What might happen to lithium (“Li“) prices this year & next? Juniors are valued as if prices will remain well below the levels required to commercialize new projects.

I believe Li-bearing spodumene concentrate will rebound substantially within 6-12 months as demand for Li in EVs is expected to grow 20% & Battery Energy Storage Systems (“BESS“) nearly twice that.

I’m bullish on the demand side as low Li, nickel, cobalt & graphite prices create many new uses for Li-ion batteries.

2024’s consumption of Lithium Carbonate Equiv. (“LCE“) reached ~1.15M tonnes. Consider that if demand increases at a +10.07% CAGR, 3.0M tonnes of LCE would be needed in 2034. At +12.74%, 3M tonnes in 2032. At +17.34%, 3M tonnes LCE in 2030…

There’s a good chance of medium-term Li demand growing 10.07% to 17.34%/yr. However, it hardly matters as I doubt supply can keep up.

As Li market participants fret over EV penetration and the growth trajectory of energy storage, a factor to consider is how much new supply is coming online.

I’m not referring to gains from existing producers SQM, Ganfeng, Pilbara Minerals, Albemarle, Rio Tinto, Mineral Resources, Tianqi & Sigma Lithium. Some of those companies are curtailing output, most others can’t keep increasing by 10% year after year.

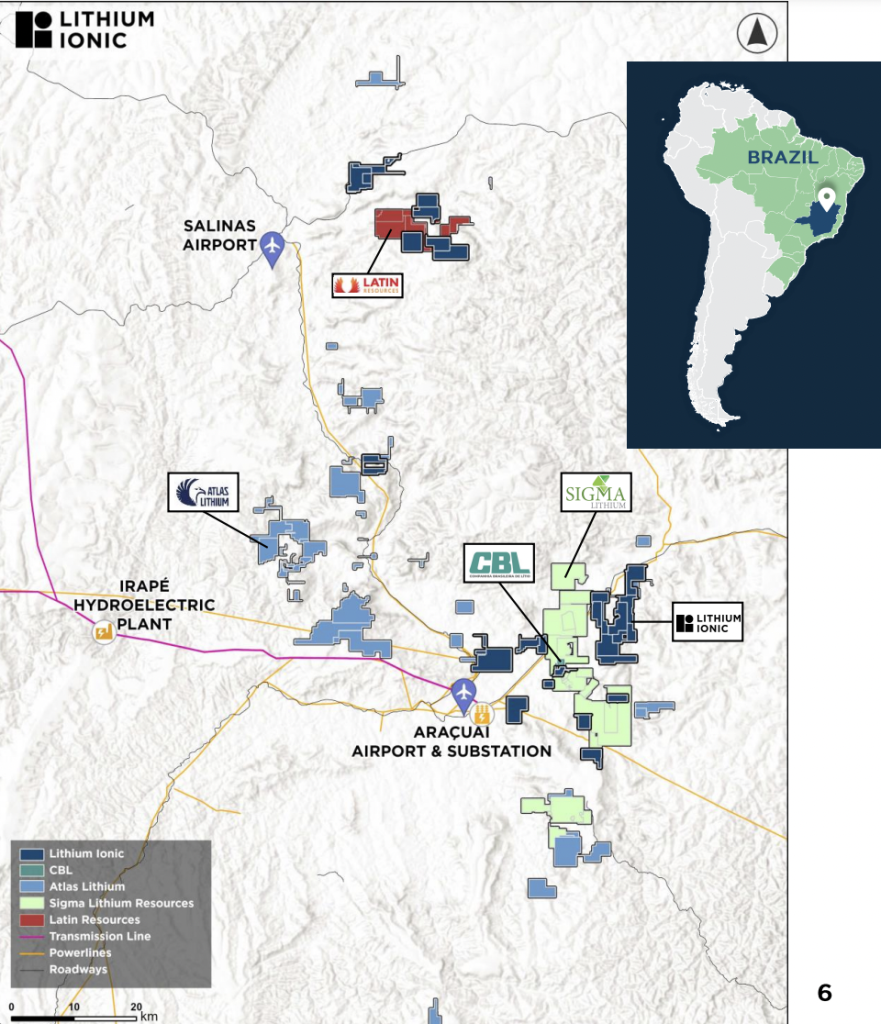

Lithium Ionic’s Baxia next to Pilbara Minerals/Latin Resources, Sigma next to Banderia

Among new projects from companies like; Lithium Americas, Critical Elements Corp., Patriot Battery Metals, Wildcat Resources, Winsome Resources & Q2 Metals, plus DLE & clay hopefuls in Alberta, Saskatchewan & the western U.S. –> NONE will be in production before 2028.

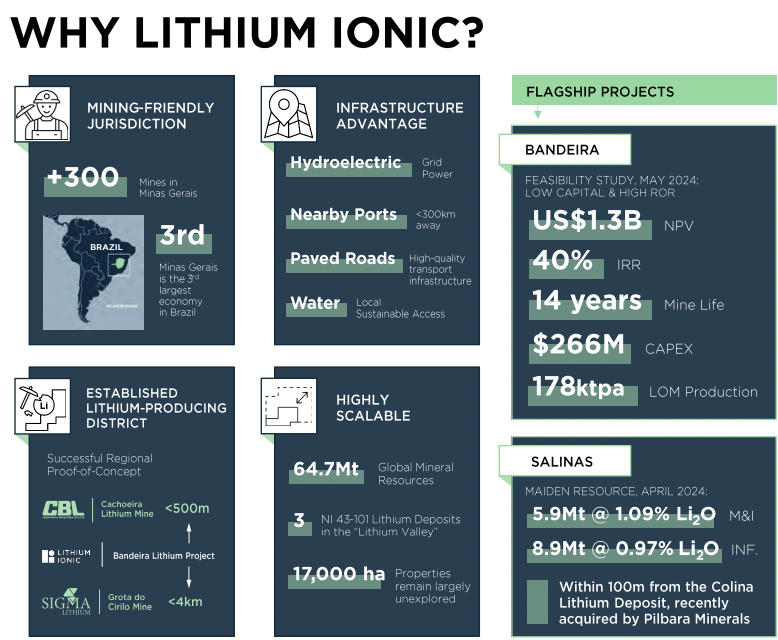

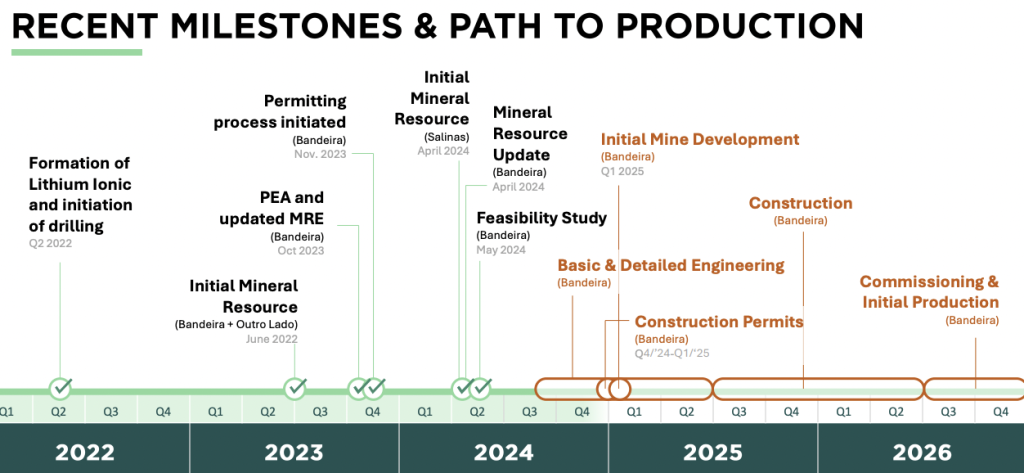

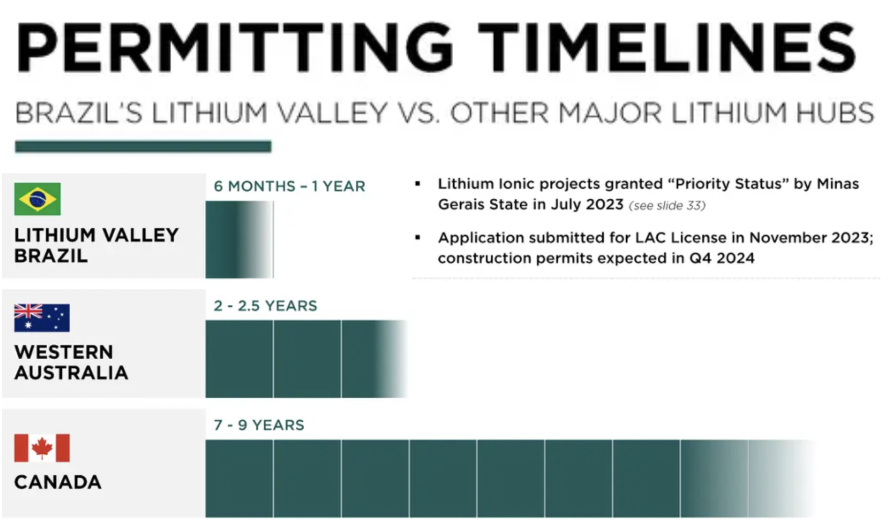

By contrast, Lithium Ionic (TSX-v: LTH) / (OTCQB: LTHCF) is following in the footsteps of neighbor Sigma, which raced into production in Brazil due to rapid turnaround times on permitting & construction.

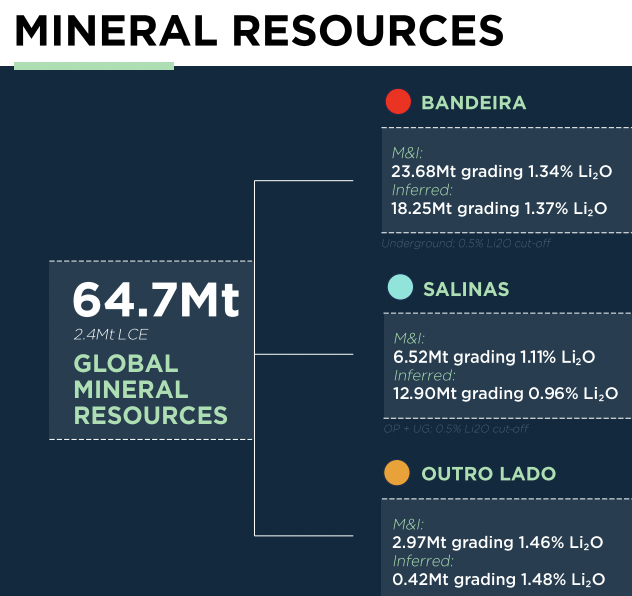

Lithium Ionic is on track to begin operations at its 100%-owned Bandeira project in 2H/26. I truly believe it’s in the right place at the right time. Amazingly, Banderia covers just 1% of the Company’s 17,000-hectare land package. There’s ample room to grow the scale of its BFS-stage flagship project.

On January 8th management stated it was close to receiving approval of the licença ambiental concomitante (LAC) license, authorizing construction at Bandeira.

In November, a major vote of confidence came via the receipt of a non-binding Letter of Interest (“LOI”) from the U.S. Export-Import Bank (“EX-IM“] for up to US$266M, equal to 100% of upfront cap-ex, in the form of a loan for up to 15 years. CEO Blake Hylands commented,

“This LOI from EX-IM is a major achievement for Lithium Ionic, providing a clear pathway to fully fund the development of the Bandeira Project. Securing this support demonstrates the viability of the Project, reflects the strength of our Project and team, and acknowledges the growing importance of Brazil’s Lithium Valley…”

The due diligence process has been underway for several months. Management is aiming to finalize a definitive financing package that will support the start of construction in the second half of this year.

Importantly, Banderia isn’t the only project the Company has. On January 14th management announced a new resource estimate of nearly 20M tonnes of 1.01% Li2O at its 100%-owned Baixa Grande (formerly the Salinas project). The new resource is 485,500 tonnes of LCE.

20M tonnes might not sound like much as some other projects have over 40M tonnes. However, I count fewer than 15 — not owned/controlled by producers — with > 20M tonnes of Li-bearing mineralization.

Baxia is in northern Minas Gerais State bordering Latin Resources’ project. Readers are reminded that giant Australian producer Pilbara Minerals acquired Latin Resources.

On the announcement date, Pilbara’s takeover valued the asset (PEA-stage) @ $216/tonne LCE. If Lithium Ionic’s 485,500 tonnes of LCE are worth that much to an acquirer, it would be $105M vs. Lithium Ionic’s enterprise value {market cap + debt – cash} of ~$124M.

Looking at the map, it seems clear that Pilbara will want to acquire Lithium Ionic. The longer they wait, the larger the number of LCE tonnes they have to pay for.

Approaching 20M tonnes at Baixa is great, but even better is management’s confidence in its potential for, “significantly” more tonnage, calling the probability, “very high,” as the resource remains open along strike and at depth.

Current interpretation suggests modeled pegmatites “potentially increase at depth.” Each meter drilled in the latest resource update delineated 17.1 tonnes of LCE. If it costs $400/meter drilled to find 17.1 x ~US$10,500 = ~US$180,000 worth of LCE (in-situ value), that’s a tremendous payout!

It’s understandably difficult to imagine takeouts in such a weak market, but readers are reminded that over the past dozen years or so, Li has been the top #1 or #2 commodity twice, and #15/#16 (of 16 commodities) twice!

If prices are going to make a big move, there’s only one way they can go. Even in a terrible market Rio Tinto is acquiring Arcadium for $6.7 billion and Pilbara acquired Latin Resources. More M&A is coming…

Rio is said to be looking for more Li exposure. It could comfortably afford to buy & develop [Pilbara, Sigma, Lithium Ionic, and U.S.-listed Atlas Lithium.

Or, consider SQM & Albemarle with oversized exposure to Li brine in Chile. Those two are constrained in how much brine they’re allowed to pump in the Atacama salar, one of the driest places on earth.

With Brazil an up-and-coming major Li hub — akin to Western Australia & [Quebec/Ontario] — SQM & Albemarle could do a lot worse than buying assets there and have plenty left over to acquire more in Quebec/Ontario.

I’m not saying Lithium Ionic is first on the list of companies to get acquired, but it’s on the list, and probably not near the bottom. And, If Sigma (high on the list) is acquired, all eyes turn to Lithium Ionic & Atlas.

In the meantime, Lithium Ionic has ~$23M in cash, enough to last several quarters even with a moderate amount of drilling. Importantly, later this year an update on Banderia’s resources will be released.

Despite Latin Resources being at PEA-stage vs. Lithium Ionic at BFS-stage, Latin was valued 3x higher on an EV/tonne basis. Booking 100’s of thousands more tonnes of LCE at Bandeira & Baxia will make Lithium Ionic’s undervaluation vs. peers more pronounced.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Ionic, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Lithium Ionic are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Lithium Ionic was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply