The following Dolly Varden Silver (TSX-v: DV) / (NYSE American: DVS) CEO interview is part of a paid advertising campaign, please see details at bottom of page.

Readers are encouraged to watch a replay of Dolly Varden’s corporate presentations at Beaver Creek and/or the Denver gold forum.

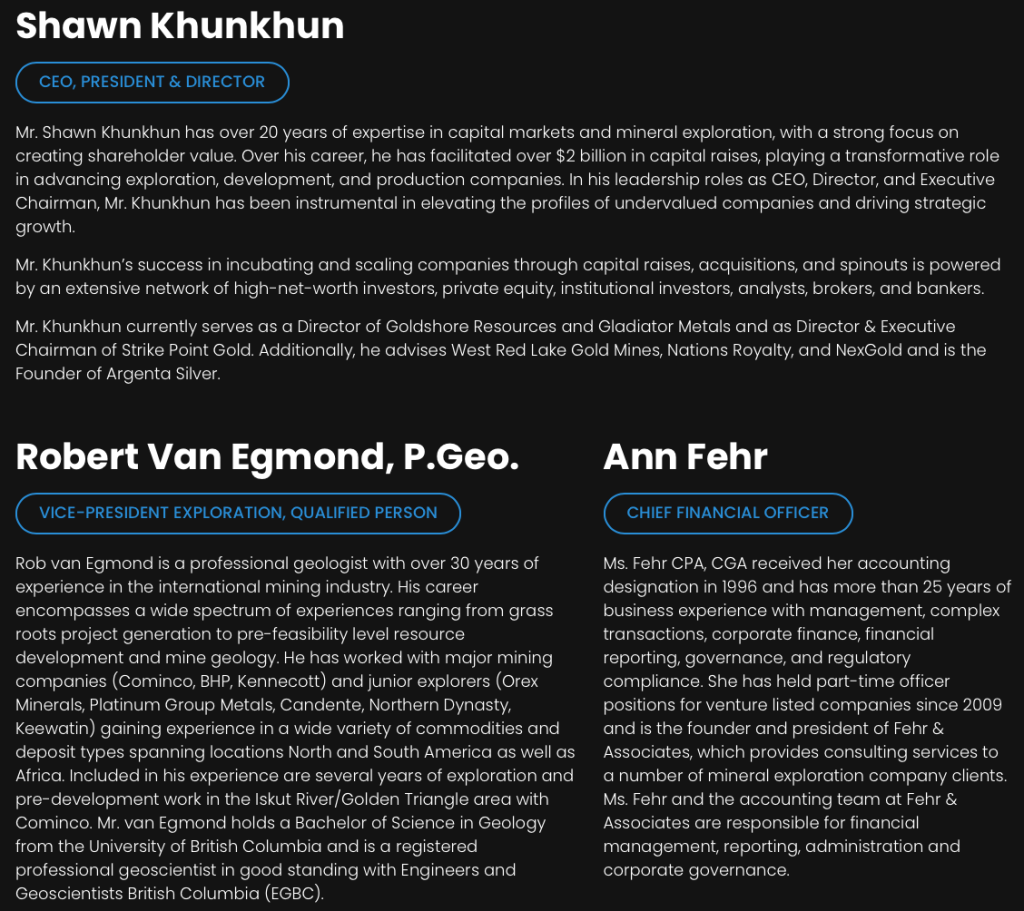

CEO Shawn Khunkhun is a young, visionary leader who’s bullish on #silver & #gold and is driving his company, Dolly Varden Silver, towards becoming a meaningful producer. No, this won’t happen overnight, but it might not take as long as some think…

The currently unused 3,000 tpd Ascot Resources Premier mill & tailings facility is nearby. Only a small handful of companies are close enough to utilize it. This mill needs more ore than Ascot’s projects can deliver.

If Dolly Varden could secure a meaningful allocation of Premier’s capacity, the team could be off to the races. That’s just one of many options, but an attractive one.

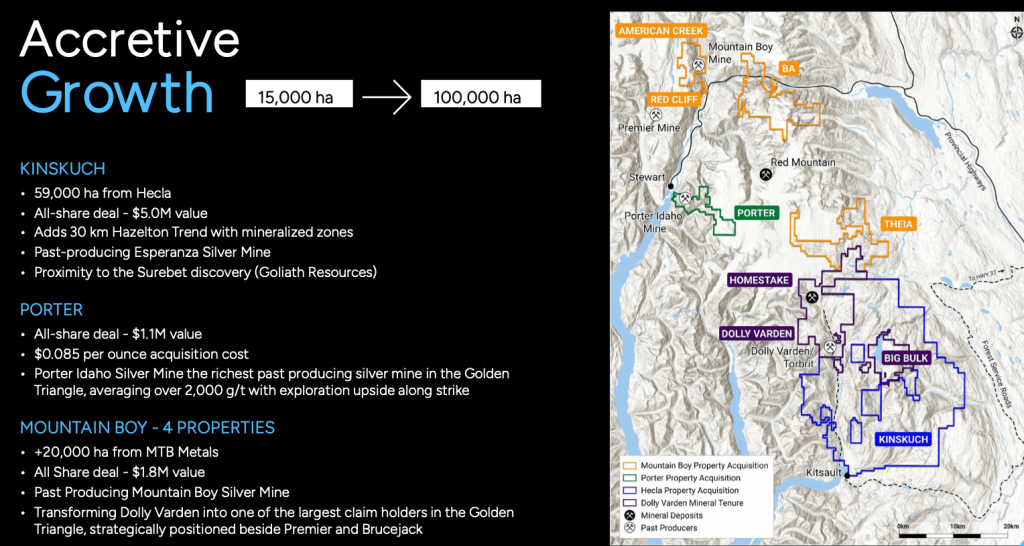

This is why the board has made tuck-in acquisitions in the area and why it might make more. Now that Dolly’s market cap is nearly C$600M, Mr. Khunkhun points out that M&A could also involve bigger targets.

The Company announced a capital raise of C$30M on top of the ~C$35M it has. Instead of Dolly being acquired by a top primary Ag producer, management is looking to roll up assets in B.C., and possibly elsewhere, to become a top producer itself.

This is an ambitious goal, but a reasonable one given the strength in Ag/Au prices and the anticipated trajectory of precious metals. Ag crossed US$40/oz for the first time this cycle less than two months ago! This week it’s over US$48/oz and is +70% YTD!

The following CEO interview of Dolly Varden’s Shawn Khunkhum is important because Dolly has not moved nearly as much as many Ag-heavy peers. The Top-36 are up an average of +430% from 52-week lows! By contrast, Dolly is +106%.

Yet, among those Top-36 are earlier-stage companies with no Indicated ounces, ones in less, or far-less, favorable jurisdictions than B.C.’s Golden Triangle, or with low-to-very low grades, and relatively poor access to funding.

Shawn, thank you for your time. Can you please give readers the latest snapshot of Dolly Varden Silver?

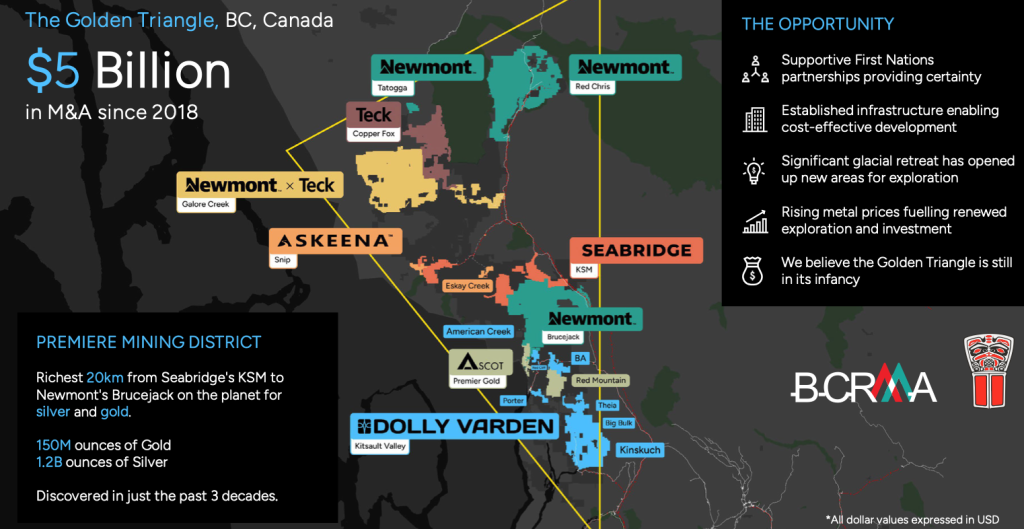

Yes, of course. 2025 has been a transformational year for Dolly Varden, and not just because silver is up +70% YTD! We are an advanced explorer focused in NW B.C.’s world famous Golden Triangle.

Our expanding footprint is in the southern portion of the Triangle, an area that enjoys better access to regional infrastructure than much of the middle & northern parts. We have a large, high-grade, primary Ag resource, plus ~$65M in pro forma cash.

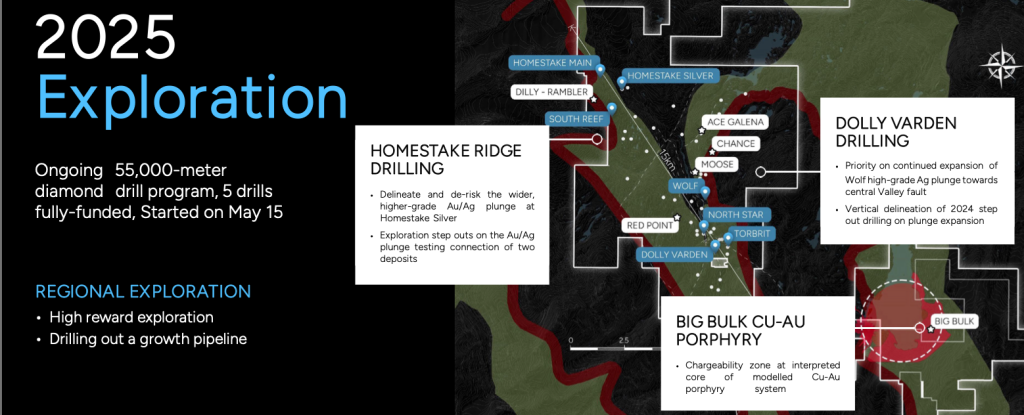

Due to exciting recent drill results — highlighted by 21.7 m of 1,422 g/t Ag and 120.0 m of 3.34 g/t Au — we increased our drill program to 55,000 meters. Drill results will be ongoing into Nov./Dec.

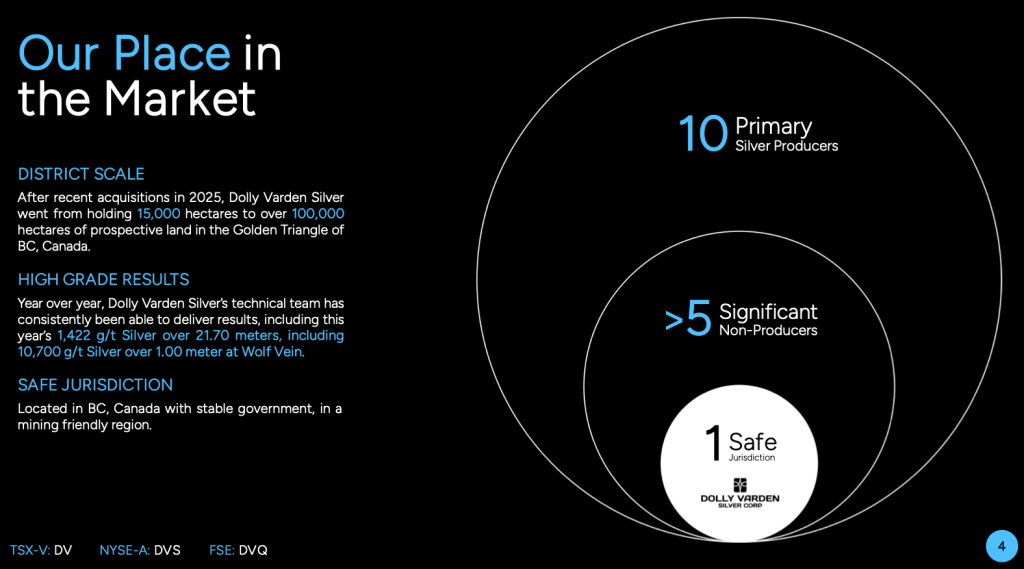

Our properties, totaling over 100,000 hectares after recent acquisitions, are in/around the richest 20 km on earth for Ag & Au. We have booked ~160M high-grade Ag Eq. ounces, and hope to grow that figure to 200M+ in 1Q/26.

Why are primary silver mines/projects like Dolly Varden’s highly sought after?

Great question. Silver is mostly (~75%) a by-product of gold, lead, zinc and/or copper mines. Primary silver projects are rare, offering pure-play leverage, but there are fewer than a dozen significant primary Ag producers.

Those producers need to develop & acquire primary Ag projects to expand. In my view, Dolly’s flagship Kitsault Valley is a Top-4 or 5 undeveloped silver asset (globally) not owned by a producer.

Interest in what we’re doing is very high, but instead of selling out to a producer, we plan to continue growing organically and through M&A to become a meaningful producer ourselves.

You say Dolly Varden will continue to make accretive acquisitions, but haven’t asset values soared, making M&A less attractive?

Yes and no. Some juniors have seen spectacular gains. For example, Capitan Silver, Discovery Silver and Silver Mountain are up an average of about +750% from 52-week lows.

However some companies or assets, with poor access to capital or stalled projects, can still be acquired at very attractive valuations, like the deals we announced in the second quarter. We’re being prudent in our negotiations. Now’s the time to play offense!

Dolly Varden boasts high-grade silver & gold, why is high-grade so important?

I love high-grade assets as they enjoy a valuable margin for error if metals prices decline. High-grade operations are often cheaper to run (less waste, tailings, plant, equipment, etc.). They deliver more metal per tonne of rock moved, crushed, and processed.

We believe Kitsault Valley’s Ag Eq. grade is Top-10% globally, making it valuable, scarce & desirable. We are actively drilling and making acquisitions to meaningfully expand our high-grade endowment.

Your land portfolio is close to Ascot Resources unused, recently refurbished, 3,000 tpd Premier mill. Explain the potential significance of the Premier Mill to Dolly Varden.

Yes, our properties are within 30-35 km of two mills, Newmont’s Brucejack and Ascot’s Premier. As mentioned, Ascot’s 3,000 tpd mill is currently on care & maintenance.

There is only a small handful of companies, including Dolly Varden, with resources/projects close enough to profitably utilize Ascot’s mill. This potential path offers the opportunity to be in production a lot faster, at a fraction of the cap-ex.

Reaching production later this decade would provide cash flow to continue expanding Kitsault Valley, develop newly acquired properties, and make additional acquisitions, possibly including larger, transformational ones.

Describe your view on generalist investor funds/groups, family offices & high net worth individuals entering the metals/mining space.

This month I attended the Beaver Creek & Denver precious metals conferences. Both were packed with bullish investors, some were generalists. We had over 50 meetings, yes mainstream investors are looking at metals & mining companies again.

But it’s early days. There is just one precious metals company, Newmont, in the S&P500. Our NYSE American listing makes Dolly Varden highly attractive to generalist funds looking for high-grade, primary-Ag exposure in safe jurisdictions.

Note: Dolly’s $DVS listing has grown to ~1.15M avg. daily volume (past 10 days), and peer Ag-heavy names listed in the U.S. trade 5-25M shares/day!

Readers can buy other silver-heavy juniors, why Dolly Varden?

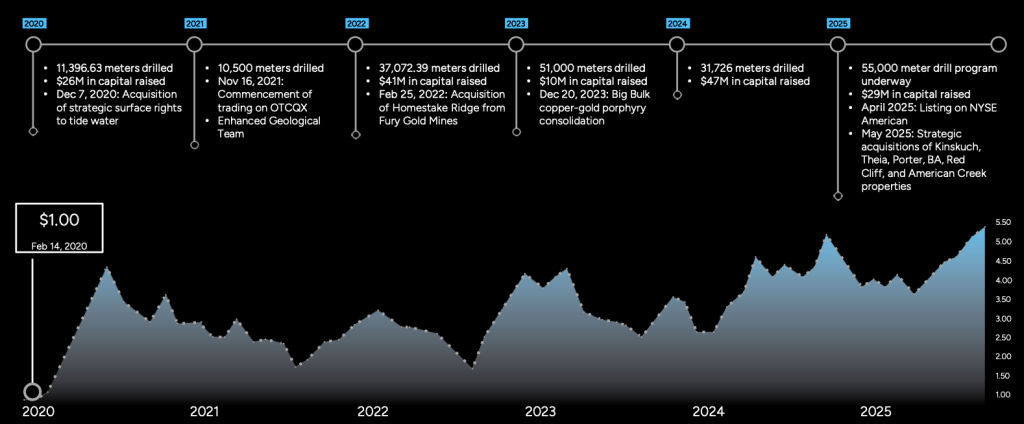

When I became CEO in December 2019, Ag was ~$16/oz and our market cap ~C$20M. Over the past five and a half years, we have raised $150M, drilled 196,000 meters, greatly expanded our B.C. footprint, and increased our market cap to nearly $600M.

Our growth trajectory is not slowing. As we book more ounces, deliver exceptional drill results and possible new discoveries, as we make acquisitions, including larger ones, Dolly Varden stands out as a junior worth owning.

As you stated earlier, Dolly has had a nice run, having doubled in the past year, but in strong bull markets, top quartile performers increase 100s, even 1,000s of percent. I’m not saying our share price will triple or quadruple overnight, but we have plenty of room to run.

Shawn, thank you again for your valuable time. Silver is in an EPIC bull market, and in my view Dolly is one of just a few must own Ag-heavy juniors. I look forward to more exciting news in the coming weeks/months.

Readers are encouraged to watch a replay of Dolly Varden’s corporate presentation at Beaver Creek and/or the Denver gold forum.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Dolly Varden Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dolly Varden are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dolly Varden was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply