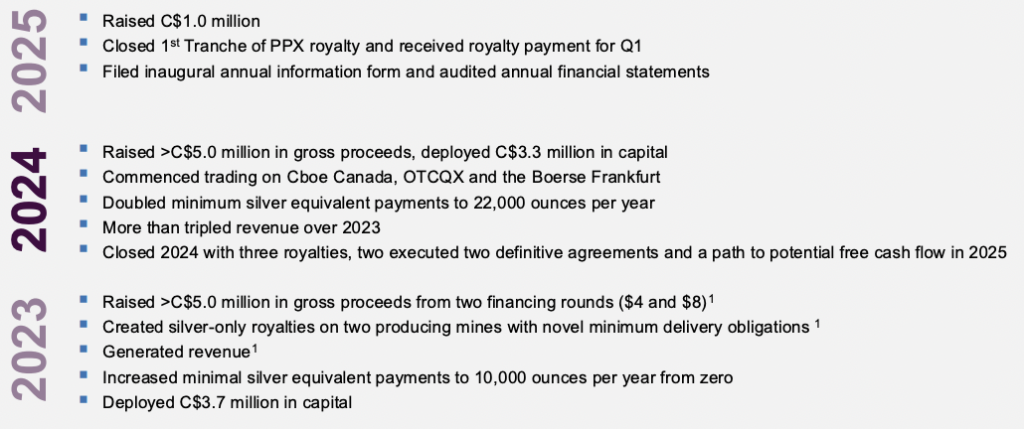

Incorporated in August 2021, Silver Crown Royalties [SCRi] (SCRI.neo) (OCTQB: SLCRF) is a small, yet revenue-generating company that’s 100% tied to silver (“Ag”). Founder, Chairman & CEO Peter Bures believes his team’s approach offers competitive advantages due to an innovative business model.

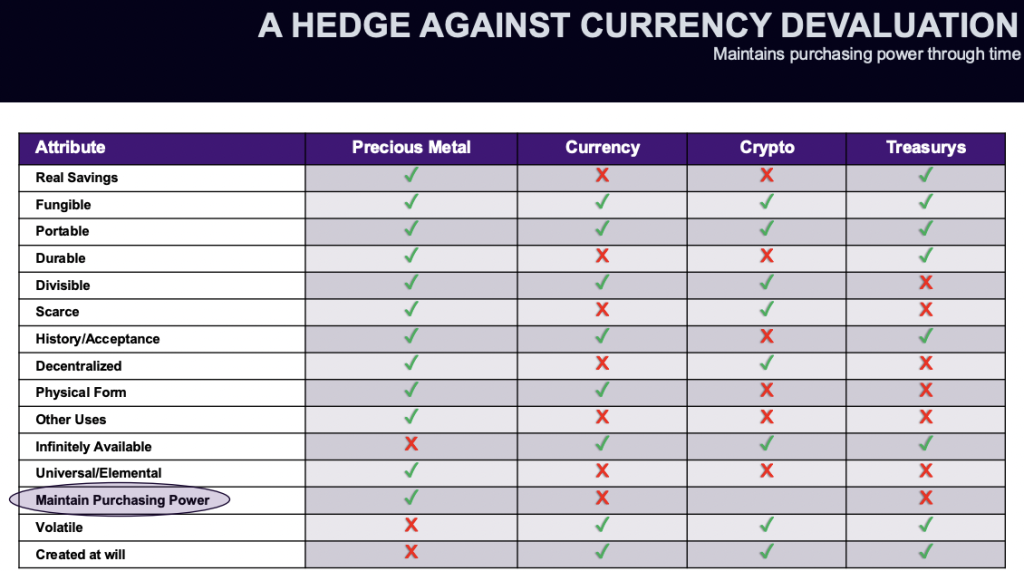

Before extolling the virtues of Silver Crown, it’s important to state that the management team, board & advisors truly believe in the following chart. While most people don’t realize it (yet), precious metals are money, offering an inflation-protected store of value.

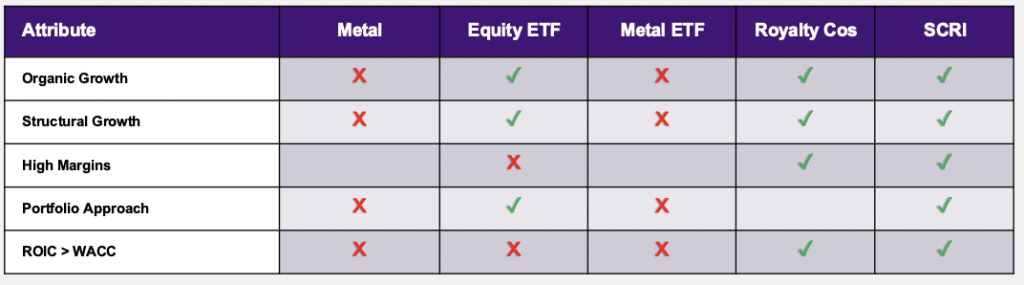

Having strong conviction in precious metals makes the team bullish on Silver Crown’s business model, which differs somewhat from peer royalty/streaming companies. The following chart depicts the potential advantages of owning Silver Crown vs. other precious metal-focused investments.

CEO Bures shines on webinars by explaining the advantages of royalty stocks vs. owning physical metals. Physical metals are superior if one’s electrical grid goes down across a large portion of one’s country for several months.

Barring an apocalyptic event like that, royalty companies are better as physical ownership carries meaningful transactional, shipping, security, and insurance costs. Management is shareholder friendly, the Company has under 3M shares outstanding.

To gain pure-play leverage, SCRi is 100% tied to Ag vs. most primary mines at 40%-75% Ag. SCRi is much riskier than larger royalty/streaming plays, but offers the potential for outsized returns just as Franco-Nevada & Silver Wheaton did in their early years.

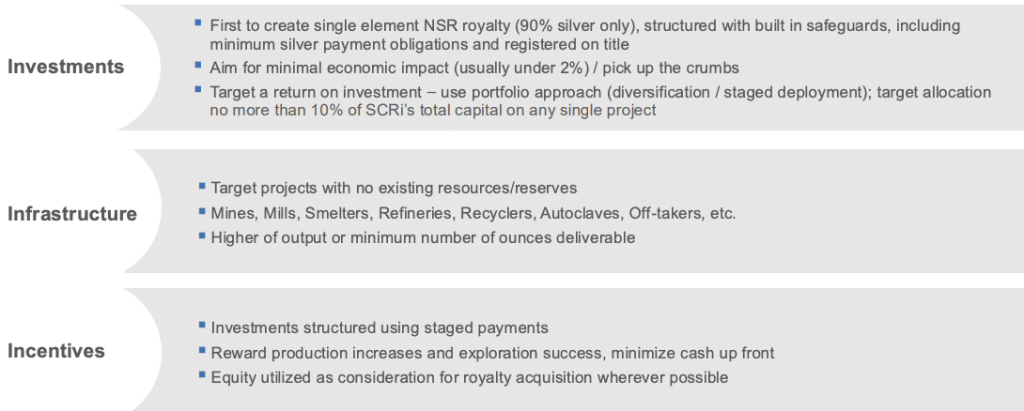

There are a few excellent slides on this topic in the latest corp. presentation. Since Ag is frequently a modest by-product, “it goes unreported in mineral resource estimates roughly half the time.” If not reported, royalty/streaming companies typically won’t touch it.

Therefore, in theory, and so far in practice, SCRi faces minimal (if any) competition on its transactions. By contrast, there are several dozen publicly-traded, conventional, royalty/streaming companies, mostly dealing in precious metals, but expanding into battery & critical metals. SCRi is all Ag all the time.

SCRi provides cash and/or shares to junior miners in exchange for a percentage of revenue derived from a Company’s Ag production only (paid in $$$, not in Ag). A substantial risk to the Company’s growth is its ability to fund new transactions.

Management plans to continue using both shares & cash. To that end, a secured debt facility is being negotiated.

A dozen prospective transactions are under review at any given time. Subject to funding, management hopes to close 3 or 4 deals in the next 12 months. Another way in which the Company can obtain a royalty on a project is by introducing off-take partners to mine/project owners.

SCRi’s management team, board & advisors provide a wide range of experience, introductions & advice to portfolio companies in a mutually beneficial manner.

Mr. Bures is a geological & mineral engineer with 25+ years of expertise, incl. as CEO at C2C Gold, co-founder & Chief Business Development Officer at Star Royalties, Director of Global Mining Sales at BMO Capital Markets & Portfolio Management at Sentry Investments.

In the following interview, conducted on May 6-7 by phone & email, I received a timely update on Silver Crown Royalties from CEO Bures.

Please explain how Silver Crown Royalties is different from other royalty/streaming companies.

SCRi focuses on silver as byproduct credits, treats royalties as revenue centers (not just options), and expects to generate a return on capital deployed no matter the silver price environment.

We are 100% leveraged to silver vs. most producers at ~20% (Pan American Silver) to 60%. We differ from peers with 0.8%-1.0% dividend yields (Franco-Nevada, Wheaton Precious Metals, Royal Gold) in that we hope to have a multiple of that yield within a few years.

The Ag price is +18% in the past year, yet many Ag juniors are 25%-40% below 52-week highs. Why not buy a high-quality Ag junior instead of Silver Crown?

The market only rewards dividends and free cash flow in a credit contraction. Many speculative investments in the microcap space will disappear. Unlike almost all other ‘silver’ plays in the nano-cap/micro-cap space, we expect to pay a dividend from FCF starting Q1 2026.

Silver Crown had been trying to close a private placement since February. About half of the stated amount was raised. Please update readers.

We closed more than half of the amount we announced. We had to close on less than $2.0 million due to regulatory constraints, and general market conditions were unfavorable.

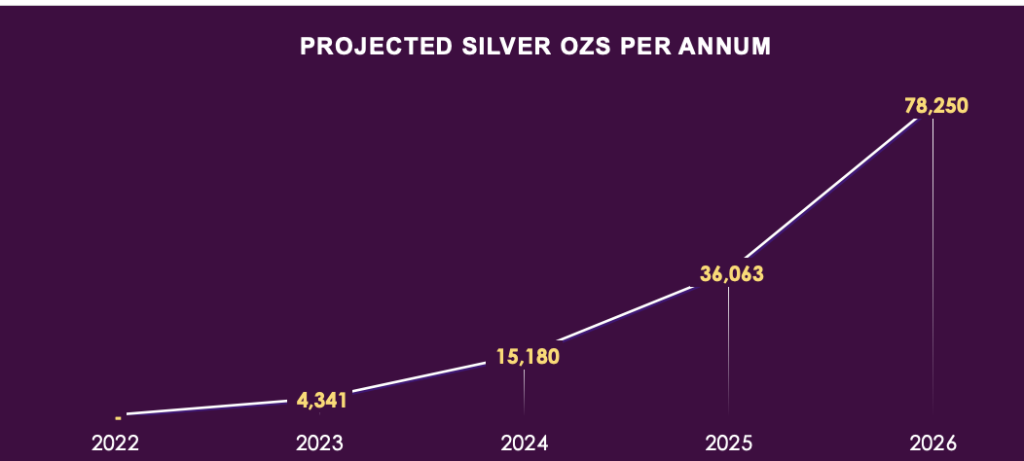

Assumes royalties paid on plan, no credit for royalties signed later this year or in 2026

We do not have any meaningful cash commitments until August, so we will revisit when market conditions are better suited for a financing of this nature. Further, we are working on alternative financing sources (non-equity).

Can you briefly describe the status of Silver Crown’s four royalties?

Two are in production, one is in restart, and one is in development. Three are already paying cash, and one is expected to start paying sometime in 2027.

We’re receiving cash payments on 26.8K ounces of silver (Q1 annualized), and expect this to grow to over 75K ounces next year, with potential to hit an annual run-rate of 110,000 ounces in 2027. [Note: 110K ounces of Ag = nearly C$5M/yr, royalty/streaming Majors trade at 20+x annual revenue]

Is Silver Crown looking to secure a debt facility to help fund new royalties? If so, what are the latest thoughts on that?

Absolutely. This is a floating target, but something in the neighborhood of a 1:5 debt-to-equity ratio should be able to meet interest coverage and other financial metrics.

Can you talk about the pipeline of new transactions over the next 12 months?

We keep 10-15 projects in our pipeline, with around 3-4 currently in advanced stages. Several are producing. Any of them could double our 2026e revenues (2x the 78K ounces we expect in revenues in 2026). We hope to provide more details this quarter.

Speaking of Q1, any updates on how the quarter went?

With the closing of our financing, we announced revenues of 6,700 ounces for Q1, setting another quarterly record and the eighth consecutive quarter of silver ounce growth since we started the company. We expect to report financials on or before May 15.

Thank you, Peter. I look forward to upcoming updates on new royalties, developments at existing portfolio companies, and a possible credit facility.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Crown Royalties, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Crown Royalties are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Crown Royalties was an advertiser on [ER], and Peter Epstein owned no shares in the Company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply