The following interview is of Scottie Resources’ CEO Brad Rourke.

Scottie Resources (TSX-V: SCOT) could soon be a prime takeout target, especially as gold prices have soared and the company has delivered a series of outstanding surface samples & high-grade drill results. This is an exciting story, highlighted by a past-producing mine, glacial retreat, expanded regional infrastructure & excellent historical assays dating back decades. A combined 545 holes have been drilled on two of Scottie’s seven 100%-owned or controlled properties. {February corp. presentation}

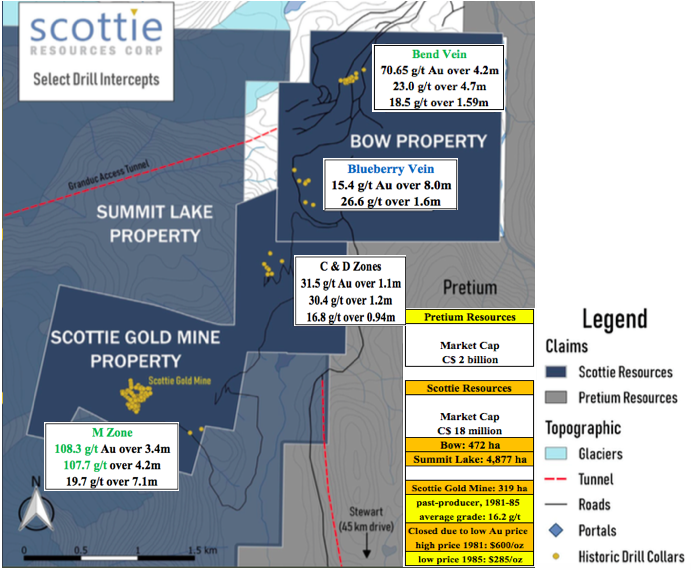

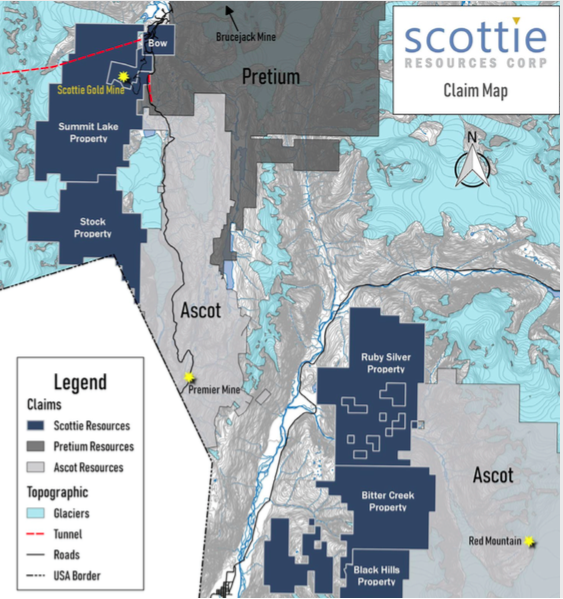

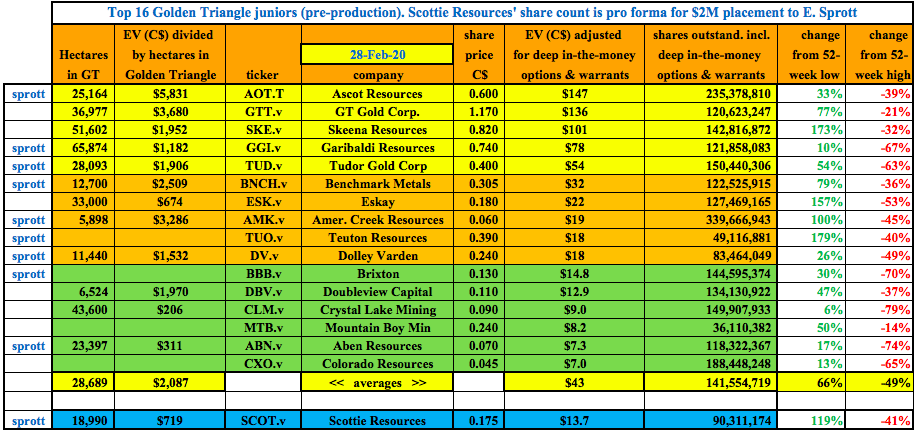

While Newmont, Barrick, Teck Resources, Newcrest Mining and NovaGold are in the Golden Triangle of northwestern British Columbia, they’re too big to care about tiny Scottie Resources. However, Seabridge, Pretium Resources, Imperial Metals and Ascot Resources might be interested in partnering with, or acquiring the company outright.

But, I’m getting ahead of myself…. There’s no rush for Scottie to be acquired. It’s cashed up, including C$2M from Eric Sprott, and has defined high-profile, drill-ready targets on multiple properties. In the past 18 months, gold has soared from the low US$1,200’s/oz. to nearly US$1,700/oz. earlier this week, before pulling back to ~US$1,640/oz. It would be hard to overstate how bullish this is for Golden Triangle juniors like Scottie Resources.

Without further ado, please continue reading this timely and informative interview of CEO Brad Rourke.

News flow at Scottie Resources has really picked up over the past year. Can you give readers the latest snapshot of the company?

Yes, of course. We started 2019 as an unknown entity and exited the year as the talk of the Golden Triangle! Eric Sprott made a cornerstone investment, capping off a truly remarkable year. Scottie Resources massively expanded its land package, now totaling 18,990 hectares (“ha“) contained in two large contiguous blocks near and around Pretium & Ascot. We solidified our technical team, most notably by hiring Thomas Mumford Phd., P.Geo as VP Exploration.

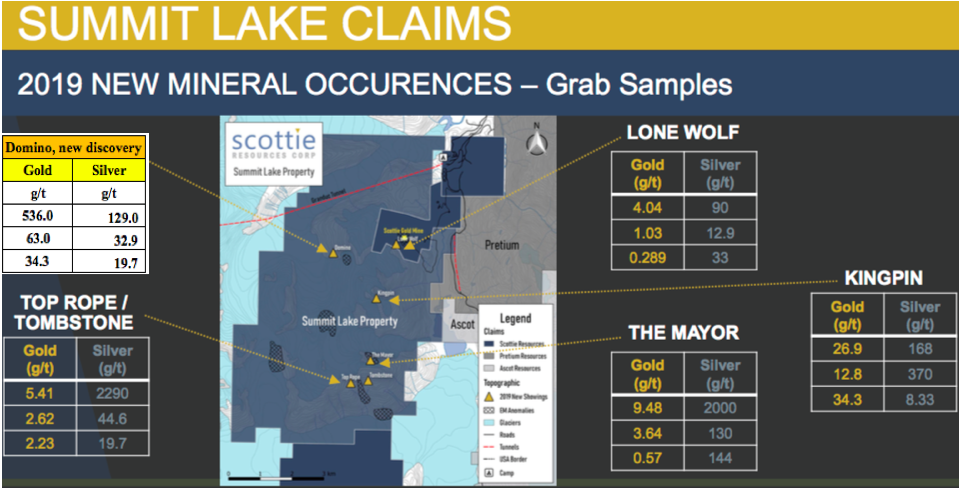

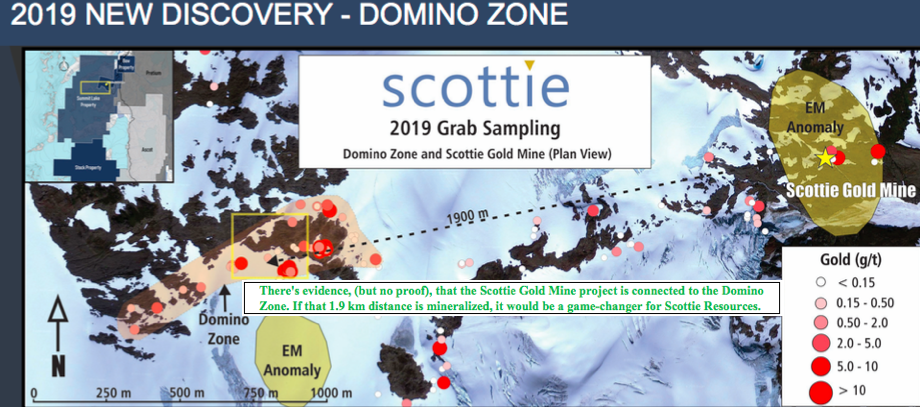

Most importantly, we had a fantastic surficial sampling program that yielded numerous high-grade gold showings – the best being a chip sample of 536 g/t [17.2 oz/.t] gold and another of 735 g/t silver — located just 2 km from our past-producing Scottie Gold mine. 2019 was capped off with a 2,000 m drill program that hit hard on three distinct zones.

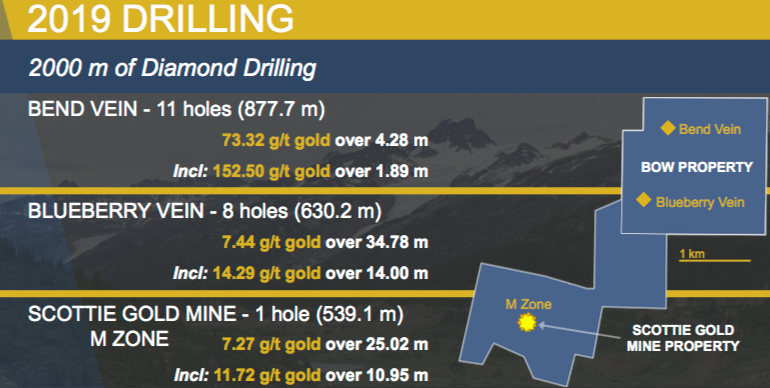

We had exceptional drill results [see chart above]; 73.3 g/t gold (“Au“) plus 71.0 g/t silver (“Ag“), or (~74 g/t Au Eq.) over 4.3 m, (true width 80%-90%)., incl. 1.9 m of 152.5 g/t Au plus 143.6 g/t Ag, equal to (~154+ g/t Au Eq.) on our Bow property. We’re chomping at the bit to get back in the field to follow up on our successes. We’re funded to get well into a substantial drill program. Virtually every high-grade intercept is well under 100 meters in depth.

As good as 2019 was, it really just stands on the shoulders of tremendous historical drill results including 108.3 g/t gold over 3.4 m and 107.7 g/t over 4.2 m in our M zone on the Scottie Gold Mine project {see map}, and 70.6 g/t gold over 4.2 m on our Bow property. Together, a total of 545 holes have been drilled on Bow & Scottie Gold Mine. {new corp. presentation}

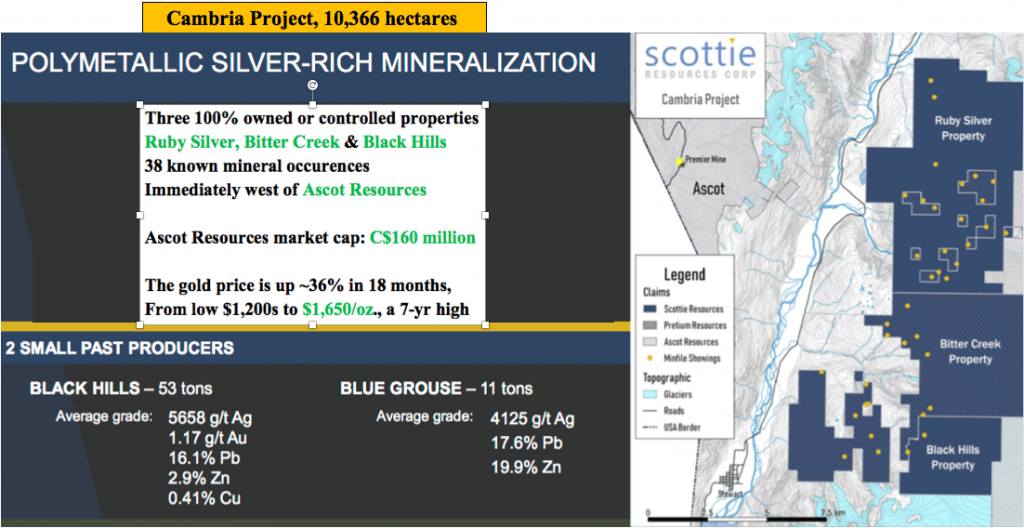

What historical work has been done on the 10,366 ha contiguous block known as the Cambria project, consisting of Ruby Silver, Bitter Creek & Black Hills?

The Cambria claims lie a few km outside of the town of Stewart and have been explored since 1898, resulting in numerous mineral showings. Our claims alone host 38! Two small past-producers operated in the early 1900’s, producing hand-sorted, high-grade polymetallic ore.

Work since then has been limited & sporadic, consisting largely of companies coming in and resampling known showings. Where new work was done, it was typically prospecting & geochemical sampling of silts & soils, with very little geophysics and almost no recorded drilling.

Scottie Resources appears to have had multiple exploration successes recently. What are the most important takeaways?

One should look at the results from our 2019 field season, and consider that this was only our first pass on the newly acquired Summit Lake claims. We followed that up with a very successful 2,000 m drill program. The main takeaway is simply that the area has exceptional metallogenic [the study of the genesis & regional-to-global distribution of mineral deposits] prospectively, and our results point to the potential of a multimillion ounce deposit.

What exploration activities does Scottie have planned for 2020?

The main activities for this summer include focused mapping & sampling around the 2019 discovered showings, advancing them in order to generate drill-ready targets.

A new airborne EM survey and a targeted IP survey to understand the extent of some of the mineralizing structures.

A 5,000+ m drill program will follow up on the three zones successfully targeted in 2019, as well as testing our more advanced new discoveries – namely the Domino zone. We plan on demonstrating a connection along the 1.9 km distance between Domino & Scottie Gold Mine.

Please comment on the metals (silver, zinc, lead, copper) on the Cambria project. Are the prospective grades high? Is mineralization near surface?

Yes, identified mineralization contain high-grade polymetallic veins. To give you an idea of the grades, past production from the Black Hills mine was 5,658 g/t silver, 1.17 g/t gold, 16.1% lead, 2.9% zinc and 0.41% copper. Our current exploration efforts are focused on targeting an underlying feeder system for these veins to show the potential for a much bigger system in the area.

How long will your cash liquidity last?

We run a very tight ship, with only two full-time employees. Our non-exploration cash burn is quite low… so we could last a long time. But, with the gold price at ~US$1,640/oz., near a 7-yr. high, now’s the time to play offense and drill as much as prudently possible this year and next.

Our current cash position will get us well underway with this year’s field season, including a drill program of 5,000+ meters. Additional money raised will be almost entirely directed towards increasing the drill program. We believe we will be able to benefit from the exercise of some warrants this year, further bolstering our treasury.

Based on proximity, it seems that Pretium Resources & Ascot Resources could potentially be interested in your properties. Can you comment on why those two companies should be interested?

We’ve probably been lucky that both companies have been so busy with their own projects and have let us consolidate around them. The biggest factor regarding their potential interest in us would be grade and access.

We compliment, in one way or another, the primary projects being pursued by both Pretium and Ascot. I talk with a number of peers, both nearby and outside the Triangle, the word is getting out regarding what we’ve achieved. In fact, we have signed a number of confidentiality agreements with companies not currently active in the Triangle, but looking to get into the area.

Please update us on your surface tailings opportunity. Is that a 2021 event? How much more attractive is the tailings asset given the move in the underlying gold price?

In 2019 we did infill sampling and flew a drone survey to estimate the volume of the surface tailings. We have samples at the lab for metallurgical testing and are in discussions with the government about potential processing and necessary remediation. Given the progress so far, 2021 seems like a very realistic timeline for us to begin to unlock value from tailings.

Can you describe onsite & regional infrastructure in place supporting your Scottie Gold Mine project?

Simply put, we’re in a Tier 1 location, with world class, and growing, access to infrastructure. Just an hour’s drive north of a deep water port in Stewart, BC, we can drive right up to our past-producing Scottie Gold Mine on an all season road. That drive passes by Ascot’s 2,800 tonne/day mill. The power line feeding Pretium’s Brucejack mine is a few hundred meters away.

If investment capital were not a constraint, could you possibly fast-track the past-producing Scottie Gold Mine into production?

Yes, the mine has an active 200 tonnes / day permit on it. However, we’re 100% an exploration company looking to show that the Scottie Gold Mine project and surrounding properties host a much larger system.

The original mine started from a vein at surface and produced ~95,000 oz. of gold from 1981-85 at a blockbuster average grade of 16.2 g/t. The mine was shut down because the gold price moved from a high of $599/oz. in 1981, to as low as $285/oz. in 1985.

The project has never had a robust, modern property-scale exploration program, or any meaningful exploration since the early 1990s. This is where we think we can add value by doing something different from previous operators.

Are there past-producing mines, or other gold project analogs held by peer gold juniors that your technical team believe to be relevant?

We’ve certainly looked around at peers to see what is similar, both from a geological & corporate perspective. From a corporate perspective, we look to modern examples of past-producing deposits being reborn like Osisko’s Barkerville Gold mine and Pure Gold’s Madsen mine.

Geologically, Scottie is somewhat unique, it hosts high-grade gold associated with pyrrhotite-pyrite shear veins. The closest analog is the Snip mine, located about 80 km NW of the Scottie Gold mine. The Snip mine produced 1.1 million ounces of gold at an average grade of 27.5 g/t. {new corp. presentation}

Thank you Brad, very insightful information as always. Nice work driving the gold price higher … Exciting times ahead for Scottie Resources this year and next!

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Scottie Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was originally posted, Peter Epstein owned no shares of Scottie Resources and the Company was NOT an advertiser on [ER]. However, as of June 15, 2019, the Company is an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this interview. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this interview or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)