From 2022-2024, Newmont’s EBIT averaged $2.7B/yr, and from 2025-27 the consensus is $7.6B/yr, a gain of +182%. Barrick Mining in 2022-24 averaged $3.4B/yr, with a 2025-27 forecast of $8.1B/yr, a gain of +140%.

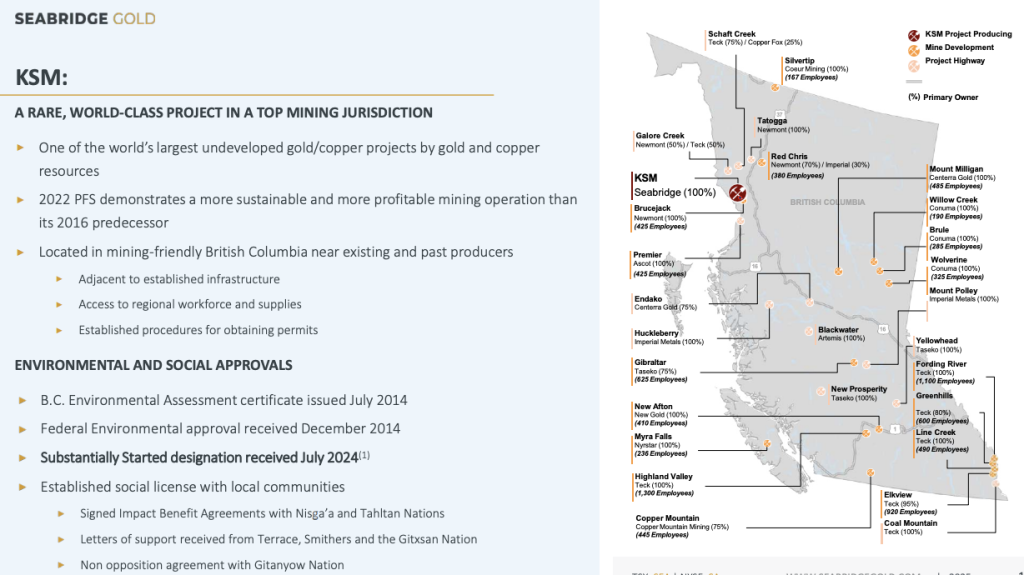

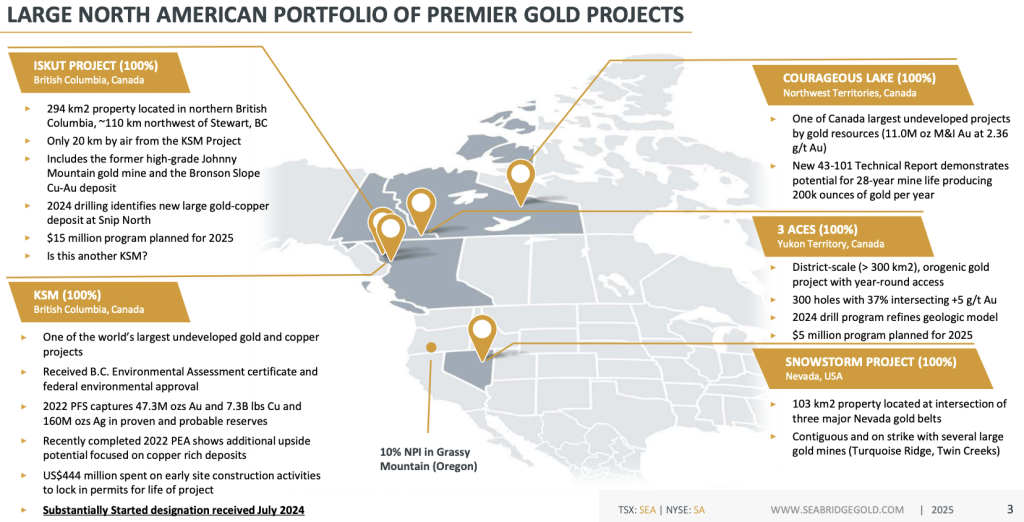

It’s increasingly clear that Majors need ever-larger acquisitions to move the needle. One can’t get any bigger than Seabridge Gold’s (TSX: SEA) / (NYSE: SA) extraordinary gold, copper, silver & molybdenum endowment spread across four projects in Canada + one in the U.S.

New corporate presentation

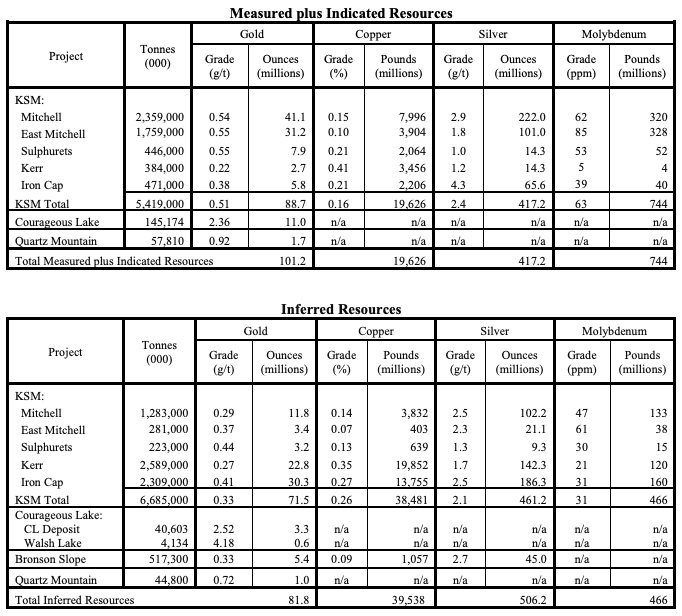

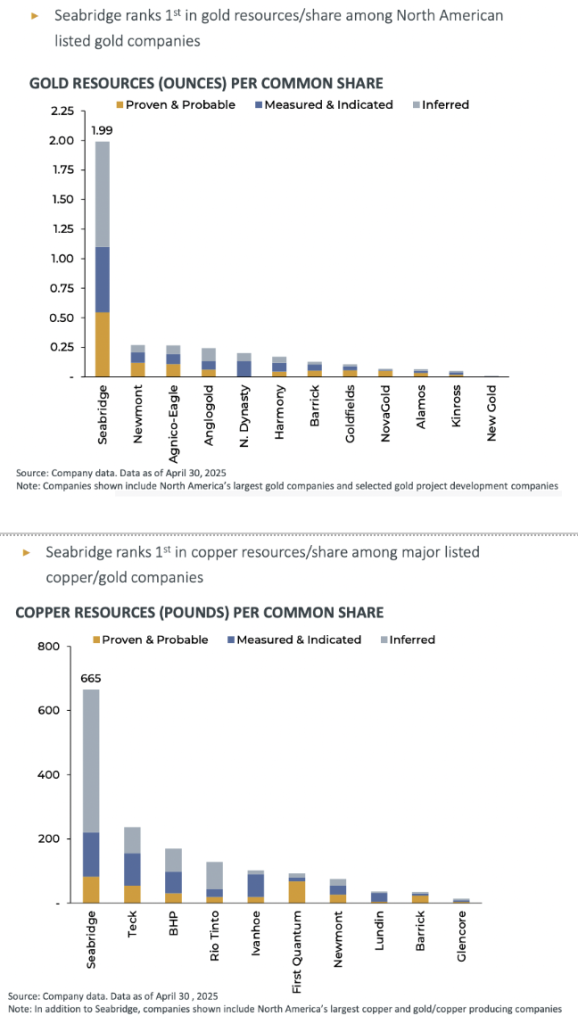

At spot pricing (ignoring the molybdenum), Seabridge has ~278 million Au Eq. ounces. Not 1, but 2 orders of magnitude larger than most development-stage projects! In-situ value is C$1.25 TRILLION! That’s ~270 BILLION lbs. Cu Eq.

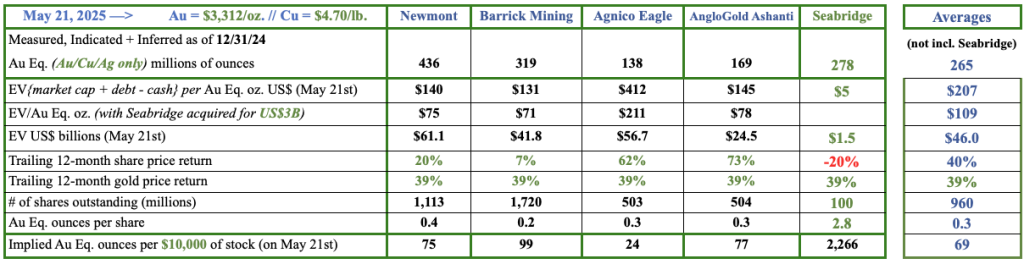

Consider that Seabridge has twice as many Au Eq. ounces as Agnico Eagle, yet as a highly successful producer, Agnico has ~33x the valuation. Seabridge offers three things Agnico would benefit from.

First, a tremendous pipeline of Au/Cu ounces –> Agnico’s/Seabridge’s Au Eq. ounces would be comparable to Newmont’s. Second, it would diversify Agnico’s heavy exposure to eastern Canada via expansion into western Canada.

Third, it would meaningfully grow Agnico’s Cu resource to ~15% of pro forma resources (Agnico is currently 2% Cu vs. Barrick, Newmont & Seabridge at 27% to 30% Cu).

Seabridge’s vast Au/Cu/Ag/Mo endowment across projects, highlighted by KSM

Although Newmont & Barrick have more Au Eq. ounces than Seabridge, investing US$10K in one of those, Agnico, or AngloGold Ashanti would deliver exposure to an average of 69 (in-situ) ounces.

Compare that to 2,266 ounces from investing $10K into Seabridge (albeit Seabridge is years from initial production).

In the chart below, notice how much a Major could benefit from acquiring Seabridge (figures include Au, Cu & Ag ounces/pounds only, no molybdenum, lead, zinc, etc.). For instance, Agnico’s EV/oz. of $412 could be slashed to $211/oz. by acquiring Seabridge at a hefty premium –> for US$3B.

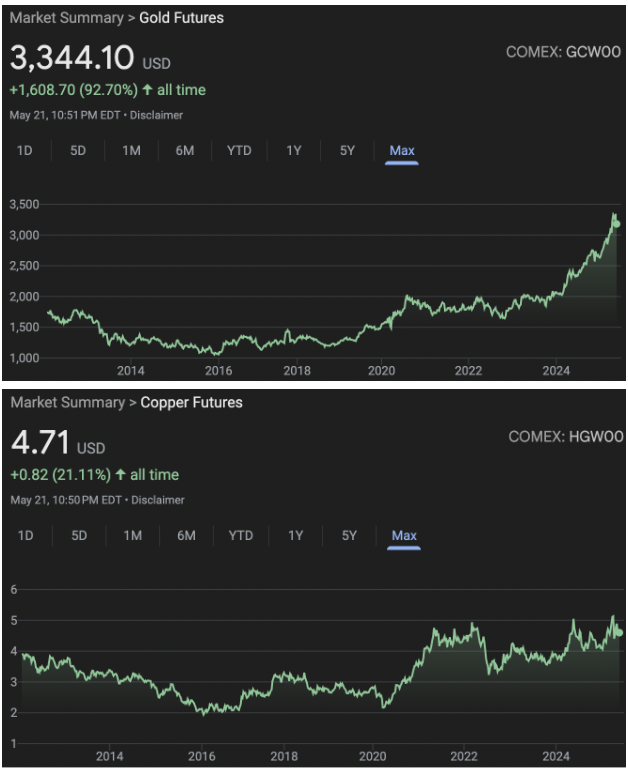

Until about a year ago, Au was mostly below $2,000/oz., averaging $1,848 from 2021-2023. YTD, the average is ~$3,000, and the spot price touched $3,500 on April 21st before falling to today’s $3,344.

JPMorgan recently said that Au could reach $6,000/oz., “if just 0.5% of U.S. assets held by foreign investors were to be reallocated to Au.” JPM expects $4,000/oz. next year.

Also calling for $4,000 in 2026 are Goldman Sachs, SocGen, Doubleline Capital’s Jeff Gundlach, Euro Pacific Capital’s Peter Schiff, and Yardeni Research’s Ed Yardeni.

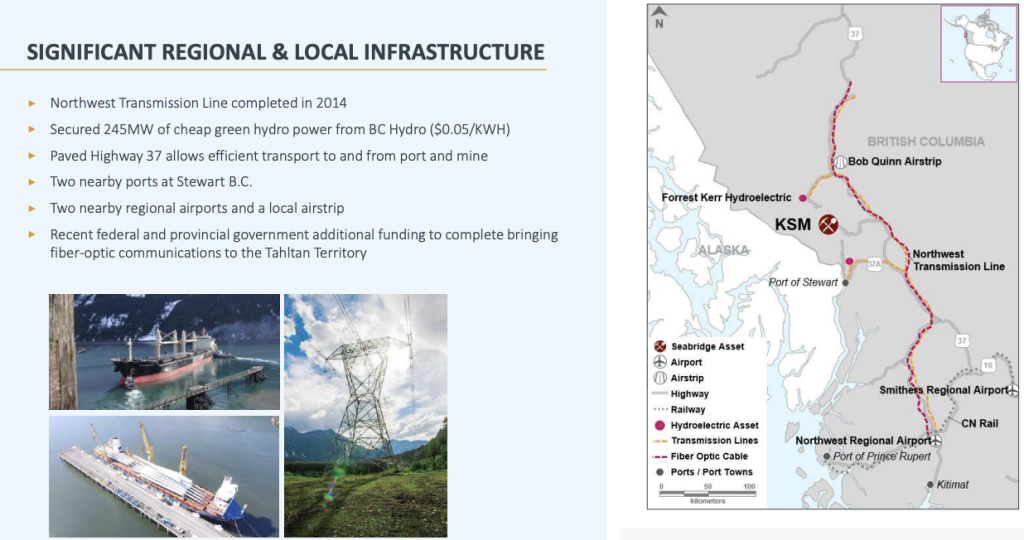

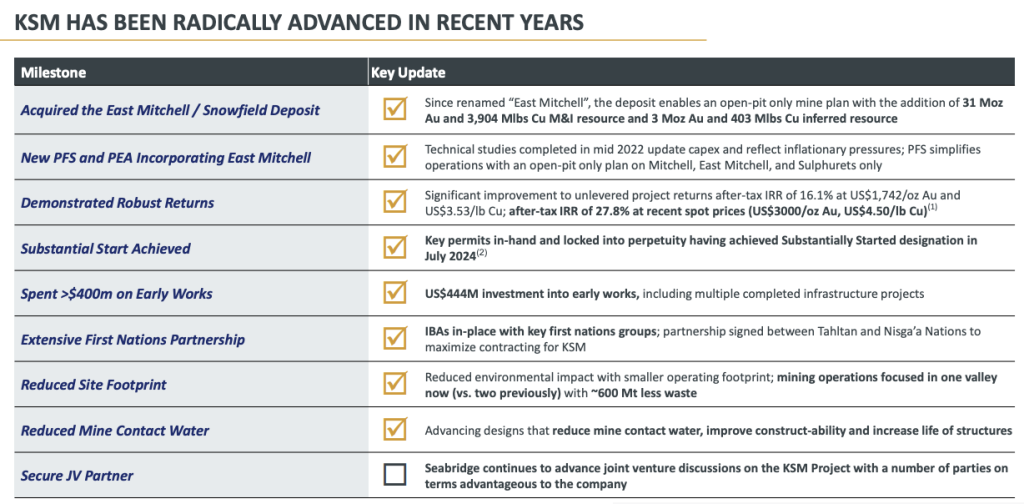

Seabridge’s KSM project in B.C., Canada, is a monster. With Au < $2,000, the $6.4B upfront cap-ex (from the 2022 PFS) was feared to be too large to fund.

Yet, in the past 15 months, the average gain in share price of Newmont, Agnico, Barrick & AngloGold Ashanti is +85%. Their combined valuation is up nearly $80 billion.

In speaking with CEO Rudi Fronk, he’s as bullish as ever on the prospects for Seabridge and expects to announce a strategic partner this year.

The time has come for a Major miner to help plan, permit, fund, build & commission KSM. I believe Western-friendly Au Majors + diversified miners with market caps above US$20B could acquire Seabridge (at a 100% premium) + fund $8.0B of cap-ex ($6.4B x 1.25 [cap-ex inflation] = $8.0B) spread over 5-6 years.

I bet a strategic investor will come from one of the following: Gold Majors — Agnico, Newmont, Barrick, AngloGold, Gold Fields, Diversified Miners, Freeport McMoran, Glencore, Rio Tinto, Teck Resources, BHP, Anglo American, Vale (Canada).

Franco-Nevada & Wheaton Precious Metals are precious metal companies, albeit not miners, valued at US$30-$35B. Could they be interested in KSM? I have no idea, but they share the same problem as Au Majors — finding assets large enough to move the needle.

Finally, there are five Japanese commodity trading houses — Mitsui & Co., Mitsubishi Corporation, Sumitomo Corporation, Marubeni Corporation, and Itochu Corp., valued at US$30 to $70B.

Why do I mention these 18 companies? Not all are interested in KSM, but many could acquire or invest in other large Au/Cu projects, making KSM increasingly scarce & vital.

At spot Au & Cu prices, the current US$/C$ exchange rate, and assuming a +25% increase in cap-ex & op-ex, post-tax NPV(5%) is ~US$20B with an IRR of ~25%.

KSM will generate a substantial amount of valuable jobs, taxes, royalties, consumer spending, infrastructure buildouts, etc., exactly what Canada needs to combat trade wars, economic uncertainty, and unprovoked belligerence from the U.S. President.

M&A is going to pick up, possibly getting heated at times. The number of Au/Cu + diversified miners valued at/above US$20B will continue to rise, especially with M&A.

In the silver space, robust M&A has begun. Mag Silver is being taken out by Pan American Silver, Gatos Silver was acquired by First Majestic, and Silvercrest Metals was acquired by Coeur Mining.

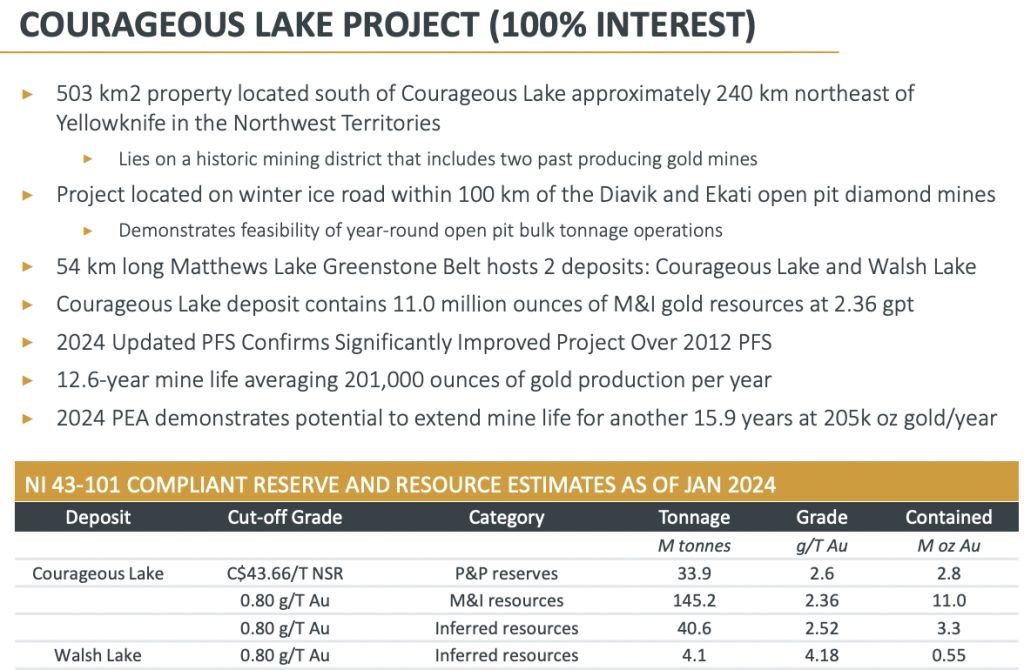

Little to no value is ascribed to Seabridge’s other assets, yet Courageous Lake & Iskut are significant. CL is in the Northwest Territories. It has a Measured, Indicated & Inferred Resource of ~13.3M ounces at an impressive 2.4 g/t Au.

If management were to farm CL out, Seabridge’s residual free-carried stake could be very valuable. CL is, without doubt, a top-decile undeveloped project in N. America, especially among projects not owned by producers.

Management believes its 294-sq. km Iskut project “could be another KSM.” It has similar geology & grades. As the crow flies, it’s 20 km from KSM. Last year’s best drill interval was 303 meters of 0.90 g/t Au Eq. (0.75 g/t Au).

Even if Iskut could show line-of-sight to being 5%-10% the size of KSM, it would be a valuable satellite deposit or a company-making asset for another company. {See NEW Corporate Presentation}

Seabridge’s 3 Aces Project in Yukon has seen 300 drill holes, with 37% intersecting 5+ g/t Au & 27% 8+ g/t Au. The geological setting is similar to some of the world’s largest & richest Au deposits. High-grade, laterally extensive Au has been found at surface.

The clear focus is to find a strong financial/tech partner to unlock an incredible treasure chest of Au, Cu, Ag & Moly. 183M ounces of Au, but also 59B pounds of Cu, meaningfully more Cu than SolGold, NGEX, or McEwen Copper, with 27-38B lbs. NGEX has a market cap of C$2.6B vs. Seabridge’s at C$1.75B.

Seabridge Gold’s valuation has lagged well behind strong share price gains by companies like Northern Dynasty, Lundin Gold, Lunina Gold, Orla Mining, Montage Gold, Skeena Gold & Silver, Artemis Gold, and G Mining Ventures, up an average of +252% from 52-week lows.

If Au remains above $3,000/oz, or climbs back toward its high of $3,500/oz, investors will recognize the significant importance of KSM to several of the 18 companies mentioned earlier. Seabridge is valued at just 0.18% of its in-situ metals value.

Pre-production peers, some at earlier stages, including market darlings like G2 Goldfields, Rupert Resources, Snowline Gold, and Perpetua Resources, trade at an EV/in-situ metals valuation of roughly 1.5% to 7.5%.

If one is bullish on Au & Cu, Seabridge delivers tremendous bang for the buck. Its KSM project will soon be (if not already) a must-own Au/Cu asset for Western-Friendly Au Majors or large diversified miners that can provide vast financial & technical expertise.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply