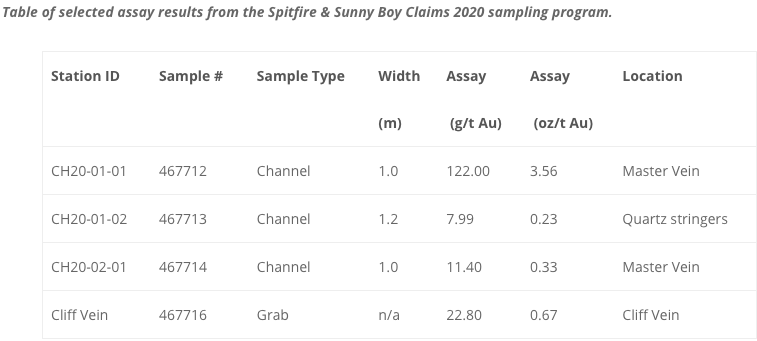

Falcon Gold Corp. (TSX-V: FG) / (OTCQB: FGLDF) / (GR: 3FA) announced channel sample results confirming high-grade gold mineralization on the past-producing Master Vein of its Spitfire-Sunny Boy (“S-SB“) project near Merritt, B.C. The samples come from a blasted trench along strike with the best sample averaging 59.8 g/t gold (1.74 oz./ton) over 2.2m, incl. 1.0m of 122 g/t gold (3.56 oz./ton). This is BIG news, in the middle of an epic bull market in precious metals.

Strong confirmation of high-grade gold at Spitfire-Sunny Boy

A second channel sample of the Master Vein, 125m southeast along strike, returned 11.4 g/t gold over 1.0m. In addition, a new potential vein structure, the Cliff Vein, was discovered down slope from the Master Vein. A grab sample of the Cliff Vein assayed up to 22.8 g/t gold.

Importantly, the geological team sampled outcrops across the entire property. These samples are undergoing whole rock geochemical analyses to provide further insights into the deposit’s scale and potential for more gold occurrences.

CEO Karim Rayani commented,

“The Merritt area has a long history of exploration & gold discoveries. Explorers focused on narrow high-grade veins while not seeing the less obvious geological indications of broader mining widths. The Company’s field crew has dedicated their work this season to studying the structure & geochemistry. The project continues to impress us as results come in. We believe the Nicola Lake area hosts the makings of a significant new gold camp.”

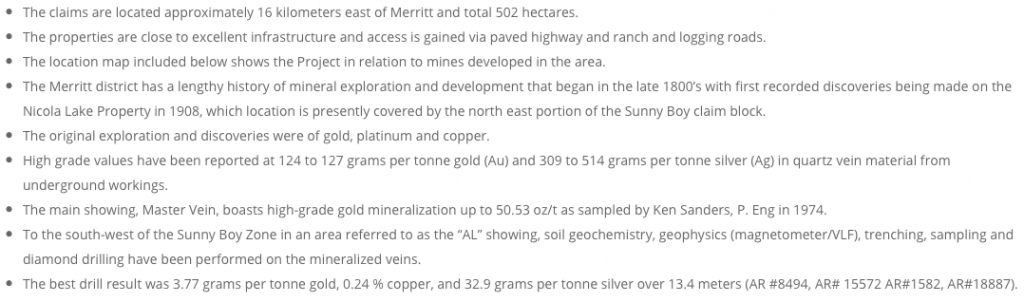

The first discoveries at S-SB were in 1908. Early exploration focused on quartz veins hosting gold, copper & silver. High-grade values have been reported, incl. 124 to 127 g/t gold, plus 309 to 514 g/t silver. These ultra high-grade veins have been trenched, pitted, blasted & drilled but never commercially mined. The Master Vein has high-grade mineralization up to 50.53 oz./t gold, as sampled by Ken Sanders, P. Eng in 1974.

Spitfire-Sunny Boy near red-hot Golden Triangle & Westhaven Ventures

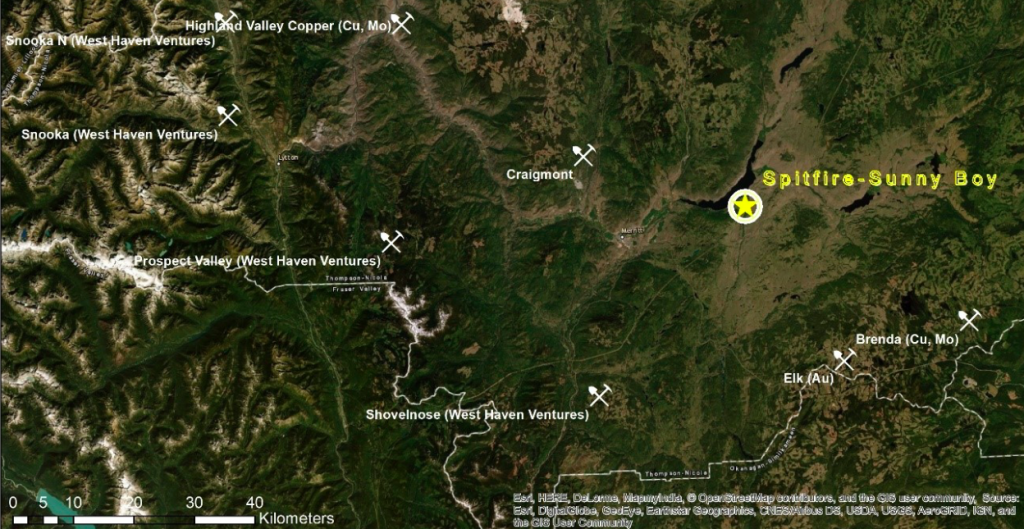

The gold mineralization & geological setting of the project bear strong similarities to other more advanced projects in the region such as the epithermal gold projects, Prospect Valley & Shovelnose, being explored by Westhaven Ventures. A number of excellent drill results from Shovelnose in 2018-19 included 1.0m at 561 g/t gold equiv., and 12.7m at 41 g/t gold equiv.

Falcon’s due-diligence work last year at S-SB confirmed gold mineralization over 300m along the Master Vein. Samples ranged from 0.33 to 2.74 oz./t. Based on sporadic past exploration, the Company has identified EM & IP geophysics, structural mapping, and excavating large surface blast pits to expose in-situ bedrock as the best approach for identifying new mineralized structures for both gold & base metals discoveries.

With gold above $2,000/oz., currently at an all-time high of $2,045/oz., Falcon Gold’s high-grade showings are increasingly valuable as stand-alone projects or as satellite deposits for others to run with. S-SB is near the famous Golden Triangle, but not in it. The Project enjoys a longer drill season & meaningfully lower drilling costs.

Comparing S-SB to some of the smaller Golden Triangle plays is revealing. I’m tracking 32 names, the average market cap of the bottom quartile is about C$10M. Westhaven’s market cap is nearly C$100M.

Given its explosive discovery and expansion potential, I believe that S-SB could be spun-out into a new company with a market cap of C$10M or more. That might not sound like much, but it’s quite significant compared to Falcon’s C$16.4M / US$12.4M market cap.

To be clear, I have no reason to believe that CEO Rayani has any plans to spin out S-SB. In fact, in Falcon’s most recent press release he stated that,

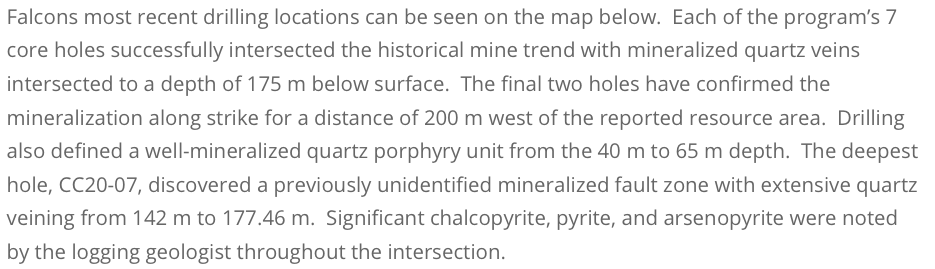

“We are keeping a close eye on similar projects in the area. We are noting the success of certain larger operators and the exploration techniques used to delineate gold mineralization along strike. Our next steps are to confirm the extent of gold mineralization at depth. Our discovery of 7.99 g/t Au in the silicified wallrock could open up significant new zones for our pending drill program. Furthermore, the recent acquisition of new claims adding 500m of strike length will further add to the exploration potential as we continue to press along strike and to depth.”

Gold at all-time high, Spitfire-Sunny Boy could grow in size & value

This suggests that Falcon could acquire, stake, option (or partner on) additional properties near the Golden Triangle. If successful, that would add critical mass to their S-SB area play, making it even more valuable. I can’t stress enough the importance of management being able to secure S-SB months ago when the gold price was much lower. Gold properties of merit are becoming harder to find, more time consuming to negotiate deals on and more expensive to lock down.

Falcon Gold has everything I’m looking for in a junior gold investment; strong team, attractive share count & low market cap., tight float, substantial blue-sky potential, past production + significant drill data, a high-grade (including some visible gold) / near-surface deposit. Multiple properties poised for exciting discoveries. All of that and more, in safe & prolific jurisdictions.

It’s a true testament to the strength of a junior miner that I can write so much before even mentioning the company’s crown jewel asset! Falcon’s sizable flagship project, Central Canada (10,392 hectares), has evidence of a (non-NI 43-101 compliant) resource from the 1930s of ~230,000 troy ounces gold. With modern mining methods, management believes it can double that number and deliver it in a NI 43-101 compliant maiden resource next year.

Crown jewel, flagship project Central Canada, awaiting two assays

Central Canada is ~22 km east of Atikokan and ~160 km west of Thunder Bay. It hosts a past-producing mine with a shaft & mill site. The Project is ~20 km southeast of, and is on a parallel system to, the one that Agnico Eagle’s 4.5 million ounce Hammond Reef deposit is on. Significant drilling was done in June/July, the first hole returned an interval of 10.2 g/mt over 3m. The assay showed a new mineralized zone starting at 104m — 18.6 g/mt over 1m. At least two additional holes will be reported in August.

Central Canada & S-SB are, potentially, two company-makers… Or, over time, perhaps two highly promising companies. These days, high-grade, near-surface gold properties in safe jurisdictions with substantial blue-sky potential, are some of the most highly-prized assets on the planet. An update on Falcon’s Central Canada from the Company’s website,

Falcon Gold has a strong management team with demonstrated deal making expertise. In coming months, I imagine Falcon Gold will continue to add to its property portfolio around Red Lake / Atikokan and near the Golden Triangle. With a market cap of just C$16.4M / US$12.4, I believe this bull market in gold could possibly drive the share price a lot higher. Few gold juniors in north America have as many boxes checked as Falcon Gold (TSX-V: FG) / (OTCQB: FGLDF) / (GR: 3FA), and a market cap under C$20M.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Falcon Gold was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)