Rare earth metals have been in the geopolitical spotlight for much of the year. Many, myself included, are surprised that the combination of severe trade tensions between the U.S. & China, strong growth in wind farm installations (they use REE magnets) and emerging growth in Electric Vehicles (expected to takeoff next decade) has not driven REE prices higher.

However, if one scans the green energy / tech / battery metals landscape, one might notice something strange. Not only have REE prices not moved higher, vanadium, cobalt & lithium prices have all fallen precipitously. My point is that commodity prices can and sometimes do remain weaker, for much longer than people imagine possible.

However, when the prices of these critical metals turn, they can move really fast. Three times over the past 15 years the uranium price has increased by hundreds of percent within a 12-month period. Cobalt, lithium & vanadium had spectacular runs from 2015 to 2017, only to fall out of bed in 2018 & 2019.

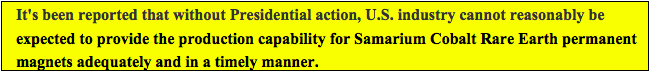

In many ways, rare earth metals are even more crucial to modern society than the green energy / tech / battery metals. Most important, they’re used heavily in every first world country’s military programs. I won’t list all of the offensive & defensive military capabilities that rely on REEs, they can easily be found with a quick Google search. The U.S. cannot allow China to continue dominating REEs.

None of what I’ve said so far is new. However, this is new…. in August, the U.S. Depart. of Defense (“DoD“) commenced a wide ranging assessment of North American REE supply chains, incl. barriers to market experienced by aspiring producers. The DoD will use information from industry participants to propose recommendations to promote the North American commercial, industrial, high-tech manufacturing, green energy & defense industries.

The DoD indicated that help could include government investment into select REE companies or projects. Canada, Australia and the U.S. are prepared to work together on this important initiative.

Canadian-based Defense Metals could serve N. American LREE markets

Tiny Defense Metals Corp. (TSX-V: DEFN / OTCQB: DFMTF) responded to the DoD’s request for information. I have no idea if it will lead to any funding, but it’s highly encouraging to know that China’s dominance of REE supply is finally being addressed.

With that in mind, I was able to track down the CEO of Defense Metals, Craig Taylor, to ask him about his company, his flagship project and of course the need for critical rare earth metals to be sourced from multiple places around the globe, not just China.

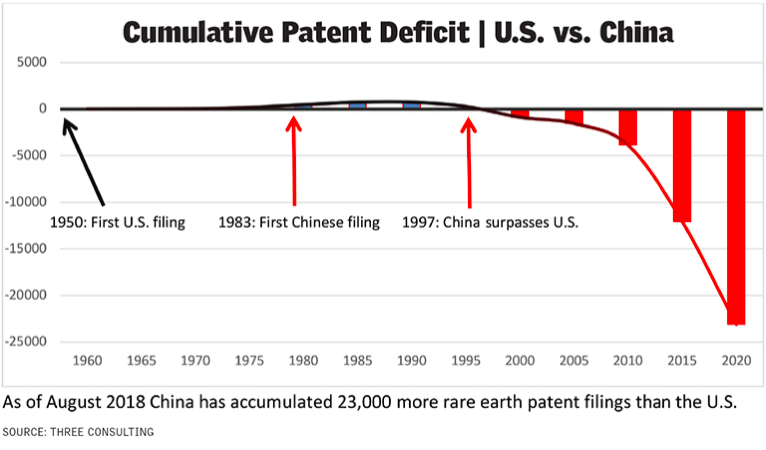

How did the U.S. get itself into this mess, a dangerous over-reliance on China for REEs (and other things)?

In the 1980’s & 90’s, the U.S. moved substantially all of the mining, production & refining of REEs to China to lower costs. A primary reason why costs were lower in China was because of weak environmental oversight. Things may have improved on the environmental front, but the damage has been done to the north American REE industry.

There have been large moves in gold, silver, palladium & platinum prices over the past year. Some of the activity presumably is due to Chinese / U.S. trade tensions. Why haven’t Rare Earth Metals prices participated in the rally?

That’s a good question. A lot of people are wondering why prices for Rare Earth Metals like Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy), and others have remained relatively steady after a meaningful move higher in May / June. By now, most readers know that China dominates the global supply of REEs. They control more than 80% of the market. China can heavily influence prices. If China wanted prices higher, prices would probably be higher….

So far, China has not restricted the flow of REEs to the west. But, we think Chinese officials are keeping that option on the table to use for maximum effect if / when they deem the time to be right. Still, no matter what China does, pricing for crucial REEs is headed higher purely on supply & demand fundamentals.

Can you please give readers the latest snapshot of your flagship Wicheeda REE project?

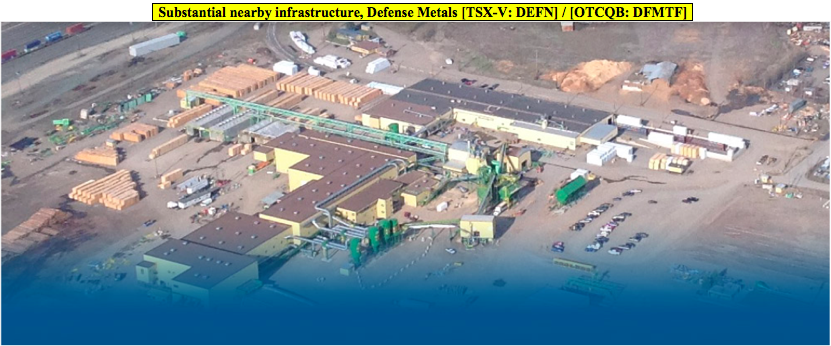

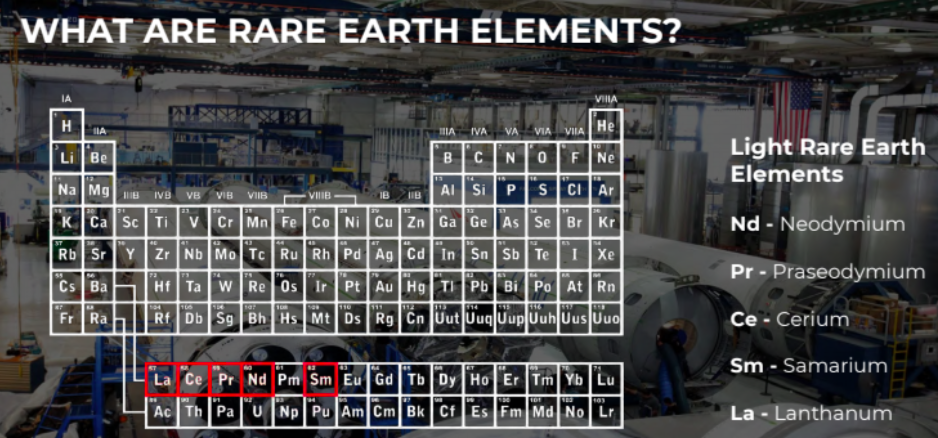

Yes, of course. The Wicheeda property consists of 6 mineral claims covering about 1,700 hectares (~4,200 acres). It’s ~80 km northeast of Prince George in central British Columbia. Favorable mineralogy and an attractive lanthanide distribution makes Wicheeda a very prospective Light Rare Earth Metal deposit. We have a trained work force, in one of the most mining friendly jurisdictions in the world. A hydroelectric power line, gas pipeline and the Canadian National Railway are all nearby.

The Wicheeda deposit’s mineral resource contains 11.37 million tonnes (Inferred) averaging 1.96% LREE, at a cut-off grade of 1.0% LREE (sum of cerium, lanthanum, neodymium & samarium percentages). The Technical report describing the project and the Inferred resources can be found on sedar under the date July 9, 2019.

Very interesting. Can you continue by telling us about the ongoing drill program?

Yes, as many readers may know, we are in the middle of a diamond drill program designed to test the northern, southern & western extent of the Wicheeda deposit, further delineate the relatively higher-grade near-surface dolomite carbonatite unit, and address select internal drilling gaps in the deposit.

Core drilling started at the location of our prior 30-tonne bulk sample, which, by the way, returned composite head assays of 1.77% lanthanum-oxide, 2.34% cerium-oxide, 0.52% neodymium-oxide and 0.18% praseodymium-oxide. That’s a total of 4.81% light rare earth oxide (“LREO“)

We are off to a great start, eight of a planned 13 drill holes totaling 1,165 m have been completed. All holes intersected significant widths of visible REE mineralization. A detailed review of historic & current drill core indicates the presence of multiple phases of REE mineralized dolomite-carbonatite, one of which visually appears to contain a higher percentage of REE-bearing minerals.

We have intersected REE mineralization in all eight drill holes to date. Resource definition drilling will allow for an updated & enhanced geological model that management believes should substantially increase the confidence level in the contained mineral resources of the Wicheeda deposit.

What are the next steps after delivering an updated mineral resource estimate? A Preliminary Economic Assessment (“PEA”)?

We engaged an experienced consulting group to give us a roadmap of the extensive environmental requirements for our project. We will start with baseline studies that have to be conducted for at least a year. So, no PEA in the next 12 months, but we expect to complete a third-party PEA in the first half of 2021.

What are your latest thoughts on the need for a pilot plant? Approximately how much might it cost?

Yes, we are looking very closely at building a pilot plant. SGS is finishing up work that will help us in our thinking about that. I can say that we’re leaning towards doing one. We think it would cost about $550k. The pilot plant would be up and running before a PEA is delivered.

So, to reiterate, Defense Metals is well positioned to benefit from demand for non-Chinese REEs and has near-term catalysts to watch for?

Yes, exactly. Let me add, it’s not just the U.S. that wants increased security of supply and a more diversified supply base, everyone does! We have a number of near-term catalysts, most notably drill results, an important update on ongoing metallurgy work being done by SGS, and a new mineral resource estimate — all within the next few months.

And, we hope to have a pilot plant & PEA several months after that. We have a pristine capital structure, with just 30 million shares outstanding and no debt, and we are funded to the end of the year.

Thank you Craig for the informative update. Continued good luck on the Wicheeda project.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Defense Metals Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Defense Metals Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock in Defense Metals Corp. and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)