We’re in the midst of an epic precious metals bull market. No one can say for sure if we’re in the early, middle or late stages. My bet is we’re not in the late stages…

The factors contributing to gold’s (“Au“) stellar rise have not changed –> grave geopolitical risks, declining trust in fiat currencies, soaring government debts, China-led BRICs exiting US$ assets, and central bank buying.

Au producers are banking incredible profits quarter after quarter with no end in sight. Even if Au were to fall $500/oz to $3,375, producers would still be killing it. They need to invest heavily in their medium-to-long-term production pipelines.

Nevada is one of the best jurisdictions on earth to explore for Au, but also one of the most geologically complex. However, the size of the prize of a big discovery is truly extraordinary.

Junior miners have a checkered past in Nevada due to the aforementioned geological complexity and often a need for expensive deep drilling. Undercapitalized plays have blown their brains out drilling dozens of holes without meaningful success.

For winners, stock price gains are quite substantial. The median gain of the top quartile of Au juniors I’m tracking (25% x 352 stocks) is +522% from respective 52-week lows! Many are pre-maiden resource & pre-PEA.

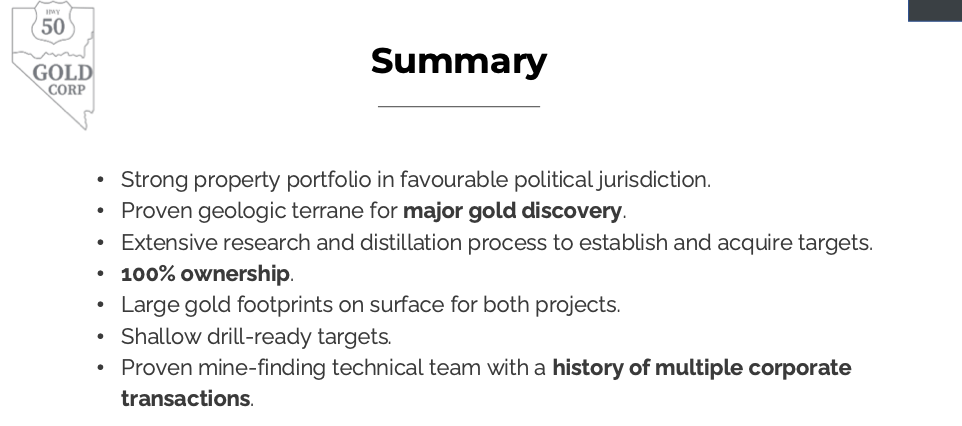

Highway 50 Gold (TSX-v: HWY) / (OTCQB: HCCGF) is led by two brothers that have been funding the Company for years, which is why there are < 40M shares outstanding. To say they have high conviction in their company would be a gross understatement.

P.Eng’s Gordon & John Leask have a strong track record of pursing specific types of targets around the world. The chosen areas at Highway 50 exhibit the same deep crustal architecture that’s present at Nevada’s Carlin, Cortez and Turquoise Ridge districts.

They have spent decades meticulously modeling north-central Nevada, selecting just a handful of key zones hosting the ideal set of attributes. Then, they waited, waited years for targets to become available.

In my view, the brothers’ track record demonstrates a mastery of structural & crustal geology, particularly an ability to identify hidden, high-potential mineralization along complex fault systems & deep-seated structures. According to Gordon Leask,

Highway 50 is the culmination of 35 years of careful study of the major gold districts in Nevada. We strongly believe we have a decent probability at making one or more blockbuster discoveries. The mineralized evidence, geological structure & analog mines/projects gives us confidence (but no guarantees) in Highway 50’s tremendous blue-sky potential.

This combination of technical skill, exploration intuition, and the proven ability to advance early-stage targets, makes them exceptionally well qualified to aggressively pursue highly prospective areas on Highway 50’s land package.

I’ve spoken with Gordon & John, I asked if they’re looking for more assets — no, the ones being explored are enough. Peer Nevada juniors are looking for 1 to 5M ounces, often low (open-pit, heap leach) or medium-grade grade underground prospects.

Highway 50 is looking for 5-20M+ high-grade ounces like the giant resources owned by Nevada Gold Mines, a JV between Barrick & Newmont. In today’s Au bull market, due to the size of the prize, projects like Highway’s can get funded for not just one, but multiple drill programs.

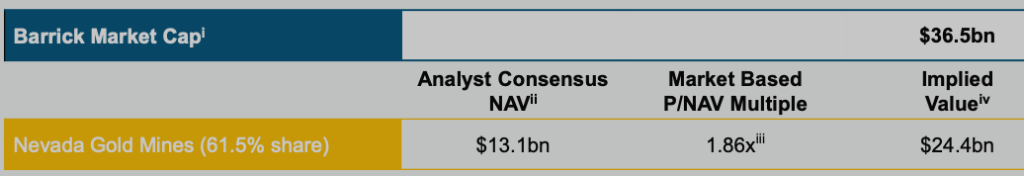

Sept. 2024 valuation of Nevada Gold Mines = US$24B –> US$39B today…

The above image is from a Barrick presentation in Sept. 2024. It shows an implied valuation for Nevada Gold Mines of US$24.4B (or ~US$40B adjusted for Barrick’s market cap gain in the past year).

Highway is valued at ~C$18M, meaning the embedded chance the Leasks can delineate a US$1B resource is ~1.3%. Admittedly, there will be equity dilution along the way. If 100% dilution, then the pro forma valuation is 2 x C$18M = C$36M, and the implied chance of a US$ billion dollar resource is 2.6%.

What do the Leasks think the odds are? A lot higher than 2.6%! I agree the chances are better than that, but a discovery hole might not happen in the initial drill program. Patience is required.

There’s also the possibly of a larger than US$1B score, a smaller one of say $100M to $500M, or no economic deposits. Producers are closely watching for the next Fourmile deposit, players like: Agnico Eagle, Gold Fields, Kinross, Coeur Mining, Hecla, SSR Mining, etc.

Why do the Leask brothers think there’s a meaningful chance of booking 5M+ ounces? At least twice before they have used deep structural geology to find Au in places that would have been difficult, too costly, or impossible to pinpoint with other exploration techniques.

White Knight is cited as evidence of the Leask brothers’ expertise in deep structural geology as that company targeted areas where regional faulting, thrusts, and carbonate “windows” in Lower Plate rocks created the ideal conditions for large Carlin-type deposits.

In the mid-2000s, they recognized geological similarities between the Lindero area and Nevada’s most prolific Au districts.

Gordon & John played pivotal roles in the discovery & development of the Lindero project in NW Argentina through their company Goldrock Mines Corp.

Despite skepticism from other mining companies, they persisted with further exploration & development that resulted in a significant Au resource, which was acquired by Fortuna Silver for C$130M.

Why should readers care about Highway 50 Gold? It has two drill-ready, Tier-1 potential Au projects in north-central Nevada. Unlike 100s of Au juniors, the Company’s stock has not soared. Why is it not moving? Simple, there’s been minimal news, but that’s about to change.

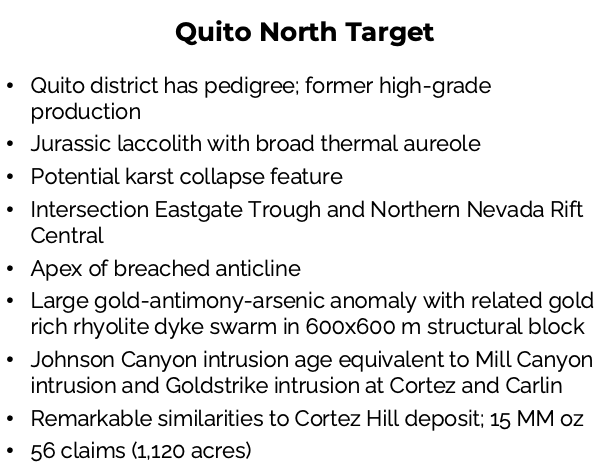

Quito North

The Company staked 56 unpatented claims ~10 km south of Austin. The Quito North (QN) claims cover the NE corner of the Quito lower-plate window, “including 3,000 m of the northern projection of the Quito mine mineralized structure.”

The southern portion of the QN claim group covers part of the Section 25 target area, where trenching + shallow drilling encountered moderate-grade Au mineralization.

Shallow drilling at this target intersected up to 1.37 g/t Au in Lower-plate limestones. This may constitute leakage above a more substantial Au deposit. Management notes a marked similarity between the geology of the Cortez trend & the Quito windows.

The past-producing Quito mine hosted significant high-grade mineralization with the pit ending in 17.1 g/t Au. Importantly, the bottom of high-grade mineralization has not been found. Drilling within the district has been shallow and limited to the Quito mine area.

Since the discovery of high-grade gold in 1980, the entire Quito district had been held by FMC Gold and successor companies. Yamana Gold was permitting a substantial exploration program prior to its takeover by Pan American Silver.

Subsequent to closing that acquisition, Pan American’s Yamana claims lapsed, allowing them to be obtained by Highway 50. Management is digitizing & collating relevant data prior to permitting a drill program.

Highway 50 holds title to four promising areas; QN, Johnson Canyon/Porter Canyon, Gold Knob & Golden Brew, all are 100%-owned and chosen due to proximity to deep-seated geologic architectures.

Gold Knob

The Gold Knob (GK) project covers 589 claims in Pershing County, NV. It hosts Carlin-type mineralization with assays up to 100 g/t Au. GK lies at the intersection of major regional trends.

Past drilling returned anomalous Au up to a meter at 2.8 g/t Au, 17 m of 0.58 g/t Au, and 12 m of 0.72 g/t Au. Geophysics defined a gravity-low/magnetic-low east of GK-2, which is a Priority 1 drill target.

Shallow cover and established bedrock depths suggest potential for near-surface oxide gold—rare in Nevada today. A second zone, Wild Horse (1 km south), hosts thick upper-plate mineralization with an historic, non-compliant ~50,000 oz resource.

Johnson Canyon

The Johnson Canyon project is located along the western edge of the Quito Mine lower-plate window. The NW corner of this window exhibits geologic elements that are markedly similar to the NW corner of the Cortez window.

Initial focus of the upcoming exploration work will be on the Johnson Canyon/Porter Canyon claims where the Company has permitted a pattern of six holes at the NW corner of the Quito Mine window. JC is comprised of 186 claims in two contiguous blocks.

Golden Brew

The 100%-owned Golden Brew project covers 101 claims prospective for Carlin-style Au. It adjoins a 760 × 60 m Au-bearing zone anomalous in all Carlin-pathfinder elements with Au up to 4 g/t.

Drilling of 13 holes in 2011–2019 identified weak but persistent Carlin-type mineralization, smoke but no fire. A gravity-low/magnetic-low target 600 m to the NW is now the highest priority.

The Leasks brothers’ approach seems to be go big or go home, but they have prudently & methodically done their homework before the upcoming drill-testing. Go big or go home is a reasonable mantra in an epic bull market for Au.

Will the Leasks find another winner? Their biggest winner? Time will tell, but drilling should provide critically important clues, even if not a discovery hole.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply