Gold (“Au“) is up +46% in the past year, and some (but not all) producers are responding. AngloGold Ashanti, Lundin Gold, G Mining Ventures, Gold Fields, Kinross, Orla Mining, Northern Star Resources, Fresnilo plc, and Coeur Mining are up an average of +192%.

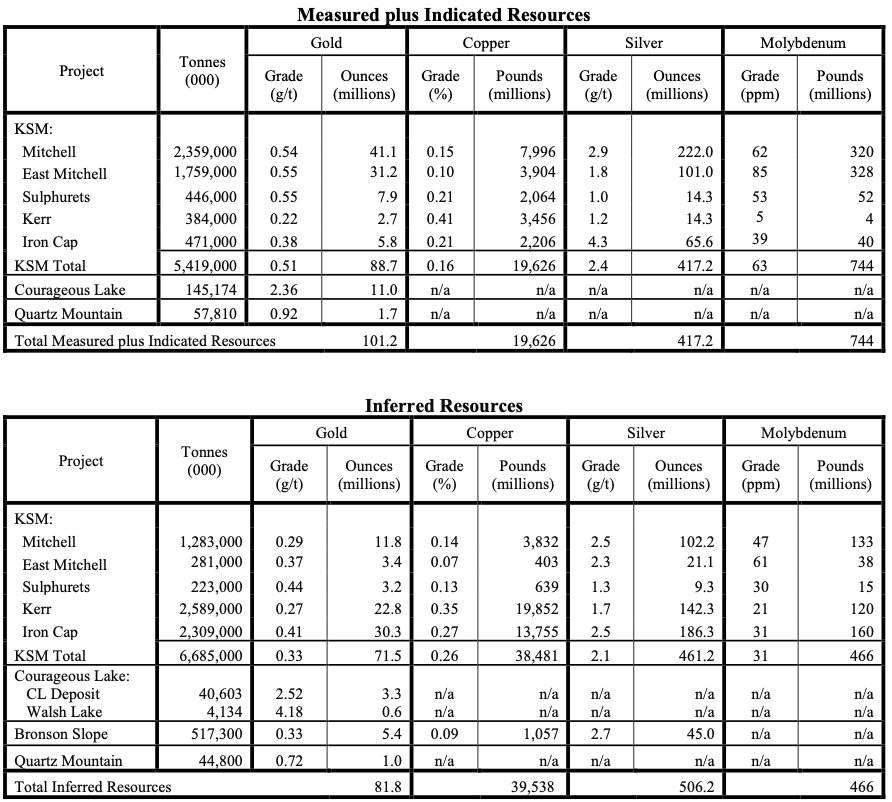

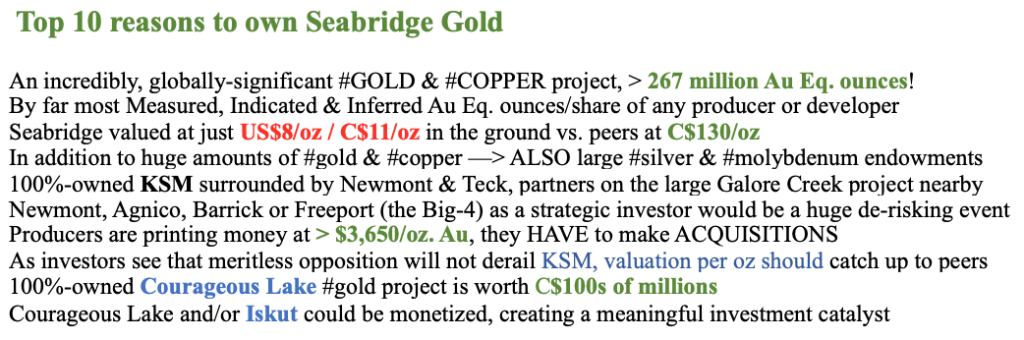

Company-wide, 267M Au Eq. oz, 280M Au Eq. incl. molybdenum

Fresnilo (50% of revenue from Au) & Coeur (67%) used to be known as primary silver companies. Even Pan American Silver derived 73% of its 2nd qtr. revenue from Au.

Top performing development stage Au companies Skeena Gold & Silver, Montage Gold, Amarc Resources, Snowline Gold, Troilus Gold, Integra Resources, TDG Gold, and Omai Gold are up an average of +402%.

Any high-quality Au junior, in a safe, prolific, western-friendly country, with strong mgmt./board/advisors, a world-class project, with good regional infrastructure, and access to workers, mining services, low-cost green power, should be up a lot more than the Au price.

Yet, Seabridge Gold’s (TSX: SEA) / (NYSE:SA) shares are up just +8% in the past year. This makes no sense, and in my view offers a very compelling risk/reward proposition.

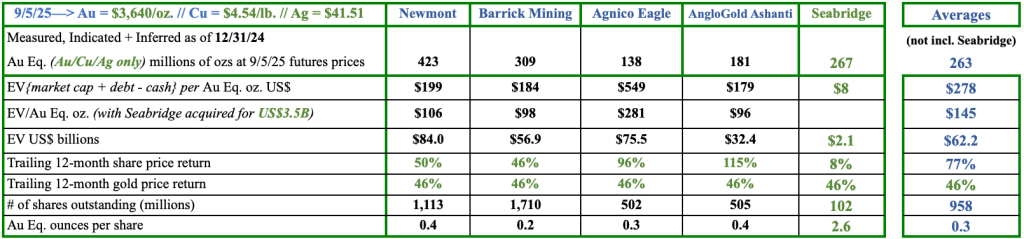

The following chart shows four Major Au producers, and Seabridge. Importantly, Seabridge, Newmont & Barrick also host considerable copper (“Cu“) resources, between 25% to 28% of total measured, indicated, inferred (inclusive of reserves, as of 12/31/24).

This is a busy chart, but full of keen insights regarding the meaningfully undervalued nature of Seabridge. Make no mistake, Seabridge is NOT a producer, it’s years from first Au pour.

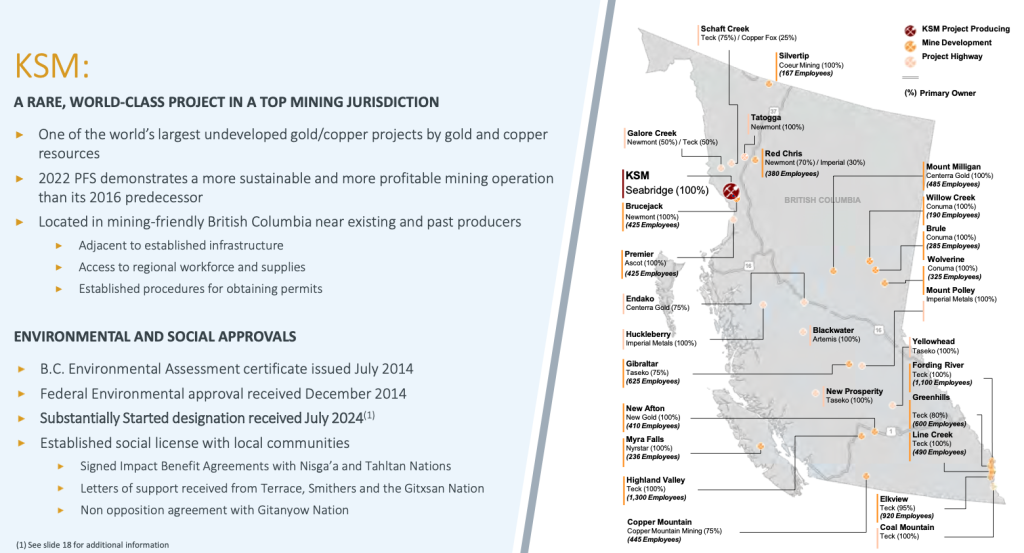

However, the Company owns 100% of the giant Au/Cu/Ag/Mo KSM project, a must-own asset. KSM is not just 1, but 2 orders of magnitude larger than typical Au projects globally. Think about that for a moment…

And, its Cu endowment of 59 billion pounds is larger than virtually all the giant S. American Cu projects, several of which are valued at C$1.0 – $1.3B.

KSM will generate a substantial amount of valuable jobs, taxes, royalties, consumer spending, infrastructure buildouts, etc., exactly what Canada needs to combat trade wars, economic uncertainty, and unprovoked belligerence from the U.S. President.

At spot Au & Cu prices, the current US$/C$ exchange rate, and assuming a +25% increase in cap-ex & op-ex, post-tax NPV(5%) is north of US$30B, with an IRR of above 30%.

There’s far too much to say about KSM in this article, but the excellent new September corp. presentation covers it all.

At 267M Au Eq. ounces, which includes booked resources from Courageous Lake (“CL“) Seabridge has more leverage to Au than Agnico Eagle or AngloGold Ashanti! And, just 14% less Au Eq. than Barrick.

If one of the four Majors shown above were to acquire Seabridge (at US$3.5M vs. its current EV of US$2.1B), the acquiring Major would reduce its EV/Au Eq. oz metric by 46%-49%. For example, Agnico would move from $549/oz to $281/oz.

An interesting way the Company describes its incredible metals endowment is by pointing out that it has 2.6 Au Eq. oz/share vs. peers in the chart at an average of 0.3 oz/shr. Notice that Seabridge has just 102M shares outstanding vs. the peer average of 958M.

Could management monetize this valuable asset to help fund KSM?

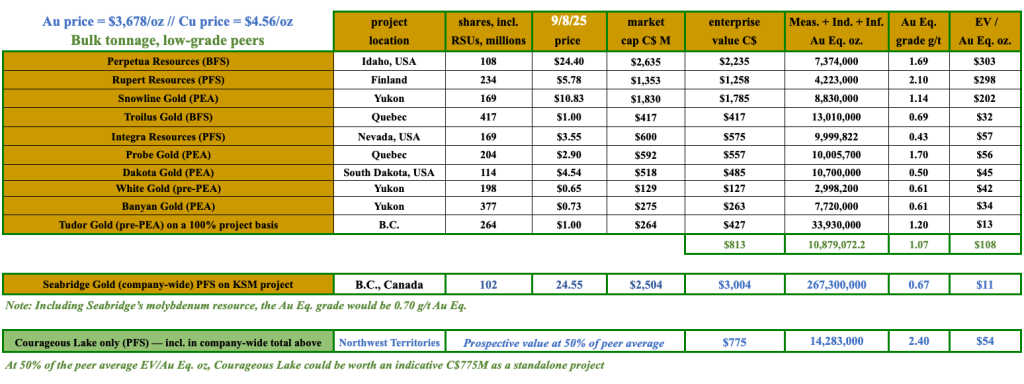

Despite being up +56% YTD, the Company is still valued at just US$8/oz! Perhaps it would be better to compare Seabridge to peer development stage companies, see chart. In C$, the Company at C$11/oz vs. low-grade peers at $110/oz, despite several only at PEA stage.

Also notice the Courageous Lake project at the bottom of the chart. It has 14.3M Au Eq. ounces at an average grade of 2.4 g/t. That’s a very significant standalone project.

If valued at 50% of the peers, it could be worth an indicative C$790M, and the peer average is less than half the grade of Courageous Lake.

Why is Seabridge seemingly so undervalued? Some fear the large cap-ex burden, which is likely to be US$8B (albeit spread over 6-7 years) vs. the 2022 PFS figure of $6.4B.

While that might have been a legitimate concern three years ago, much has changed since the PFS. Most notably, gold is +114%.

Three years ago, the only Majors big enough to play ball with Seabridge were Newmont, Barrick & Freeport McMoRan. Yet, since then, Agnico, Wheaton Precious Metals, AngloGold Ashanti, Gold Fields, Kinross, Alamos Gold & Lundin Gold are up an average of +423%.

Wheaton, Ashanti, Gold Fields & Kinross have an average valuation of US$35B vs. Newmont, Agnico, Freeport & Barrick (the Big-4) at US$75B.

While it remains highly likely that Seabridge partners with one of the Big-4, any two of the others could team up to fund KSM.

As strong as Au producers are today, readers should consider the Au/Cu market in the early 2030s when Seabridge should come online. By then the Big-4’s average valuation could easily double to US$150B, and the others to US$70B+, especially with a tsunami of M&A.

Therefore, those eight companies need to think ahead, to skate where the puck is going to be. Very few projects are anywhere near as large as KSM. Funding US$8B in cap-ex, for companies destined to be worth $70-$150B is not a reach.

Please note, that $70B-$150B assumes the gold price moves up fairly modestly from today’s $3,670/oz, say +2.5%/yr through 2032 to $4,362/oz.

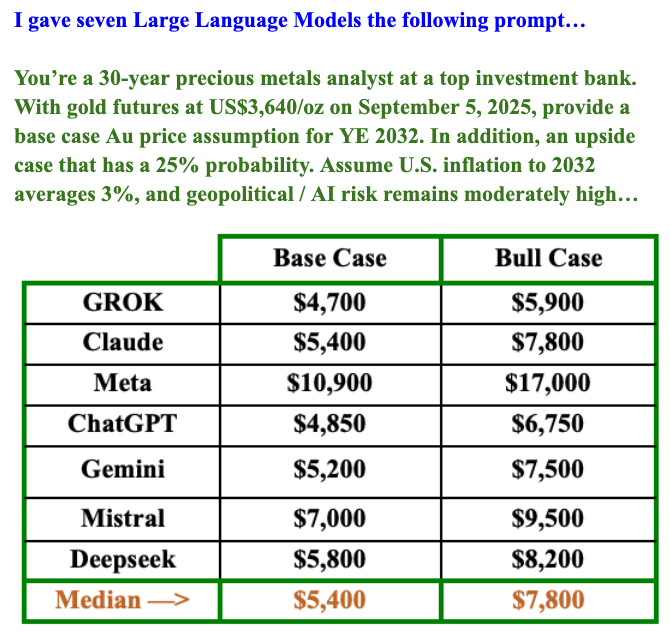

If Au is headed to $5,400–$7,800 {see below}, the valuations of those eight could triple or quadruple instead of just double?

Does that sound too aggressive? No, the Big-4 valued at an average of US$300B (after M&A) is hardly a stretch if Au soars. Compare that to Nvidia’s US$4 trillion valuation today.

By 2032, Newmont could easily be producing 10M Au Eq. ounces. At US$5,400 Au and an AISC of $2,000/oz, Newmont would generate US$34B in cash flow. I’m saying this WILL happen, but it certainly could, and big producers need to plan ahead.

Note, $5,400 would be a +5.7% CAGR to 2032 vs. a +17.0% CAGR over the past seven years!

Seabridge Gold (TSX: SEA) / (NYSE: SA) expects to announce a strong strategic partner before year end, one that not only has tremendous financials, but also strong technical abilities to drive KSM towards production. That will be a great de-risking event.

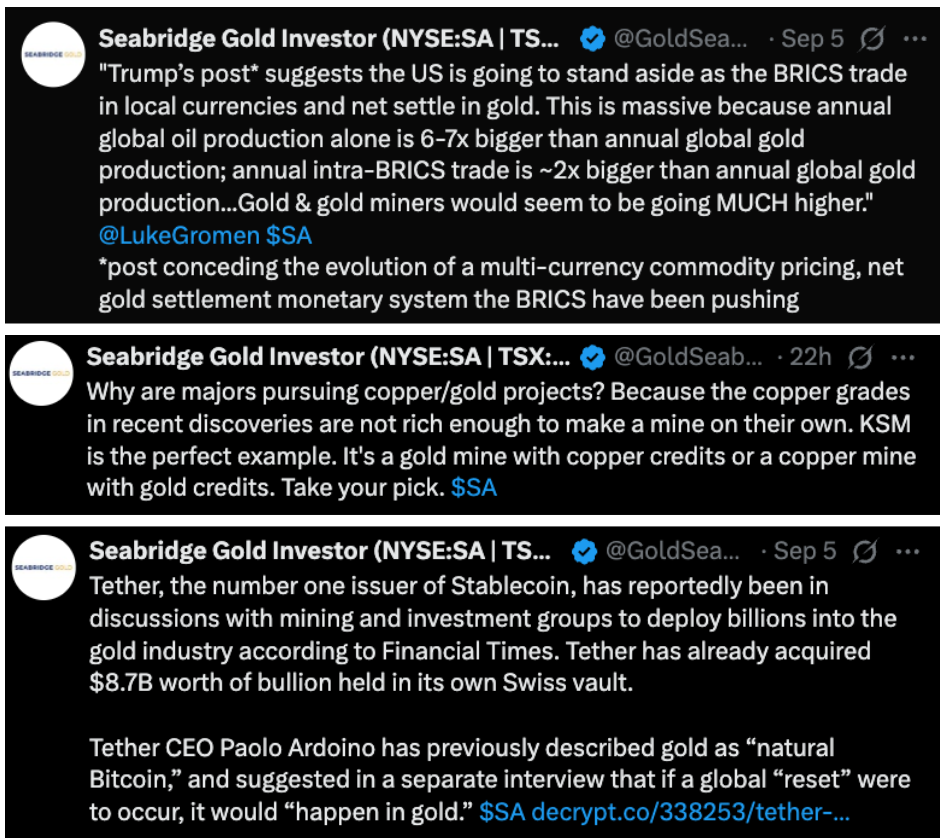

Seabridge has MUST-FOLLOW Twitter/X account for #Gold/#Copper news

We could also see a resource estimate at the 100%-owned Iskut project, also in B.C. CEO Rudi Fronk’s technical team thinks there could be millions of Au Eq. ounces as the geology and other attributes are similar to KSM. Even 5-10% of KSM would be another monster.

KSM, Courageous Lake, Iskut + a few others, with Au at US$3,670/oz (just 8% below $4,000!). Seabridge has ample room to run in this epic bull market, arguably more upside (from here) than the producers named above that have nearly tripled.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Seabridge Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Seabridge Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Seabridge Gold was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply