Many uranium juniors have had nice share price gains over the past few months. This, despite the underlying spot uranium price being stuck around US$30/lb. The reason for the gains can be traced back to electricity consumption, which is poised to move a lot higher in coming decades as electrifying global modes of transportation really takes off.

And of course, there’s also the massive effort to decarbonize the planet’s economies. With the possible exception of hydroelectric generation, nuclear energy is the only base load, low-emission, always on power source.

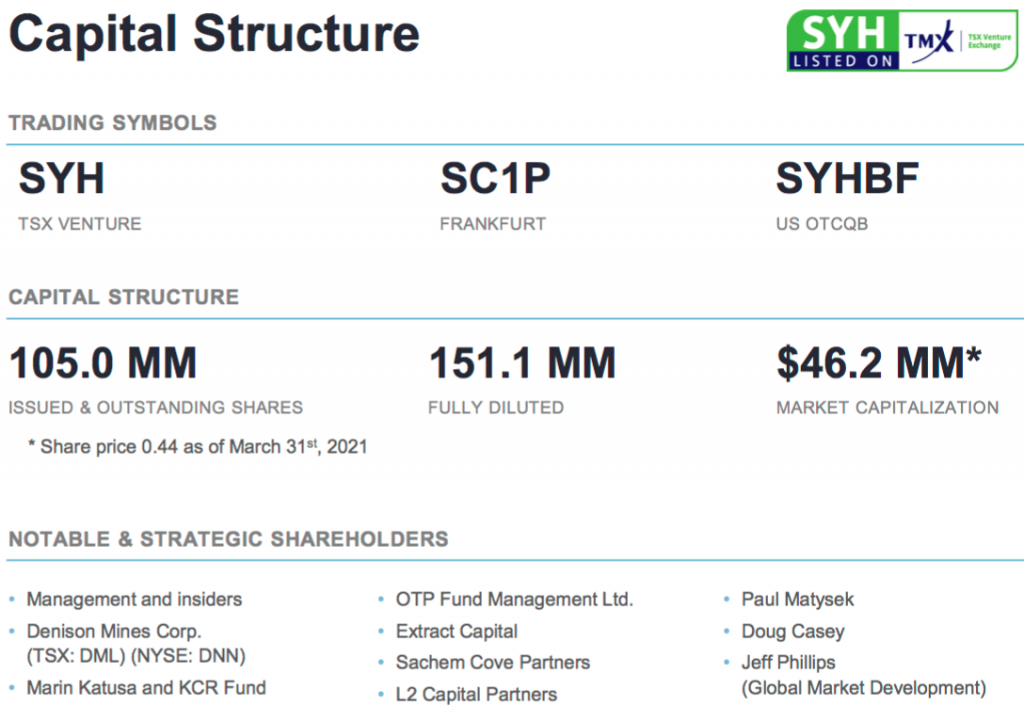

One uranium junior that is attracting more attention in the market lately is Skyharbour Resources (TSX-V: SYH) / (OTCQB: SYHBF). I interviewed Jordan Trimble, CEO of Skyharbour for a corporate update. Jordan consistently provides some of the best uranium sector commentary, so please continue reading.

Jordan, please give readers the latest snapshot of Skyharbour Resources.

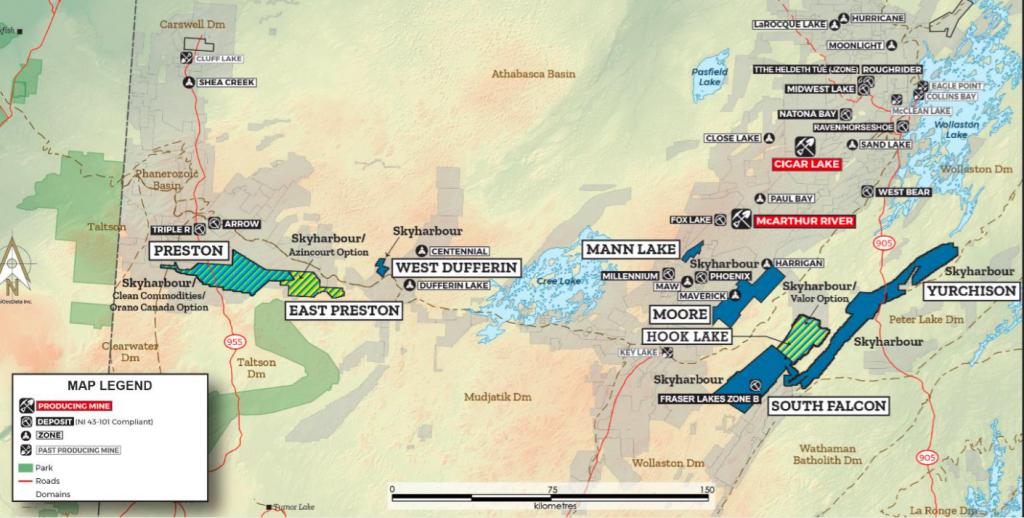

Yes, thank you. Skyharbour Resources‘ projects are located in the prolific Athabasca Basin of Saskatchewan, Canada, host to the highest-grade & largest uranium deposits in the world. Saskatchewan is consistently voted a top global mining jurisdiction by the annual Fraser Institute Mining Survey.

During the market downturn of the past five years we have acquired six top-tier uranium projects across the Basin at attractive valuations.

Our Company is run by a strong management & geological team who are major shareholders and have extensive capital markets experience, plus uranium exploration expertise. Our goal is to maximize shareholder value through new mineral discoveries and committed long-term partnerships.

We acquired 100% of our flagship, high-grade property, the Moore Uranium Project, from Denison Mines, who remains a large strategic shareholder in Skyharbour. The Moore project hosts the high-grade Maverick Zone, where drilling has returned 21% U3O8 over 1.5 m within 5.9 m of 6.0% U3O8. The project also hosts other mineralized targets with strong discovery potential.

Skyharbour employs the prospect generator model, bringing in partner companies to advance & fund exploration. We have three project partnerships: one with industry-leader Orano Canada Inc. (formerly AREVA), another with Azincourt Energy, and one recently signed with Australian-listed Valor Resources.

These partners fund exploration and pay us — in cash & shares — to earn a majority interest in the projects. Skyharbour also owns the Falcon Point Uranium Project, which has an NI 43-101 compliant uranium resource.

Lithium, cobalt & silver prices have more than doubled from multi-year lows, copper & tin are at, or near, 10-yr. highs. Yet, U3O8 prices are down ~60% from the low $70’s/lb. 10 years ago! What will it take to get the spot uranium price above $40/lb.?

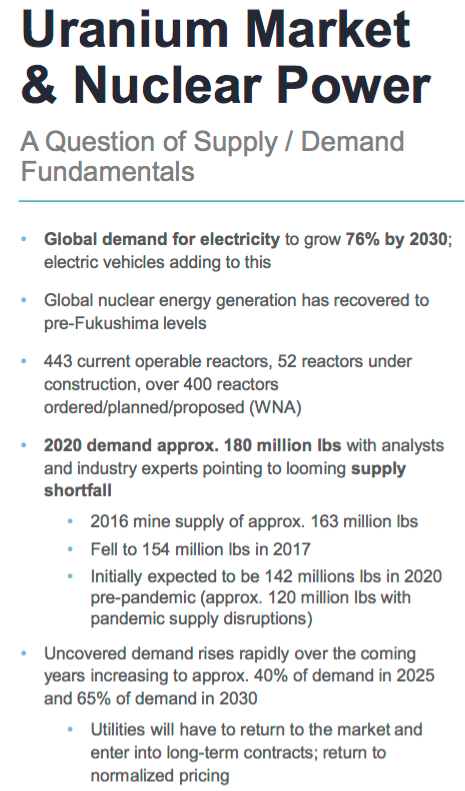

Yes, uranium prices are well off the levels of 10 years ago, but the spot price has been trending higher from a low of ~$18/lb. in 2016. Still, the current price of ~$31/lb. is below the industry average all-in cost of uranium production, and well below the price needed to incentivize new projects to come online.

While some globally significant projects could be viable at $40-$50/lb., most need at least $60/lb. Low prices over the past five years led to a major supply-side response, resulting in a primary mine supply deficit of 30-40M pounds of uranium/yr.

Fuel buyers & utilities are covering this shortfall by drawing down inventories & acquiring material in the spot market, but this approach is clearly not sustainable. As the market tightens, there will eventually be strong upward pressure on prices, forcing the spot price back above $40/lb.

UxC Consulting reports that U.S. utilities have been contracting at an average of ~75M pounds/yr. from 2014-2019 — far below normal. More than 50% of reactor requirements after 2027 are not yet covered by long-term contracts. This is highly unusual.

We’re seeing more uranium purchases from mining, development & physical holding companies. Companies like Denison Mines, UEC, Boss, Yellowcake and others have recently raised capital to acquire uranium.

This, in addition to the two largest producers, Cameco & Kazatomprom, that have been purchasing uranium to make up for curtailed production.

In the face of weak prices, Cameco announced production cuts & closed its McArthur River/Key Lake facilities in January 2018. Operations remain suspended. In early 2017, Kazatomprom cut company-wide uranium production by 20%. In May 2017, the state-run producer cut production further. Those substantial cuts have been extended into 2022.

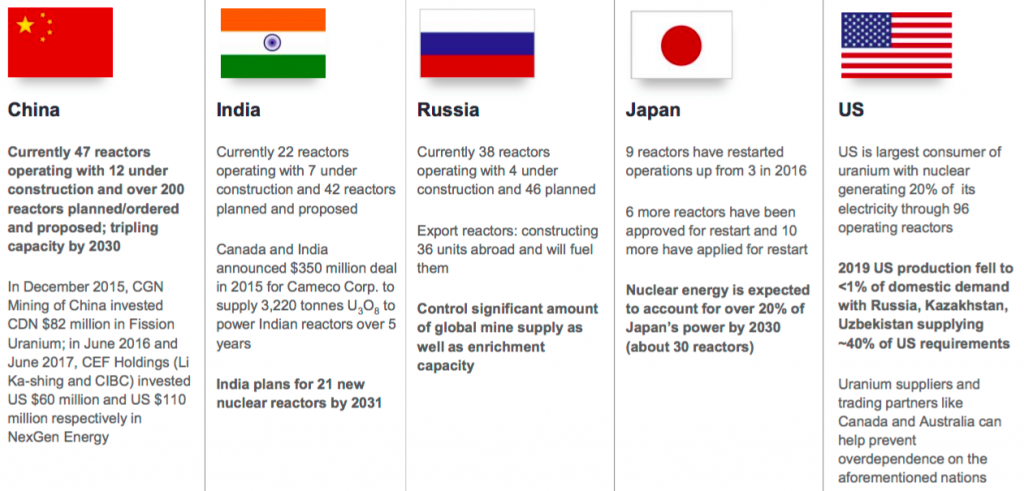

The global pandemic further exacerbated the supply/demand cycle last year as ~50% of worldwide primary mine supply was offline at one point or another. Canada’s Cigar Lake, Kazakhstan’s operations and the Chinese-owned Husab & Rossing mines in Namibia — all experienced supply disruptions — illustrating that risks to supply far exceed risks to demand.

I’m hearing more and more about the prospects for Small Modular Reactors (SMRs). What’s the latest news on the SMR front?

Most nations with nuclear programs have allocated funding towards developing SMRs. The U.S. has the Advanced Small Modular Reactor R&D subprogram with the goal of reinvigorating & reversing the downward market trajectory of its nuclear power sector. Bill Gates’ TerraPower is one of the leading companies in the space.

Canada has recently announced that it will compete to be a global leader in SMR technologies with its December 2020 Action Plan. Some industry pundits strongly believe SMRs are the future of nuclear power. They certainly could help solve the two most challenging issues to the more widespread, eager adoption of nuclear energy; time & money.

Analyst’s views on the global penetration of EVs for 2026 range from about 12-15% vs. just 2-3% today. How much could EVs move the needle of electricity demand?

The Rocky Mountain Institute (RMI) recently estimated that electrifying all ~ 251M light duty vehicles in the U.S. would increase annual electricity demand by ~25%. Nuclear power will have to play a significant role in meeting increased electricity consumption as it’s the only source of clean, base load (24/7), reliable, affordable power.

I should add it’s not just the electrification of transportation, it’s also the ‘Internet of Things’ the dynamic where so many devices are being connected to the Internet, each needing more electricity to operate.

It appears that the nuclear & uranium mining industries have garnered ESG investor interest, can you comment on this?

Yes, this has certainly been a catalyst in our industry over the past six months or so. We have seen a positive change in sentiment around nuclear energy & uranium mining as ESG-focused investors are waking up to the simple fact that the world needs nuclear power if we’re serious about combating climate change.

Many countries have set goals of becoming carbon neutral over the next 30-40 years. Furthermore, the U.S. rejoining the Paris Climate Agreement, and President Biden’s potential $1.7 trillion climate change program, would greatly benefit the nuclear power industry.

For the past few years there’s been talk about the U.S. government supporting domestic uranium players. Where does that initiative stand? Might Canadian companies like Skyharbour benefit from any action taken by the U.S. government?

Now that we have some resolution to the Section 232 & Nuclear Fuel Working Group as well as the extension & amendment to the Russian Suspension Agreement, those clouds have been lifted. This will allow U.S. utilities to come back to the market to sign long-term contracts.

However, the U.S. does not have the production capacity to meet even a small portion of its annual requirements. It would take more than five years for U.S. producers to ramp up to 20% of the Country’s annual consumption. Canadian companies have an opportunity to step in as reliable, secure sources of uranium, right across the border.

Canada will continue to be an important source of uranium for U.S. utilities increasingly weary of relying to heavily on supply from Kazakhstan, Africa or Russia.

Your team believes you could be close to discovering something meaningful in the basement rocks at your flagship Moore Uranium project. What’s your latest thinking on this?

We already intersected grades up to 21% U3O8 in the sandstone right above the unconformity at the Main Maverick Zone. These high-grade uranium lenses or pods at the unconformity are very interesting.

We believe they’re the product of feeder zones bringing mineralization up from larger / higher-grade zones in the basement rocks. We intend to drill-test these basement targets this year using a new geological model that will increase the chance of us finding what we’re looking for. Our goal is finding a resource of 50+ million pounds of uranium at Moore.

What’s the total amount of cash that will be spent on the Moore Uranium Project and your other projects in 2021?

We’re planning for a 3,000 m Spring drill program at Moore to test targets at the Maverick Corridor which will cost about C$1M. Once we interpret the results and previous geophysical data, we will choose targets for a Summer/Fall drill program, of similar size to the Spring program, for a total budget of C$2M.

The other projects that we have JV partnerships on are predominantly funded by partner companies. We have JVs with Orano & Azincourt at our Preston & East Preston projects whereby $4.8M & $2.5M has been spent in exploration expenditures, respectively.

Azincourt recently completed a Winter drill program at East Preston with results pending and they have plans for a Summer program. Over at our Hook Lake Project (previously called North Falcon Point), our partner Valor Resources is planning a multi-phased exploration program.

They hope to complete an 80% earn-in of the project over the next 3 years by spending C$3.5M in exploration expenditures, paying us C$475k in cash, and issuing Skyharbour 233,333,333 shares of Valor. {currently worth about C$2M}

Mobilization has begun for Skyharbour’s 2021 geophysical & diamond drilling programs at its flagship 35,705-hectare Moore uranium project. What is the plan for the drilling and which zones are you targeting?

The Company has planned a small moving loop EM (electromagnetic) (SML-EM) geophysical program to refine additional drill targets and has begun mobilization of equipment for a 3,000 m diamond drill program of 10 to 12 holes at Moore.

These fully-financed & permitted programs will follow up on existing unconformity & basement-hosted targets along the high-grade Maverick structural corridor and identify new targets at the Grid Nineteen area. Other targets along the 4.7 km long corridor will be investigated, including the Esker target, again with a focus on basement-hosted mineralization.

We’ve been very pleased with the results to date at the Maverick East zone and we will continue to focus on the expansion of this high-grade zone along strike, down plunge and at depth — with a focus on basement-hosted mineralization.

Some of the better drill hole intersections in the Maverick East zone include ML-202, which returned 1.79% U3O8 over 11.5 m, incl. 4.17% U3O8 over 4.5 m & 9.12% U3O8 over 1.4 m, and the recently announced ML20-09, which hit 0.72% U3O8 over 17.5 m from 271.5 to 289.0 m, incl. 1.00% U3O8 over 10.0 m in the basement portion of the interval (279.0 to 289.0 m).

Thank you Jordan, I look forward to seeing your drilling progress at Moore this year, and the drilling done by your partners on other projects.

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned no shares in Skyharbour Resources, and Skyharbour was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)