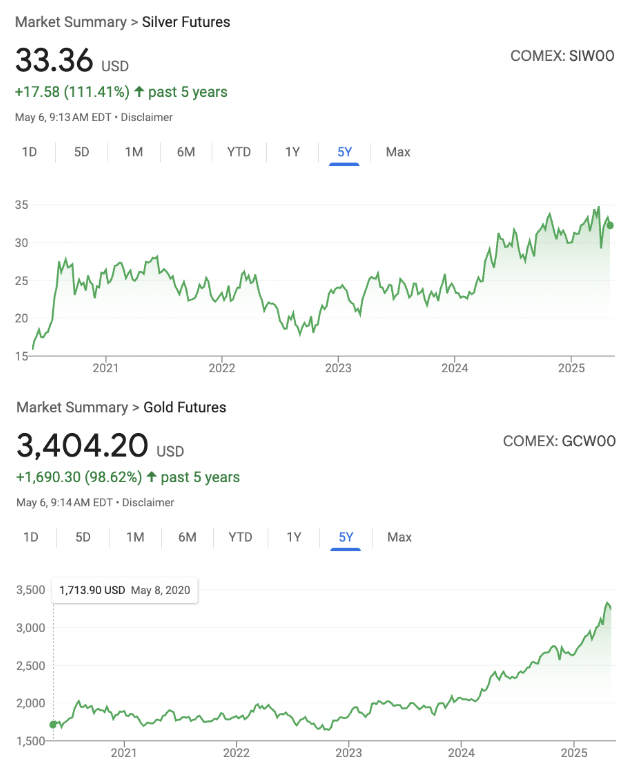

Silver (“Ag“) is up +15%/+22% (YTD/past 12 months), while gold (“Au“) is +29%/+47%! Those are strong numbers, but not unprecedented. In the decade ending in 2011, Ag had a +23.2% CAGR, and increased +33.7%/yr in the nine years ending in 1980.

The inflation-adjusted Ag price for the entire year of 1980 was $86.20/oz. Today’s price of $33.36 is -61% below that, despite a tiny fraction of today’s solar panels in use, zero EVs, and no wireless electronics or telecom systems (pre-cell phones/internet).

This is year five of a mined Ag deficit. Among the top-8 Ag producing countries are China (#2), Russia & Bolivia. Given geopolitical events, it’s safe to assume that N. American economies will seek precious & critical metals sourced regionally.

That’s great news for Ag/Au players in Mexico, the world’s largest Ag producer. A company I continue to love is Silver Storm Mining (TSX-v: SVRS) / (OTC: SVRSF), with a pro forma enterprise value {market cap + debt – cash} of C$84M. ($0.12/shr. morning of 5/6/25).

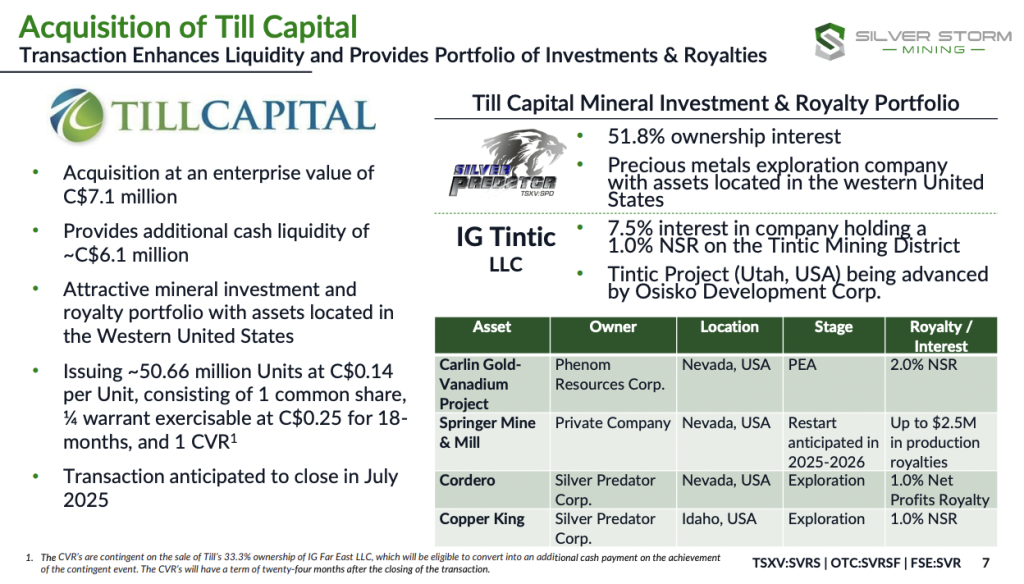

On May 6th, the Company announced the proposed acquisition of Till Capital Corp., owner of 51.8% of Silver Predator Corp. [SPC] + two 1.0% NSRs on SPC properties.

More importantly, Till Cap. had C$6.2M in cash on 12/31/24, all of which will go to Silver Storm if the acquisition closes. If one values 51.8% of SPC + the two NSRs at C$1.5M, management is effectively issuing shares in Silver Storm at ~C$0.15 with a quarter warrant for 18 months at C$0.25/shr.

This seems like an attractive transaction, as the cash can be used to help restart the 100%-owned La Parrilla (“LP“) mine & mill.

If management can restart this mine complex in the next 12 months (management is hoping for this year, but is tied to a yet-to-be-arranged debt package) without excessive equity dilution, the share price should do quite well.

Readers may recall that ~$15M was thought to be needed to restart LP, but in my view, more will be raised to provide a margin for error. I had assumed C$22.5M of additional [debt + equity] before the Till Cap. deal. I imagine a fairly modest amount of equity will be needed by 12/31/25.

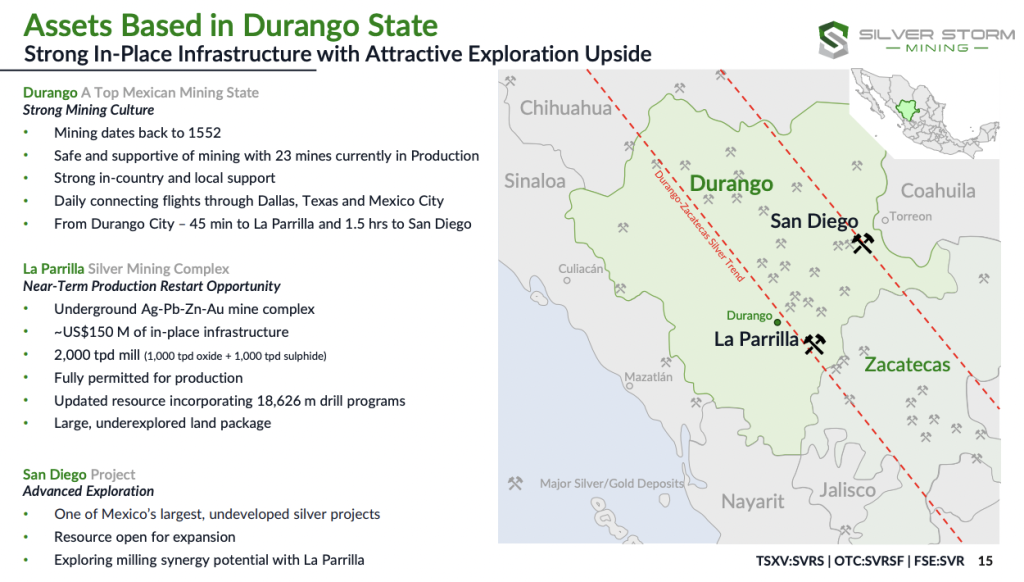

Silver Storm holds 100% of two primary Ag projects in Durango State in central Mexico. The past-producing LP mining complex sits on 38,128 contiguous hectares just 76 km SE of the Capital of Durango.

LP was continuously operated from 2005 to mid-2019. In the four years ended 9/30/19, the average Ag price was ~$17/oz, with periods below $15/oz. Silver is now nearly double that $17 figure, vs. roughly a smaller 40% increase in mining costs.

At $33.36/oz, the operating margin could be $13.36 = ~C$18.4/Ag Eq. oz. Management, led by CEO Greg MacKenzie, plans for 3.0M Ag Eq. oz/yr, but prior owner First Majestic operated at up to 4.67M oz/yr (in 2014).

With the Au: Ag ratio at ~103:1, Ag is a coiled spring, potentially outperforming Au in the coming quarters. Over the past 50 years, the ratio has been this high (or higher) < 2% of the time. Why does it matter?

Eventually, the ratio will revert towards its long-term average of ~61:1. In the past 12 months, it was as low as 73:1. At 80:1 and today’s Au price, Ag would be $42.55/oz.

Therefore, if one’s bullish on Au, it would be hard not to be bullish on Ag. On April 16th, the Silver Institute updated its demand/supply model for 2024. According to its latest report,

“Demand continued to benefit from structural gains linked to the green economy, including investment in grid infrastructure, EVs, and solar applications. Demand was further boosted by end-uses related to Artificial Intelligence, which drove growth in consumer electronics shipments.”

The State of Durango hosts two dozen mines, making it a very mining-friendly jurisdiction. LP was acquired in 2023 from First Majestic, which is Silver Storm’s largest shareholder at ~36% (Eric Sprott owns ~15%).

The fundamental backdrop for Ag could hardly be better, setting the stage for Silver Storm’s return to production. In February, management announced an excellent resource upgrade at LP to 26.0M Ag Eq. ounces. CEO Greg McKenzie under-promised & over-delivered on that resource update.

At spot pricing for Ag, Au, Zn & Pb, the average grade is 254 g/t Ag Eq. (~2.5 g/t Au Eq.). Importantly, 75.1% of the economics come from Ag (70.6%) & Au (4.5%) vs. a combined 24.9% from zinc & lead.

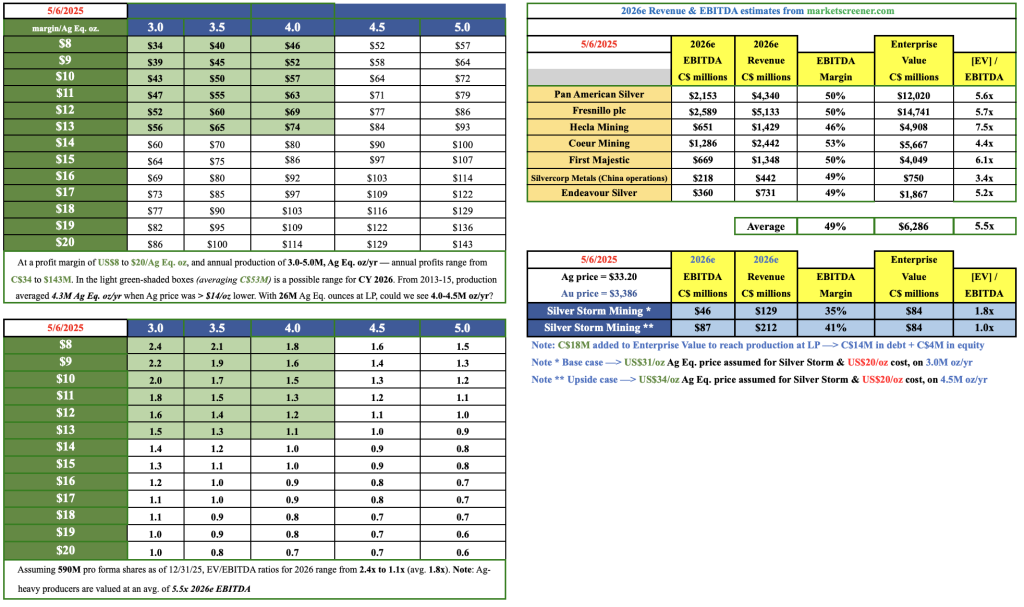

The following chart is a busy one, but notice that the average EV/2026e EBITDA ratio is 5.7x vs. 1.8x for Silver Storm. Silver Storm is not yet in production, so it deserves to be valued at a significant discount to producing peers.

Yet, that 1.8x figure ascribes zero value to the 100%-owned San Diego project, an asset worth up to $100M (see below).

This valuable 26M Ag Eq. oz. endowment should support 5 or 6 years of operations, and ongoing drilling should extend mine life. LP’s resource includes blockbuster Ag Eq. intervals including: [1,810 g/t over 14.6 m], [911 g/t over 13.1 m] & [689 g/t over 9.4 m].

Please note, 1,810 g/t Ag Eq. is among the top 5% of results for Ag intervals of > 10 m. This year’s Ag Eq. highlights to date include [618 g/t over 18.0 m] and [565 g/t over 7.2 m].

Silver Storm also wholly owns the large bulk tonnage San Diego (“SD”) primary Ag project, valued as high as $110M at the end of 2020 when it was the sole asset of a predecessor company. Readers should note that Ag is about +30% higher since then. The plan is for cash flow from LP to help fund SD.

SD is billed as one of Mexico’s largest undeveloped primary Ag assets. Readers are reminded that SD is truly valuable & strategic as one of the very few sizable primary Ag projects not owned by a much larger company.

SGS Canada reported that SD’s resources could (with more drilling) be expanded by 20-50 Mt at 100-150 g/t Aq Eq. (mid-point = ~141M Ag Eq. oz) from “existing structures + lateral & depth extensions.”

For this article, I assume there are 220M booked Ag Eq. ounces (at spot, 59.1% Ag/Au, 40.9% Zn/Pd).

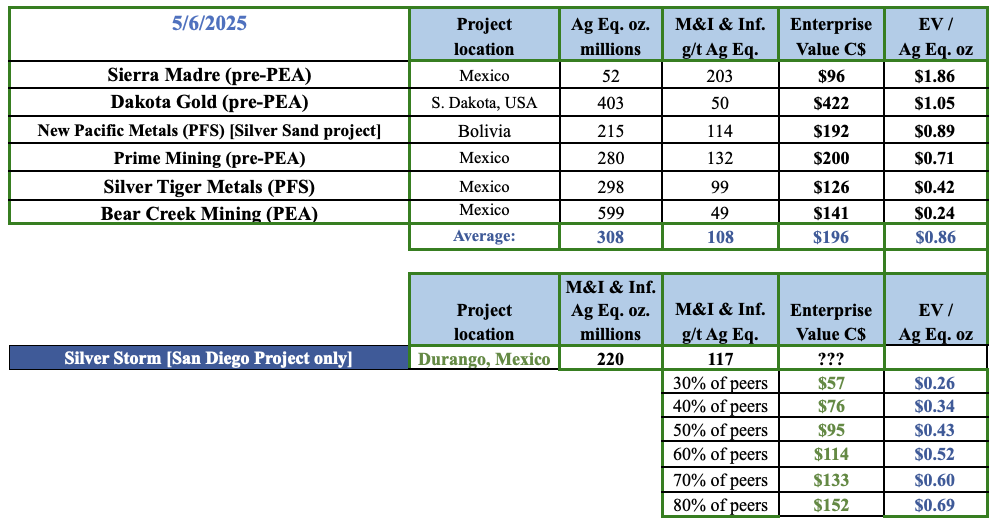

I searched for juniors with Ag-heavy, bulk-tonnage projects. The six shown below are valued at an average of $0.86/oz. If SD’s 220M ounces are worth that much, SD would be valued at $190M.

At $0.43/oz., or 50% of peers, SD is “worth” $95M. The top dozen Ag-heavy names (producers, developers, explorers, with market caps > C$10M) are +200% to +950% from their 52-wk lows. By contrast, Silver Storm is +72%.

Silver Storm faces considerable risks over the next two years, most notably 1) obtaining restart capital for LP, 2) execution/technical risks of resuming production, 3) timing of the restart, and 4) ramping up beyond 3.0M Ag Eq. oz/yr.

These and other critical risk factors (the peso, Ag/Au prices, operating costs, etc.) explain why the Company’s pro forma valuation is (arguably) too low at $84M. However, news of the funding package for LP’s restart in the next few months will be a major step in de-risking the Silver Storm story.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm Mining are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER], and Peter Epstein owned shares in the Company bought in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply