Silver Storm Mining’s (TSX-v: SVRS) / (OTCQX: SVRSF) share price has performed well in the past year, more than doubling from its 52-week low, yet the top dozen silver-heavy producers/developers are up an average of +641%.

In the past year, Capitan Silver is +1,014%, Discovery Silver +609%, Santacruz Silver +592%, Argenta Silver +539%, Andean Precious Metals +448%… Silver Storm is +104%, but has a compelling story.

I think Silver Storm shares have ample room to run. Note: management is currently raising C$13M (gross) in equity capital at C$0.25/shr.

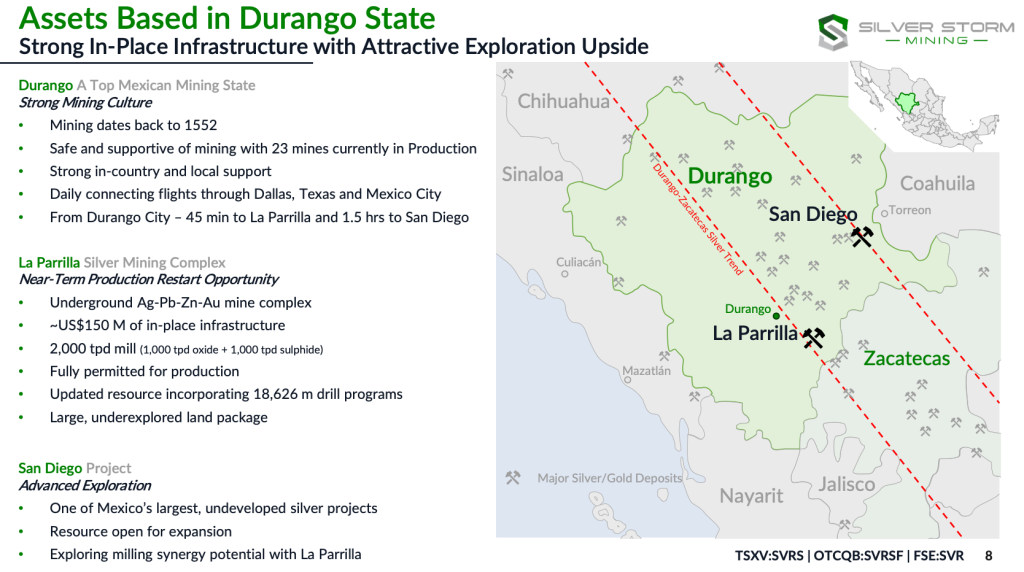

As a reminder, the Company has two assets in mining-friendly Durango State, Mexico, the 100%-owned, past producing La Parrilla Mine complex, and the very large (210M Ag Eq. ounces at spot pricing) San Diego project.

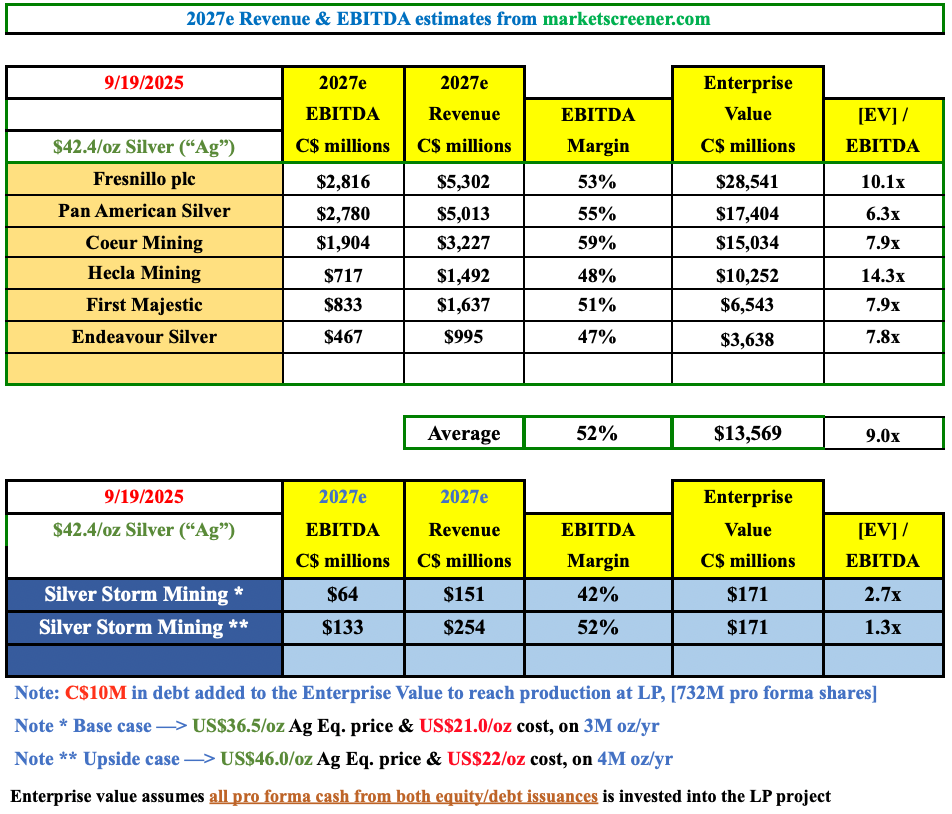

The Company remains valued at a steep discount to the producers in the following chart. The current silver (“Ag“) futures price is US$42.83/oz, I use a base case price of $36.50/oz for CY 2027.

Assuming Silver Storm’s LP complex produces3.0M Ag Eq. oz in 2027, with an EBITDA margin of US$15.5/oz, that’s [$3 x $15.5 x 1.38 (FX) = C$64M of EBITDA, and an EV/EBITDA ratio of 2.7x.

Producers in the chart are valued at 8.9x 2027e EBITDA. I add C$10M in debt, on top of multiple equity raises, to Silver Storm’s EV to cover the cash needed to get LP back into production.

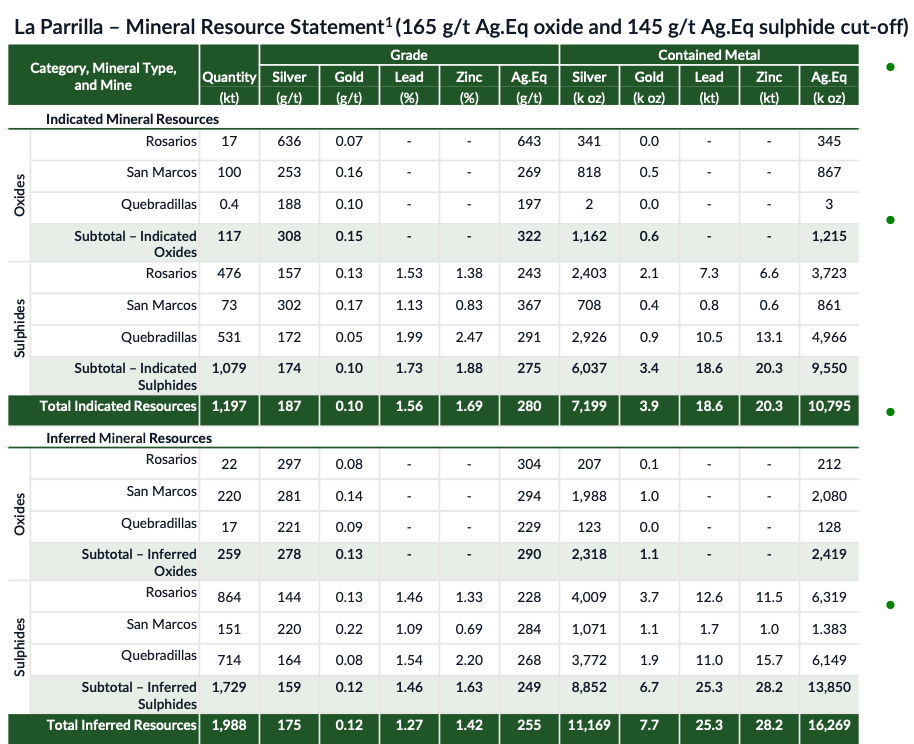

At spot pricing, LP has ~25M Indicated + Inferred Ag Eq. oz at a strong weighted average grade of ~255 g/t. There’s an estimated 1M tonne stockpile grading 60-65 g/t Ag Eq., and a 2nd high-grade stockpile of 43,151 tonnes at 217 g/t Ag.

Those stockpiles are worth ~C$120M at spot, pre-recoveries. Processing above ground stockpiles, possibly blended with newly mined ore, offers a fairly low-risk (logistically simple) restart scenario.

An additional 3.8M ounces are thought to be recoverable from mineralized pillars. Therefore, depending on throughput, there’s enough ore for roughly 6-8 years of operations.

First Majestic owns 26% of Silver Storm and Eric Sprott 12%, but those figures will change modestly after the capital raise. Restarting production at LP is the primary focus with a goal of that happening by 6/30/26.

LP hosts 40 contiguous mining concessions spanning 38,128 hectares and five underground mines surrounding a mill. The processing plant consists of parallel 1,000 tpd flotation & 1,000 tpd cyanidation leach circuits to treat both oxide & sulfide ores conventionally.

Both ore types contain Ag as their principal economic component, significant lead & zinc, + minor amounts of Au. Oxide ore is processed by cyanide leaching to produce doré bars.

Sulfide ore is processed by differential flotation to produce an Ag-rich lead concentrate and a zinc con. The replacement value of the infrastructure at LP alone is estimated at US$150M.

An average of 3.5M annual Ag Eq. ounces (~67% Ag + ~33% Pb/Zn) was produced between 2012-2018. First Majestic operated the Complex at up to 4.67M oz/yr in 2014, when Ag averaged ~$19/oz, 56% below the futures price.

If Silver Storm only had LP, and LP didn’t have medium-term upside beyond 3.0M Ag Eq. oz/yr, then the Company’s pro forma EV of ~C$171M would be far less compelling.

In past articles I’ve focused on near-term production potential at LP, but the pink elephant in the room is the large, 100%-owned San Diego project.

6-18 months ago, with Ag a lot lower than $42.83/oz, and several C$10s of millions needed to properly advance SD to the next development stage, investors did not ascribe a lot of value to it. They still don’t.

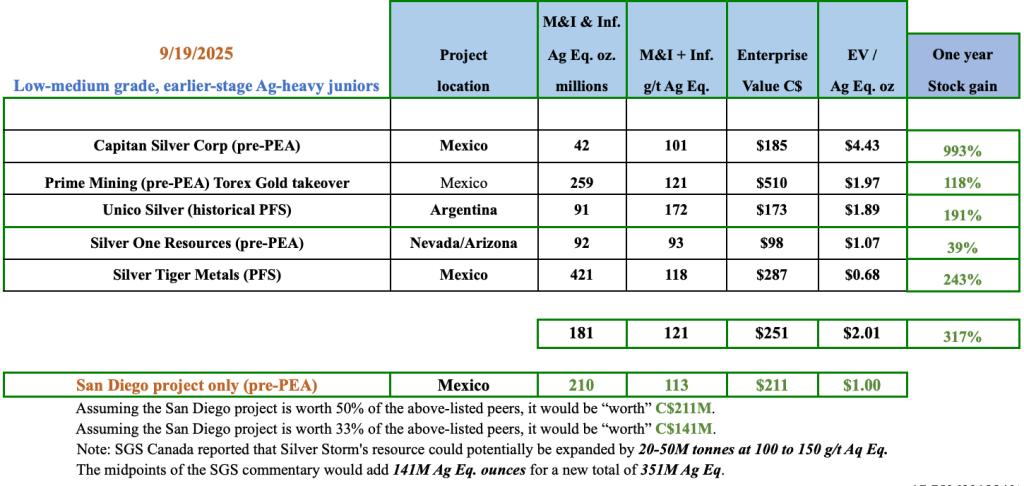

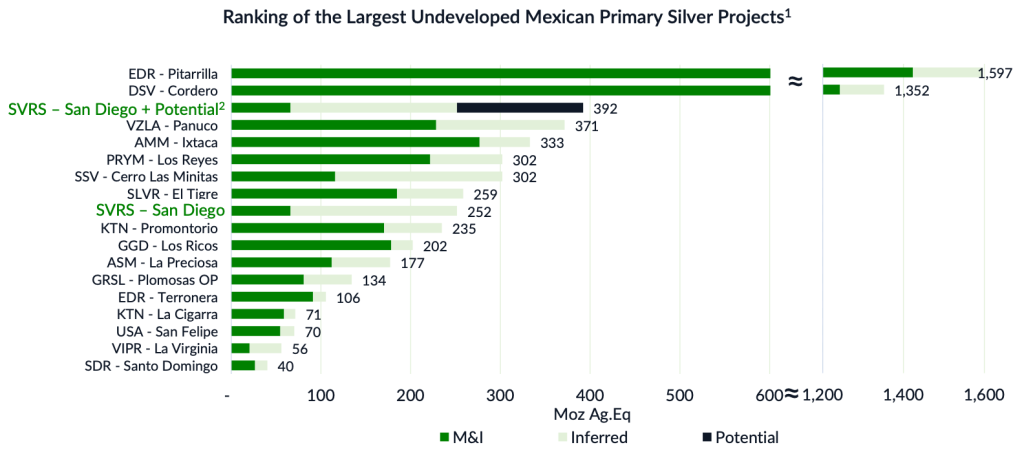

However, peer Ag-heavy valuations have improved so much that San Diego can no longer be ignored. In the following chart, SD compares favorably to low-medium-grade peers.

Peers have an average grade of 121 g/t Ag Eq. on an average of 181M Ag Eq. ounces, which is close to SD’s metrics. If SD were valued at 50% of peers, it would be “worth” C$211M. Even at 33% of peers, SD is “worth” $141M.

Please take a moment to compare San Diego to the others. It’s a bit earlier stage, but in the center of the fairway in terms of grade & scale. If Ag continues to run, San Diego’s value will become more important and obvious to investors, strategic partners & acquirers.

How can San Diego’s valuation not be higher than it was back in late 2020 when valued in a single asset predecessor company as high as C$110M? At that time, Ag was > 35% lower, and debt-laden producers were in far worse financial shape.

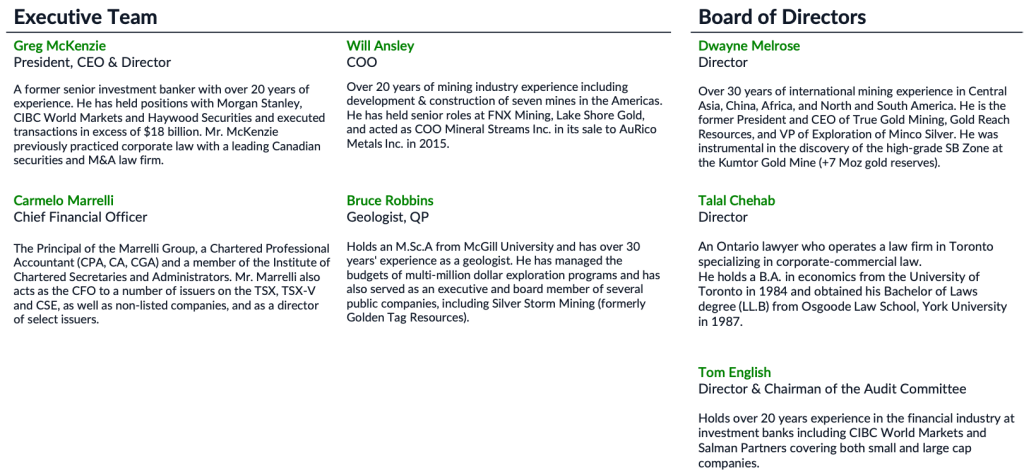

Readers should note that CEO Greg McKenzie uses a conservative methodology in the Company’s resource estimates for LP & San Diego. While the vast majority of juniors assume 100% recoveries, Silver Storm reports net of estimated recoveries.

By my reasoning, not guidance from the Company, if Silver Storm reported its resources with assumed 100% recoveries, LP’s & San Diego’s resources would be 15%-30% larger.

Notably, SGS Canada reported that Silver Storm’s resource could potentially be expanded by 20-50 million tonnes at 100 to 150 g/t Aq Eq. The midpoints would deliver an incremental 141M Ag Eq. ounces for a new total of 351M Ag Eq.

In this bull market, imagine how many companies can comfortably afford to acquire San Diego and fund it through production. With Ag over $43/oz, dozens of groups could/should care.

In my view, McKenzie & the board could probably farm out 60-75% of San Diego for a sizable cash payment plus get free-carried through commercial production.

I have no idea if the board is contemplating such a move. One thing’s for sure, having avoided taking on a partner has paid off, as prospective terms are only getting better. As many commentators like to point out, primary-Ag producers are a rare bread.

Companies like Coeur Mining & Pan American Silver used to get over 50% of revenue from Ag. In the latest quarter, Pan American received 73% from Au, and Coeur 67%. By contrast, ~55% of SD’s in-situ value (at spot) comes from Ag.

Look at market darling Discovery Silver, not included in the comp table because it’s well more advanced at BFS-stage. It has an extraordinarily large (> 1.3B Ag Eq. oz) resource in Mexico.

Even though the grade is low, ~50 g/t Au Eq., the stock is ~600% in the past year! Assuming Discovery’s Cordero primary Ag project accounts for 50% of the Company’s valuation, Cordero’s ounces are valued at ~C$1.50 each.

To reiterate, San Diego has ~210M Ag Eq. ounces (net of recoveries). This is a scarce & valuable asset that will not be ignored forever.

If one believes management can get LP up-and-running next year, with a full year of production at 3.0M oz/yr (possibly more) in 2027, investors at C$0.22/shr. essentially get San Diego for free.

Ag is +46% year-to-date. Silver Storm has considerable execution risk, but now could be an excellent time (in a notable Ag bull market!) to take on higher-risk to gain exposure to promising development plays.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm Mining are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER], and Peter Epstein owned shares in the Company bought in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply