all metals prices are in US$, other figures are C$ unless indicated otherwise

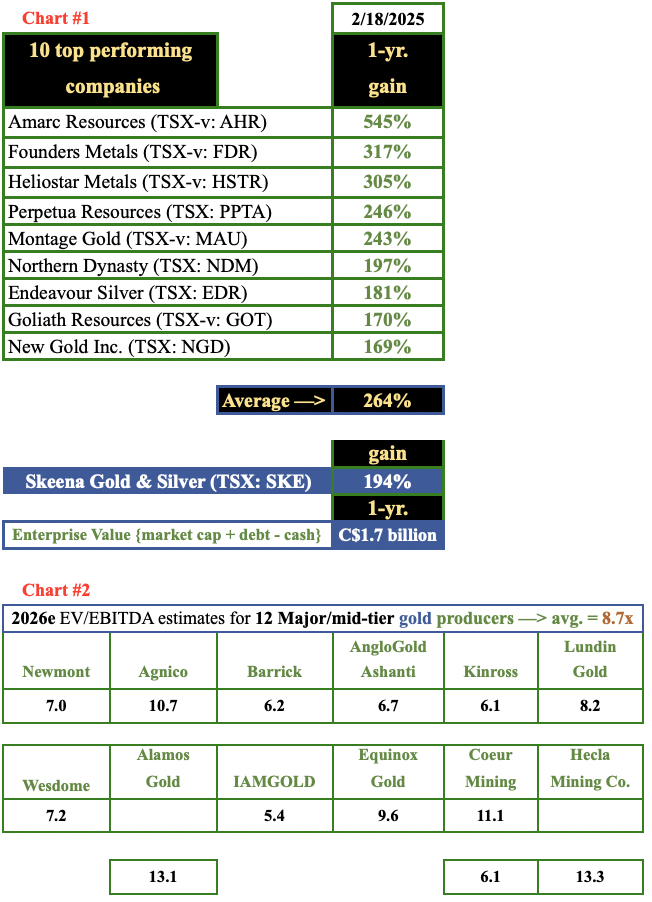

Gold & Silver are enjoying serious bull market gains, up over +43% in the past 12 months! The spot price is less than 2.5% from $3,000/oz… A basket of 10 better-performing precious metals producers & developers is up an average of +264% {Chart #1}

Over the same period, Skeena Gold & Silver (TSX: SKE) / (NYSE: SKE) has nearly tripled, up +194%. I firmly believe Skeena still has substantial upside. It has the 3rd largest land holdings in B.C., Canada at ~180,000 hectares, plus numerous other attributes.

The blue-sky potential is enticing as the past-producing, 100%-owned Eskay project is a relatively low-risk, advanced development-stage asset that’s moving toward commercialization at a rapid but prudent pace.

Note in Chart #2 that the average 2026e EBITDA/EV multiple is a healthy 8.7x or 7.8x without Alamos Gold & Hecla Mining. If Skeena could earn an 8x multiple later this decade, it’s meaningfully undervalued today.

Management expertly secured > 100% of upfront cap-ex, including a provision for cost overruns. This achievement alone places Skeena ahead of the pack. The funding package is innovative & highly flexible. Debt can be refinanced at any time, without prepayment penalty.

Eskay’s upfront cap-ex is $713M, yet management secured $1.07 billion of debt, streaming & equity. All but US$25M of the equity component is done.

In this interview Exec. Chairman Walter Coles Jr. thinks Skeena’s undrawn ~12-13%% debt facility (with a 1% standby fee on US$350M of capacity) could potentially be replaced with a U.S. corporate bond yielding roughly 8%.

Unlike other royalties/streams, two-thirds of the Company’s streaming transaction can be repurchased –> hugely beneficial if Au rises. Gold is up over $650/oz. since 1H/24 when the stream was negotiated!

None of Skeena’s BFS-stage peers are fully funded unless they share economics with a partner. For comparables, one must assess equity dilution (incl. warrants) in the coming years.

Among the largest Au projects outside of N. America are hopefuls in Mali, Côte d’Ivoire, Senegal, the DRC, Mauritania, Ghana, Nigeria & Egypt. I’m not picking on Africa, but projects there are sometimes very remote, and/or landlocked. Corruption & security are challenges in many of the countries mentioned.

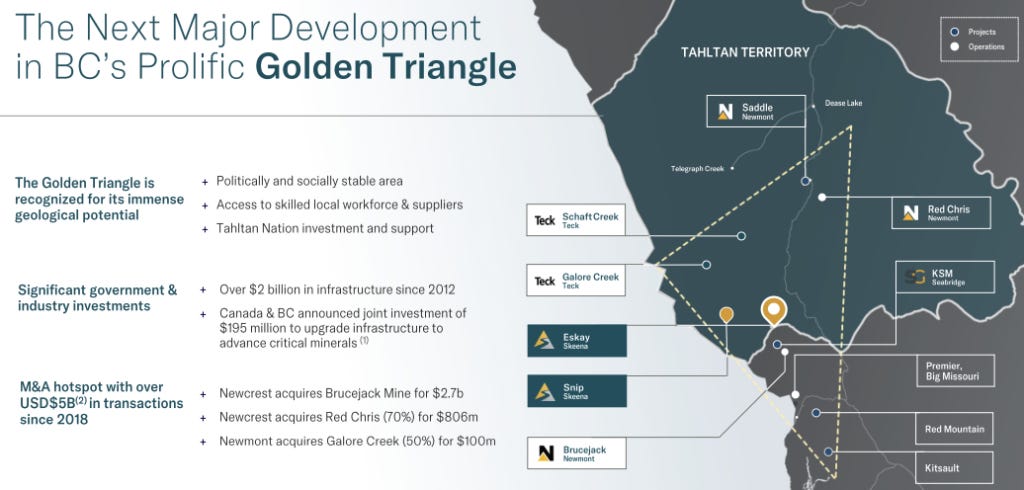

Barrick Gold was recently burned in Mali, and a few years ago in Argentina / Chile on Pascua-Lama. First Quantum took a major hit in Panama on Cobre-Panama. By contrast, Eskay is in the world-famous Golden Triangle of northern B.C. Canada, and has one of the highest-grade open-pit projects on earth.

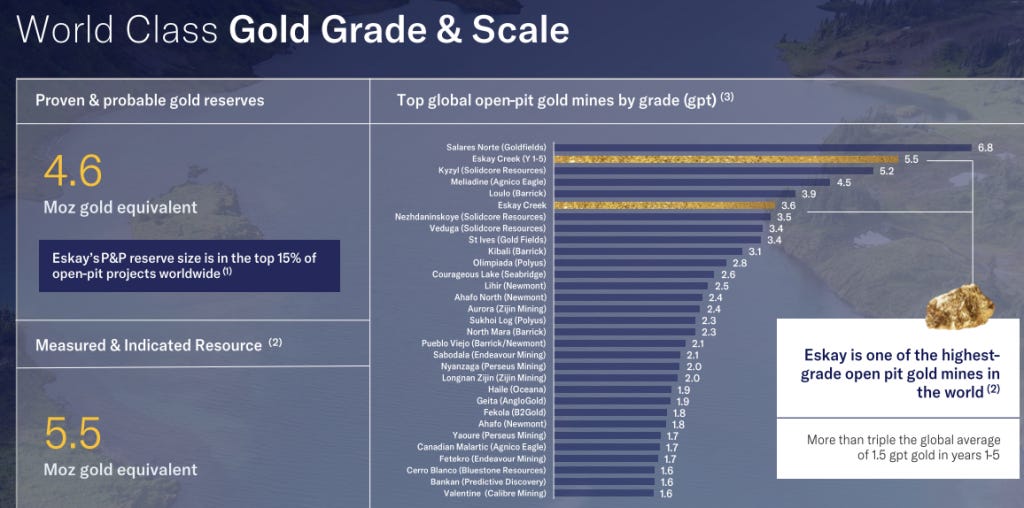

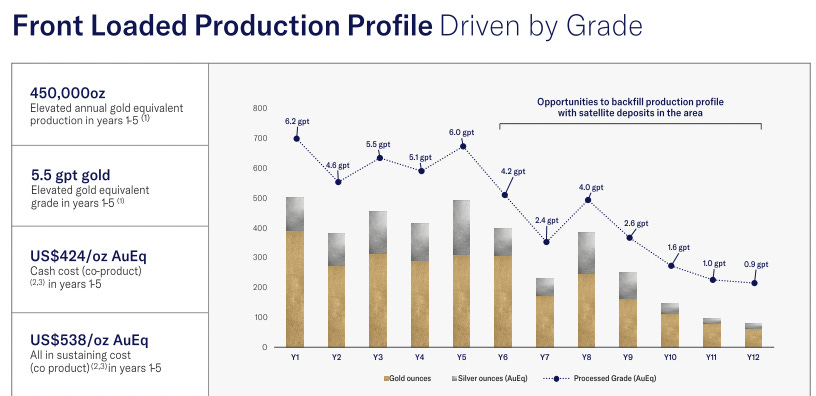

In the following chart are 30 open-pit mines. Eskay would be #5 in terms of grade. In years 1-5, the grade will be 5.5 g/t Au Eq. (~3x the average open-pit grade). Including Eskay, only 8 of those 30 are in the Western-friendly jurisdictions of S. & N. America or Australia.

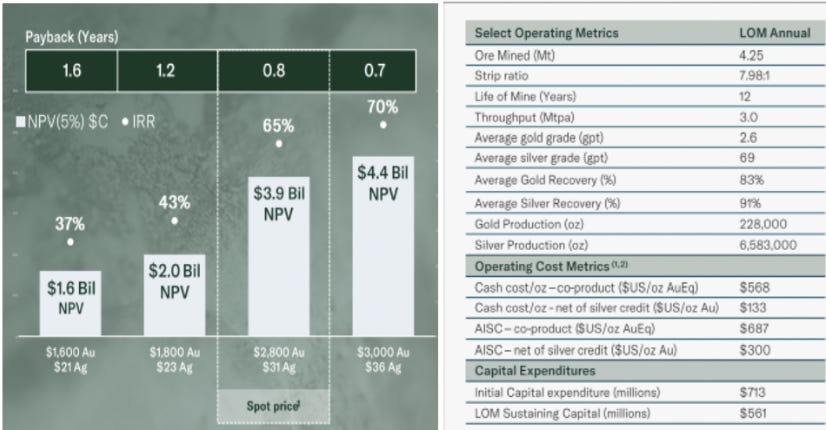

High-grade deposits allow for a margin of error if the Au price falls. Admittedly, with Au at $2,900/oz. and Eskay’s AISC in the bottom decile of the cost curve, it’s hard to imagine an alarming scenario! All-in-Sustaining-Cost (“AISC“) is US$687/oz.

Compare that to the third quarter AISCs at Newmont Corp., Barrick & AngloGold Ashanti that averaged $1,578/oz. In my view, even a +30% increase (margin for error) to $893/oz. by 2H/2027 when Skeena expects to be in production would still be a bottom decile AISC.

Low operating & capital costs contribute to a very strong post-tax IRR of > 65% & NPV(5%) of $4.1B — assuming US$2,880/oz. Au and $32.50/oz. Ag. One is hard-pressed to find a higher IRR or ratio of [NPV to upfront cap-ex]. For Skeena that metric sits at 6.0x.

In years 1-5 average production is expected to be 450,000 Au Eq. oz./yr. Another notable attribute is Eskay’s Ag endowment of 101.4M ounces, slightly larger than the average holdings of Gatos Silver (acquired by First Majestic) & SilverCrest Metals. In years 1-5, Eskay plans to deliver 9.5M oz./yr. of Ag.

If silver’s relationship to gold, as measured by the Au: Ag ratio, were to return to 76.5:1, the midpoint of the long-term average of 63:1 and today’s 90:1, Ag would be $38/oz. The ratio hit 65:1 in 1Q/2021 & 32:1 in 2Q/2011.

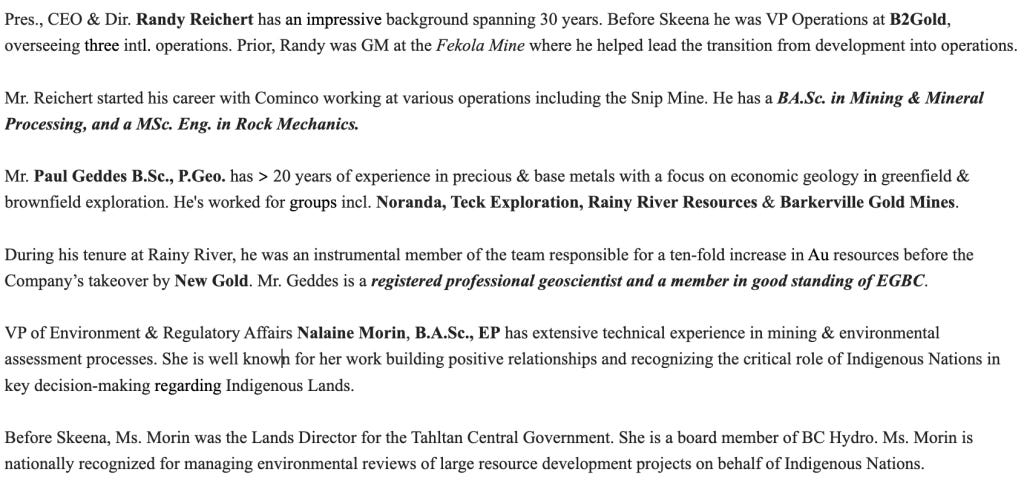

Skeena is led by Exec. Chairman Walter Coles Jr. & CEO Randy Reichert. Many know Mr. Coles, who’s driven the Company forward for seven years. The following execs are notable, and bios of the entire team can be found on the Company’s excellent corp. presentation.

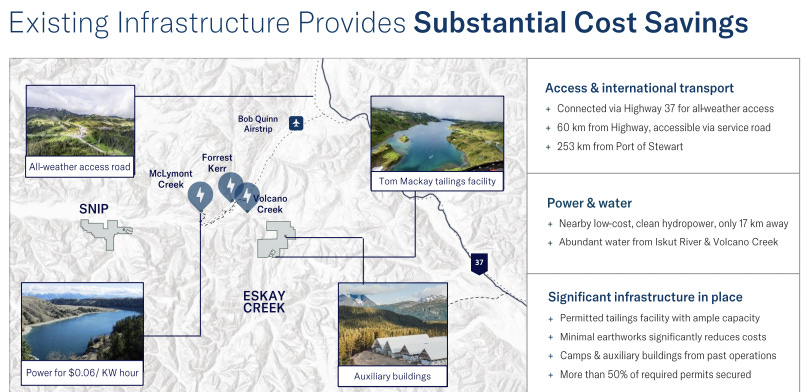

Another compelling factor is that the Company is surrounded by Teck Resources & Newmont Corp. Newmont’s Brucejack mine sits ~25 km from Eskay. While junior miners love to talk about nearby infrastructure, northern B.C. has seen > $2B of investments in the past few decades.

Looking at the map, Teck, Newmont & Seabridge Gold virtually guarantee additional regional infrastructure will be built. Teck/Newmont (50/50 partners on northern B.C.’s Galore Creek) want to own clusters of mines & mills, not standalone assets.

Eskay is worth more in a portfolio of assets than by itself. A sustainable advantage of being a Major or a large mid-tier producer is the opportunity to de-risk through diversification. As producers grow, operating & logistical synergies, spreading mgmt. resources & realizing economies of scale become of paramount importance.

With that in mind, Teck and/or Newmont are prime candidates to acquire Skeena. Newmont would gain operating / logistical synergies, and economies of scale. Also in northern B.C. are Freeport McMoRan, BHP, Barrick, South32, and Boliden AB.

Smaller companies with interests in northern B.C. include Hecla Mining, Coeur Mining & Centerra Gold. Barrick has no meaningful investments in B.C., nor does Agnico Eagle or AngloGold Ashanti. That’s a dozen prospective suitors, could there be a bidding war?

A problem with the takeover narrative is that management has no interest in selling anywhere near the current valuation! In fact, Mr. Coles talks about making acquisitions (Skeena recently obtained a 13% interest in TDG Gold).

At spot prices, the Company is valued at 44% of post-tax NPV. However, Skeena has a second sizable asset.

The 100%-owned Snip project, ~40 km west of Eskay, has a monster grade of 9.0 g/t Au on 937,000 ounces (so far). Eighty-eight percent of the Snip resource grades 9.35 g/t Au and is in the Indicated category.

Trucking ore to Eskay’s mill would be a no-brainer. How much is a nearly million high-grade ounces worth in a mill just 40 km away? I believe it’s in the $100’s/oz.

As a satellite deposit, there would be no mill or tailings facility. Nine g/t Au has a gross in-situ value of $840/oz. (at $2,904/oz.). Look at the Front Loaded Production Profile slide below. Imagine the final six years filled in with 150,000 (and possibly more subject to drilling) high-grade oz./yr. from Snip.

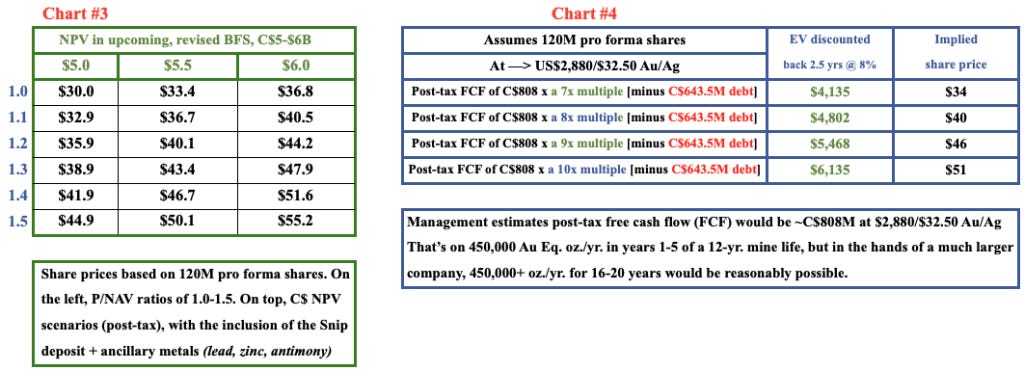

Management is working on a new, enhanced BFS to incorporate Snip’s ore and optimizations in Eskay’s mine plan. For example, management sees opportunities to lower the strip ratio, and include other metals (lead, zinc, antimony) as credits.

In my view, a post-tax NPV (at today’s Au/Ag prices) of > $5.0B is possible, if not likely. That suggests Skeena is valued at ~37% of its pro forma NPV, or 0.37x Price/NAV.

I think it’s reasonable for the Company to be valued at a P/NAV ratio of at least 1.0x as it gets nearer to production. And, according to Haywood Securities, the average industry P/NAV multiple hit 1.5x in 2020, when Au was $1,000+/oz. lower. Mid-tier producers Wesdome Gold Mining & Lundin Gold are currently valued at 1.4x.

Therefore, the opportunity in Skeena Gold & Silver is moving from 0.37x P/NAV to 1.0x (or more), on a post-tax NPV of $4.1B. And, that NPV could move above $5.0B within a year from adding Snip and including the benefits of other improvements.

In my view, (not necessarily that of mgmt.) a combined Eskay + Snip could potentially grow to 450k+ Au Eq. oz./yr. for 16-20 years. Consider that Newmont is 50x the size of Skeena. It could generate $12B+ in EBITDA this year.

Charts #3 & #4 are NOT meant to be price targets. I include them to show a range of possibilities reflecting the key fact that the # of fully diluted shares will not be growing much larger, I assume 120M shares in 1H 2026.

Newmont could acquire Skeena, at a 100% premium, [half in cash, half in Newmont shares,] for ~2% equity dilution, or 1% dilution with some debt. As a Skeena shareholder, I would vote no to that takeover! Shareholders should hold out for a potential bidding war.

The math for Newmont can be applied to Agnico, Teck, or Freeport, each of which could comfortably acquire & develop/expand multiple companies of Skeena’s size!

Switching gears for a moment, an interesting development has been a quadrupling in the price of antimony (“Sb”) due to China banning exports of this critical material to the U.S.

At spot prices, Eskay hosts over US$1 billion of in-situ Sb value. U.S. Au/Sb developer Perpetua Resources has attracted significant government funding for its Sb holdings.

I’m not counting on antimony to move the needle, it’s icing on the Au/Ag cake. The advanced-stage, high-grade, near-term production, 100%-owned Eskay project — surrounded by Newmont & Teck, in B.C.’s Golden Triangle, on ~180,000 hectares (including 937,000 ounces at 9.0 g/t Au at the nearby 100%-owned Snip deposit) is more than enough!

Disclosures: Skeena Gold & Silver is a speculative small-cap company that is pre-revenue. Although first production is expected in 2H/2027 and the Company is fully funded, delays could unfold. Readers are urged to consult with investment advisors before investing in speculative stocks.

At the time this article was published, Mr. Epstein of Epstein Research owned shares in Skeena purchased in the open market. Skeena is not currently a paying advertiser on Epstein Research but is expected to pay for one (and possibly more) article(s) in the future. Mr. Epstein should be considered biased in favor of Skeena Gold & Silver.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply