If one’s bullish on copper (“Cu”) demand and therefore prices, one should be excited about low-valued Cu explorers/developers who can be in production within 3-5 years. But not juniors with projects in difficult jurisdictions.

High-risk jurisdictions like Zambia, the DRC, Mongolia, and Indonesia are by no means uninvestible, but why go to places where very few U.S. or Canadian investors know anything about? One can get the Cu call right, but be mired in country risk.

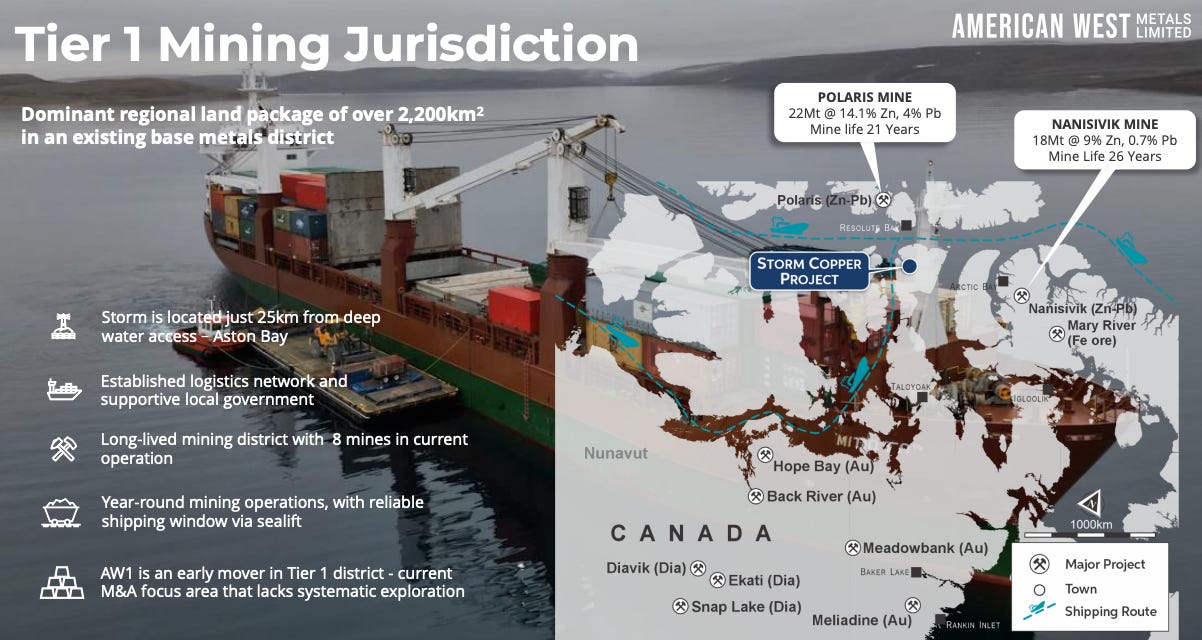

Some countries that juniors are operating in are questionable, but Canada, Australia & the U.S. are Tier-1 locations that Western countries can rely on. In the precious metals space, the pace of M&A is rising. I think the same is true for Cu companies, which will increase valuations across the board.

U.S. tariffs & belligerence result in Canada fast-tracking projects

Given Trump’s ongoing threat to Canada’s sovereignty & arbitrary tariffs, Canadians are now (understandably) quite serious about fast-tracking mining projects. One company I continue to love is Aston Bay Holdings (TSX-v: BAY) / (OTCQB: ATBHF).

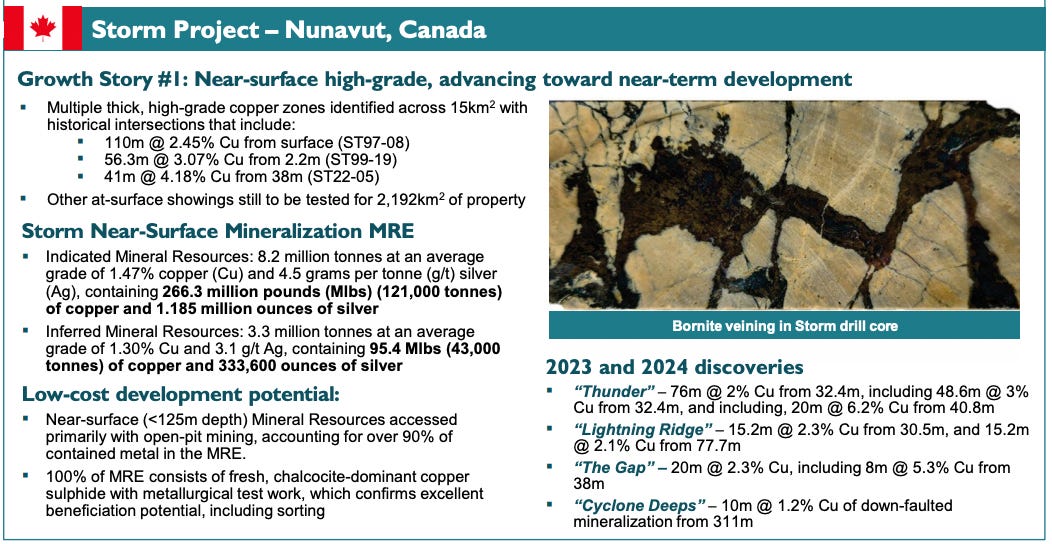

Aston is a tiny company with excellent leverage to Cu (+ some silver). It discovered the exciting high-grade Storm Copper project on Nunavut’s Somerset Island, ~25 km from deepwater shipping on the Northwest Passage, and farmed it out to Australian-listed American West Metals, which now owns 80%.

That leaves Aston with a free-carried 20% interest in the [Australian JORC-compliant] PEA-stage project spanning > 2,200 sq. km, upon which Aston recently announced a Canadian NI 43-101 resource estimate for near-surface mineralization (< 120 meters depth).

The resource included six deposits within the greater Storm area: Cyclone, Chinook, Corona, Cirrus, Lightning Ridge & Thunder. Drill highlights include 110 m / 2.45% Cu, 56 m / 3.1% Cu, and 48.6 m / 3.0% Cu.

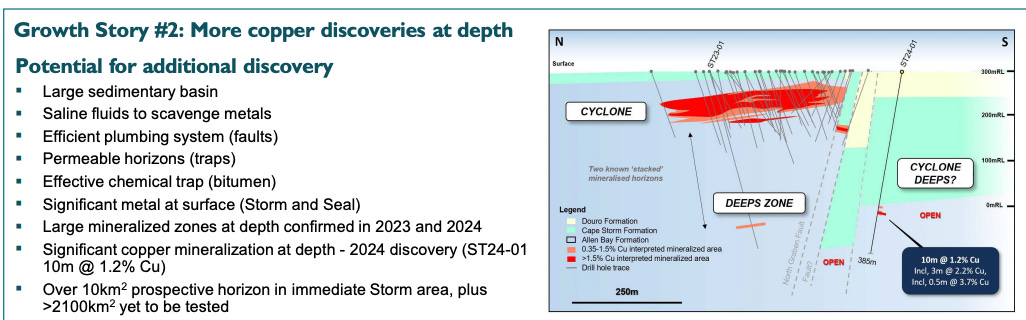

In the image above, note how much blue-sky exploration potential there is. The Project comprises both the Storm & Seal Zinc deposits (best interval at Seal is 22.3 m @ 23.0% Zn, (equiv. to ~6% Cu). Including Midway, there are 18 named zones (some well understood, others undrilled but highly prospective).

Ocean Partners joins Taurus Funds Mgmt. backing Storm Copper

Earlier in April, global metal trading, tech advisory, and financing company Ocean Partners Holdings agreed to fund 80% of the upfront cap-ex on Storm. This strong vote of confidence in that Project is critically important as Aston has a 20% free-carried interest in this valuable asset.

The odds of Storm becoming a mine have meaningfully increased. Ocean has vast experience with ore-sorting & direct shipping ore operations. It conducted extensive due diligence over several months. Taurus has > US$1 billion invested in the metals/mining sector, incl. US$12.5M in American West.

Ocean Partners’ CEO commented: “We are delighted to be partnering with American West on the Storm Copper Project, which is rapidly emerging as a long-life, district-scale copper opportunity.”

Notably, the PEA does not reflect either long-life or district scale. Therein lies the opportunity! Additional discoveries this year and/or next are quite possible.

Even without discoveries, there are plenty of mineralized zones to expand upon. Importantly, Storm is fairly well understood down to ~150 meters, but remains open at depth in most areas. In a recent press release, American West provided a promising pre-drilling update.

More than 58 m of intermittent visual Cu sulfides were found in a historical drill hole from 2018 (5 km west of the mineral resource estimate, an area now named the Midway prospect).

Substantial exploration upside at Storm Copper…

The 20-km stretch of the 110 km Cu-mineralized belt hosting the Midway, Storm, and Tornado prospects is along known conduits for Cu-mineralizing fluids confirmed for high-grade Cu.

Midway is yet another highly prospective regional target, along with other priority targets including Tornado & Blizzard. Reinterpretation of historical (EM) & (IP) surveys identified numerous large-scale Cu opportunities.

This year, an MMT survey designed to see deeper than 150 m & detect a broader EM spectrum will generate even more targets in the Storm & regional areas.

In addition to testing regional targets, the drill program will follow up on discoveries such as Squall and The Gap, and near-mine expansion drilling. CEO Thomas Ullrich is excited by the upcoming (July) MMT survey as he believes this particular technology is ideally suited for the host rocks at Storm and the surrounding areas.

Importantly, there’s good potential to expand Cu mineralization outside the Storm area. Only 5% of the 110 km Cu belt has been explored with focused, modern geophysics & drilling. Aston is free-carried through two more exploration seasons by American West.

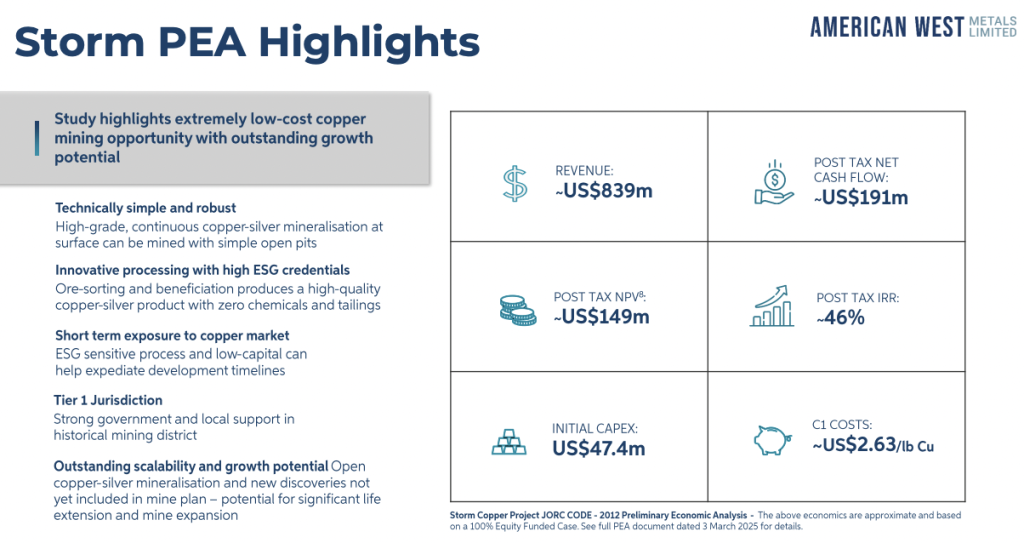

Some complain that Nunavut is too far north. Yet, it’s not too far north for Agnico Eagle, Teck Resources, BHP, MMG Ltd., or B2Gold. Aston owns 20% of the economics of American West’s indicative (JORC) $149M post-tax NPV(8%).

An 8% discount factor is modestly conservative as most gold projects, even at the PEA stage, use a more aggressive 5%.

Is Aston Bay’s C$10M valuation too low?

Aston’s Enterprise Value {market cap + debt – cash} is ~C$10M [$0.055/shr. on 4/25/25]. Compare that to 20% of the [US$149M NPV(8%, $4.60 Cu) = C$42M], or [US$213M (at $5.06/lb. Cu) = C$59M].

I’m not suggesting Aston is worth C$42-$59M today, but C$10M seems too low — a figure that might be warranted if Aston faced major equity dilution for Storm — it doesn’t.

Without relying on a higher Cu price, currently $4.90/lb., two more drill seasons (at zero cost to Aston) will deliver a mine life extension and/or an increase in annual production. Therefore, the NPV(8%)… or the NPV(5%)… in next year’s BFS (should be) above $149M, unless the Cu price falls.

Ocean Partners is covering 80% of the US$47.4M in cap-ex for Storm, which includes a 25% contingency. That leaves $9.5M to be equity-funded, of which just $1.9M would be Aston’s share. Importantly, readers are reminded that Aston has no funding calls on Storm until after the delivery of a BFS.

As American West/Ocean Partners invest in Storm this year & next, the cap-ex figure will decline. CEO Thomas Ullrich points out that the Company’s 20% share of a royalty signed last year by American West should bring in an additional US$1.5M, of which $0.7M is expected in April.

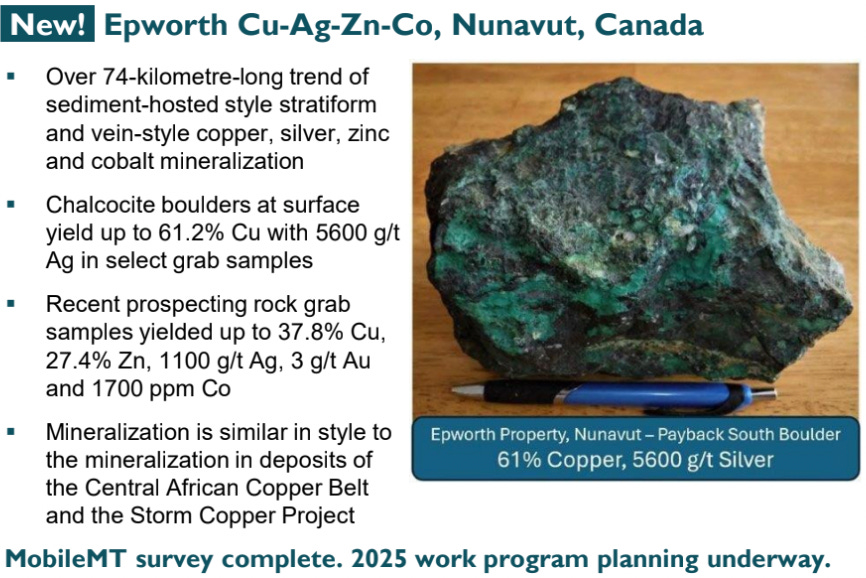

That’s on top of ~US$1M on the balance sheet. The more I think about Aston’s earn-in opportunity for up to 80% of the promising Epworth property, also in Nunavut, the more I believe it, too, could be worth a multiple of Aston’s entire enterprise value.

Is Aston’s 80% earn-in option on Epworth —> Storm Copper 2.0?

Of course, that statement is subject to drilling, following up on samples from chalcocite boulders yielding up to 61.2% Cu + 5,600 g/t Ag. If Epworth becomes Storm Copper 2.0, and management farms out half of its 80% option to get free-carried on 40% for several years, Epworth could be quite valuable.

Importantly, when management negotiated the Epworth transaction in 4Q/23 — 1Q/24, Cu averaged $3.80/lb. Today it’s +29% higher! There are no annual work commitments, just a requirement to invest a total of C$3M over four years.

After further demonstrating the likelihood of a low-cost, high-margin operation at Storm with robust resource growth potential, a key objective will be to prove Aston can retain its 20% stake, plus a 20%-40% interest in Epworth, without excessive equity dilution. Perhaps Ocean Partners would be interested in investing in Epworth.

Strategic partners, smelters, royalty/streaming groups & debt providers can help Aston explore/develop Epworth, potentially making its stake worth C$10’s of millions.

Imagine if American West delivers line-of-sight to production by 2028… That would be great news for shareholders and a meaningful de-risking event for Epworth, as management could replicate Storm’s logistics & funding strategies.

Although highly speculative, Aston is free-carried on a 20% interest in Storm Copper, has a low cash burn rate, and is earning up to 80% of Epworth under flexible terms. Its EV of C$10M is low, and the Cu price has been rising, making Aston Bay a compelling risk-adjusted proposition.

Disclosures/disclaimers:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aston Bay are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER], and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply