Mining is hard. There are dozens of risks to navigate. Some big ones; 1] finding mineralization, 2] mgmt. team, 3] environmental, 4] community relations, 5] permitting, 6] funding / project economics, 7] water, 8] technical / technology, 9] metallurgy, 10] remoteness / infrastructure….

One thing seems certain — the time, capital & mgmt. experience required to bring new projects online is increasing.

However, a silver lining is that ongoing challenges in sustainably sourcing critical metals, of which copper is one — in a safe, environmentally friendly & cost-effective manner — virtually assures that prices will remain stronger for longer.

With this in mind, I turn to Copper and Peru. Forty percent (40%) of newly mined copper comes from Chile (28%) & Peru (12%). Naming some of the other top-10 producing countries we have; China, the DRC, Russia, Zambia & Kazakhstan. What could possibly go wrong?

Readers might be wondering what the impact of Peru’s new self-described Marxist-Leninist president Castillo will be. Of course, no one knows for sure, but everyone agrees he will have great difficulty getting things through a divided congress.

While this election is important in Peru and for South America, to me Castillo is just another mining project risk factor to consider.

Swapping Peru political risk for the same or more severe risks elsewhere, makes little sense. Consider that Chile, Peru, the DRC & Zambia share many of the same challenges. Combined those four countries alone accounted for 49% of last year’s newly mined copper. There’s simply no avoiding substantial risks with large, long-lived mining projects.

One of my favorite risk-adjusted copper opportunities is Element 29 Resources [“E29”] (TSX-V: ECU) / (OTCQB: EMTRF). The Company has two 100%-controlled, highly prospective copper projects in Peru – Flor de Cobre and Elida.

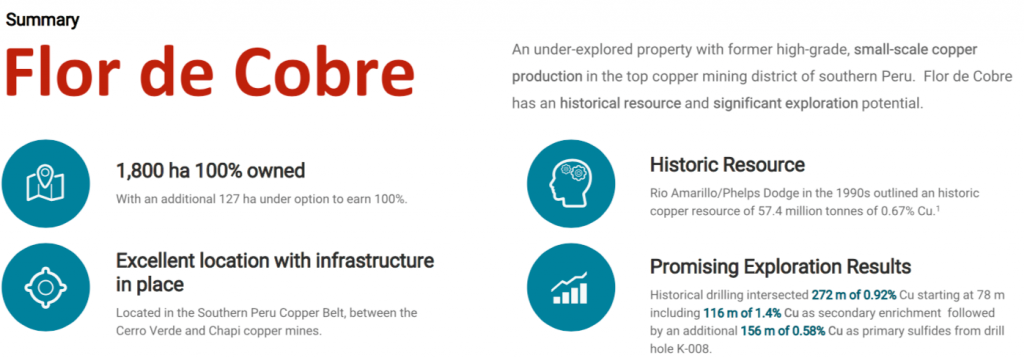

The Company’s advancing its flagship high-grade, past-producing Flor de Cobre (“FdC”) porphyry copper project, with an option to earn 100% of the property.

It’s in southern Peru, ~30 km southeast of Freeport’s Cerro Verde Cu-Mo mine. An historical resource done in the mid-1990s showed small tonnage, 57.4M tonnes of copper, but good grade at 0.67%.

At the same time, at the 100%-controlled Elida project, mgmt. just mobilized drills to begin exploring the remaining 22,000 hectares of its mining concessions, incl. the large, 2 x 2 km alteration system enclosing a cluster of porphyry centres that represent five distinct exploration targets.

The Elida project is in central Peru, 85 km from the coast. FdC & Elida will see drilling this year, with a NI 43-101 mineral resource estimate published on Elida in early 2022 and mineral resource estimate on FdC a few months after that.

Both FdC & Elida are below an elevation of 2,500 meters, a level that does not require specialized equipment or onerous worker-safety protocols, but does reduce the # of people, plants & animals in the area. By comparison, the average elevation of seven of the highest copper / gold mines in the world (all in Peru) is about twice as high at 4,840 m!

Both FdC & Elida will greatly benefit from existing & new regional infrastructure including roads, power, ports, airstrips, mining services & skilled workforces. Importantly, both projects are new to the market, not properties that have been shopped around for decades without meaningful progress.

Unlike for a growing number of projects in Chile, water is not expected to be an issue for E29. Many Chilean projects / mines are in or around the Atacama desert, one of the driest places on earth.

By contrast, one of the Company’s projects is close to a river and the other project is near available sources. Both of E29’s assets are outside northern Peru, in the more mining friendly southern & central parts of the country.

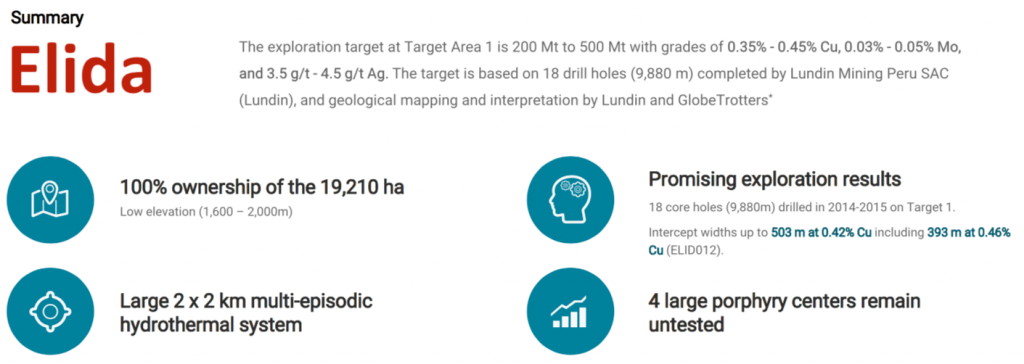

Elida is a porphyry copper-molybdenum exploration project (discovered in 2013) within a property composed of 28 mining concessions totaling 19,210 hectares. It sits at just 1,600-2,000 m of elevation. Elida is a large, 2 x 2 km alteration system enclosing a cluster of porphyry centres that represent five distinct exploration targets

Based on 18 historical drill holes done by Lundin Mining Peru, an exploration target (Target area 1) of 200-500M metric tonnes grading 0.35-0.45% copper + 0.03-0.05% moly + (a minor silver credit) has been identified. Extensions at depth & laterally are possible.

E29 is fully-funded to drill-test Target 1, and deliver a NI 43-101 compliant maiden mineral resource estimate at Elida within roughly nine months.

The other four untested Targets provide an exploration pipeline with an opportunity for significant additional resource expansion. It will likely take a few years to delineate all five zones into a mineral resource estimate.

Porphyries are only found in certain regions of the world, under select geological conditions. But, when they’re found, they typically come in clusters. E29 controls 100% of two projects, each of which has eliminated the single biggest risk — finding mineralization.

The FdC project contains the Candelaria prospect and the recently outlined Atravezado prospect. It’s in the Southern Peru Copper Belt, 6-8 km northwest of Nexa Resources’ Chapi mine, ~30 km southeast of Freeport McMoRan’s Cerro Verde mine, and ~45 km southeast of the town of Arequipa.

Rio Amarillo & Phelps Dodge explored the Candelaria area in the mid-1990’s, delivering an historical resource of 57.4 Mt at 0.67% Cu. This historic estimate is not being replied upon, but is useful for design & implementation of an exploration program to efficiently test mineralization.

Drilling at FdC will likely start in late 3rd, or early 4th qtr. But before that, drills will be turning at Elida, where a single hole will test the vertical extent of mineralization up to 1,000 m below surface and 5 holes will consist mainly of infill drilling to investigate the continuity & zonation of mineralization.

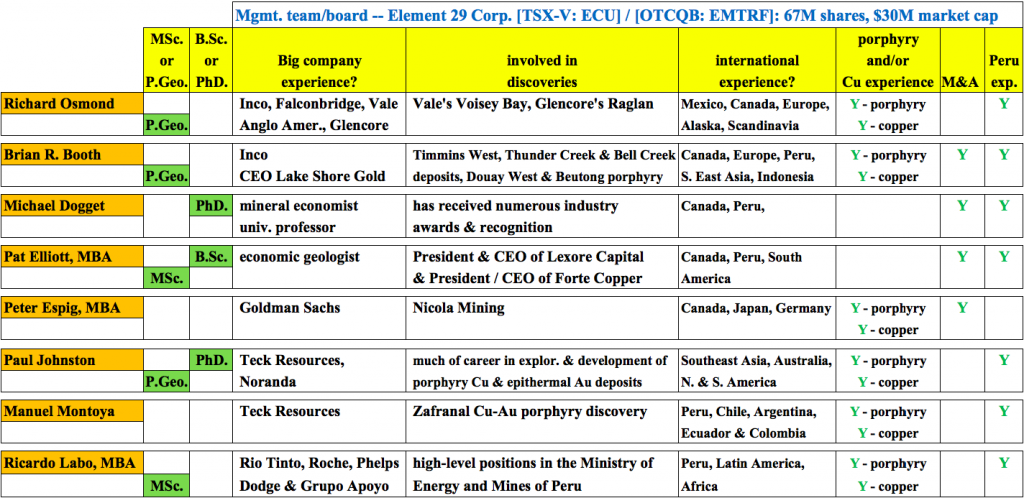

E29’s team is very experienced, with the right balance of skill sets to create value, especially for a company with an Enterprise Value (“EV”) {market cap + debt – cash} of $29M.

The team is led by CEO & President Brian Booth P.Geo, who has > 30 years’ experience with both large & small mining companies in Canada, Europe & southeast Asia. He was CEO & a board member of Pembrook Copper, where he developed the copper resource at Pecoy in Peru. Please see Brian’s full bio here.

I strongly recommend readers take a few moments to review the mgmt. & board’s qualifications. The highly seasoned, well-respected execs shown below would not attach their names & reputations to this story unless significant upside was reasonably likely.

It’s rare to have two company-making assets in one company. E29 has that. For both FdC & Elida, one of the hardest parts is behind them (finding promising mineralization).

It’s also rare to have such a strong team in place for a company with an EV of $29M. And, it’s rare to have two projects that have such substantial blue-sky potential. E29 has > $4M in cash to drill both projects and deliver a maiden mineral resource at Elida within nine months. Readers should consider taking a closer look at E29. {please see corp. presentation}

FdC has higher-grade potential, but if Elida can demonstrate 200M+ tonnes by next year, at a Cu Eq. grade of 0.40%-0.45%, then Element 29 Resources (TSX-V: ECU) / (OTCQB: EMTRF) could be sitting on two 100%-owned, top-quartile, (global) Cu exploration projects.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Element 29 Resources., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Element 29 Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Element 29 Resources was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)