FenixOro Gold Corp. (CSE: FENX) / (OTCQB: FDVXF) continues to advance its Abriaqui Gold Project in Colombia. The Project is directly on trend, ~15 km west of Zijin Mining’s 12M ounce, high-grade Buriticá mine. Abriaqui is in the Middle Cauca trend. Since 2007 > 80M ounces of gold have been discovered in deposits like; AngloGold’s Nuevo Chaquiro & La Colosa, Gran Colombia’s Marmato, and Zijin’s Buriticá.

Management believes its property shares a number of key characteristics with Buriticá, a project that traded hands for ~C$1.4B in December 2019, when the gold price was around US$1,460/oz., vs. US$1,950/oz. (+33%!) today. At Buriticá the intrusion is of similar age, size & composition as that of Abriaqui.

Could FenixOro’s Abriaqui project possibly be the next Buriticá?

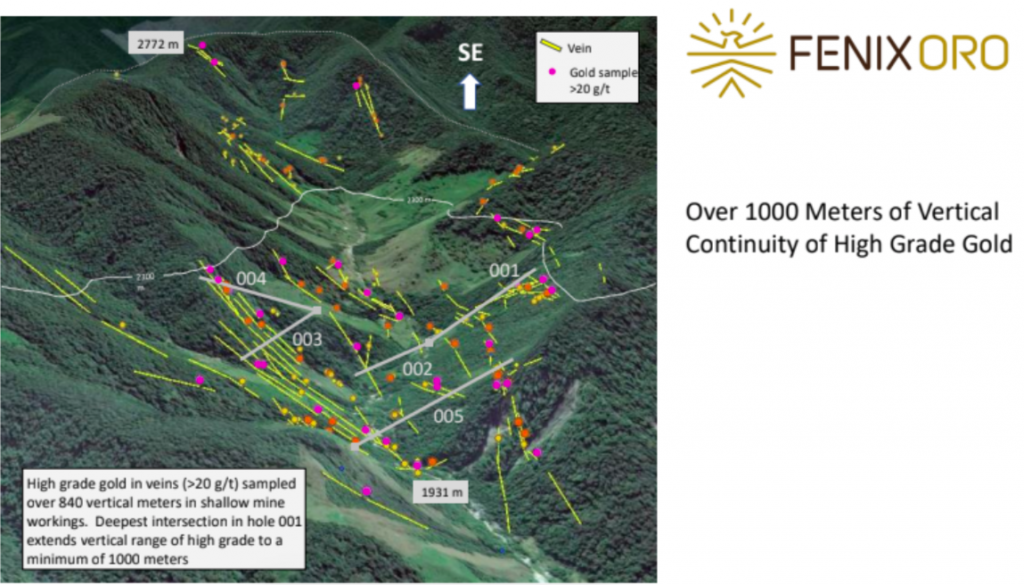

High-grade veins extend over a 1,200 m vertical extent at Buriticá vs. 1,000+ m at Abriaqui. Both deposits have 100+ closely-spaced, high-grade veins in 400-500 m wide corridors, with many areas of interstitial, lower grade mineralization.

If instead of December 2019, that transaction were consummated now (with the gold price nearly US$500/oz. higher) — I believe Zijin would have had to pay $2B. Compare that figure to FenixOro’s valuation of just $28M. Admittedly, it’s not an apples to apples comparison. Buriticá was a year from commercial production with 12M high-grade ounces of gold under the hood.

However, consider how much FenixOro might be worth (even at a pre-PEA stage) in the hands of a much larger, mid-tier or Major precious metal company able to much more aggressively explore & develop Abriaqui.

Of course, it’s too early to talk about a takeout of FenixOro, not before management does a substantial amount of drilling. New veins are continually being identified. The potential to discover a multiple of the 100+ currently known veins is increasingly clear.

In a year or two, there will be dozens of players interested in a company like FenixOro, a junior potentially hosting deposit(s) totaling (perhaps) 2M-6M fairly high-grade ounces (my opinion only, not necessarily that of mgmt.). Make no mistake, while it’s still to early to delineate a multi-million ounce deposit, reading between the lines offers encouraging signs.

FenixOro could become a prime takeover target in 1 or 2 years

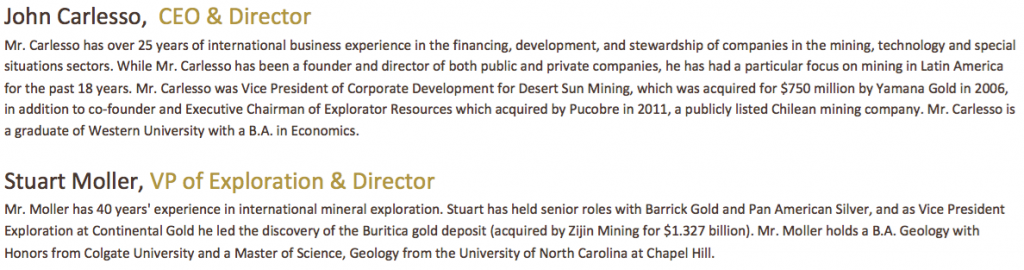

A few weeks ago, CEO John Carlesso and VP of Exploration Stuart Moller held an investor conference call. Their body language conveyed confidence in the early exploration progress to date and the results of the first four holes.

Furthermore, management indicated that the core from hole #5 looked very interesting, they’re anxious to get assays back on hole #5. If it’s nicely mineralized, and its bottom connects to the top of hole #1, that would demonstrate a potential strike length of almost 1,200 meters and another example of substantial vertical extent. There are over 20 known historical surface mine workings in this area alone.

FenixOro is fully-funded for significant near-term drill plans

Yet, that potential connection represents a small portion of the property. Connections like this could be abundant across a number of targets. If there are many connections, the possibility of a multi-million ounce deposit will soar. There’s a lot of smoke here, can the technical team find the fire? How quickly can they find it? Is there more than one fire?

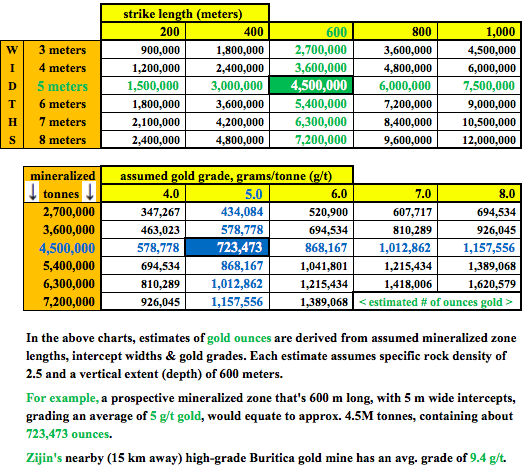

Back of the envelope math suggests that several zones of decent grade mineralization (if they exist) could add up to a sizable global resource. For example, if an area 600 m long, with intercepts averaging 5 m wide, grading 5 g/t gold over a vertical extent of 600 m can be defined — that alone would equate to approx. 723,000 ounces.

Both mid-tier & Major gold companies from multiple countries have expressed interest in FenixOro. With some of the world’s top geologists & mine engineers examining drill results, we could have line-of-sight to one or more meaningful deposit(s) by year end.

FenixOro’s valuation is very cheap, trading as if the nearby Buriticá mine did not exist, and we weren’t in the midst of an epic bull market in gold. This under-appreciation could end at any time as smart-money / high new worth investors, institutions & precious metal funds watch the Buriticá mine thrive under Zijin, and the M&A tide lifts all boats.

Of course, the best way to attract attention is with strong drill results, especially multiple-meter, high-grade intercepts. Speaking of which, the Company is beginning hole #6 of a 10-hole program (4 holes at least partially reported on so far).

Initial drill results; informative & encouraging, but no blockbusters

The aim of the phase 1 drill program is to test as many of the known veins as possible, plus several gold-in-soil anomalies found between vein swarms. This phase is restricted to the vein systems in the northwestern part of the property.

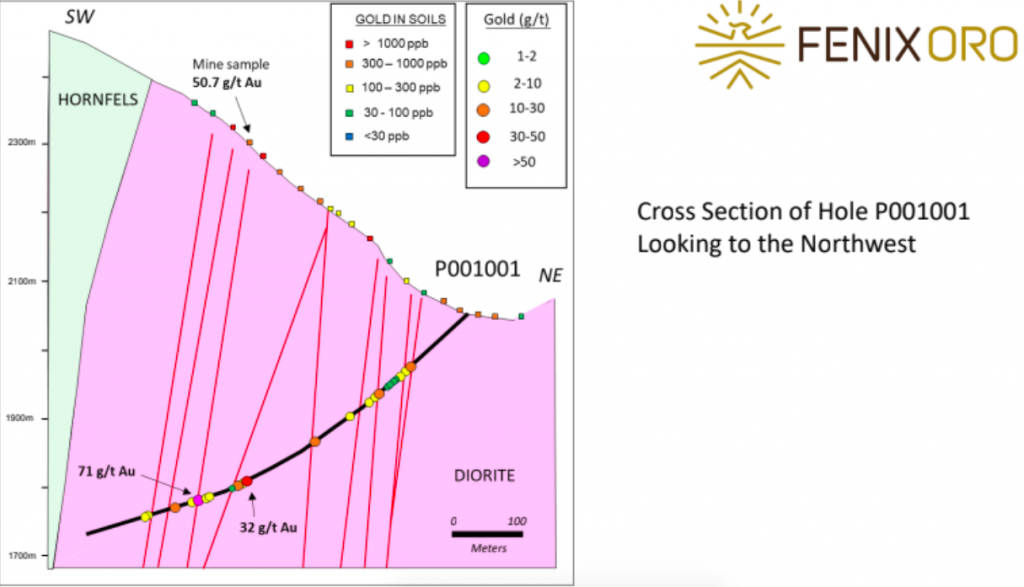

The first drill hole intersected nine mineralized veins from 122 to 416 meters, including intercepts of 0.7 m of 19.75 g/t gold + 59 g/t silver…. and 2.6 m of 9.1 g/t gold…. and 1.3 m of 28.2 g/t gold…. (incl. 0.5 m of 71.9 g/t gold + 60 g/t silver). These intercepts extended the vertical range of > 20 g/t gold in veins to over 1,000 m.

According to the 11/24/20 press release, “intercepts at depth indicate correlation with shallow surface mines & gold in-soil anomalies,” and, “at least three generations of veining indicate multiple pulses of mineralization.” Also noteworthy was the fact that hole #1 was selected for logistical reasons, it was not considered among the highest-potential targets.

On December 17th, partial assays from holes 2, 3 & 4 were announced. Ten additional veins were intersected, but there were no intercepts of both high grade AND significant widths. Four additional zones, 7 – 10 m thick, intersected lower-grade mineralization. Six of the ten veins intersected were “virgin discoveries” targeted only by gold-in-soil anomalies.

Importantly, these discoveries validated the soil sampling technique being used in this setting, substantially increasing the prospects of other areas across the property that have no known mineralization. These are just the first holes, many high-grade vein targets have not yet been drill-tested.

So far, management believes that vein swarms occur over a sizable area of 1.5 by 4.0 km, in corridors 250 to 350 m wide, up to 1,200 m long. Assays of > 20 g/t gold in veins have been received over a 1,000 m vertical extent. Grades of > 20 g/t gold are common, with occasional samples of > 100 g/t. A significant portion of the observed gold occurs as fine-grained free gold.

Still early days, but mgmt. is optimistic, 6 more holes to report

Management has stated in conference calls & press releases that drilling is going well, that the technical team’s theories about continuity, geology & structure are proving to be mostly accurate. Although there’s been no blockbuster holes yet, I agree with management that the potential certainly exists.

Management reminds investors that it’s still early days (only 4 holes reported so far, 6 holes pending). After Phase 1 drilling is analyzed & understood, a phase 2 program will commence in the Spring.

This is a highly experienced team. They would not be actively trying to draw attention to this drill program if they thought it might be a dud. Here’s a brand new quote from CEO Carlesso,

“We’re very encouraged by the results we’ve received to date. We’re seeing many of the characteristics that make up, ‘Buriticá style’ mineralization; very high-grade gold vein systems & wide zones of lower grade mineralization. It’s this combination that can create economic value. At our early stage, each hole is designed to test its own unique objective – and the feedback we’re receiving is very positive.”

“Our team is hitting what we’re aiming for because soil anomalies / mine workings on / near surface have had strong correlations with vein structures at depth. We’ve demonstrated vein continuity of over 1,000 m. This correlation is quite promising. Based on the sheer number of existing small mines & soil anomalies, we expect that many more gold-bearing veins (some high / very high-grade) will be discovered.”

Conclusion

Readers have dozens of high quality, compelling gold juniors to choose from. But, how many early-stage peers could be sitting on (perhaps) 2M-6M fairly high-grade ounces?

How many have flagship projects very near not just an operating mine, but a mine that could be one of the best in the world? How many are fully-funded for a high-impact drill program that could yield blockbuster results?

The single best analog mine for FenixOro’s project would likely be worth $2B if it sold today, instead of a year ago. Even after discounting heavily for FenixOro’s much earlier stage, much higher risk and considerable equity dilution ahead — its market cap should be higher than $28M. With any luck, as the current drill program continues, and more results are received, results will send the valuation significantly higher.

Disclosures: The content of the above article is for information only. Readers fully understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD CORP., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand & agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed & agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was an advertiser on [ER] & Peter Epstein owned shares in the Company.

Readers understand & agree that they must conduct their own due diligence above & beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)