All $ figures are C$ unless stated otherwise. All metal prices are US$

Silver Crown Royalties [“SCRi“] (CBOE: SCRI) / (OTCQX: SLCRF) is a high-risk / high-reward proposition in a precious metals bull market with no end in sight. The Company has just 2.7M outstanding shares.

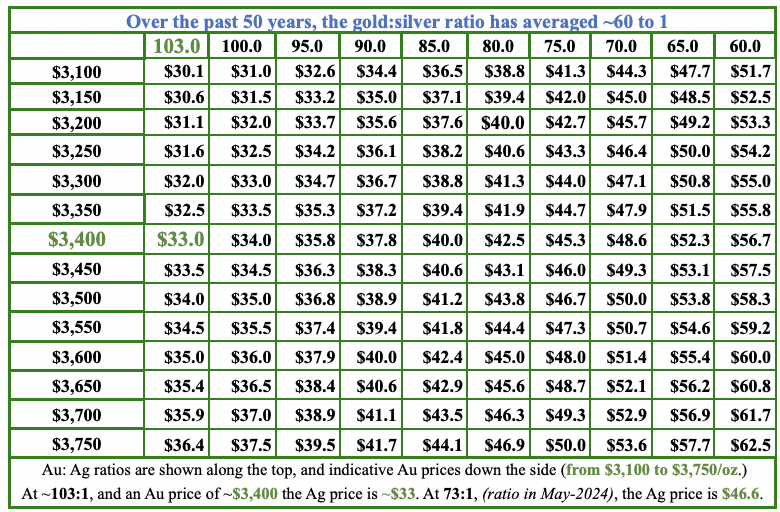

With the gold (“Au“) silver (“Ag“) ratio at ~103:1, Ag is a coiled spring, potentially outperforming Au going forward. Over the past 50 years, the ratio has been this high (or higher) < 5% of the time. Why does it matter? Eventually, it will revert towards its long-term average of ~60:1.

In May 2024, it hit 73:1. At that level and today’s Au spot price of ~$3,400/oz., Ag would be ~$46.6/oz. Therefore, if one is bullish on Au, one would be hard pressed not to be very bullish on Ag. Don’t be alarmed at talk of $46.6/oz. Ag, the inflation-adjusted all-time high is $205/oz.!

On April 16th, the Silver Institute updated its demand/supply model for 2024. Industrial demand for Ag rose 4% to 681 million troy ounces. From the latest Silver Institute report,

“Demand continued to benefit from structural gains linked to the green economy, including investment in grid infrastructure, EVs, and solar applications. Demand was further boosted by end-uses related to Artificial Intelligence, which drove growth in consumer electronics shipments.”

Global Ag demand exceeded supply for the fourth consecutive year. The deficit was 149M ounces in 2024, and 678M!! ounces since 2021. Meanwhile, global mine production rose by 0.9% to 820M ounces. Ag supply is projected to increase by +1.5% in 2025, resulting in a smaller deficit of 118M ounces.

Owning physical Ag is one way of getting pure-play exposure, but coins/bars are priced ~10% above the spot price, and there are shipping/insurance/storage costs.

The search is on for producers & developers poised to deliver the most Ag bang for the buck as the Au: Ag ratio hits 90–> 80 –> 70:1. However, 95%+ of mines/projects are polymetallic (Ag mined alongside Au, lead, copper, and zinc). Most Ag-heavy juniors are ~40-70% Ag.

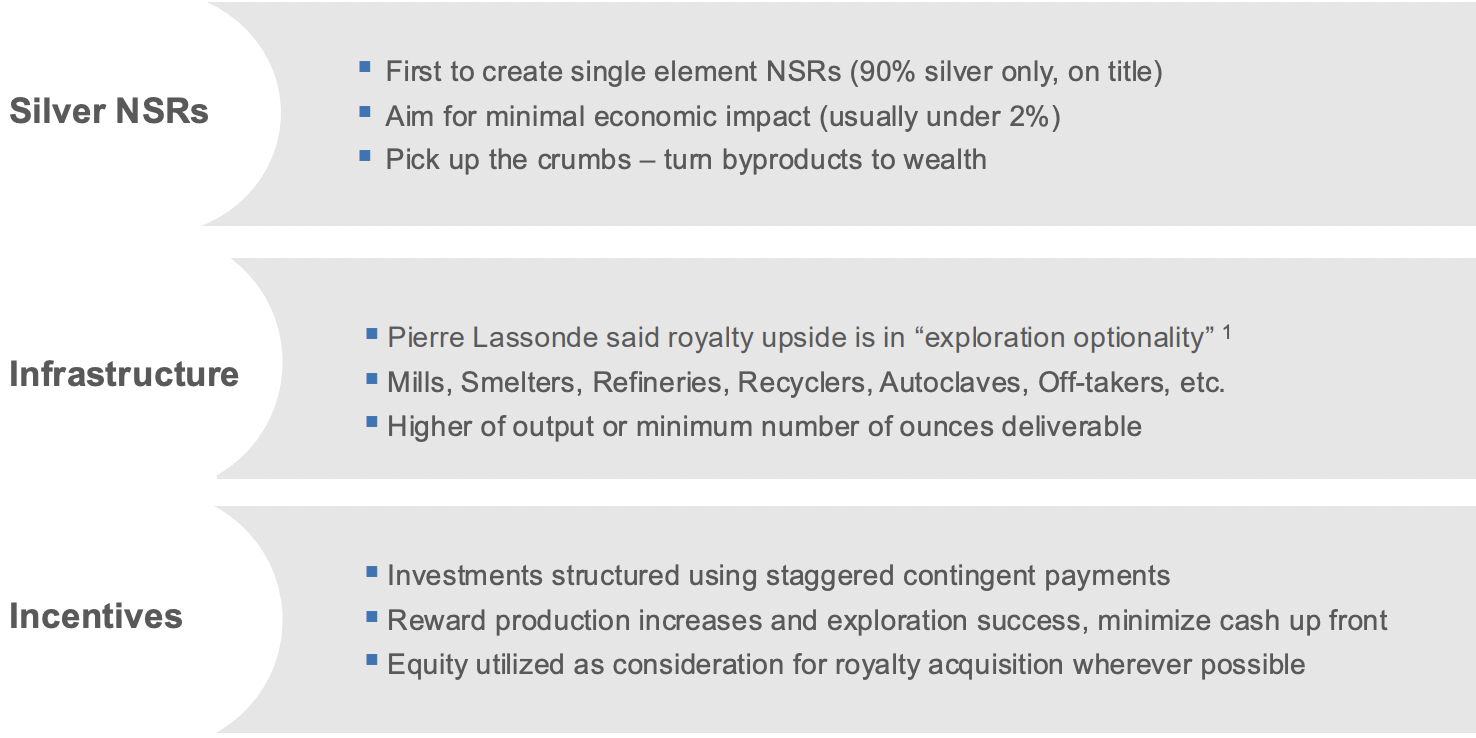

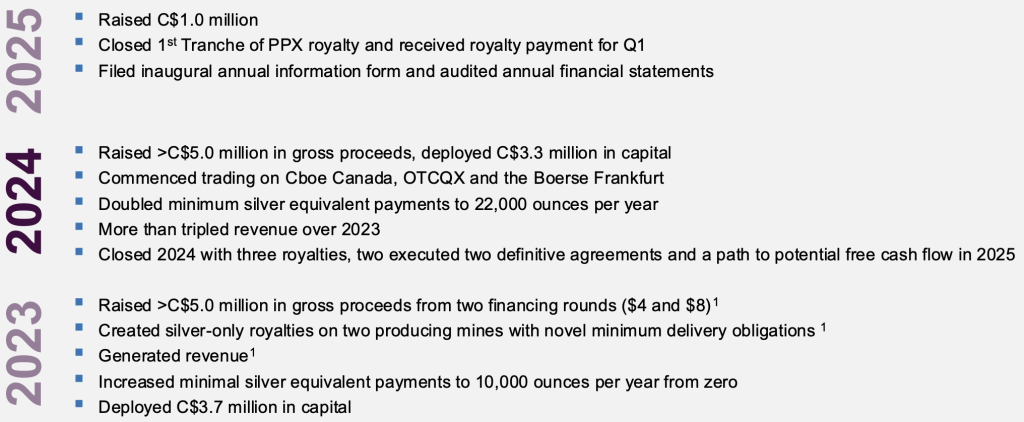

Incorporated in August 2021, Silver Crown Royalties is a small, yet revenue-generating company that’s 100% tied to Ag. Founder, Chairman & CEO Peter Bures believes his team’s approach offers competitive advantages due to an innovative business model. I agree.

According to CEO Bures, since Ag is frequently a modest by-product in mine plans, “it goes unreported in mineral resource estimates roughly half the time.” If not reported, royalty/streaming companies typically won’t touch it.

Even when reported, the Ag component is often too small for most peers, leaving SCRi to pick up the Ag. Partnering with royalty companies, taking the Ag, and giving up the Au, lead, copper, zinc, would be a win-win for SCRi and larger royalty/streaming companies.

SCRi provides cash and/or shares to junior miners in exchange for a percentage of revenue derived from a portfolio Company’s Ag production (paid in $$$, not in Ag). Management’s attractive deal with PPX Mining Corp is indicative of things to come.

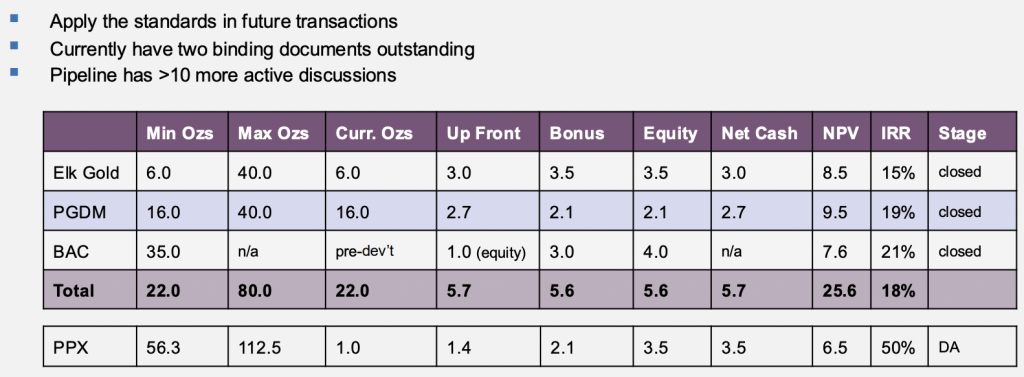

In two tranches totaling US$2.5M ($1.0M paid), SCRi will get a royalty of 15% of the Ag produced from PPX’s Igor 4 project in Peru. Once fully executed, minimum quarterly payments will equal 14,062.5 ounces (56,250 oz./yr.). The number of ounces is capped at 225,000.

At today’s ~$33/oz., the undiscounted payback would be US$7.425M on the US$2.5M invested. The plan is to do more deals like this, larger over time, funded with reasonable amounts of equity. Importantly, most deals are and will be uncapped.

A substantial risk to the Company’s successful growth is it’s ability to fund new transactions. Management plans to continue using both shares & cash. To that end, a $5M secured debt facility is being negotiated. And, nearly C$1M of an ongoing C$4M equity raise has been completed.

Over a dozen transactions are under various stages of review at any given time. Subject to funding, management hopes to close 3 or 4 deals in the next 12 months. Another way in which the Company can obtain a royalty on a project is by introducing an off-take partner to the prospect.

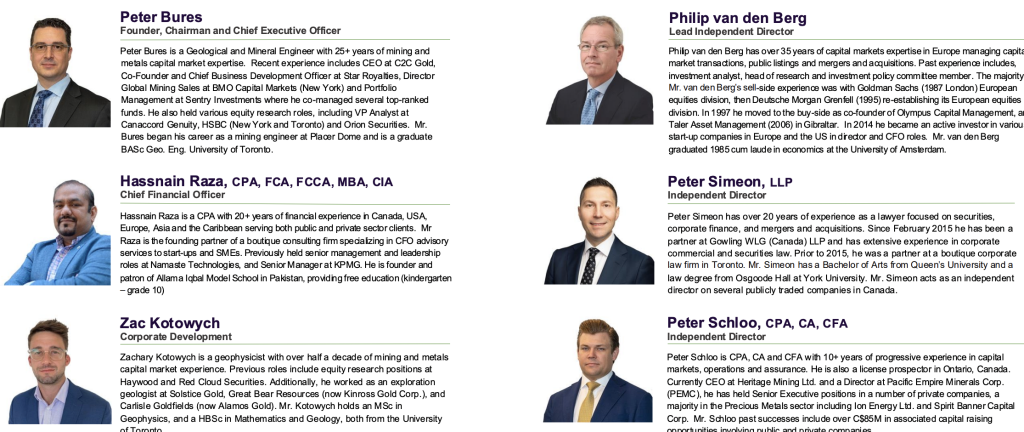

SCRi’s management team, board & advisors provide a wide range of experience, introductions & advice to portfolio companies in a mutually beneficial manner.

Mr. Bures is a geological & mineral engineer with 25+ years of expertise, incl. as CEO at C2C Gold, co-founder & Chief Business Development Officer at Star Royalties, Director of Global Mining Sales at BMO Capital Markets & Portfolio Management at Sentry Investments.

Mr. Bures held equity research roles after beginning his career as a mining engineer at Placer Dome. He’s a BASc Geo. Eng. from the Univ. of Toronto.

Lead Independent Director Philip van den Berg has > 35 years of capital markets & deal-making experience across Europe. His vast network helps SCRi find both investors and new investment opportunities.

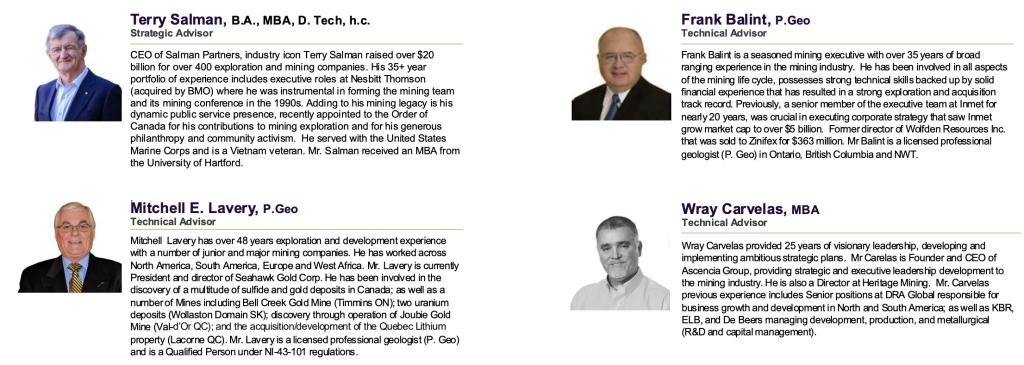

Although only three execs draw a salary, the team includes numerous experienced directors & advisors –> see bios above. The four strategic & technical advisors, including Terry Salman, CEO of Salman Partners, have an average of 36 years of financial and/or technical experience.

Once free cash flow is positive, SCRi will target 50% exposure to immediately cash-generating projects, 30% to near-term development assets, and 20% to exploration targets. Upon achieving positive FCF, the risk profile will improve quite dramatically.

Unlike peers in the royalty/streaming space, SCRi plans to payout a much larger portion of profits as dividends. I’ve always been surprised at the low 0.8%-1.0% yields offered by players like Franco-Nevada, Wheaton Precious Metals & Royal Gold. SCRi wants to standout by delivering a substantially higher yield.

The Company’s focus on minimum cash-equivalent deliveries expands the playing field to opportunities otherwise inaccessible to competitors –> projects that don’t report Ag production because it’s immaterial to overall operations.

Another example of SCRi’s business model is a transaction with Bactech Environmental Corp., whereby it was granted a royalty on a bioleaching facility being built in Ecuador to receive the cash equivalent of 90% of the Ag to be produced.

SCRi will receive a minimum of 35,000 ounces (paid in cash, not Ag) annually for at least 10 years following the commencement of regular processing operations. 35,000 ounces at today’s spot price of ~$33/oz. equals C$1.6M/yr.

The total purchase price consisted of (i) $1M in Silver Crown units at a deemed price of $10/unit, consisting of a common share and a 36-month warrant to acquire a new share for $16,

(ii) 100,000 special warrants, exercisable for 36 months into 100,000 shares upon Bactech successfully financing the project; and (iii) 200,000 special warrants, exercisable for 36 months into 200,000 shares upon Bactech achieving commercial production.

CEO Bures commented,

“This royalty has the potential to more than double our revenue for less than 25% equity dilution. We look forward to cultivating a positive relationship with Bactech as they continue to process environmentally sensitive mine waste…”

Ross Orr, Bactech’s Pres. & CEO added: “As shareholders in Silver Crown, it’s safe to assume they would be our first call should we obtain additional material for processing.” Note — Bactech shares are up +50% in the past few months.

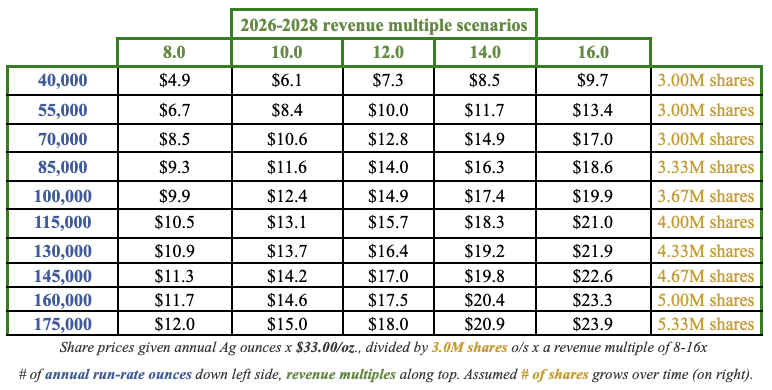

SCRi is well positioned in this EPIC precious metals bull market, a pure-play — 100% leveraged to the price of Ag — a metal well positioned to outperform Au going forward (timing unknown). Peer royalty/streaming companies are valued at ~18x 2026e revenue.

The following chart shows what SCRi could be worth in the coming quarters & years. This is just an approximation of how things could play out. Actual results will differ. For example, the number of shares (far right column) is highly dependent on the share price.

I estimate it might require 333.333K new shares to fund each incremental 15k of annual Ag ounces. If it were to take 500K ounces per 15K, the resulting share price estimates would be –13.3% lower. I use a range of revenue multiples ranging from 8x to 16x.

Readers are invited to look at the Au: Ag chart once again (at top of this article). At 85:1, Ag would be US$40/oz., hardly a stretch as the ratio was 73:1 in May of last year.

Yet, even much stronger Ag prices would not greatly enhance the ability of junior miners to monetize small or tiny Ag streams upfront, as the only company willing to do transactions in this area is Silver Crown Royalties.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Crown Royalties, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Crown Royalties are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Crown Royalties was an advertiser on [ER], and Peter Epstein owned no shares in the Company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply