{Please see disclosures at bottom of page}

In a recent article I opined that over the medium-to-longer term, solar evaporation ponds used for lithium brine extraction / processing might become a thing of the past. That’s because future projects might not need ponds, as one or more new lithium brine extraction / processing technologies will reach commercial-scale production sometime next decade. However, I believe brine companies with PEAs, some of which have been working on projects for years — will be allowed to move forward with ponds.

Most of these companies at PEA-scale or even more advanced, are in Argentina. The companies at PEA-scale are Millennial Lithium, Advantage Lithium, Neo Lithium, LSC Lithium and Australian-listed Argosy Minerals. Also in Argentina is a much more advanced JV (Cauchari-Olaroz) between Lithium Americas & Ganfeng. This project is at BFS-stage, is fully-funded and construction has commenced. It’s expected to be in production in 2020.

Another significant project is Sal de Vida, 100% owned by Australian-listed Galaxy Resources. The project is not fully-funded, but recently received a US$280 M cash injection from POSCO. POSCO acquired 17,500 hectares of Galaxy’s non-core lithium-bearing property. The parcel reportedly has 1.58 million metric tonnes of Lithium Carbonate Equivalent (“LCE“) of JORC compliant Measured & Indicated resources. So, POSCO has a project now in Argentina as well. POSCO might be one of the first companies to use new technology instead of ponds.

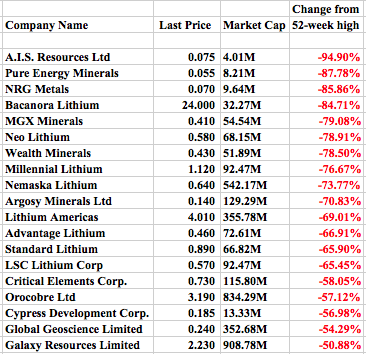

The stock price performances of some of the better known lithium stocks has been atrocious, (see chart below). However, the world needs lithium! perhaps not so much this decade, but a lot by the middle of next decade. There are dozens of sell-side analysts, industry consultants and lithium sector pundits who are trying to predict lithium demand in various years between 2025-2030.

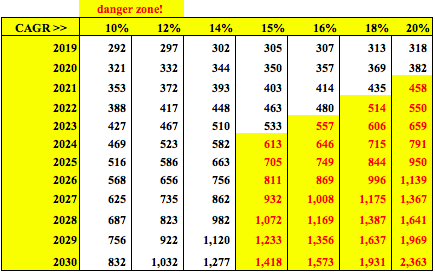

It seems to me that no matter how you slice it, the industry needs the Argentinean brine mines to be completed, even the ones at PEA-stage. Even though they carry considerable risks, they are the best shot the market has to remain balanced. Look at the chart of lithium LCE demand scenarios at growth rates ranging from 10%-20% CAGR (assuming 265k LCE in 2018 according to a recent UBS report). The yellow areas are what I consider the danger zone, where demand could outstrip supply.

Think about it, in 2028 vs. 2027, the incremental demand in LCE in that year alone ranges from 62,000 tonnes LCE (@12 CAGR) to 161,000 tonnes LCE (18% CAGR). That’s the equivalent of 2-5 new brine projects in 2028. It barely matters when the market hits 800,000-1,000,000 LCE/yr., (2026-2028?), we know it’s coming and we need all the brine production we can get.

![]()

Yet, total new Argentinean brine supply in the early 2020’s, will probably remain below 100,000 tonnes LCE/yr. And, even by 2025 that number will probably be below 200,000 tonnes LCE/yr. from known projects today, including POSCO. It takes a LONG TIME to get new brine projects up to full capacity….

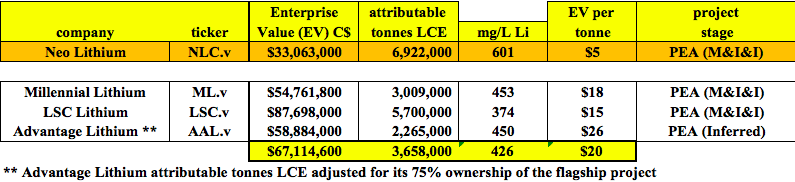

One company that has sold off more than many despite strong fundamentals is Neo Lithium Corp. (TSXV: NLC; OTCQX: NTTHF; FSE: NE2). Neo has an Enterprise Value (“EV“) [market cap + debt – cash] of C$33 MM. They have no debt, and I assume they have about C$35 M in cash (they had C$45 M at 9/30/18). In late November Neo contracted GHD to complete a Pre-Feasibility Study (“PFS”) at the 3Q Project by Q1 2019. The central zone of the 3Q project contains roughly 4 million tonnes of lithium carbonate in the Measured & Indicated categories at an average grade of 614 mg/L Li, plus about 3 million tonnes in the Inferred category, at an average grade of 584 mg/L Li.

The project has a lot going for it, both big and small things. For instance, there’s no inhabitants or aboriginal communities in the area. And, the Company owns 100% of the project with no option payments. A full pilot pond plant 1:1,200 scale has been operating for over 2 years and at 1:600 scale for one year. The PEA compares favorably to peers, but that PEA was done in 2017, it’s dated. Neo has made considerable progress since then.

The Company is drilling in the northern high-grade zone of the project to build two new production wells. This zone contains 746,000 tonnes of lithium carbonate in the Measured & Indicated resource categories at a grade of 1,007 mg/L Li plus 186,000 tonnes in the Inferred resource category at a grade of 1,240 mg/L Li. All of this high-grade resource is found 100 meters or less from surface! and is included in the overall resource.

In the chart above, notice that Neo Lithium is trading at C$5 per Measured, Indicated & Inferred tonne LCE. That compares to an average of $20/tonne LCE among the 3 peers. It could be argued that all 4 names are oversold, but Neo seems to be the cheapest of the cheap. Note, I did not include Argosy Minerals because its PEA was done at a 10% discount factor and it’s a much smaller project.

Potential significant improvements on PEA

1) calcium precipitates as calcium chloride without the use of any costly reagents (calcium is a deleterious material that needs to be removed.)

2) a significant increase in the size of the resource estimate subsequent to the PEA, (+220%) which could increase mine life.

3) discovery of a high-grade zone with over 1,000 mg/L Li, continued drilling of this high-grade zone in 2019.

4) due to items #2 & #3, the size of the ponds required might be smaller, requiring less cap-ex, (pond construction is a major cost for lithium brine projects).

5) positive environmental base line study & hydrogeological model results showed that there should be minimal impact on the brine level of the salar, even under extraction scenarios of 60,000 tonnes LCE/yr. (the 3Q Project has a significant recharge system).

6) The Company is looking into offering both lithium carbonate & lithium hydroxide (the results of this analysis would be included in the PFS.)

7) Neo is achieving concentration levels of 3.8% lithium in brine without any additives, chemicals or reagents, (which should lead to higher brine recoveries than in the PEA)

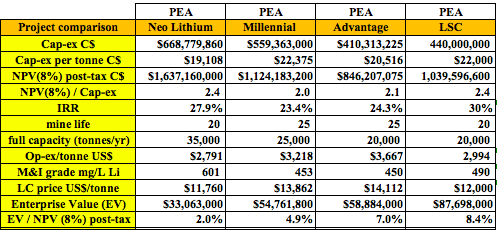

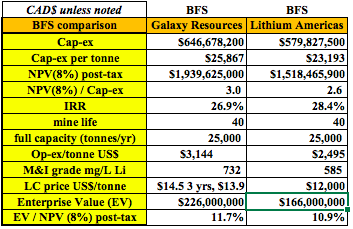

Notice that Neo’s after-tax NPV(8%) is about 60% larger than the average of the other 3 companies, its op-ex/tonne is 15% lower than the average of the other 3. Neo’s M&I lithium grade is 21% higher, and its long-term lithium carbonate price assumption is 12% lower. Neo’s EV / NPV(8%) = just 2%! The others are cheap as well, but on average are trading at 6.6% of their respective NPV(8%) figures.

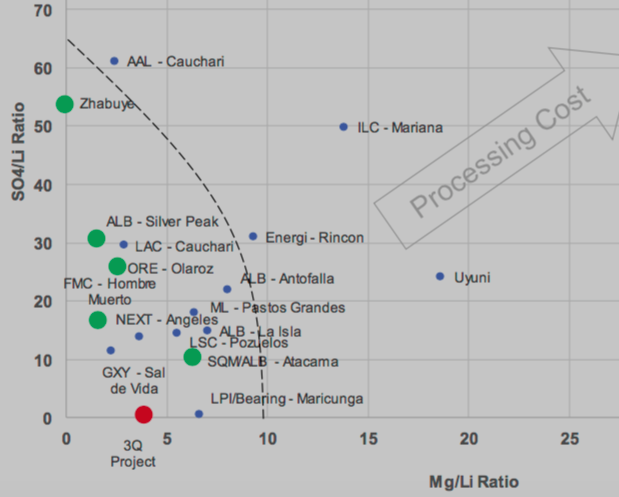

A major difference between Neo and its peers is that it claims to have the lowest impurities of any brine project in the world. I can not verify that claim, but the following chart from the Company’s corporate presentation appears to show that the 3Q project (the red dot), is certainly among the lowest as measured by two common impurity ratios Mg/Li & SO4/Li.

Based on a superior PEA to begin with, and the potential for significant improvements on the PEA’s project economics, including from smaller pond sizes, > 35,000 tonnes LCE/yr., a longer mine life, lower chemical/reagent use than anticipated, higher Li recoveries, the newly discovered northern high-grade zone, and other factors, Neo’s PFS could compare quite favorably to the BFS-stage projects mentioned earlier.

The above mentioned factors, if realized, could increase the after-tax NPV(8%) & IRR, lower op-ex/tonne and potentially lower capital intensity (cap-ex/annual tonnes LCE). Below are the 2 BFS-stage projects, although only at PFS stage (in the next few months), Neo Lithium could compare nicely to these two projects.

Both Australian-listed Galaxy Resources and Lithium Americas have multiple projects. Therefore, the EVs have been adjusted to reflect only those companies’ brine projects in Argentina. For Galaxy, I took one half of its EV (recall the company just received US$280 M from POSCO.) For Lithium Americas I used 80% of the EV. Lithium Americas has a lithium clay project in Nevada at PFS stage. Then I took 65% of the remaining valuation to account for Lithium Americas’ 65% ownership in its Argentinean JV.

Although just estimates with some necessary assumptions applied, Galaxy’s & Lithium Americas’ projects are trading at about 11% of their respective after-tax NPV(8%) values. Recall, Neo Lithium is trading at 2%. Like other high quality lithium companies around the world, I suspect that Galaxy & Lithium Americas shares could have attractive risk/reward at current levels.

Notice that the 2 BFS-stage projects trade at an average of nearly C$200 M. Compare that to Neo’s EV at C$33 million. I think the better quality lithium stocks will rebound in 2019. Some of the rebounds could be big. If true, the relative valuation of Neo Lithium to peers (post its PFS) will continue to look quite attractive and could offer a compelling opportunity.

Disclosures: As of December 31, 2018, Peter Epstein & Epstein Research [ER] had no prior or existing relationship with Neo Lithium. At the time this article was posted, Peter Epstein was long shares of Neo Lithium bought in the open market.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)