I firmly believe that now could be a good opportunity to invest in high-quality precious metal juniors, especially those that are 100% silver (“Ag“) + gold (“Au“). The past week has been awful, but the outlook for Ag/Au remains bright.

Gold’s safe-haven appeal is on full display, protecting against the U.S. wrecking ball diplomacy (tariffs/trade wars/annexations) of Trump/Vance/Musk, and the geopolitical quagmires of Russia/Ukraine/NATO, and Israel/Gaza/Iran.

Au remains above $3,100+/oz. on Central Bank buying, as a hedge against inflation, a store of value. After a BIG move to an ATH price of $3,166/oz. on April 2nd, Au is down -2%. Compare that to U.S. stock indices like the S&P500, NASDAQ & DJIA –> down an average of -18% (thru April 8th).

Gold is a prime beneficiary of U.S. adversaries exiting USD investments, few other asset classes (besides equities, which are not typically held as reserves) can absorb $10’s of billions of inflows per month.

When Au soars, Ag follows (eventually), and sometimes it outperforms. The Au: Ag ratio touched 106:1 on April 6th, vs. 73:1 in late May 2024, and 101:1 currently.

At 73:1, Ag would be ~US$42.5/oz. The U.S. BLS inflation-adjusted high Ag price (in today’s dollars) is ~$204/oz., and the 50-year avg. Au: Ag ratio is ~60:1. Think about that… Today’s Ag price is 85% below its inflation-adj. high –> from Jan-1980!

Imagine the earnings & operating margins of Newmont, Barrick, Aginco Eagle, etc. at $3,108 Au… Even in this pullback Tech valuations remain elevated at 12-20x EBITDA vs. Au miners at 4-7x.

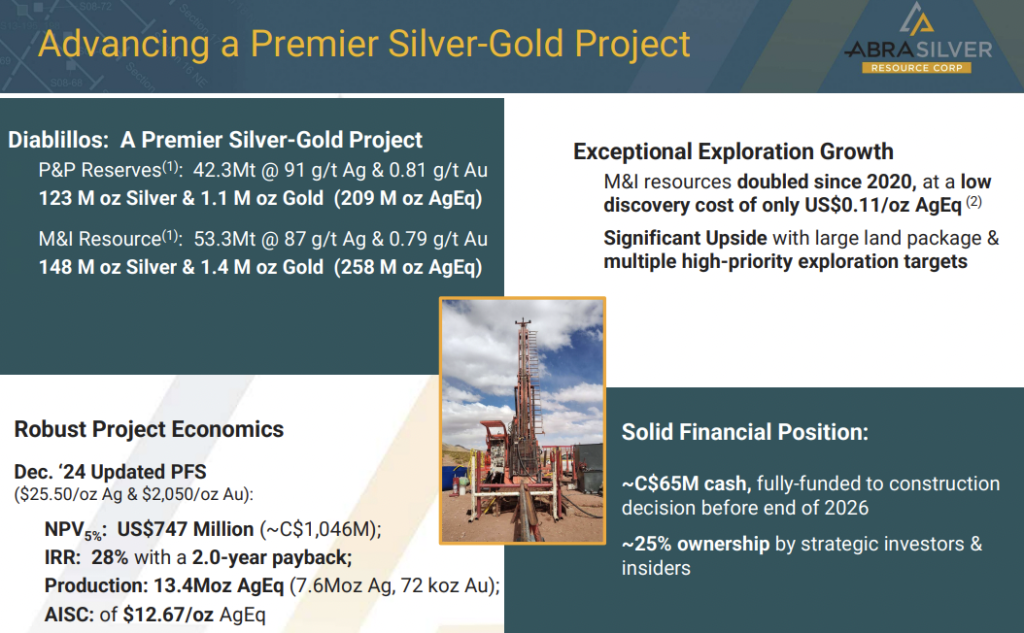

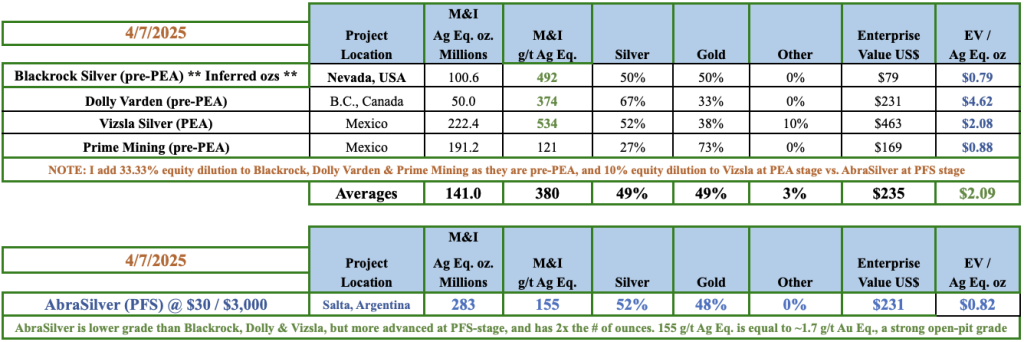

AbraSilver Resource Corp. (TSX: ABRA) / (OTCQX: ABBRF) owns 100% of a world-class Ag 52%/Au 48% project in Salta province, Argentina hosting ~284M Measured & Indicated [“M&I”] Ag Equiv. ounces (at $30.86/$3,108 Ag/Au).

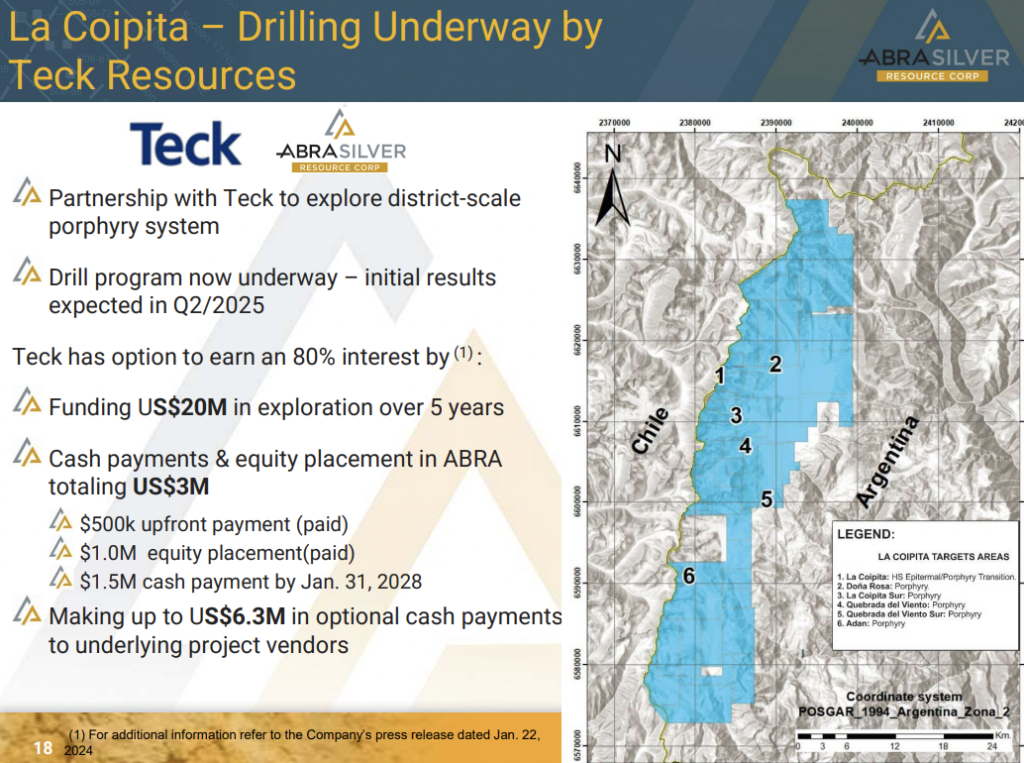

It has a valuable secondary project in partnership with Teck Resources, which is earning up to 80% of the 70,000+ hectare La Coipita project by investing $20M over five years + cash payments to AbraSilver of up to $9.3M.

Drill results are expected at La Coipita this month. In my opinion, if Teck is successful, a 20% free-carried interest could one day be worth over $100M, yet it’s valued at zero by the market.

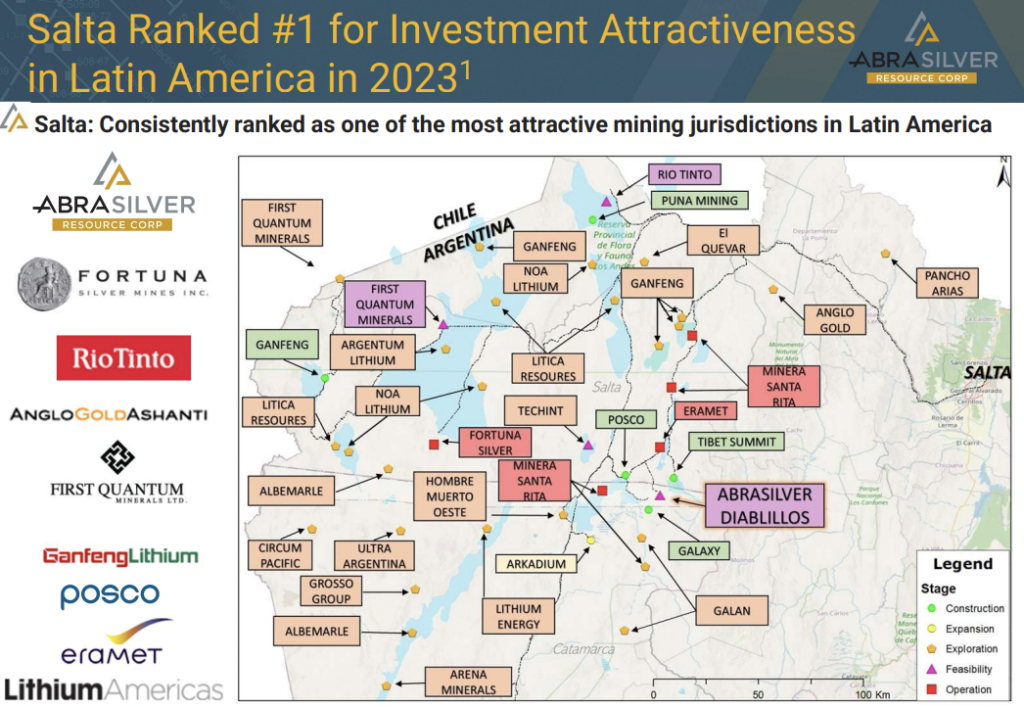

The 100%-owned flagship Diablillos project is in the Puna region of Argentina, along the border with Catamarca province. It comprises 15 contiguous & overlapping mineral concessions acquired in November 2016 —> when Au was $1,150-$1,200/oz.

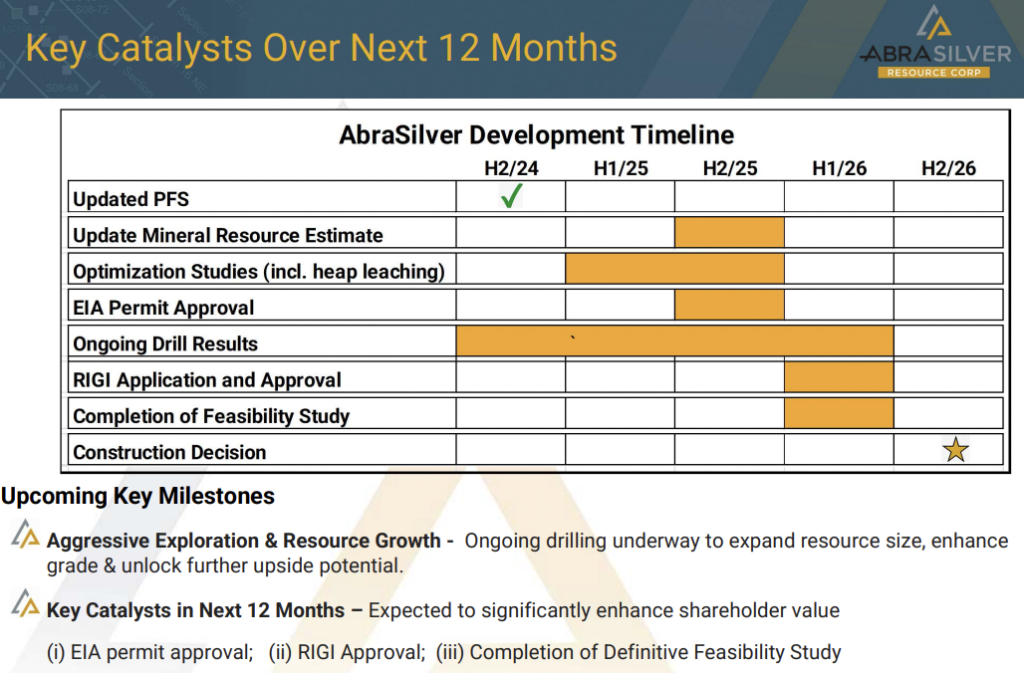

A crucial factor in considering AbraSilver is that it’s fully funded (~C$65M in cash) through 2026! How many junior mining peers can say that? In my view, being fully funded in this extremely volatile market is a hugely positive de-risking attribute.

Diablilos has year-round accessibility via a 150 km paved road, followed by a well-maintained gravel road, shared with adjacent projects.

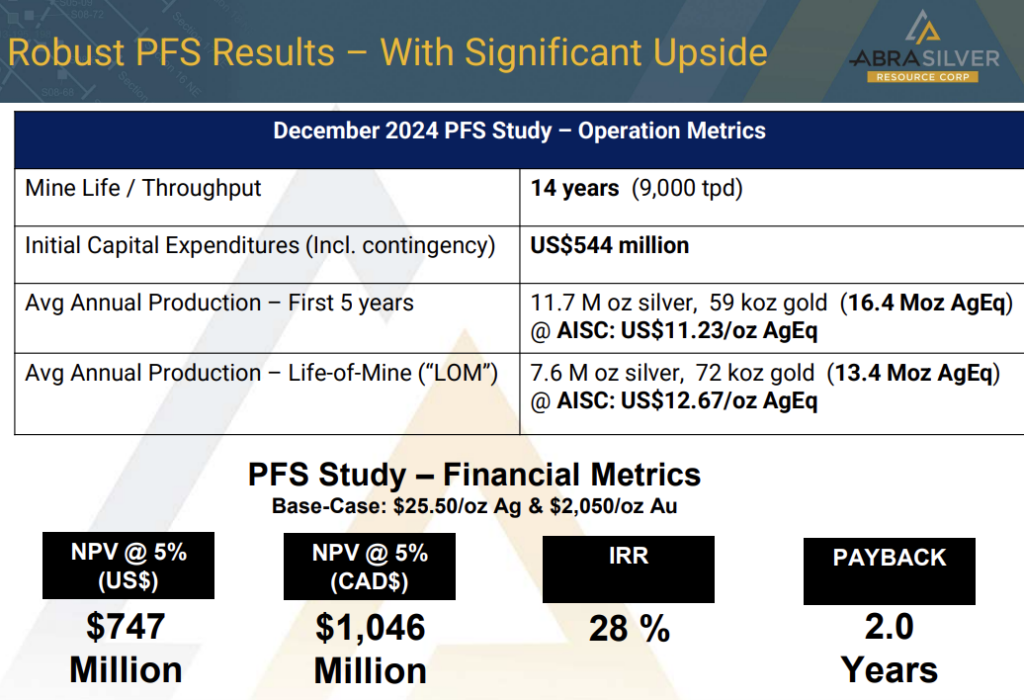

I estimate the spot price-adjusted post-tax NPV(5%, $30.86/$3,108) is ~C$2.0B with an IRR of ~41%. AbraSilver’s Diablillos is valued at 16% of its NPV, and investors get the 20% free-carried interest in La Coipita for free (assuming Teck earns 80%).

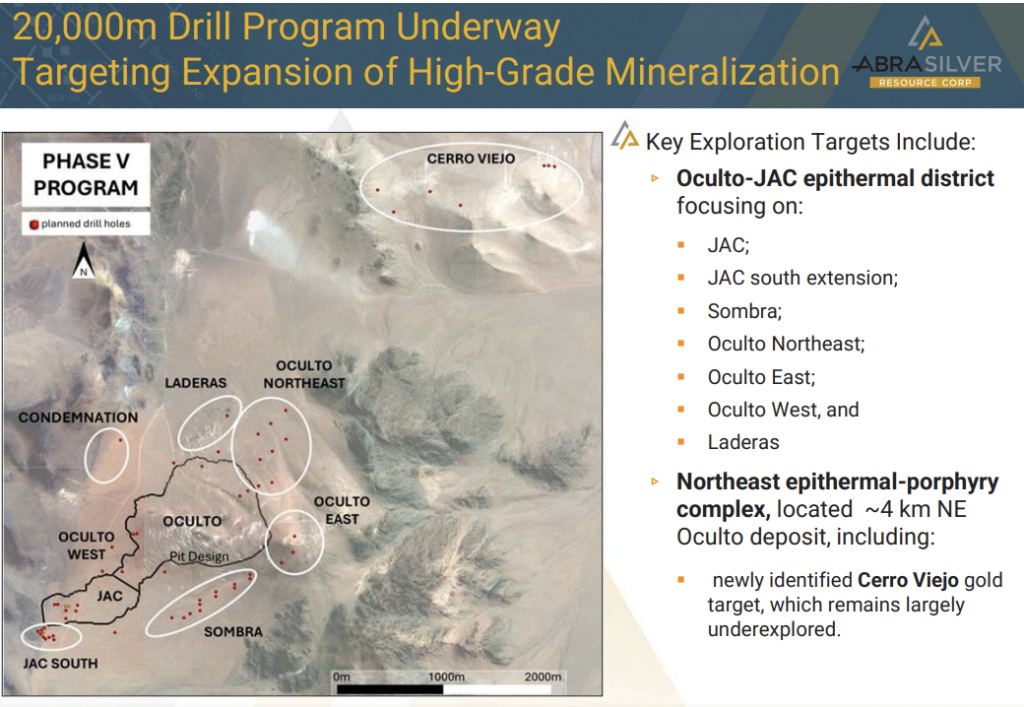

While it hasn’t been a focus to date, a large porphyry complex is centered ~4 km NE of Oculto consisting of outcropping porphyry intrusions and associated Au-rich epithermal mineralization.

Subject to further drilling, this complex could attract the attention of much larger companies like Barrick, Newmont, AngloGold Ashanti, Glencore, Pan American Silver, SSR Mining, Hochschild, and Fortuna Mining, each with investments in Argentina.

On April 2nd, management released additional results from the recently completed Phase IV drill program. From the JAC Extension area, highlights were:

- Hole DDH 24-079: 47 m at 169 g/t Ag, from 111 m, incl. 4 m at 674 g/t Ag

- Hole DDH 24-084: 63.5 m at 190 g/t Ag, from 80 m, incl. 9 m at 341 g/t Ag

- Hole DDH 24-088: 70 m at 147 g/t Ag, from 61 m, incl. 9 m at 331 g/t Ag

Shallow Ag mineralization including high-grade intervals at JAC continue to extend south/SE of the existing modeled open pit boundary. Importantly, mineralization remains open to the south, where ongoing Phase V drilling will target further resource growth & continuity.

And, from Oculto NE DDH 24-074: 100 m beyond the margin of the Oculto resource –> 10 m at 1.5 g/t Au + 56 g/t Ag (193 g/t Ag Eq.) in oxides, from 206 m. This hole confirms the continuity of the area. Additional drilling is planned to potentially expand this emerging zone.

A high-grade, Au-dominant trend extends along the northern margin of the Oculto open pit and continues 100’s of meters to the NE, well beyond the open pit boundary. Dave O’Connor, Chief Geologist, commented,

“The continuity & consistency of the near-surface silver mineralization south of the JAC open pit is quite remarkable. With strong results from both new & existing zones, plus several targets still to be tested, our Phase V program will unlock further upside across the broader Diablillos system.”

These plus future results will contribute to an upcoming mineral resource estimate, scheduled for mid-2025. Using prior updates as a guide, I expect a ~15% boost to Ag Eq. ounces to 300M+ Measured & Indicated (assuming an Au: Au ratio of 90:1 vs. the current 99:1).

Over 300M Ag Eq. ounces will enable an extension of the 14-yr. mine life in the PFS and/or more Ag Eq. ounces/yr. in the upcoming Feasibility Study.

Phase V drilling is underway, with ~20,000 meters planned. Key targets include the NE epithermal-porphyry complex, ~4 km NE of the main Oculto deposit, including the newly identified Cerro Viejo Au target, which remains largely unexplored.

Also being drilled is the Oculto-JAC epithermal district, with a focus on the JAC, JAC south extension, Sombra, Oculto NE, Oculto East & Laderas targets.

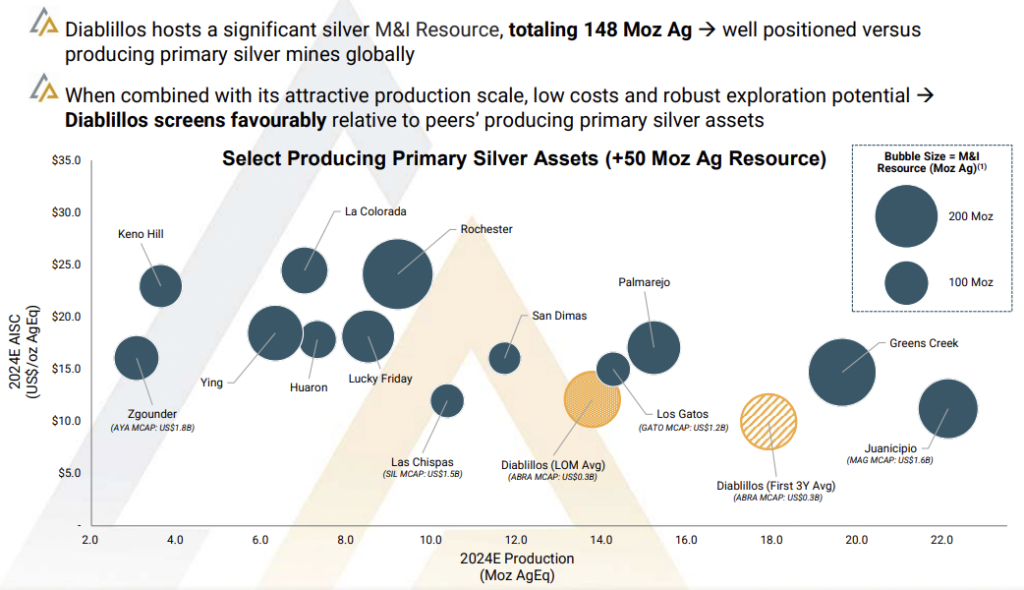

It would be nearly impossible to overstate how impactful the past year’s gains in Ag/Au have been for projects that can reach production this decade. Not only do higher prices improve economics, but they also increase the odds that Diablillos will get built.

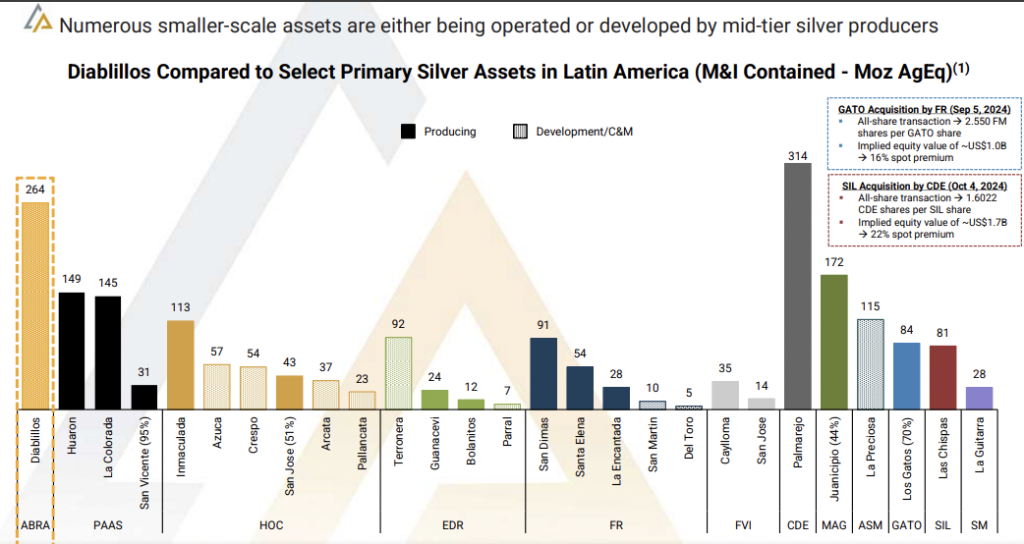

There are very few large, high-quality, undeveloped, heavy-Ag projects not owned by producers. In the above chart, notice that 3 of 4 peers are at the pre-PEA stage. All four are promising, but except for Vizsla, peers are years behind PFS-stage AbraSilver.

I believe a substantial strategic investment or an outright takeover of AbraSilver is likely in 2026 or 2027 at a share price well above current levels. Take a look at the above chart of Ag-only, Measured & Indicated ounces.

Diablillos is poised to be in the best quartile on costs across S. America and on the high end of annual production (and, no lead/zinc, 100% Ag/Au).

Diablillos is a scarce, world-class, must-own asset that would expand mine life & diversify jurisdictional risk for players like Industrias Peñoles, or First Majestic who are possibly overexposed to Mexico.

If the Ag/Au bull market picks up where it left off, we could see bidding wars for the world’s best Ag-heavy, precious metal-only assets like Diablillos. A bidding war is not a base case scenario, but owning a tremendous Ag/Au asset provides robust leverage to precious metals.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about AbraSilver Resource, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of AbraSilver Resource are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, AbraSilver Resource was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply