676!

Magma Silver has access to a dataset that includes drilling & samples records & assays, and and internal (never made public) PFS-level economic study from Newmont. Management believes there’s a meaningful amount of Ag & Au at the project, but it’s NOT NI 43-101 compliant.

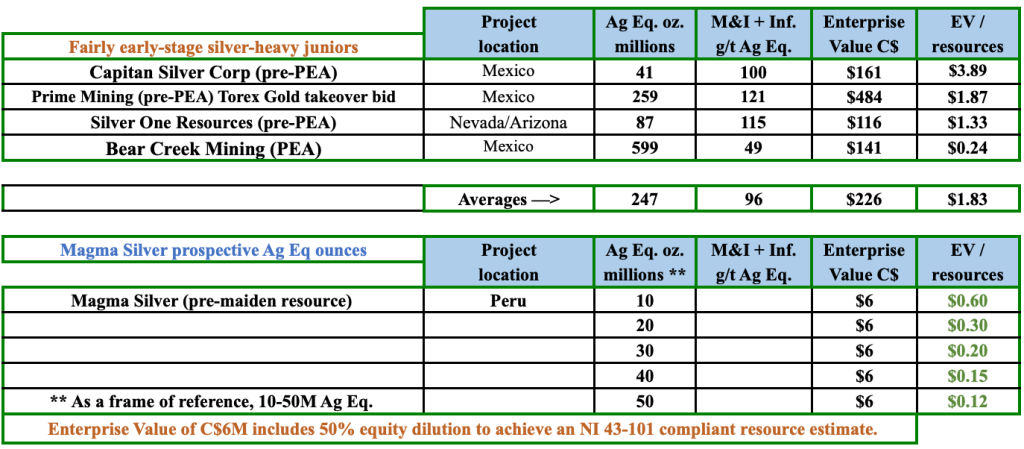

Depending on how many Ag Eq. ounces one wants to give Magma credit for, the project is valued fairly cheaply. In the following chart I showed 10-50M Ag Eq. ounces merely as a frame of reference. Why 10-40M? I think that’s conservative.

The juniors in the chart are more advanced than Magma Silver, but all except one are pre-PEA. Am I saying that if Magma Silver comes out with a maiden resource of 30M Ag Eq. oz it will be worth C$1.83/oz x 30M = C$55M? No, but its current valuation is just C$4M.

Given that Newmont did an internal economic study, I’m presuming that they would not have bothered if they did not think they had the beginnings of a decent sized resource.

Is it fair to compare Magma Silver’s prospective C$0.12-$0.60 EV/oz metric (based on to low/medium grade Ag-heavy peers like those shown above?

Peers are more advanced. Therefore, it makes sense to factor in equity dilution by Magma to achieve an NI 43-101 compliant resource estimate in the future. I assume 50% equity dilution, bringing Magma’s enterprise value to C$6M. Note that upon 50% dilution there would still only be 51-52M shares outstanding.

Make no mistake, this is a high-risk investment proposition in a C$4M company. However, what better time to take on significant risk (for commensurate outsized return potential) than in a robust bull market in precious metals.

Au/Ag are up +43%/+40% in the past year, and +130%/+112% over the past three years. Are we in the beginning, middle or end of this bull market? I believe we’re NOT nearing an end. M&A in precious the precious metals space has barely just begun.

Ag/Au producers are printing money. They need to bolster their long-term pipelines with M&A of producers, but also development projects including early-stage plays. Among the Top-10 Ag producing countries are China, Russia, Bolivia & Kazakhstan.

Peru will remain a leading Ag/Cu/Au producer with companies including; Grupo México/Southern Copper, Glencore, Freeport McMoran, Teck Resources, Anglo American, First Quantum, Buenaventura (BVN), MMG Limited, HudBay & Hochschild Mining Plc.

A meaningful risk for a tiny company like Magma Silver is equity dilution as the Company’s market cap is just C$4M. So far there’s just 34M shares outstanding, but that number will obviously grow.

With Au $3,676/oz, Ag at $42.12/oz, and Cu expected to rally in the coming months, all eyes are on projects that have tremendous blue-sky potential in Western-friendly jurisdictions, strong management teams & advisors, boots on the ground, and favorable relations with local communities.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Magma Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Magma Silver are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Magma Silver was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply