Kincora Copper (TSX-V: KCC) / (OTCQB: BZDLF) stands to benefit from a strong copper price, and also this year’s major rally in gold. A weak global economy and ongoing (worsening?) pandemic would suggest otherwise, yet spot copper touched $3.26/lb. a few days ago, a 3-yr. high.

As great as the copper price news is, readers might not recognize that Kincora Copper is also highly leveraged to the price of gold. The Company’s first hole hit an interval from 39 meter’s depth of 1.17 g/t gold + 0.54% copper, (1.8 g/t gold equiv.) over 51 m, incl. 20.5 m of 3.3 g/t gold equiv. In this particular hole, gold has a greater economic impact than copper.

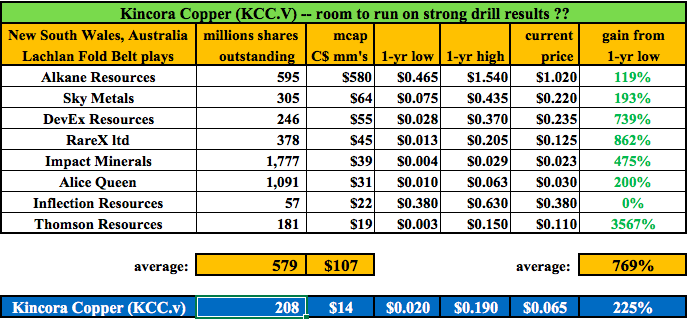

With interest growing rapidly, not just for precious metal & copper juniors, but also I’ve noticed for lithium & nickel players — investors in the U.S., Canada & Australia are piling into the best names they can find.

Importantly, Kincora plans on dual-listing its shares in Australia in March. Director John Holliday is one of the world’s top experts in porphyry systems in the region and lives in New South Wales (“NSW“), Australia.

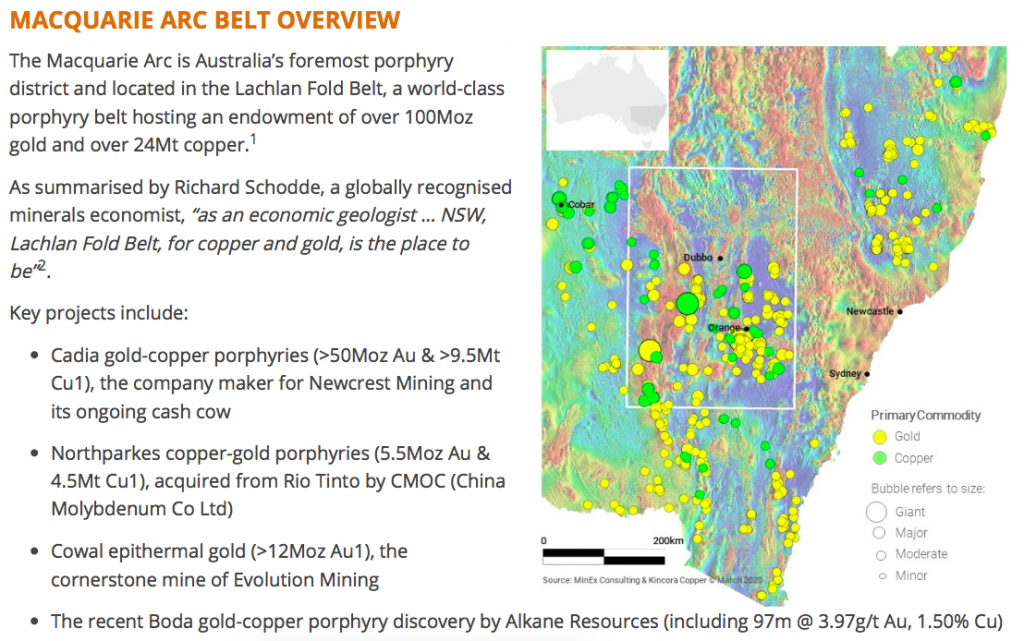

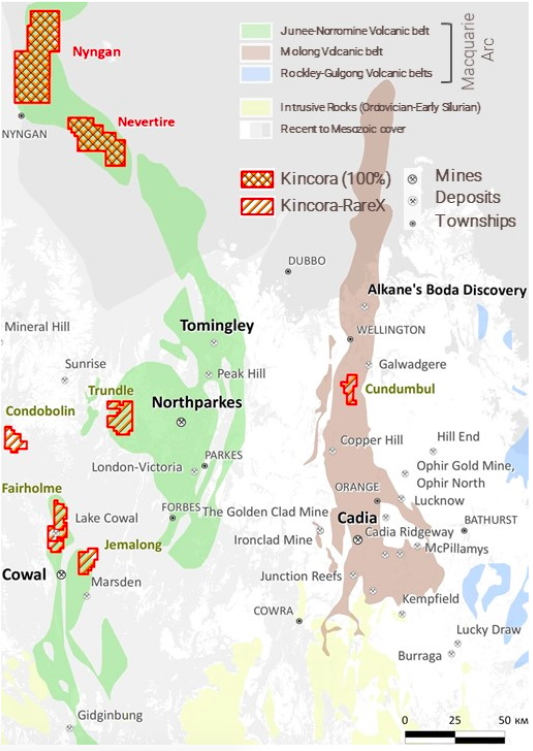

Management aims to be the leading pure-play porphyry explorer, in one of the top copper-gold porphyry districts in the world. Kincora has a district-scale position in the key belts of the Macquarie Arc, within the Lachlan fold belt, in Central West NSW..

The Macquarie Arc is a world-class gold-copper porphyry belt hosting > 100M ounces gold and > 24M tonnes copper (at spot prices that’s 53% / 47% gold / copper, in-situ value). This is a company led by a team with vast global & regional experience and an enviable track record of Tier-1 discoveries.

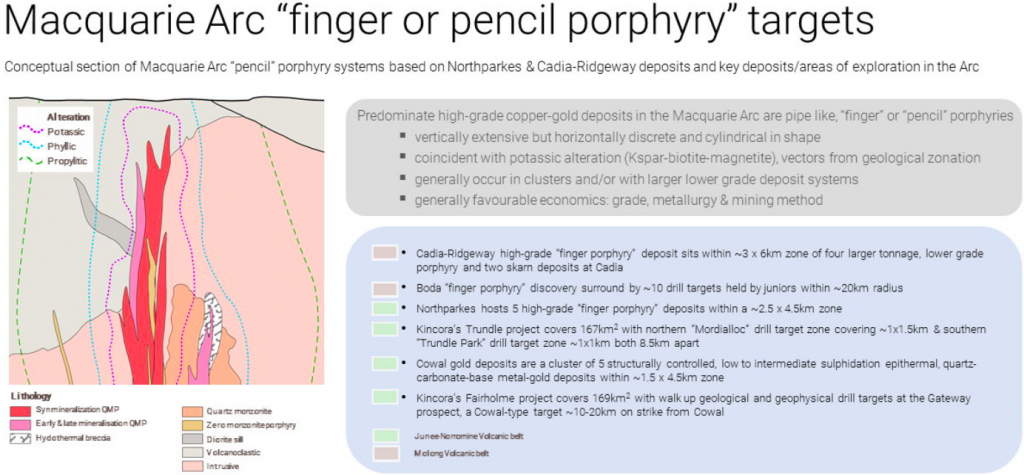

The two main targets at Trundle are 8.5 km apart, there’s well defined mineralization across a 10 km strike. Key mines in the region are China Molybdenum’s Northparkes (the same minerals complex to Kincora’s Trundle project), Newcrest Mining’s Cadia (Australia’s largest gold mine and with one of the lowest operating costs, benefiting from copper credits), and Evolution Mining’s Cowal (target gold endowment of 15Moz). Alkane Resources’ Boda is the best exploration project in NSW.

Please continue reading this timely interview of Sam Spring, CEO at Kincora Copper. Kincora’s share price has recently been impacted by a shareholder overhang. Visual indications of the most recent drill holes look good in the near-term. Next year I believe that copper & gold will be great investments. Kincora is exploring for both metals in one of the hottest basins on the planet.

The copper price has rebounded ~60% from a COVID-19 intra-day low of ~$2.00 in late March to $3.20/lb., a 3-yr. high. Why has the copper price held up so well?

Good question, yes, copper has been quite volatile this year, yet currently sits near its highest level since December 2017. The impact of COVID-19 to immediate copper supply and project pipelines (now at historical lows), is up against a “V”-shaped economic recovery in China and significant government stimulus packages around the world.

In addition, LME copper inventories hit an all-time low in late September. Favorable medium-to-long term copper demand is underpinned by the electrification of passenger, commercial & industrial transportation and giant renewable energy projects to combat global warming – all these trends are significantly more copper intensive than conventional carbon-sourced alternatives.

Meanwhile, medium to long term global copper supply is at risk due to aging mines, lower mined grades, few large mines coming online, a lack of new development projects in the pipeline and a sustained low rate of new discoveries.

Roughly 45% of copper production comes from just two countries, Chile & Peru — both of which face clean water issues, increasing capital intensity, pressure for tax contributions to the State and growing social license challenges from local communities / politicians.

Another (combined) ~30% of production (from China, the DRC, Zambia, Russia, Mongolia & Kazakhstan) is potentially prone to geopolitical and/or other supply disruptions. With global demand surprisingly robust, and supply increasingly uncertain, we think the copper price should remain strong.

Please describe your key Australian assets. How leveraged is each target to gold vs. copper?

The Macquarie Arc is a world-class gold-rich copper porphyry belt hosting > 100M oz. gold and > 24M tonnes (~53 billion pounds) copper. The largest mine in this belt is Cadia, the cornerstone cash cow for Newcrest Mining. In the quarter ended September 2020, Cadia produced 196,504 ounces at an All-In Sustaining Cost of only $113/oz (after copper credits).

Kincora has a controlling interest in a district scale portfolio of 8 licenses across 1,649 sq. km, with all but one project within interpreted strategic locations of the Macquarie Arc.

We’re currently drilling at our flagship Trundle project. It’s rare for a junior explorer to secure such a tremendous brownfield opportunity in any jurisdiction, let alone in a Tier-1 location like the Central West of NSW in Australia.

Trundle is in the same system as Northparkes, Australia’s second largest porphyry mine with five economic deposits. Northparkes, 80% owned by China Molybdenum, is a gold-rich copper mine. At Trundle, Kincora has two priority targets, Trundle Park, a gold-copper target mineralized at-near surface, and the Mordialloc, a copper-gold target at greater depth.

Kincora’s next target is the Fairholme project, less than 15 km from Evolution Mining’s 9M oz. Cowal mine. We plan to start a drill program there to explore for the first time Fairholme’s potential for “Cowal-style” gold and base metals. Prior drilling, geophysics and structural setting strongly suggests it possibly does — another rare opportunity for a junior to be drilling in the shadow of a headframe setting in a Tier 1 jurisdiction.

Historical drilling confirmed significant mineralized systems at both the Trundle porphyry and Fairholme gold projects. The first hole at Trundle demonstrated significant blue-sky potential and pointed to our new strategy on these projects. We’re benefitting from previous exploration that, in our minds, did not adequately test their primary targets.

Can you please update readers on the status of Kincora’s drill program on the Trundle copper-gold porphyry project?

We’re well into a drill program at Trundle that, from a technical standpoint, has been very successful so far, and we are now looking to convert this technical success into commercial success and the share price.

We’re currently on hole #10. We have drilled three holes at our Mordialloc target, which have continued to support our concept that this prospect has the potential for a pencil porphyry system from medium depths. It’s clearly a large intrusive system, vectoring to the core of the system is a continued work in progress.

We’re now drilling at the Trundle Park target, the sixth hole at this target where we are predominately testing the at/near surface skarn potential plus causative intrusion. We’re significantly improving our geological understanding of this zone, assisted by encouraging results.

The assay that grabbed investor’s attention in May contained 1.17 g/t Au + 0.54% Cu, (~1.8 g/t Au Eq.) over 51 m, incl. 20.5 m of ~3.3 g/t Au Eq. It was near surface, starting at just 39 m downhole. Can you discuss the potential depths of your targets in NSW?

Despite the very positive results at shallow depths at the Trundle Park target, generally at the Trundle project level we feel previous exploration efforts failed to drill deep enough, or in ways required to properly test for what big deposits look like in this belt – like the 5 deposits at Northparkes or the Cadia-Ridgeway pencil porphyry or even the recent Boda discovery. These deposits generally don’t outcrop at surface, but are vertically extensive from moderate depths. Grades can also be quite good.

We have a mix of targets requiring both shallow and deep drilling. Our first hole at Trundle Park was a mixture of both. We saw a decent grade skarn system near surface, but the bigger prize is trying to find the deeper source of these fluids.

We’re waiting for assay results on hole TRDD008; it’s the first southern hole to TRDD001, where there are two very broad skarn zones of mineralization with a small fault in between. Probably ~70 m in the first zone and ~125 m in the second – a couple of photos of the core from these holes are in our corporate presentation on the website.

Of course, grade is the great unknown, and we’re not yet on top of the likely true widths, but these are the thickest horizons we have seen to date. Thick horizons are very promising as they help indicate potential upside to the scale of the skarn and vectors to chase the causative intrusion we’re after. We’re also getting a better handle of the structures and vectors for where we feel the larger prize might be, the causative intrusion and source of fluids in the skarn.

Can we get an update on your efforts to co-list Kincora shares in Australia? What does your team expect to gain from this initiative?

Over half the funds from our August capital raise of C$5.33m came from Australian sources; this is a previously untapped capital market for us. With our primary focus now in NSW, and the board / management’s experience and track record in Australia, we feel a natural market for us is the ASX.

When one looks at valuations and liquidity of similar exploration peers listed in Australia, in many cases it’s very favorable. We’re well engaged in the process, drafting of prospectus, independent technical report etc, and aim to be dual-listed in late 1Q 2021.

Have there been any significant new discoveries or strong exploration results from your peers in Central West New South Wales this year?

Alkane Resource’s discovery at its Boda porphyry project has certainly attracted a lot of attention, and with intersections like 97 m at 4 g/t gold and 1.5% copper within 1,167 m at 0.55 g/t gold and 0.25% copper, one can understand why.

The discovery at Boda illustrates the nature of these vertically extensive systems requires juniors to be prepared to drill to at least moderate depths. Exploration juniors in this region have benefited from this news flow and many are undertaking drilling programs seeking to confirm the next big discovery.

Kincora has been awarded an AUD$120k, “co-funding grant” from NSW to drill two porphyry targets at its Nyngan copper-gold project. Can you explain this award and the Nyngan project?

The Company’s wholly owned Nyngan & Nevertire projects cover a significant portion of what is conceptually the largest intrusive centre of the Macquarie Arc. Before the Boda discovery, Kincora pegged 1,144 sq. km over the interpreted northern undercover extension of the Junee-Narromine Belt. Our sizable property is similar to the geological setting of the parallel northern undercover extension of the Molong Belt, which hosts Boda.

With cooperative funding grant support from the NSW Government in place, Kincora is planning a drill program that will test two copper-gold porphyry targets at our Nyngan project. Inflection Resources is undertaking a similar style stratigraphic and target testing drilling program in this region as well as FMG Resources also starting a maiden drilling program.

What’s the status of the Fairholme gold project? Why is this project high on Kincora’s list to explore?

Kincora’s drill targets at Fairholme are less than 15 km along strike from the five shallow epithermal deposits that comprise the Cowal mine (target endowment of 15M oz. gold). Yet, prior drilling at Fairholme focused on deeper copper-gold porphyries — despite encouraging results at shallow depths for a “Cowal-style” system.

Since the last field program was done at Fairholme, resources have increased from 3.4 M to 9.0 M oz. gold over at Cowal, with the gold endowment far outshining the copper porphyry potential. Our team has designed a maiden drill program that will — for the first time — be focused on testing the potential for shallow to moderate depth, structurally-controlled, Cowal-style gold / base metal mineralization. Such an opportunity is pretty exciting and is why we’re keen to get on with drilling to see if our new concepts are right.

Kincora’s share price is below the last capital raise price, can you provide some color?

Yes Peter, last week a significant block of stock emerged from one broking account and knocked the share price down pretty hard. While it’s positive to see improved trading liquidity and new buyers stepping, we haven’t been able to pinpoint the seller and look to cross the block in a more orderly manner.

With drilling ongoing and visual indications from the last few holes in at the lab looking pretty good, hopefully this will prove to be an attractive entry point for the shares of Kincora Copper (TSX-V: KCC) / (OTCQB: BZDLF).

Thank you Sam, it sounds like the drill program is progressing well. I look forward for your next corporate update and additional drill results!

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)