all figures US$

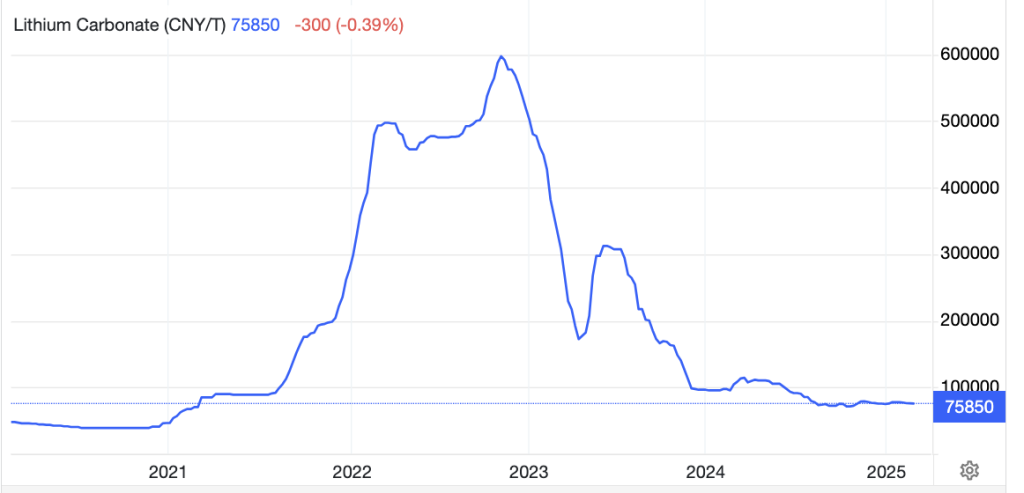

The phrase, “the cure for high prices is high prices” expertly connects key supply/demand drivers of a market, in this case, lithium. An insane two-year period — ended in November 2022 — delivered a +1,400% gain in the benchmark battery-quality lithium (“Li“) carbonate spot price (in China).

Since then, a brutal reversal. For Canadian hard-rock projects, the chart below is not as critical as a key Li carbonate & hydroxide feedstock –> spodumene concentrate (“SC“) (~5.0-6.0% Li2O grade).

Battery-quality Li carbonate [spot] price in China (yuan/tonne)

The SC price averages ~10% of the Li carbonate price. In my view, most developers in Canada require a SC6% price north of $1,600/t, vs. the current level of ~$840/t. I believe SC prices will rise above that mark.

Why? The cure for low prices is low prices! SC peaked at > $8,000/t, so retaking $1,600/t is hardly a stretch. But wait, isn’t Li demand weak? No, last year global EV sales were +25%. And, EVs are no longer the only story.

RK Equity’s Howard Klein & Rodney Hooper were among the first to note that stationary Battery Energy Storage Systems (“BESS“) would grow faster than expected. BESS surged > 50% in 2024…

Recently, the world’s largest Li-ion battery (“Lib“) maker, China’s CATL, confirmed RK Equity’s analysis. CATL predicts ~1.1 million tonnes of LCE might be needed in 2030 — just for BESS — where Libs have captured 90%+ market share due in large part to low Li, graphite, cobalt & nickel prices.

Libs’ dominance in EVs + [grid, commercial, industrial & residential BESS] makes them the de facto choice for new uses in watercraft, aircraft/drones, robotics, military applications, industrial machinery/mining equipment, etc.

Demand is strong, Li prices will be dictated by supply, which has been abundant due to low-quality Li-bearing materials from Africa & China. Much lower grade (often a quarter that of projects in Canada), dirtier, energy-intensive, and less efficient (low recoveries, much more waste) — makes those deposits costly to exploit.

Ultra-low-grade Li feedstocks will be a shrinking portion of the global supply, allowing higher-quality SC prices to climb. Is now a good time to bottom fish in this hated sector?

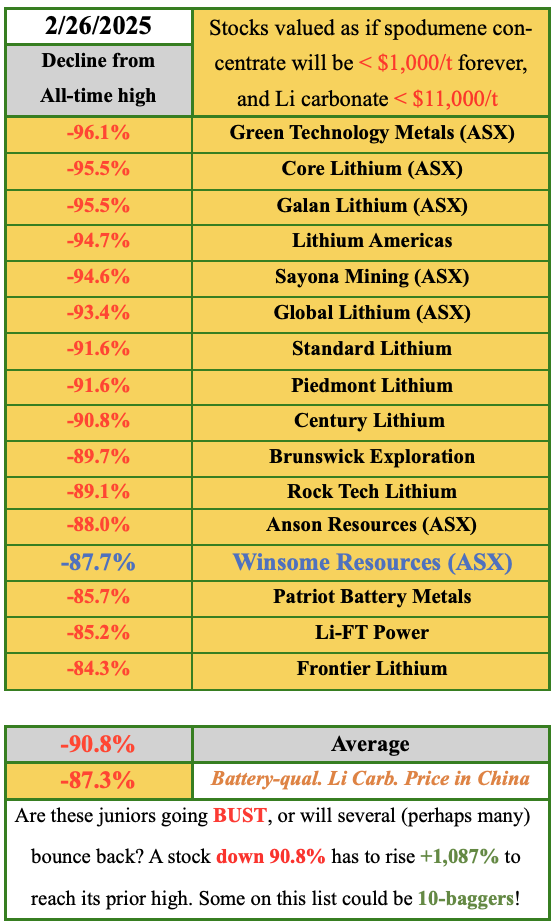

A group of formerly high-flying juniors have seen valuations collapse an average of -90.5% from ATHs {see above chart}. Will most of those companies fail, perhaps, but the survivors could bounce back hard.

Notably, even Pilbara Resources, Albemarle, Ganfeng, Mineral Resources {“MinRes”}, SQM, and Sigma Lithium are down an average of ~73%… Brutal.

Buying deeply out-of-favor companies, but sticking to the best ones with strong teams, and low-risk, green projects near major EV & LiB component hubs offers an attractive risk/reward proposition.

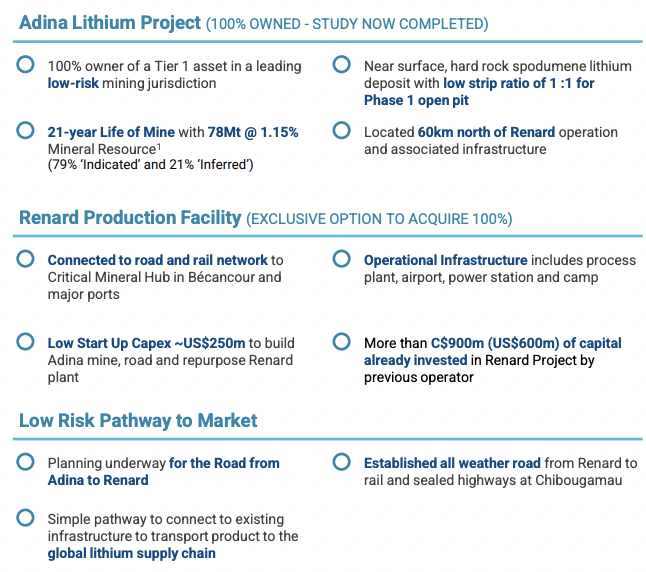

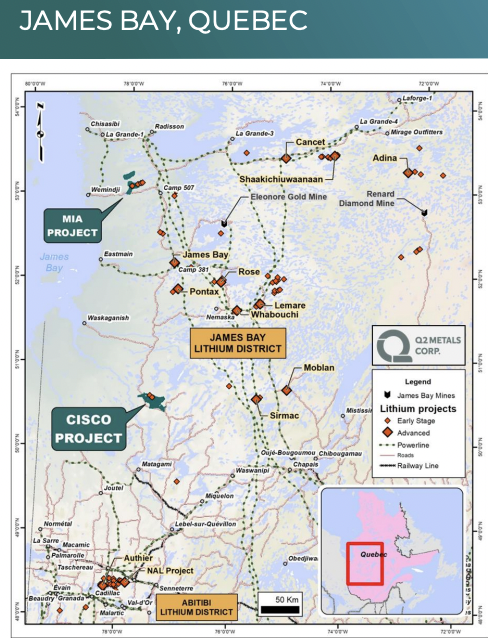

This article is on Australian-listed Winsome Resources and its flagship, 100%-owned, Adina project in the James Bay region of Quebec — close to Patriot Battery Metals’ world-class project. Rio Tinto has been actively acquiring hard-rock Li assets in Quebec.

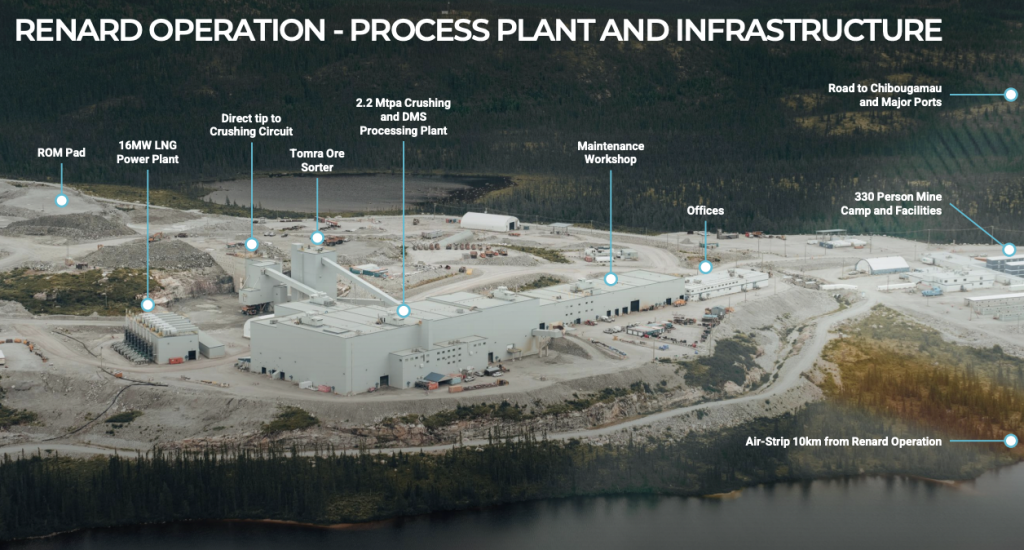

Winsome’s share price has been decimated by sector woes and equity dilution fears. Management plans to acquire the nearby Renard processing facilities + site infrastructure, which will be retrofitted to produce SC5.5%.

Investors were shocked that management is paying $6M to extend the Renard option another six months. However, had Winsome closed on Renard this month, they would be paying $6M in care & maintenance costs… It’s a wash!

I honestly believe management has got this. Look at the bios of CEO Evans, Chairman Biggins, Dir. Zeng, Dir. Boylson and newly hired Chief Development Officer Simon Iacopetta. These are very seasoned execs with hard-rock mining, processing, AND Li experience.

Rounding out the team are execs with Quebec permitting & First Nations expertise, not to mention strong exploration/development skillsets. The Renard complex is connected by road & rail to a critical mineral hub in Bécancour (in southern Quebec).

More than $600M has been invested into the Complex by the prior operator. To take 100% ownership, Winsome needs to pay a total of $37M over the next 36 months, but 78% of that amount is not due for 30 months.

Management can pay up to 100% of the purchase price in shares (not comforting at the current stock price, but they’ve got three years!). Key to the story is the Company’s plans to secure a strategic partner in the coming months.

That partner will presumably fund the majority (or all) of upfront cap-ex + working capital through commercialization, including the costs to acquire, maintain & refurbish Renard. CEO Chris Evans said the Company has hosted site visits with a dozen interested parties, some visiting more than once.

Importantly, the Company’s cash liquidity does not consider a valuable & strategic 19.6% equity stake in Power Metals (+ 100% of the off-take rights for Li, cesium & tantalum).

That investment alone is worth ~$29M (without the off-take rights) vs. Winsome’s Enterprise Value [“EV“] {market cap + debt – cash} of ~$37M. Some believe its off-take rights are worth 5-15% of its EV of ~$148M.

The $29M EV does not include a liquidity discount should Winsome need to liquidate its investment. {Power Metals 10-day, daily-avg. [CAD + U.S.] shares = 2.2 million}.

> $600M invested in Renard complex — Winsome can acquire it for < 7% of that!

Is much of a liquidity discount necessary given that Power Metals is one of the best-performing Li stocks on earth, up +528% from its 52-week low?

Along with up-and-coming hard-rock star Q2 Metals (pre-maiden resource, very strong drill results), Rio, Patriot & Winsome ensure regional infrastructure (roads, rail, power, etc.) will be built.

By 2030, the combined resources of Cancet + Shaakichiuwaanaan + Adina could be > 400M tonnes at > 1.15% Li2O, meaning the 180 km stretch will almost certainly be developed into a major N. American Li hub.

Rio could easily afford to acquire Patriot & Winsome & expand/develop the region along with other Quebec Li assets gained from its acquisition of Arcadium.

In mid-2023 Albemarle Corp. acquired a 5% stake in Patriot for $82.6M for an implied valuation of $1.65 billion! (after its maiden resource, but before an excellent resource update and a strong Preliminary Economic Assessment).

Other prospective suitors include MinRes, Pilbara Minerals & SQM. Major EV & battery OEMs are clearly in the hunt, and possibly Japanese commodity traders like Mitsui & Co., Sumitomo Corp., and Mitsubishi Corp., who have Li investments in Brazil, the U.S., Australia & Canada.

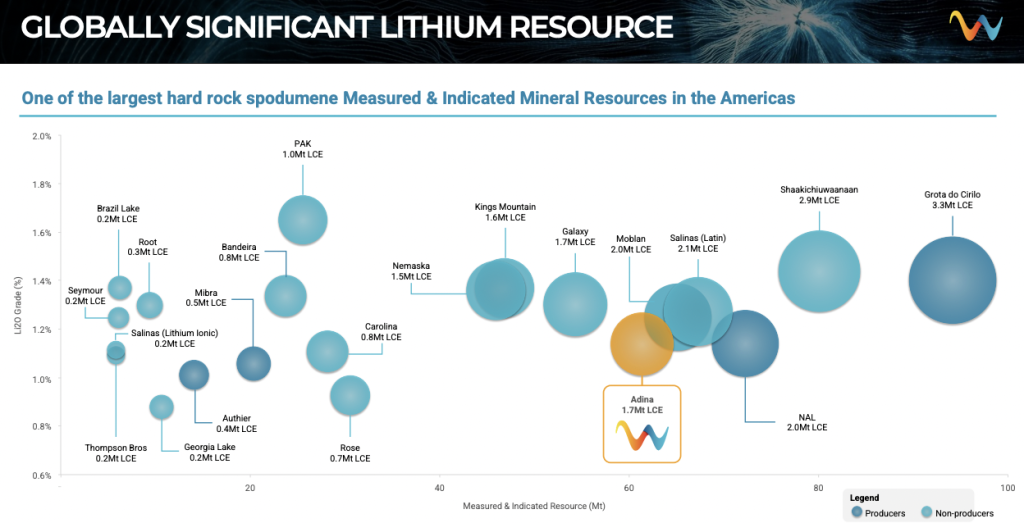

Winsome’s share price is down a lot, -87.7% from an ATH, even as it has reported a string of good-to-very-good news. The resource estimate sits at 77.9M tonnes (79% in the Indicated category) grading 1.15% Li2O (equal to 2.21M tonnes LCE).

Winsome has booked a very impressive 38.2 tonnes of LCE/meter drilled, +23% more than Patriot’s 31.9 tonnes LCE/m.

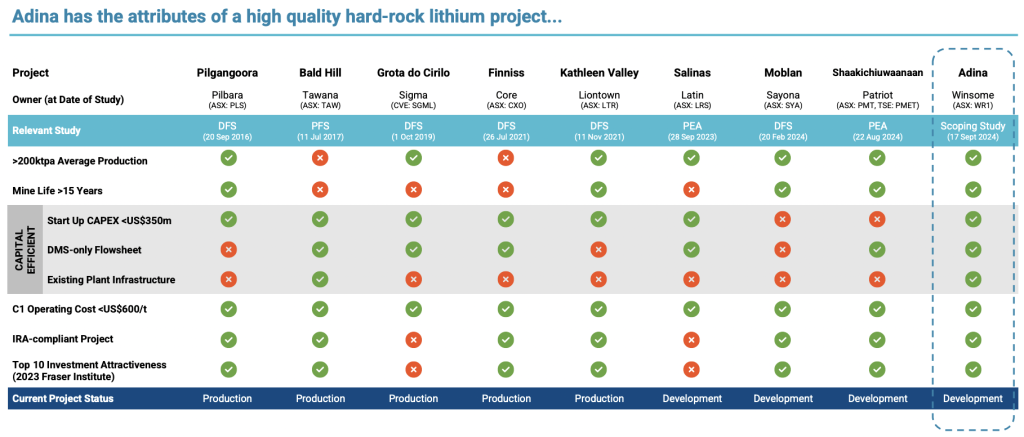

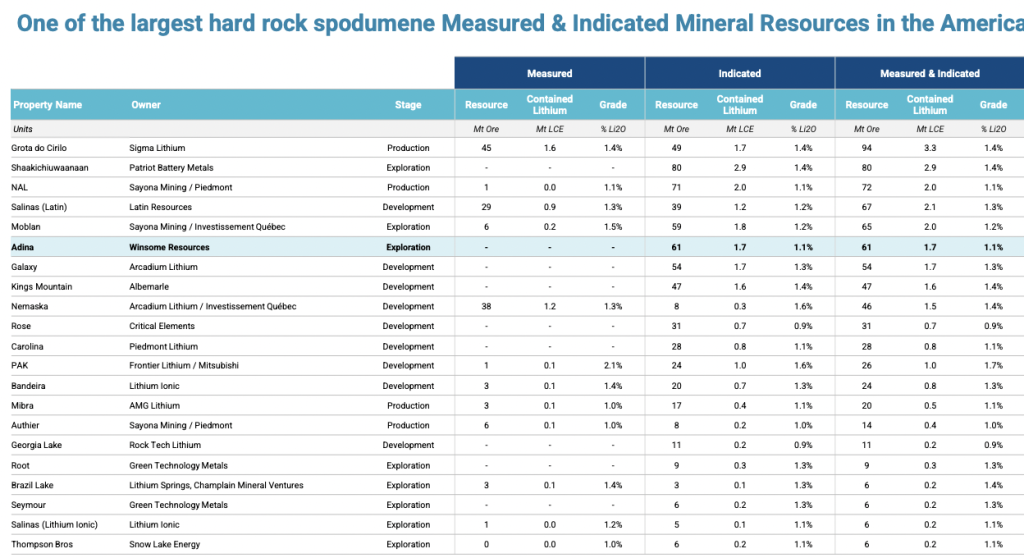

In the following chart, notice that Winsome at 1.7M tonnes of LCE is in the middle of seven globally significant Measured & Indicated resources of 1.5 to 2.1M tonnes of LCE. At $1,375/tonne, Winsome’s PEA uses the lowest SC5.5% price assumption of any Li project in the world.

Patriot’s monster M&I + Inferred resource is +121% larger [in LCE terms] than Winsome’s and is higher grade, but Patriot’s EV is 12x Winsome’s (adjusted for the value of Winsome’s ancillary assets).

Make no mistake, Patriot is not overvalued, Winsome is massively undervalued vs. peers. In addition to Adina, Winsome’s 100%-owned, 200 sq. km Cancet project has seen multiple drilling campaigns.

Shallow, high-grade Li mineralization combined with “very high” recoveries at a coarse crush size make Cancet an attractive asset. A highlighted interval is 18.3 m of 2.9% Li2O from 3.0 m depth.

Eighteen months ago, analysts thought Cancet could be worth $40-$60M. Even if a quarter of that, it has significant strategic & monetary value.

The 41.3 sq. km Sirmac-Clapier property boasts outcropping high-grade Li and is close to a major mining town & airport. Road & power infrastructure traverse it.

Winsome’s Adina + Cancet projects surround Patriot’s Shaakichiuwaanaan

A strong interval of 2.7% Li2O + 1.15% Cs₂O over 26.0 meters, incl. 3.1% Cs₂O over 4.0 m, is exciting given that high-grade cesium is a key driver (along with blockbuster tantalum grades) of Power Metals’ extraordinary share price gain.

In my view, considering the value of Winsome’s [19.6% stake in Power Metals + off-take], Cancet & Sirmac-Clapier, and cash on hand, investors are getting the 77.9M tonne (and growing), Adina project for free. Yet Adina is a Top-5 hard-rock Li project in N. America!

Due to the tremendous deal Winsome struck to option 100% of the Renard assets for pennies on invested dollars, the total cap-ex to commercialize Adina is manageable. A sale of 20% or 25%, would go a long way towards funding the remaining 80% or 75% of the Project.

[note, the following calculations are my own, merely illustrative of a range of possibilities].

Assuming 65% of upfront cap-ex could be satisfied with debt, that would leave [~$280M x 35% = ~$98M] in equity. If Winsome were to sell 25% of Adina, it would remain on the hook for 75% x $98 = $73.5M + [$37M x 75% = $26M, due over 36 months, can be paid in shares] for Renard.

That’s a total of $101M, most of which the Company could probably get free-carried by a partner. Other funding opportunities could include partially pre-funded off-take agreements & equipment financing.

Winsome might also obtain loans/free-money grants, and tax incentives from the Quebec & Federal governments. A $20M grant and/or a $20M upfront off-take payment would be a lot compared to the indicative $101M equity hurdle.

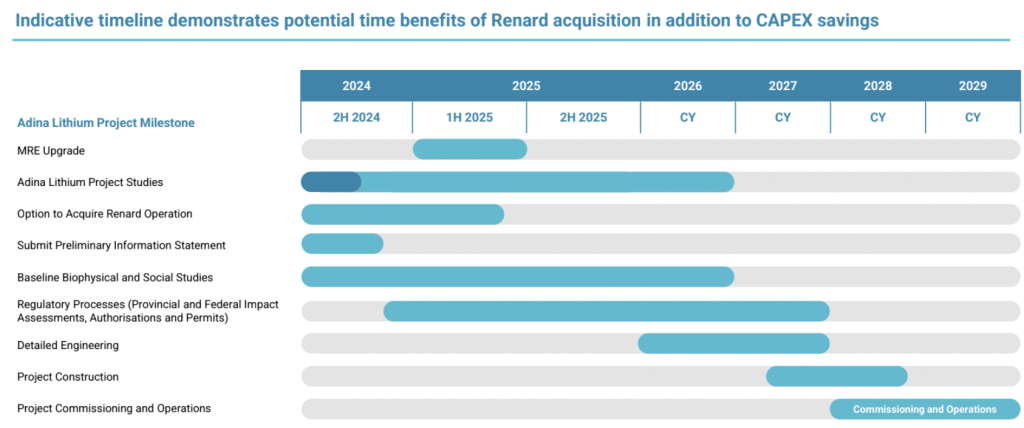

Management did the right thing by optioning Renard. It’s been painful because Li prices remain depressed, but this strategic move should pay off big time. It will allow Adina + a strong partner to enter production by 2028 while most peers are stalled or worse.

Believe in the project, the jurisdiction, the Renard assets, a rebound in Li prices, and most importantly the management team, board & advisors. This is NOT a dire, distressed situation, Renard is a blessing, not a curse!

Winsome Resources has attractive paths to choose from, details of which will unfold this year, most notably landing a strong strategic partner.

Disclosures: Winsome Resources is a very speculative small-cap company that mostly trades in Australia. Although the first production of Li-bearing spodumene concentrate is expected in 2028, delays could occur. Readers are urged to consult with investment advisors before investing in highly speculative stocks.

At the time this article was published, Mr. Epstein of Epstein Research owned shares in Winsome Resources purchased in the open market. Winsome is not currently, and never was, a paying advertiser on Epstein Research. However, Mr. Epstein should be considered biased in favor of Winsome Resources due to his shareholdings.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply