For over a decade, investors have been told that Rare Earth Elements (“REEs“), very heavily controlled by China, could be weaponized against the West in a Trade War. After numerous escalations, things took a terrible turn for the worse this month.

The Trump Administration enacted import tariffs on over 160 countries, with China quickly rising to the highest levels. The chaotic details leading up to mid-April hardly matter; the U.S. & China are locked in a grave Trade War with no end in sight.

Effective April 13, the Chinese government announced the immediate suspension of exports of several key REEs, including dysprosium & terbium—materials fundamental to advanced manufacturing, clean energy, and indispensable to U.S. National Defense.

According to the management team of Ucore Rare Metals (TSX-v: UCU) / (OTCQB: UURAF),

“This development caused shockwaves throughout global markets and governments alike, a stark reminder of how vulnerable our modern economies remain to geopolitical leverage over critical mineral supply chains.”

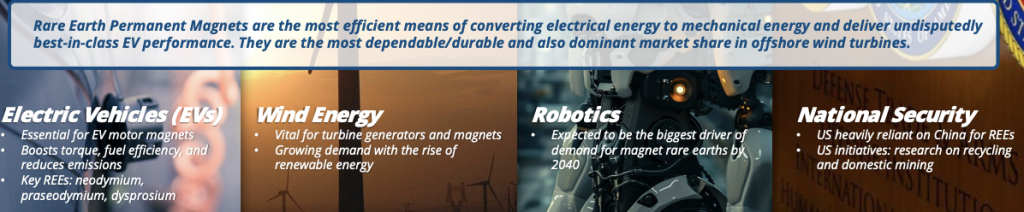

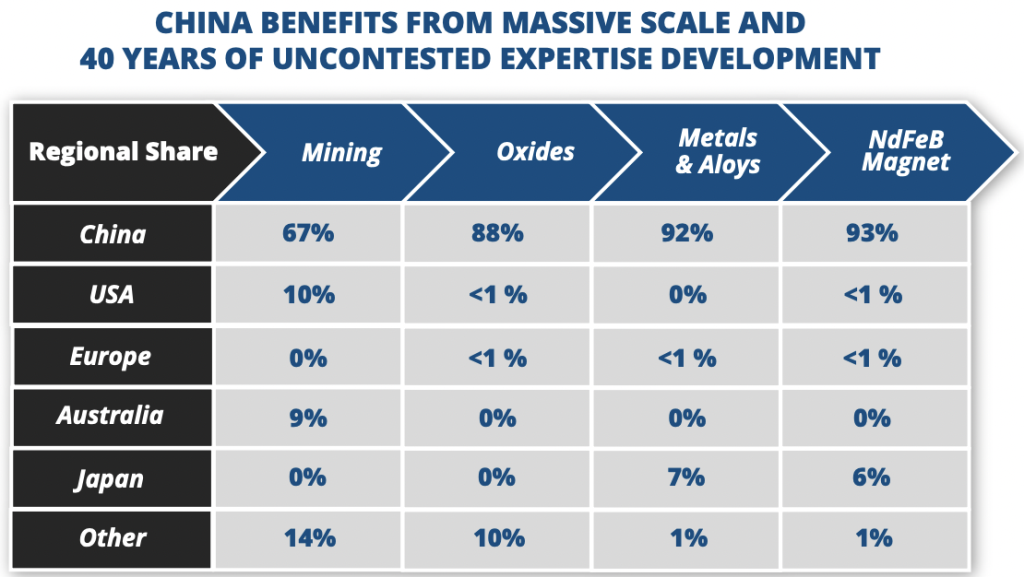

Ucore points out that China processes & refines well over 90% of heavy REEs and manufactures ~90% of the permanent magnets that use them. Adamas Intelligence forecasts a +8.3% CAGR in demand for REEs through 2035, triple that of copper.

Adamas recently published a piece on humanoid robots based on Elon Musk saying there would be 10 billion humanoids by 2040 — the report concluded 10 billion would require, “186-times the current annual NdFeB magnet production… for humanoids alone.”

Dialing back that 10 billion figure by a factor of 100x would still be an incremental +4.2% CAGR just from humanoids. Imagine the number of new end uses, some not yet dreamed of — that will need a sustainable supply of REE magnets.

There are surprisingly few good ones to consider. The U.S. needs a new “Manhattan Project” to kickstart domestic REE production, and I think it’s coming. Not only increased funding for companies like Ucore, but also fast-tracked projects.

Compare Ucore to pre-revenue juniors USA Rare Earth, Inc., Rare Element Resources Ltd., Meeka Metals Limited and NioCorp Developments Ltd. with an average market cap of C$1.3B vs. Ucore’s at just C$126M. From April 11th to April 16th, the top-10 performing REE companies were up an average of +77%!

A year from now, many REE prices will be higher, perhaps a lot higher. This week, there’s renewed talk of the U.S. stockpiling REEs.

Look at antimony (not a REE, but critical for Aerospace & Defense), it’s up 350%+ in the past 18 months on China initially restricting, then banning, exports. Might we see a bifurcated market in which a premium is paid for REEs sourced in Western-friendly countries?

Ucore shares have tripled from their 52-week low, but the Company has only 72M shares outstanding. Given much larger share counts, many REE stocks have higher trading volume than Ucore.

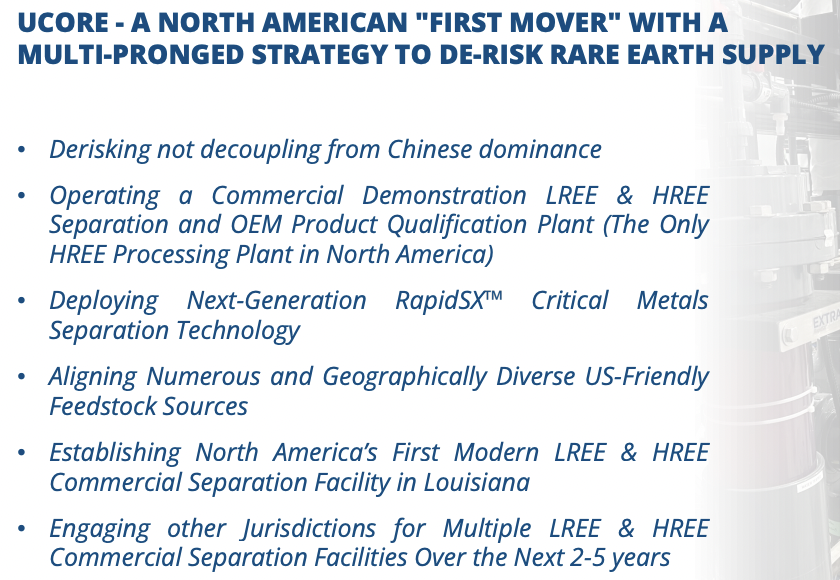

However, Ucore could look to uplist shares in the U.S., perhaps on NASDAQ, to expand its horizons. Unlike most peers, Ucore’s REE processing facility is in the U.S., one of the best locations on earth amid this serious Trade War.

Unlike most pre-revenue peers, operations are expected to start next year. Unlike most peers, Ucore will have significant flexibility in the REEs it works with and the crucial ability to opportunistically switch across light, medium & heavy REEs.

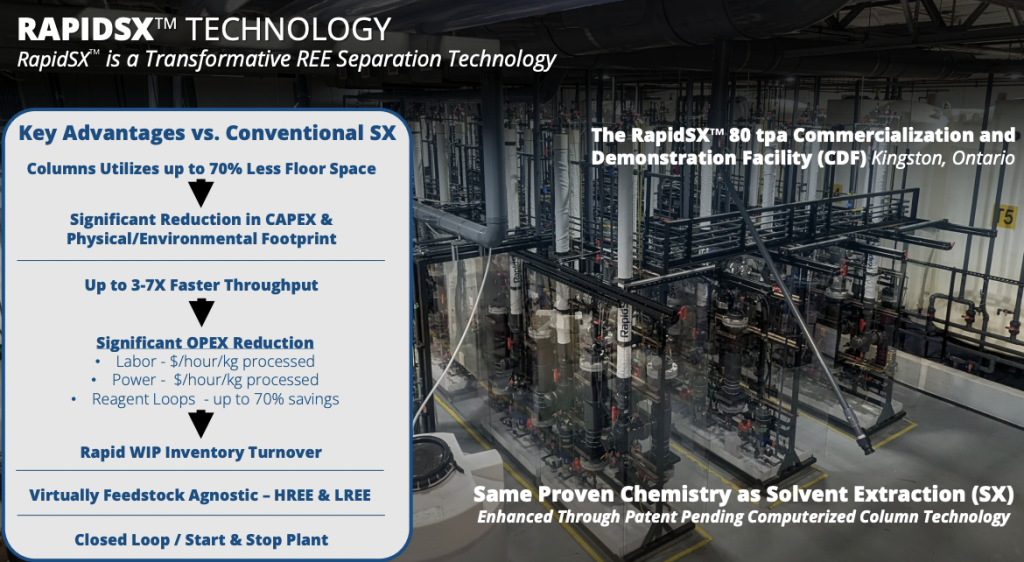

The Company is separating, processing & purifying REEs at its RapidSX™ commercial demo plant in Ontario as part of a $4M contract with the U.S. Department of Defense (“DoD“). Thousands of hours have been logged. Importantly, a $10M follow-on grant is approved for the next steps.

Ucore has been recognized by the DoD as a critical player in the effort to re-shore REE & REE magnet production capabilities. In addition to free-money grants, the Company has been in discussions for over a year with off-take partners for upfront cash payments.

Management is developing a Louisiana, USA, Strategic Metals Complex (“SMC“), in a “foreign trade zone” that’s exempt from import tariffs! Management outlines a deployment of 2-3 modular operating lines by mid-2026, and seven lines by 12/31/26.

The SMC is designed to process both heavy & light mixed REE chemical concentrates. Additional SMCs are being studied for Canada & Alaska. The buildout of critical domestic mining/processing/refining capacity is being compared to Operation Warp Speed to ramp up COVID-19 vaccines.

U.S. & Canadian gov’t support BEFORE the Trade War began!

Ucore also secured C$4.3M from the Canadian government to demonstrate the commercial efficacy of its RapidSX™ technology (up to 3x-7x faster, cheaper, more efficient, greener). Ucore will produce high-purity NdPr, Pr, and Nd from 13-15 tonnes of Canadian & U.S. feedstocks.

In addition to Canadian & DoD support, the Company has a non-binding LOI with the U.S. State of Louisiana for grants, tax incentives, and payroll rebates with an estimated value of $15M.

RapidSX™ promises to utilize up to a 70% smaller footprint, with significantly lower cap-ex & power intensity + reduced op-ex. A closed-loop, modular operation that’s “feedstock agnostic,” and can be stopped & started in hours, not days or weeks.

A facility poised to offer superior operating flexibility, plus the ability to scale up rapidly. Discussions are well underway with 25+ U.S.-friendly, tariff-free, feedstock sources.

Later this decade, the development of Ucore’s 100%-controlled Bokan-Dotson Ridge Rare Heavy REE Project on Prince of Wales Island in SE Alaska could be partially funded with cash flows from Louisiana’s SMC.

Ucore Rare Metals is in the right place, with the right team in the right sector at the right time. The Company is getting inundated with calls from investors, off-take seekers, and prospective strategic partners. Ucore is one of just a handful of REE juniors worth looking at.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Ucore Rare Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Ucore Rare Metals are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Ucore Rare Metals was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply