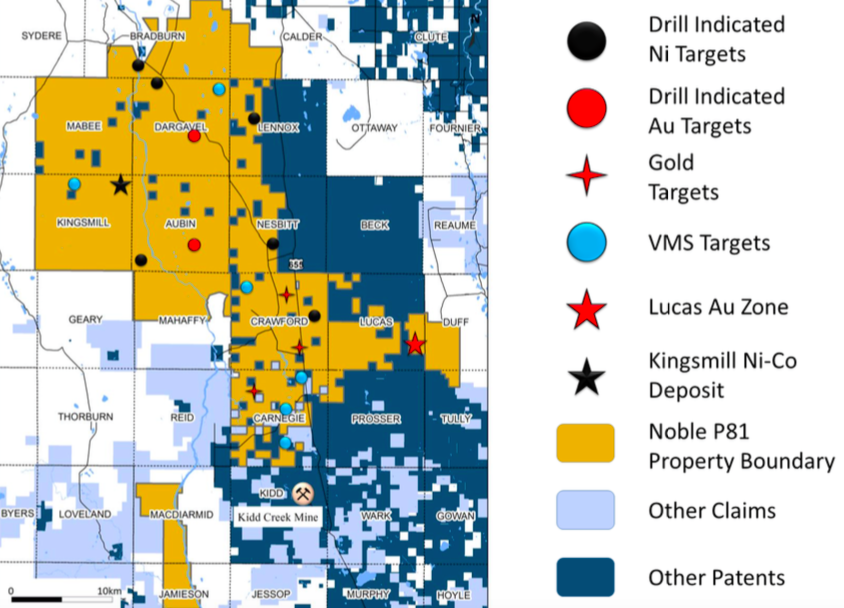

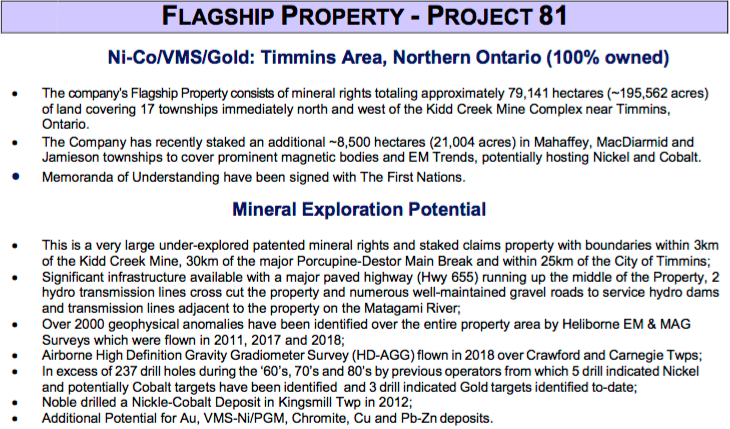

Noble Mineral Exploration Inc. [TSX-V: NOB] / [OTC: NLPXF] is a Canadian-based explorer owning 100% of > 79,000 hectares (>195,000 acres) of mineral rights (nickel-cobalt VMS & Gold targets) covering parts or all of 17 townships immediately north and west of the Kidd Creek Mine Complex near Timmins, Ontario. The Company’s flagship Project 81 is just 30 km north of Timmins, a camp that’s produced > 75 M ounces of Gold. The Kidd Mine has produced >150 mm tonnes of high-grade ore. This is Canada’s most prolific mining district.

More Than Infrastructure & “Closeology” to Kidd Creek

Infrastructure is world-class, from labor, mining services & equipment, to roads, highway, rail and an airport, to power & water. It’s all there in abundance. And, importantly, Memoranda of Understanding have been signed with The First Nations.

Close proximity to Kidd Creek is much more than a bragging right, or a “closeology” bullet point. The Mill has excess capacity available for toll milling nearby ore. The entire Project 81 property is within trucking distance on Highway 655 to the Kidd Creek Mill. Imagine the tremendous savings in time & money if property owners on Project 81 did not have to design, permit, fund, construct & operate a mill & tailings facility.

Noble Operating Like a Project Generator….

Noble plans to initiate 6 or more additional JV exploration programs this year with suitable strategic partners. In these deals, Noble is free carried for a number years and retains a significant minority interest, (typically 25%) in the property if the partner executes on its side of the agreement, otherwise 100% interest in the property reverts back to Noble.

Partners pay Noble a combination of cash, shares + warrants and have meaningful annual work commitments to earn into select areas of Project 81. Each option or JV agreement signed de-risks Noble’s giant land package as it begins to operate like a project generator.

A Very Brief History

It all started with Abitibi-Bowater’s receivership in 2010-11. Noble’s VP of Exploration was lucky enough to locate a box of documents at the Ministry of Mining. The box contained info about a property he was trying to track down. In that box he found evidence of a ~1,300 foot intercept of ~0.30% Nickel. Several months later, Noble owned Project 81, having acquired it from Abitibi’s post-receivership successor company.

A very wide intercept like that of low-grade Ni, instantly reminded CEO Vance White of Royal Nickel Corp.’s Dumont mine, which hosts ~2 billion lbs. of 0.26-0.27% Ni and low-grade Cobalt and of Glencore’s Kidd Creek Mine, which is just 3 km south of Project 81. The Kidd Creek discovery hole in 1963 was 629 feet averaging 1.18% Copper, 8.1% Zinc & 3.8 troy ounces/ton Silver. Project 81 is in a great neighborhood.

Mr. White believes Noble might potentially have a 1.0-1.5 billion tonne deposit of similarly low-grade Nickel & Cobalt mineralization in the Kingsmill portion of Project 81. NOTE: {this is a conceptual exploration target only, it is not NI 43-101 compliant}. The area he has in mind represents a small portion of the entire 79,000+ hectares.

Why Does This Massive Opportunity (Project 81) Still Exist?

Noble controls one of Canada’s largest, under-explored land packages. Giant deposits like Kidd Creek are frequently surrounded by clusters of satellite deposits of roughly 30-50 million tonnes, often found within 15-30 km of a mega deposit.

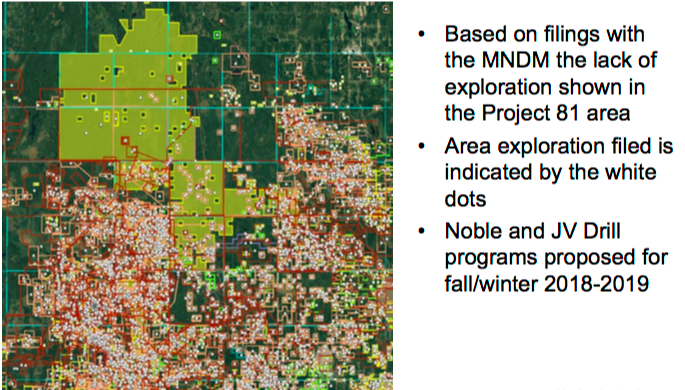

There has been some historical exploration done on parts of Project 81 in the 1960’s-1970’s-1980’s, BUT IT’S STILL LARGELY UNDER-EXPOLORED (see map below), RIPE FOR NEW DISCOVERIES. It wasn’t actively explored because it was mostly held for its timber & forestry rights. Further, exploration done decades ago was ineffective due to the property being completely covered by overburden.

However, technology has changed A LOT in 50 years…and, it has improved substantially in the past 10 years. Geoscience, gravity surveys, modern airborne geophysics & gravity gradiometer surveys covering the project, etc. Noble, its partners & consultants are using state-of-the-art, cutting-edge technologies including Artificial Intelligence.

CEO Vance White commented on the work that’s been done,

“In late 2017 we partnered with ORIX Geoscience Inc. to compile a complete and very extensive data compilation for Project 81. Orix is a team of geosciencetists who partner with junior exploration companies and specializes in compiling, interpreting & modeling large datasets, such as with Project 81. In December of 2018, Orix provided us with a new Digital Data Network Organization, compiled a complete Drill-hole Database by consolidating and standardizing all historical drill hole data into a well organized database, and finalized all Legends by lithology, alteration, structure, textures, mineralization & assay results.

The compilation included all recent Heliborne EM/Mag & Gravity Gradiometer surveys and the Artificial Intelligence survey over Carnegie & Crawford Townships, as well as all data available over the balance of the project area. Orix also provided us with the capability to provide to our partners a full range of additional geological services. The importance of this compilation is that we now have, (since December) detailed data for drill-ready targets that can be shared with our partners where the foundation work has already been done to make specific target identification decisions.”

This is why Noble is such an exciting opportunity for 2019. There will be a number of drill programs starting this year, and ongoing for years to come, spread across the entire project. Next year alone there could be C$6M-C$8M of exploration invested into Project 81. Discoveries would be great news for Noble AND the discovering partner. Noble would own shares + warrants in that partner, + an ongoing interest in the property.

Good News For 1 Partner Will Be Good For All, Especially Noble

Noble will have 10 or fewer carefully chosen partners on the 79,000+ hectare land package. And, the contiguous land is homogeneous, which is really good if there are multiple zones of mineralization as management believes. Given the work done by Noble, its partners & consultants since picking up project 81 in 2011, there’s ample evidence of mineralization and hundreds of drill-ready targets.

As mentioned, a good discovery hole could move the needle for Noble and the discovering partner. In addition, a good hole could also move the needles of other partners in Project 81 (Noble would own shares + warrants in those companies + meaningful property interests). A really good hole? Everyone will want into Project 81, and Noble Mineral Exploration could become a takeout target.

As management prudently options / joint ventures properties, its cash burn will decline. That means the Company’s need to go back to the capital markets will diminish. Noble recently raised C$1M, they probably won’t need to raise much additional capital this year. Low cash burn is a favorable hallmark of the project generator model.

Regarding drilling on Project 81, there are 2 groups that have partnered with Noble. One of them, Spruce Ridge Resources Ltd. (TSX-V: SHL), has completed a 2,000 m diamond drill program on the Crawford Township property it optioned.

Spruce Ridge was pursuing a low-grade Nickel target (possibly with some Cobalt) with a Phase 1 drill program. The first of 4 drill holes was planned to be 600 m deep and was meant to test the strongest portion of a 3,000 m long magnetic anomaly, also confirmed by the Artificial Intelligence analysis carried out by Albert Mining (TSX-V: AIIM). Drill results are expected in the next few weeks. Very wide intercepts of Nickel grading 0.25% or higher would be a big win for Spruce Ridge as it would confirm historical assays and start to hint at the potential size of the orebody.

The Spruce Ride Option / Joint Venture

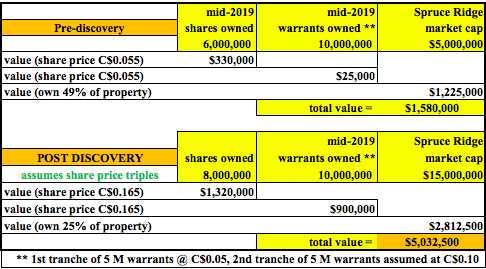

Let’s look at the Spruce Ridge option and JV deal. By mid-year, Spruce will have issued 6,000,000 shares + 5,000,000 stock options to Noble. Spruce will soon have earned 51% of up to 2,000 hectares in Project 81. Pre-discovery, the value to Noble of the shares + warrants + 49% interest in the project is ~C$1.6M. That assumes the 49% interest in the Project 81 property represents half of Spruces’s market value, (Spruce also has a Cu/Au play in Newfoundland that just reported strong Cu drill results). {see chart below}

Post a potential discovery, the value of Noble’s shares + warrants + 25% interest (Spruce would earn into a 75% interest) would be significantly higher, ~C$5.0M. Although Noble’s interest in the project would be cut from 49% to 25%, the value of the project would be much greater. And, Spruce’s 75% interest in Crawford would represent a larger portion of its market cap. Spruce’s share price would presumably be higher, and Noble would own 8,000,000 shares, up from 6,000,000. Finally, Noble will own 10,000,000 warrants that would likely be in the money. {see chart above)

Commenting on the Crawford Township opportunity, CEO John Ryan of Spruce Ridge said,

“What drew Spruce to this property was that it was underexplored, close to the Kidd Creek mine and had several priority targets from a recently flown EM/Mag survey. What made this acquisition even more appealing was the historical drill results from INCO showing the potential of a large tonnage low-grade Nickel deposit. The Nickel grades at Crawford are very close to those at RNC’s Dumont project in Quebec, with some intervals assaying up to 0.42% Ni and we believe that there was never any analysis carried out for Cobalt….”

As mentioned there are dozens if not hundreds of drill-ready targets all over Project 81. As a quick example, consider the Lucas Gold property, according to Noble’s Geologist, Randy Singh,

“The Lucas Gold Target is a known historical gold deposit that has been traced for ~650 m out of a 1,700 m geophysical identified structure (EM & IP) with at least 6 untested parallel structures totaling ~ 4,700 m of potential strike length. Mineralized widths vary from 25 m to over 100 m and have multiple limbs. The deposit exhibits the classic Timmins Camp types of alteration in close proximity to the gold mineralization.”

Conclusion

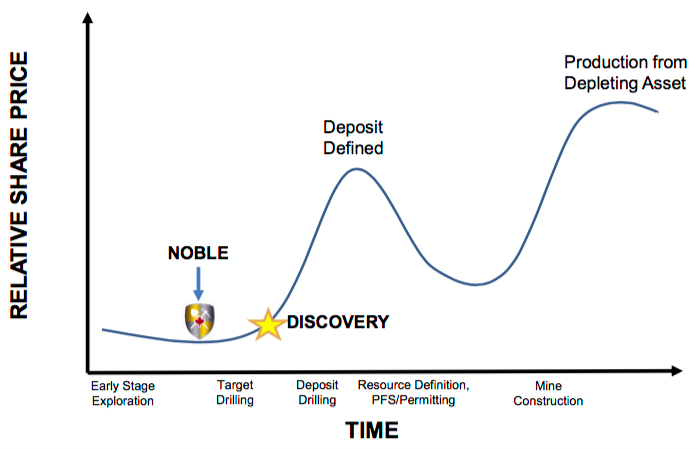

Later this year and next, drill programs will be commonplace all over Project 81, informed by the latest technology and funded by partners with a lot of skin in the game and their feet to the fire to produce results. That’s a big part of Noble’s strategy, to obtain significant equity positions + warrants in partner companies. The companies Noble is working with are at a favorable spot on the discovery curve depicted below. With meaningful equity + warrant positions in partner companies, Noble even benefits from discoveries on those companies’ other projects.

Noble Mineral Exploration [TSX-V: NOB] / [OTC: NLPXF] owns 100% of a giant property that’s Target-rich, Infrastructure-rich and Catalyst-rich. Will it be Discovery-rich this year? A lot of exploration is going to occur, almost all funded by earn-in partners, in 2019, 2020 and beyond. Noble is a high profile discovery play with multiple drill programs coming from multiple partners. That means there are multiple ways to win.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Noble Mineral Exploration, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing co-ntained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Noble Mineral Exploration are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Noble Mineral Exploration was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)