After a break from writing about Electra Battery Materials (TSX-v: ELBM) / (NASDAQ: ELBM), I’m back and excited once again. Not excited to chase the stock above C$7.5/shr. as some did last week, but ready to buy pullbacks as profit takers & warrant clippers sell shares.

ELBM.v trades at ~C$2.2/shr. (Oct. 23rd). I have no advice on how to trade this stock. Some high-flyers, including most meme stocks + crypto currencies do not have strong hard-asset backing. Electra is different from those so-called “investments.”

Due in large part to a collapse in battery material prices & investor sentiment, the Company experienced project delays (and cost overruns) at its 100%-owned, fully-permitted, now fully-funded, hydro-metallurgical cobalt (“Co“) sulfate refinery in Ontario.

On October 22nd, management announced the closing of a comprehensive recapitalization that greatly reduced & refinanced remaining debt to C$38M, and fully-funded the refurbishment of the Company’s flagship mill complex, albeit increasing fully-diluted shares to ~224M.

Importantly, if the new warrants are exercised at US$1.25/C$1.75, it would bring in a hefty C$177M in unencumbered cash.

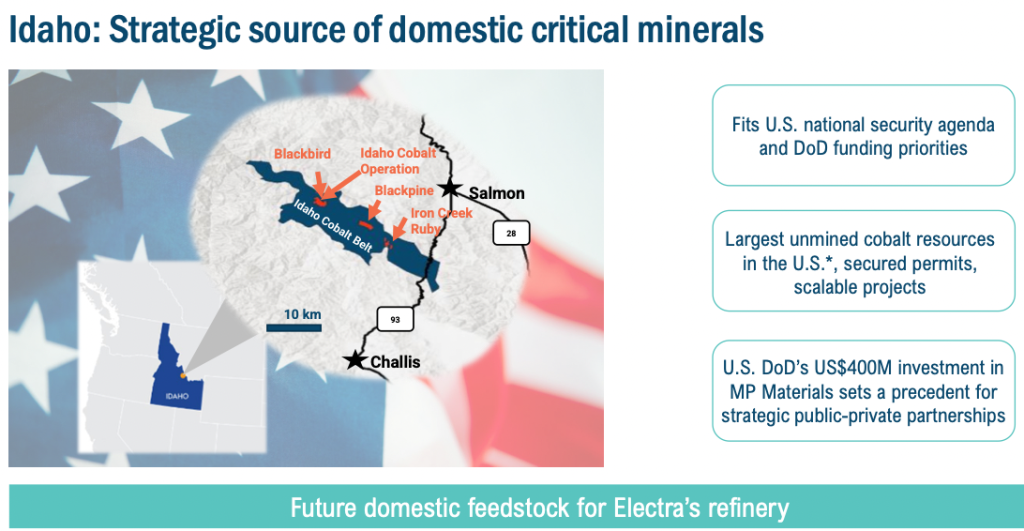

Electra also owns valuable Co/copper properties/projects in Idaho, USA. A year ago, with Co & battery metals completely out of favor, prior to the Trump Administration taking a very active role in rebuilding supply chains, no one cared about the Idaho prospects.

Yet Idaho is poised for renewed, robust growth and a potential re-rating. I believe that Idaho could become a meaningful portion of Electra’s total valuation. At spot prices, there’s nearly 200M Cu Eq. lbs. there, a figure that could grow substantially with drilling in the coming years.

With possible government grants, low-cost loans, and/or direct investments a lot more likely today than a year ago — this could be an important driver of value. Numerous new players are anxious to gain exposure to the U.S. market.

From a long-time cash-starved position, warrant proceeds could enable CEO Trent Mell to make tuck-in acquisitions, or acquire assets elsewhere in the U.S.

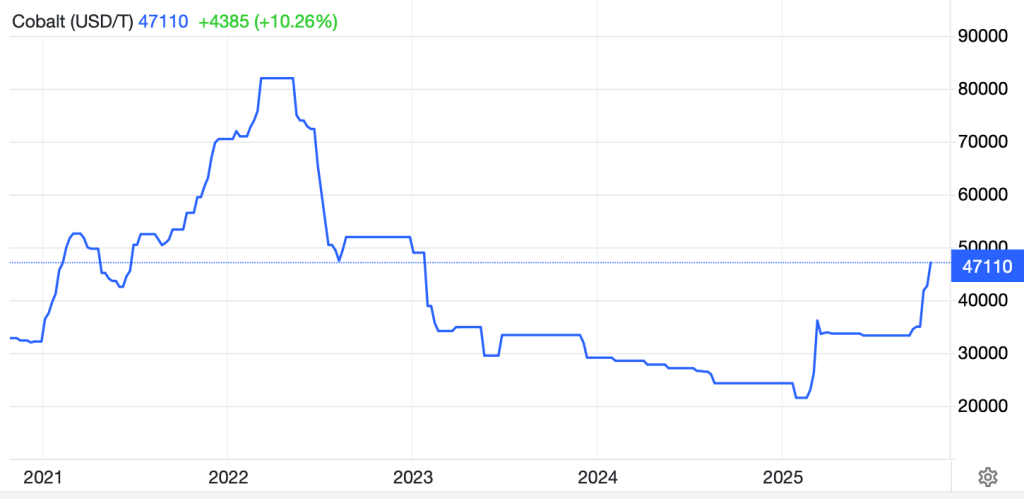

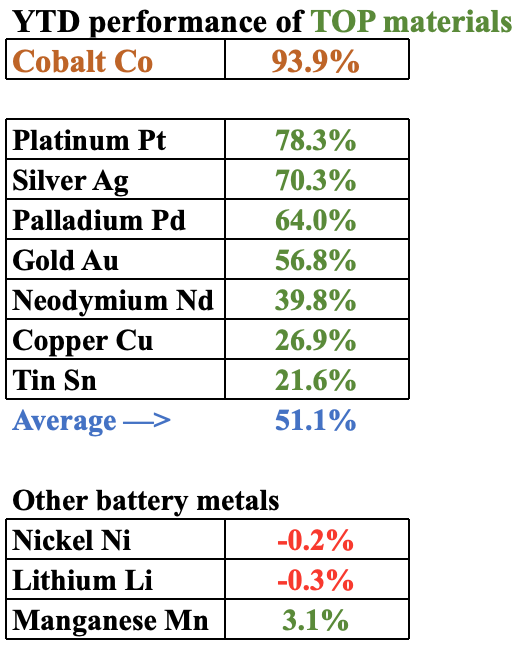

Unlike other battery metals (nickel, lithium, graphite & manganese), and many REEs, which have not moved all that much, the Co price is +119% to US$21.4/lb. In 1q/25. Co bottomed around $9.8/lb.

Above $21/lb., Electra can consider a partially market-based toll-milling operation vs. the lower-risk fixed fee plan, potentially expanding earnings potential.

Understandably, some worry about Co demand as LFP batteries deployed extensively in EVs & stationary battery energy storage systems (“BESS“) use no Co. I shared that concern until I dug deeper…

The Cobalt Institute, related industry reports & Reuters articles illustrate scenarios where demand rises from ~220K tonnes/yr in 2024 to ~400K by the early 2030s. That would be a high single digit CAGR, 3x the CAGR projection for Cu.

In a bifurcated world, the West’s demand for NON-CHINA-touching critical materials is effectively insatiable until safe, long-term, sustainable supply chains are re-established across N. America & Europe.

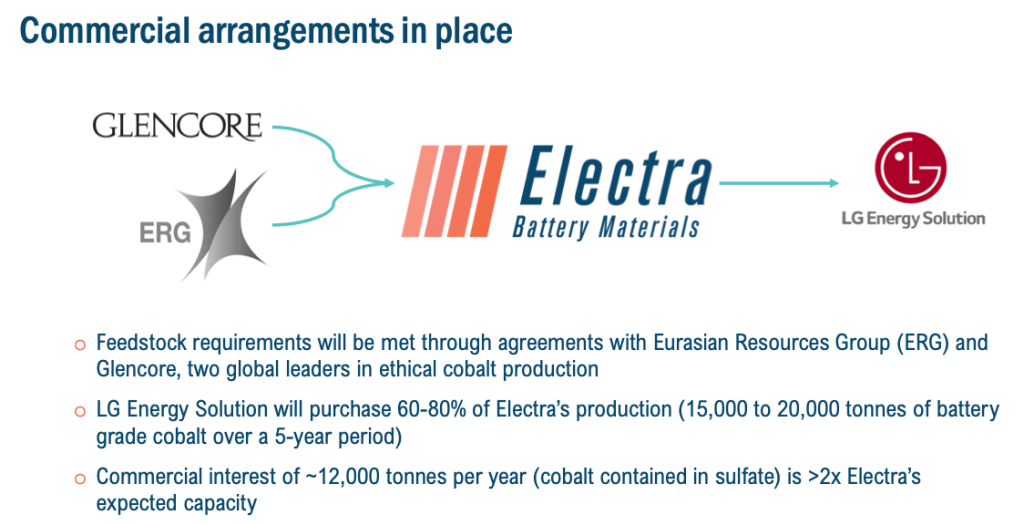

Electra has a very serious strategic asset. LG Energy Solution signed a $700M off-take agreement in which it will purchase 60-80% of production (a total of 15,000 to 20,000 tonnes of Co sulfate over a 5-year period).

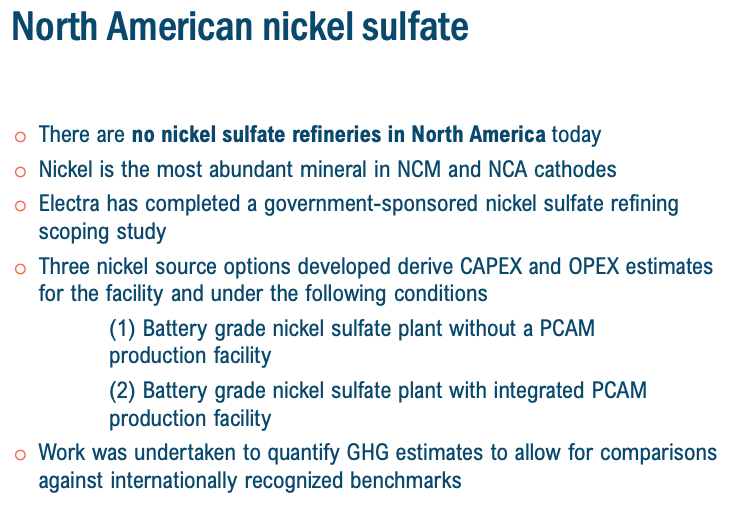

This Complex will be the only facility of its kind in N. America, expected to be low-cost, environmentally-friendly, flexible & expandable. A Complex supporting both primary refining of multiple materials & Li-ion battery recycling by leveraging existing infrastructure & equipment.

That’s why management calls the refinery a Battery Materials Park (“BMP“). It’s now on track for commissioning sometime in 2027. As valuable as the BMP is, the past few months suggest its strategic & monetary value could be even higher.

The race is on for hard asset commodities and facilities in Western countries to process / refine them. The world is splitting into rival camps. Entirely new supply chains of critical materials need to be established, and they will.

Unlike mines with 15-20 year lives, Electra’s BMP could last into the 2100s. Timelines to plan, permit, fund, build & commission processing facilities to handle substantially more materials remains 4-8 years, making existing & near-term Western facilities incredibly important.

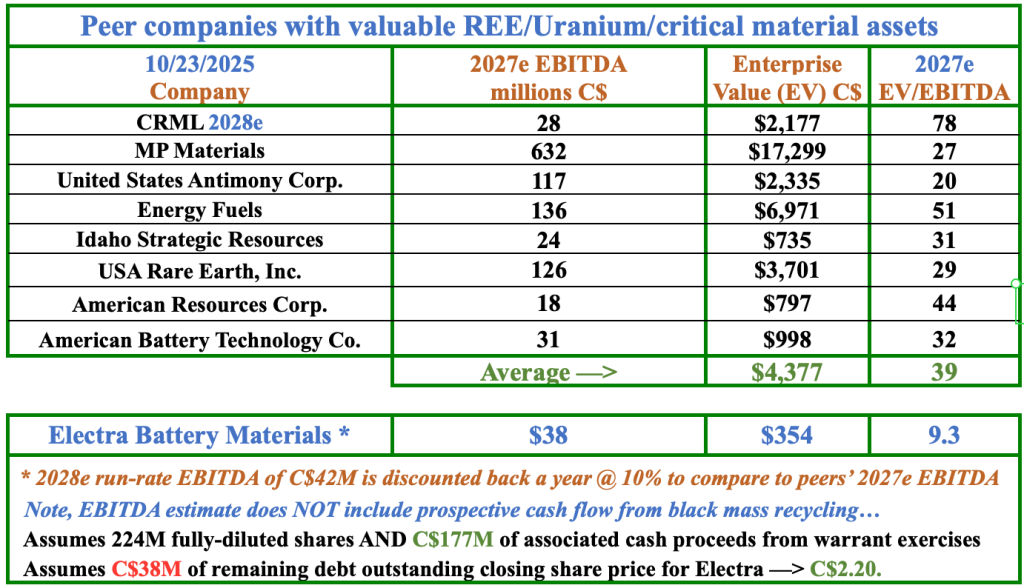

Energy Fuels is an excellent analog with its White Mesa uranium mill being repurposed to (also) process rare earth elements (“REEs“) & high-value waste streams. To be clear, White Mesa is what drives that company’s valuation — a robust 51x multiple of 2027e EBITDA.

In the following table, some well-known REE companies are valued at 20x-78x 2027e EBITDA. Admittedly, if Electra’s BMP was ONLY going to produce Co sulfate, its third-party replacement value of US$250M (probably US$300M+ now due to inflation) would not be as compelling.

Management estimates it could deliver an annual run-rate of $42M in EBITDA in 2028. Discounting that back a year at 10% to be comparable to the others would be ~$38M. That puts Electra at a 9.3x 2028e run-rate EBITDA multiple vs. companies in the table averaging 39x.

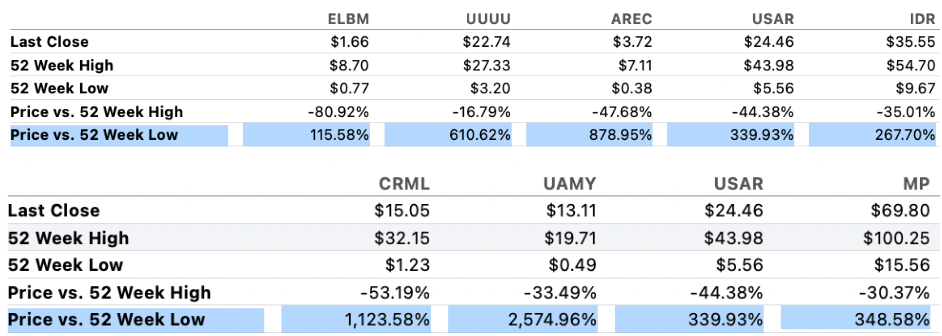

Perhaps Electra deserves to trade at a discount due to execution risk, but the other companies carry plenty of risk as well. For example their share prices have soared a lot more than Electra’s (see below).

One of the KEYS TO THE ELECTRA STORY is that the Complex sits on over 600 acres, is fully-funded & permitted, and has room for BOTH expansion in size/scale, and the addition of new circuits to handle other valuable materials. A few years ago, REEs were not contemplated for the BMP.

Today, with a lot more REEs going to be mined in Canada, management has the flexibility and cash to consider studying the processing/refining of REEs.

Black mass (shredded Li-ion battery waste) recycling has already been trialed successfully in batches and more work is being done via a C$5M grant, of which ~C$3M is yet to be deployed.

REE company stocks recently launched substantially higher (although they have recently pulled back moderately) on a combination; 1) the anticipation of higher REE prices, 2) U.S., Canadian, Australian & European government support, and, 3) volatile, intractable China/West relations.

A SECOND KEY TO ELECTRA’s STORY is that although producing A LOT more REEs, critical materials, battery, base & precious metals outside of China is great, and is going to happen, it won’t matter if those materials can’t get processed & refined outside China!

Tied to this narrative is the resulting surge in interest in N. American mines, projects & facilities from Japanese, Korean & European groups urgently seeking greater access to the world’s second largest EV, clean-energy, high-tech market.

Chinese EVs are incredible & very low-cost, but they’re shut out of the U.S. This makes the U.S. a tremendously attractive market for Auto/Battery OEMs that have trouble matching China’s prowess in Asia & Europe.

Electra benefits from a perfect storm of increasing demand for essential materials processed outside of China, but meaningful gains in processing capacity across N. America & Europe 5+ years away.

The Company’s share price soared along with many rare earth, and critical material juniors plus dozens of natural resource companies with projects in the U.S.

Look at Lithium Americas, MP Materials & Trilogy Metals, up an average of +458% from 52-week lows on various U.S. gov’t grants, investments, loans, and the implicit stamp of approval.

Metals/mining juniors are hoping U.S. gov’t support is coming their way, and again, it’s not just the U.S., but several Western countries & Europe. And, it’s not just governments stepping up.

JPMorgan launched a US$1.5 trillion “Security and Resiliency Initiative” to fund (through numerous partnerships) industries vital to U.S. national & economic security. Targets include advanced manufacturing, defense & aerospace, energy resilience, and frontier technologies. These are sectors that require battery materials.

The world’s Sovereign Wealth funds have trillions in assets. They too are expressing increased interest. In the U.S. there’s talk about creating a Sovereign Wealth fund next year. If JPM can facilitate $1.5 trillion, I imagine the U.S. could pledge a trillion+…

I could list more Western initiatives; pundits point out that private equity, pension & hedge funds are joining the hunt for critical materials.

To be clear, I’m not suggesting that Electra will necessarily benefit directly from these particular initiatives, but with cash flooding the zone, all companies with strategic assets will benefit. Valuations will rise across the board.

Over the years Electra has had a difficult time, but the heaviest lifting is done. Funding has always been the biggest challenge, and funding seems to be in very good shape. The mgmt. team, board & advisors are strong, let’s see what they can accomplish in the next few years!

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Electra Battery Materials, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Electra Battery Materials are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Electra Battery Materials was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply