The weakness in the U.S. dollar has been an important, but underreported financial event. There are breathless accounts of BIG YTD gains in gold (“Au“) +28% & silver (“Ag“) +27%, yet DXY (the US$ vs. a basket of six currencies, with a heavy Euro weighting), is -11% in the past six months.

Why does this matter? It means inflation from the cost of imports (on top of tariffs on those imports) will be a drag on the U.S. economy & global stock markets in the coming quarters. Meanwhile, trade, cold & Hot wars rage around the world.

Therefore, the next few years should be very good for Au/Ag developers/producers. The trailing 12-month operating margin (“EBIT“) ended 3/31/25 at Agnico Eagle was 42%, vs. the average of Nvidia, Microsoft, Meta & Google (Alphabet) of 45%.

Gold/Silver +28%/+27% YTD… AND, +74%/+53% above PEA assumptions!

During that period, Au averaged $2,582/oz. If it were to average $3,400/oz in the year ending 3/31/26, that would be +32%! Are the magnificent 7 stocks achieving price increases of +32%?

Agnico’s EBIT margin will probably be 50%+ for the foreseeable future. With sector-leading margins, Au producers need to build their production pipelines via BOTH internal growth AND acquisitions.

M&A valuations remain attractive relative to underlying precious metal prices. Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF) is in the sweet spot of being a relatively advanced (robust PEA in hand) development play, (~6-8 months from a PFS), cheaply valued, and capable of production this decade.

In April, Thesis received a HUGE vote of confidence in the form of a strategic investment (9.9% equity stake at 10% premium to market, no warrants) from producer Centerra Gold [CG] ($2B market cap, $1B net working capital 3/31/25).

This game-changing stamp of approval is on the 100%-owned Lawyers-Ranch project, management team, board & advisors, and the jurisdiction –> Toodoggone District in north-central B.C., Canada.

While the Company’s share price has doubled from its 52-week low, the Top-10 Au producers & developers (market caps of > $100M) are up an average of nearly 800%! Many more juniors will likely see meaningful share price gains… Will Thesis Gold?

Having CG’s backing, experience & credentials helps a lot with funding, First Nations, local communities, technical aspects/mine planning, and exploration. This investment enables Thesis to think bigger & work smarter.

CG’s $24M cash injection + another $24M capital raise, topped up Thesis Gold’s treasury to ~$54M, enough to fund the Company for a long time, including 2025-26 drilling and delivery of a PFS.

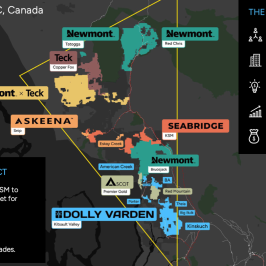

B.C. is thriving these days. South32 Ltd. is invested in central B.C.’s American Eagle (joining Teck Resources as a shareholder). Freeport McMoran is earning into Amarc Resources’ Toodoggone-based Joy project and another project owned by Finlay Minerals ltd.

Sweden’s Boliden AB is invested in the Duke project, and Skeena Gold & Silver recently took a stake in TDG Gold.

Toodoggone is a less-explored version of B.C.’s Golden Triangle with the same, (or very similar) geology, a more favorable climate, and a significant discovery very close to the Lawyers portion of Lawyers-Ranch.

Look at the above map, CG’s past-producing Kemess mine complex has a 230 kV power line, 50,000 tpd processing plant, mine camp, administration facilities, truck shop, warehouse, and an expandable tailings facility.

CEO/Pres./Dir. Ewan Webster commented,

“…Centerra’s deep technical expertise, operational experience, and regional presence through the Kemess asset present a clear opportunity for collaboration & unlocking district-scale synergies.”

“District-scale synergies” is the critically important phrase. In addition to Centerra, much larger players Freeport, Newmont & Teck are also active in northern B.C., Newmont’s Red Chris mine is ~250 km directly west of Lawyers-Ranch.

In addition to CG’s formidable tech team, Thesis Gold’s team/board/advisors are also quite impressive. See bios above & below.

The Kemess Cu-Au complex (7.0M Au Eq. ounces at 0.6 g/t) makes a lot more sense to restart if combined with ore from Lawyers-Ranch. If a decision to send ore to Kemess is made, fast-tracking Lawyers-Ranch will become even more important.

Freeport (and others) are printing money, it could easily afford ($93 billion valuation!) to acquire Thesis Gold, Centerra, Amarc, and TDG Gold, and fund the entire district’s commercialization + greatly expanded exploration.

With Freeport’s/Amarc’s new discovery AuRora, the past-producing Kemess complex being revisited, and the promising Lawyers-Ranch — it seems likely that this district will be actively developed.

Freeport should care deeply about the Toodoggone district. Its flagship, giant, 38-yr old Grasberg Au/Cu mine is in Indonesia, a country meaningfully influenced by Chinese investment. Grasberg is a JV with a State-owned partner, not a great situation…

By all accounts, CG should be there next year to acquire an additional 10% (to go to 19.9% ownership), hopefully at a much higher valuation. Or, a second strategic investor could step up. {see NEW corp. presentation}

Lawyers-Ranch is considerably more valuable with CG’s backing. Several key synergies could be pursued, most notably (subject to further studies) sending Lawyers-Ranch ore ~50 km to CG’s existing 50,000 tpd Kemess mill.

The mill is on care & maintenance, but is large & close enough, especially with Au at $3,367/oz (spot touched $3,500 on April 22nd), and silver at $36.81/oz. Thesis Gold’s 495 sq. km Project is roughly 78% Au/22% Ag (no lower value base metals).

Lawyers-Ranch’s 1.55 g/t Au Eq. ore is ~US$168/tonne of rock. AI stars ChatGPT & GROK believe it would cost ~US$11-$12/tonne (all-in) to ship ore to Kemess.

Importantly, Thesis has no debt, streaming or royalty burdens except for a small 0.5% NSR at Lawyers with Royal Gold, and a 2.0% NSR on Ranch. Note, the vast majority of booked ounces are on the Lawyers side..

When the PFS comes out, this 4.71M (and growing, 85% in Measured & Indicated categories) Au Eq. ounces will attract considerable attention.

If producing today, Lawyers-Ranch would be a Top-10 Canadian mine, and the only one not owned by a producer like Agnico Eagle, Newmont, or Alamos Gold.

My view is that with a partner, the existing mine plan of 215K Au Eq. ounces/yr could be expanded to 300K+ ounces/yr, and the 14-year mine life extended.

I recognize I’m espousing overtly bullish commentary, but the Au price is +74% since Thesis Gold’s PEA, and Ag is +53%! At 300K/yr, Lawyers-Ranch would be the 6th largest Au mine in Canada (if in production today).

The U.S. President continues to attack & belittle Canada and has started major Trade Wars around the world (China, Canada, Europe, Japan, Mexico…).

B.C. Premier David Eby announced plans to fast-track 18 metals, mining, oil/gas & infrastructure/power projects. This is great news for the Toodoggone District.

From 4.71M Au Eq. ounces, there could be a line-of-sight to 6.0M ounces after this year’s and next year’s drilling. In addition to chasing high-grade Au/Ag near surface, a few deeper holes will be drilled in search of one or more porphyry orebodies.

Promising deep porphyry results could attract Freeport, Barrick Mining, Teck, Boliden AB, South32, Coeur Mining, and Hecla. Thesis has graduated to developer status as it continues to de-risk Lawyers-Ranch.

Thesis Gold’s valuation at $220M is low on an EV/Au Eq. oz basis vs. the peers shown above. Notice that three are pre-PEA, so years behind. Compare Thesis at $47/oz to the average of $110/oz, (or $90/oz without Rupert Resources).

I believe the chance of Lawyers-Ranch becoming a mine is higher than projects owned by peers. I would rather be invested in B.C. than in the Yukon, Brazil, Ghana (West Africa) or Guyana (S. America).

As M&A picks up, takeouts at ever-higher valuations (well above $47/oz) will be the norm. Peer average valuations will climb, providing meaningful room for Thesis Gold to catch up.

Producers are making so much cash, they won’t blink at paying an extra $25 or $50/oz to secure 5M+ high-quality, medium-term, safe Au/Ag ounces like those held by Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF).

{see NEW corp. presentation}

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply