MP Materials is a C$17 billion behemoth. The stock is up nearly 450% from its 52-week low. Why the excitement? It mines & produces rare earth element (“REE“) concentrates & (increasingly) permanent REE magnets in the U.S.

It recently secured major financial backing & sales commitments from the U.S. Department of Defense (“DoD“) & from Apple Inc.

The DoD is providing $400M in convertible preferred equity, a $150M low interest loan, a $110/kg price floor for NdPr products, and a $140M minimum EBITDA guarantee on a new 10,000 metric tonnes/yr (by the early 2030s, 2028 startup) REE magnet facility.

That robust floor (reportedly twice the domestic China price when negotiated) is a game-changer, proving that the U.S. is serious about rebuilding a supply chain for REEs & REE magnets that does not touch China.

But wait, it gets better — the floor is for NdPr products, “stockpiled or sold,” encouraging MP to produce as much as possible, as quickly as it can, but allowing it to sell at a measured pace.

On MP’s latest earnings call, the CEO stated his belief that NdPr prices will go “materially” above the $110/kg floor. The NdPr price is now ~$80/kg in China.

NOTE: Will the US$110/kg floor apply to all U.S. NdPr developers? Reports indicate the MP arrangement is, “not a one-off deal.” Australia is said to be considering its own floor price on select REEs, and the U.S., Europe & Australia are considering strategic stockpiles.

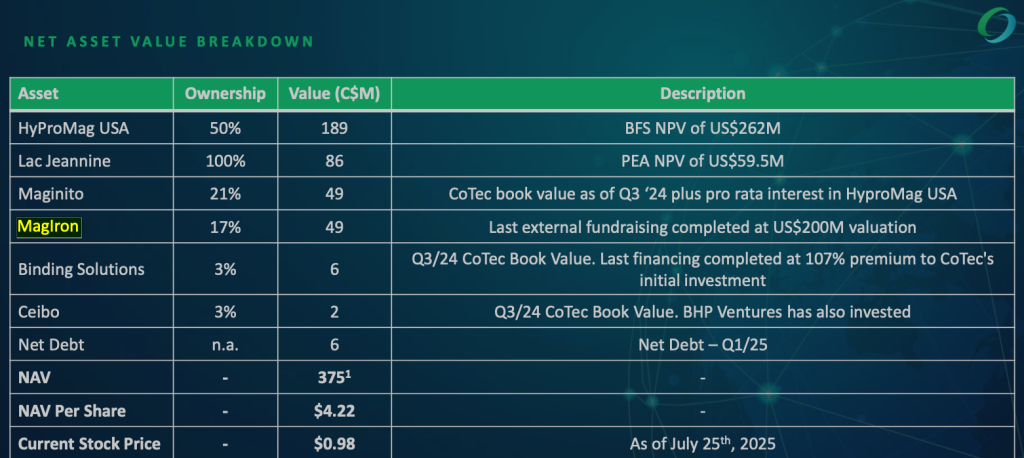

What’s the connection of MP to this article’s feature company, CoTec Holdings (TSX-v: CTH) / OTCQB: CTHCF)? While MP is in a league of its own in the REE space, CoTec has serious #REE credentials.

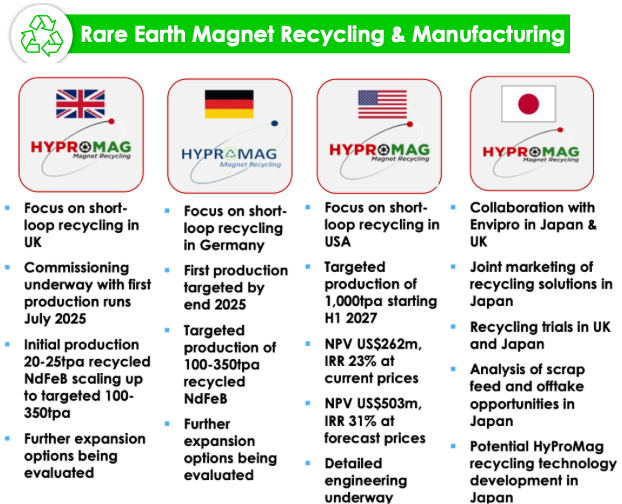

It holds a 60.3% (direct + indirect) interest in a U.S.-based REE magnet recycling & new magnet manufacturing operation expected to be operational a year ahead of MP’s new facility.

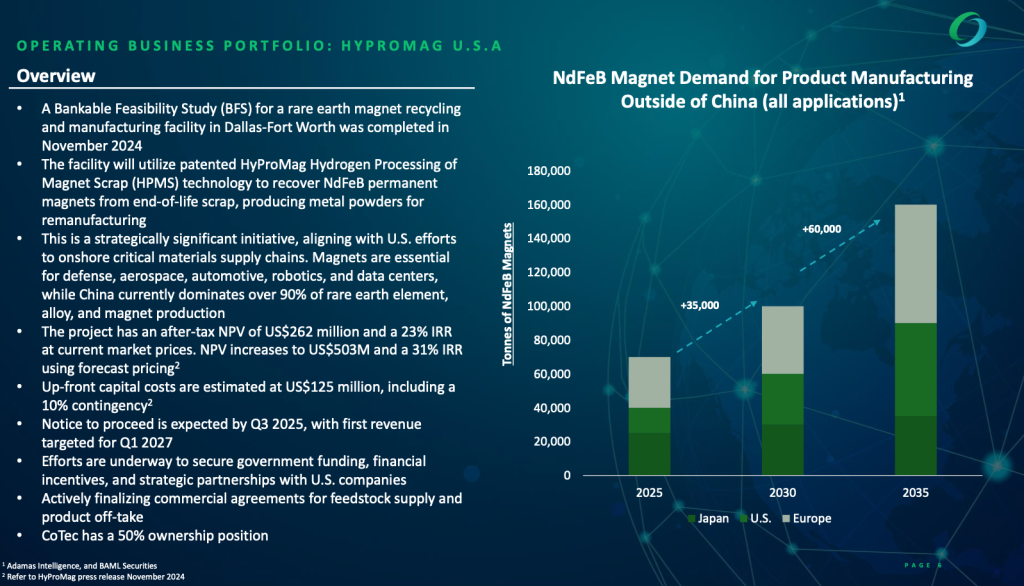

MP is trading at ~13x 2027e revenue. Assuming a NdPr price of US$93.5/kg, (15% below the DoD’s floor for MP), CoTec’s stake in HyProMag USA could generate ~C$58.7M in run-rate revenue by 2028 or 2029 (60.3% of C$97.3M, based on 750 tonnes/yr).

Adding four other REE players to MP (Lynas Rare Earths ltd., Energy Fuels, USA Rare Earth & IperionX ltd.) results in an average 2027e EV/Rev multiple of 9.0x

Using 6x (33.33% below the 9x avg.) implies a potential valuation of ~C$330M net to CoTec on just one of several segments under development. Compare that to CoTec’s current enterprise value of ~C$83M.

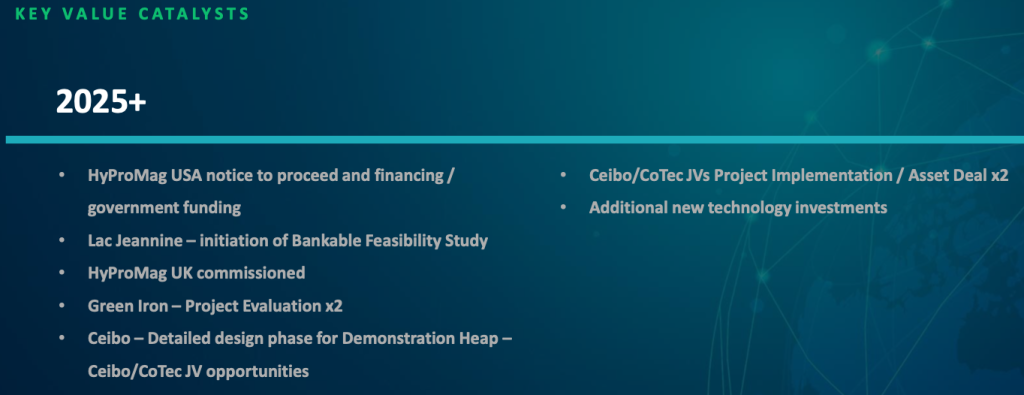

A November 2024 Bank Feasibility Study (“BFS“) included a Texas Hub + two pre-processing facilities. In March, HyProMag USA added three HPMS vessels to the game plan to boost annual production to 1,557 tonnes/yr by the early 2030s. Detailed engineering is well underway.

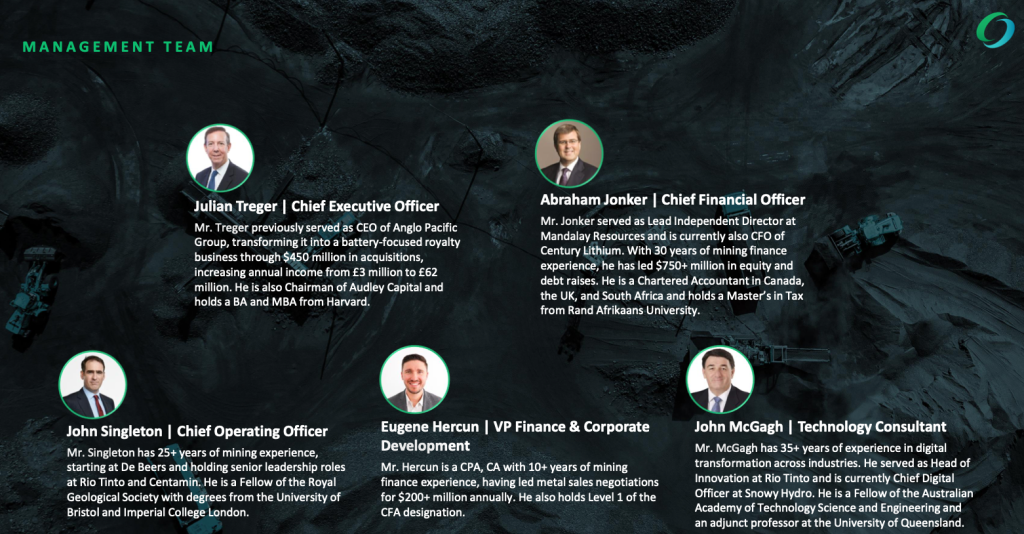

Due to the strength of the management team & board, the opportunities CoTec has secured are both impressive & growing. See bios above, AND the latest Corp. presentation.

Late last month, CoTec & Mkango Resources announced a critically important feedstock supply & pre-processing agreement with global electronics recycling company Intelligent Lifecycle Solutions.

CEO Julian Treger commented,

This collaboration is a first step in securing reliable long-term feed supply for HyProMag USA to sustain the Project as we advance towards construction. We believe over time we will be able to build sufficient feedstock to sustain several magnet recycling & manufacturing hubs…

ILS will secure neodymium iron boron (“NdFeB”) in advance of the commissioning of HyProMag USA. Through ILS, CoTec will provide full traceability on its products, supporting a “closed loop” circular economy & critical mineral supply chains in the U.S.

The goal is to secure 6-12 months of feedstock prior to commissioning HyProMag USA. On August 25th, the Company announced that stockpiling had officially begun at ILS.

On August 11th, the Company announced the conversion of all the Kings Chapel convertible debt, and that it had lined up new loans (undrawn) for up to C$6.6M convertible at C$1.15/shr. Pro forma shares outstanding is 98.1M. The current share price is C$0.99 (Aug 20th).

Global demand is at the beginning of a step change, especially if humanoid robots become a thing. Several pundits envision 1 to 10 billion humanoids by 2050. Each will require multiple REE magnets.

Yet to be imagined end uses for REE magnets are sure to follow… CoTec recently raised C$13.5M, and HyProMag USA has an indicative LOI from the U.S. Export-Import bank for US$92M with a repayment term of 10 years at a favorable interest rate.

Upfront cap-ex in the BFS calls for US$125M. Subtracting $92M would leave $33M. That’s hardly a big hurdle, and could be less if HyProMag USA receives one or more free-money grants.

I found at least eight U.S. government programs across agencies ready, willing & able to grant millions of dollars to companies like CoTec.

In addition to the DoD, MP secured Apple for off-take. Apple is pre-paying US$200M for future product deliveries.

HyProMag USA could potentially secure pre-payments from aerospace/defense companies like (Lockheed Martin, Raytheon, Boeing, etc.). Or, wind power giants Siemens Gamesa & Vestas.

Or, EV OEMs Tesla, GM, BYD, BMW, Volkswagen, etc. Or, other major corporations including; Samsung Electronics, ABB, Rockwell Automation, Amazon, Google, Nvidia, Microsoft, Sony, Applied Materials, Intel, Ericsson, Nokia.

Despite a very promising REE magnet segment, CoTec is not trading like a REE company. Nor is it being rewarded for setting up in the U.S. where projects could potentially enjoy premium pricing vs. the China price.

The top-10 performing #REE plays as of Aug. 22th (of ~70 I follow, with market caps > C$70M) are up an average of +811% from their 52-week lows! CoTec is up +116%. That doesn’t necessarily mean CoTec’s share price will rise, but there’s certainly *potential* upside.

Is CoTec getting credit for the above mentioned US$92M indicative LOI from the U.S. EXIM? Julian Treger, CEO of CoTec, commented:

“We believe that HyProMag USA could be a major contributor to the U.S.’ permanent magnet independence and the speed at which HyProMag’s capabilities could be deployed distinguishes it from competitors.”

Speaking of competition, demand for REE magnets & heavy REEs from Western-friendly countries, especially in the U.S., will grow even faster than the overall market.

Although HyProMag USA is understandably in the spotlight, readers are reminded that the Company has investments in three technologies, + tech collaborations on a few more, and is securing projects that will deploy those technologies.

In the image below, note that Binding Solutions & Ceibo are technologies in which CoTec has equity interests, and Salter & WaveCracker are being advanced in collaborations.

The Company also has a 17% stake in the MagIron project (green steel, iron ore), and an option to acquire 100% of the Lac Jeannine tailings site in NE Quebec, poised to produce high-purity iron ore concentrate (up to 66.8% iron) with minimal impurities.

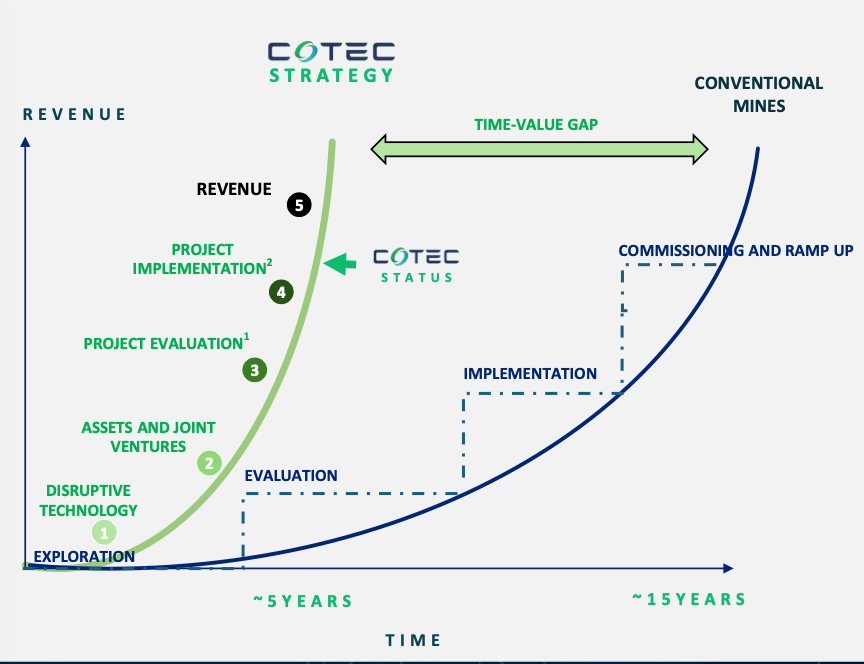

Most companies have 1 or 2 flagship mines/projects taking 10-20 years to develop, with *hoped for* lives of 15-20 years, followed by considerable reclamation activities, timelines & costs.

By contrast, CoTec is developing technology solutions to deploy across numerous sites in 2-4 yrs/site, each potentially lasting decades.

By the early 2030s, cash flow from HyProMag USA (+ a 20% interest in HyProMag operations outside the U.S.), + MagIron, + Lac Jeannine, and perhaps a few others, should drive tremendous blue-sky growth.

Funding is one of the biggest challenges facing metal/mining developers. CoTec has demonstrated an ability to raise equity & convertible debt on favorable terms, and its projects are in high demand from government agencies & major corporations.

Trends of on-shoring, or “friend-shoring,” to diversify from China’s dominance in numerous critical materials, (especially on the processing end) makes CoTec Holdings (TSX-v: CTH) / (OTCQB: CTHCF) a compelling risk/reward proposition.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about CoTec Holdings,including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CoTec Holdings are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, CoTec Holdings was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply