Dollar figures are US$, unless indicated as C$. Met coal prices quoted in US$

For some, coal is a naughty, four-letter word. However, there’s a HUGE difference between thermal coal (burned to generate electricity) & steel-making coal, a primary input in manufacturing steel.

Make no mistake, the burning of BOTH thermal & steel-making coal is bad for the environment. Yet, 90%+ of consumption is thermal, and coal-fired power generation is steadily being replaced with renewable energy sources.

Steel-making coal (aka metallurgical or met or coking coal) presents a trickier proposition. There are ways to reduce its use, namely new technologies & more recycling, but most experts agree that for the next few decades, there’s no practical way around current methods.

With > 90% of coal burn dedicated to generating electricity, and since replacing thermal is easier than replacing met, the overwhelming emphasis should continue to be on transitioning away from thermal coal to renewable energy.

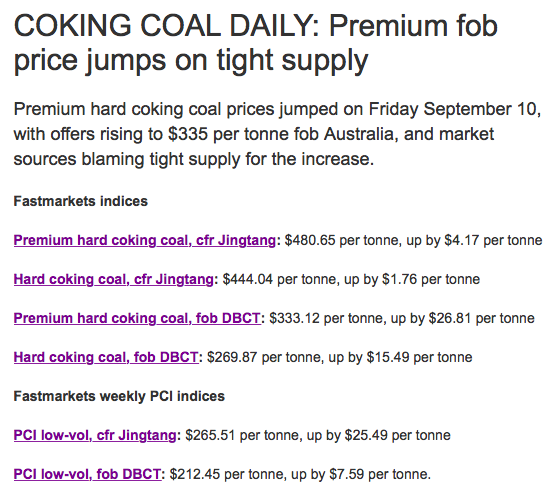

Met coal prices at $$ all-time highs $$ due to perfect storm of demand & stressed supply

Met coal is in short supply due to a perfect storm of geopolitical discord, environmental concerns, weather / wildfire disruptions & Chinese mine safety issues …. underlain by increasingly strong demand from massive, COVID-19-induced, global stimulus packages.

A company poised to greatly benefit from planet-wide economic stimulus is Colonial Coal (TSX-V: CAD) / (OTCQB: CCARF), with two valuable projects (no thermal — 100% met, both with Preliminary Economic Assessments “PEAs”), in the world-class Peace River Coalfield (“PRC”).

Note: I urge readers to review Colonial’s detailed & informative corporate presentation.

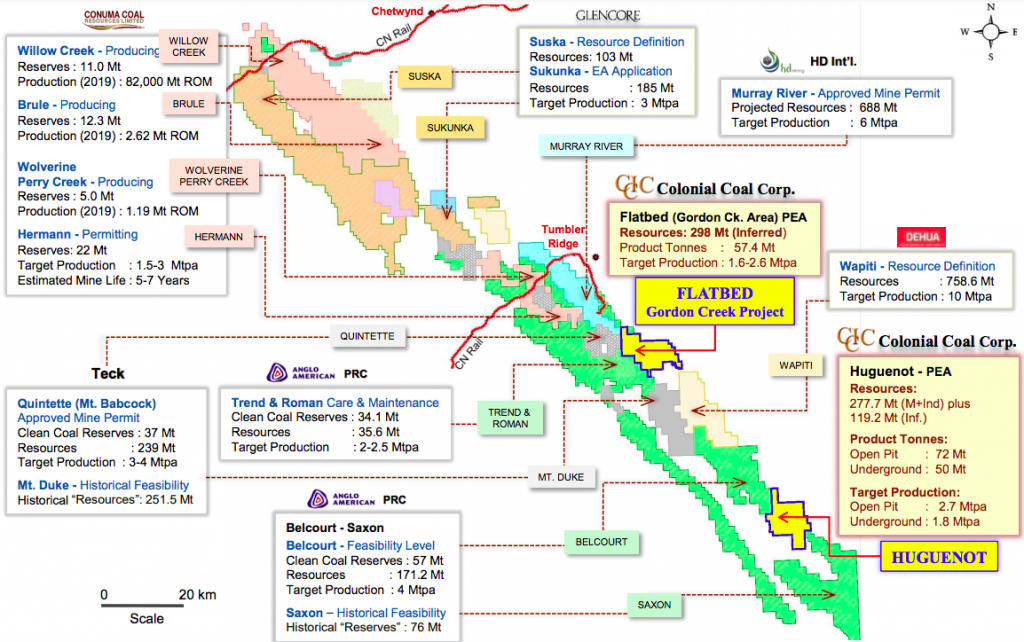

The projects are not in difficult places like (China, Africa & Mongolia), they’re alongside giants Teck Resources, Anglo American & Glencore in a well-known, safe & prolific mining camp in northeastern British Columbia, Canada.

The PRC hosts high-quality met coal, which is low in sulfur, ash & phosphorus. Product is shipped by rail to the coast, and then sent by bulk-cargo ships, mostly to Asia, from the ice-free, natural deep water port of Ridley Terminals in Prince Rupert.

Coals from the 100%-owned Huguenot & Gordon Creek / Flatbed projects are considered premium coking coals, very similar to products sold by Teck & Anglo. In the hands of a larger, well-funded company, one or both projects could possibly reach initial production in 3 or 4 years.

Colonial’s fully-diluted market cap is C$274M (190M shares @ C$1.49 on Sept. 9th). The Company’s shares are up 58.5% this week alone as investors incorporate higher met coal [spot] prices into their thinking. A total of 4.25M shares traded in Canada on Sept 8- 9, more than the past 30 days combined.

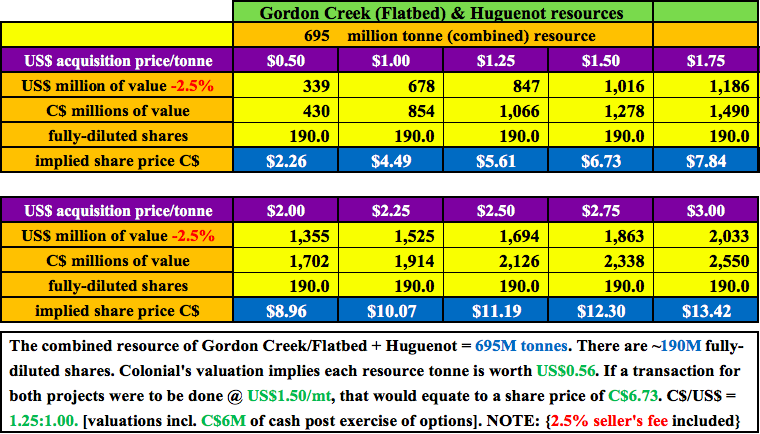

The two projects host 695M resource tonnes, each metric tonne (“mt”) is valued [by the market] @ $0.305 in the ground, yet high-quality (washed) tonnes [ready for use] in steel-making are trading at > $300/mt.

Shares of Colonial represent an event-driven investment opportunity with attractive risk/reward

Most analysts & shareholders I speak with believe the consideration paid by an acquirer of Colonial’s resources should be from $1.5 to $3.0/mt. I think the range might be more like $1.25 to $2.50/mt, which equates to ~C$5-$11/share. See chart above.

The image below from Colonial’s corporate presentation is one of the best maps I’ve seen of the basin. Readers should take a moment to look at the resources / reserves of the main players.

Colonial has delineated ample NI 43-101 compliant resources — no reserves yet — but the quality & characteristics of products coming out of the PRC basin have been well-understood for over half a century, and robust export to Asia has been commonplace for decades.

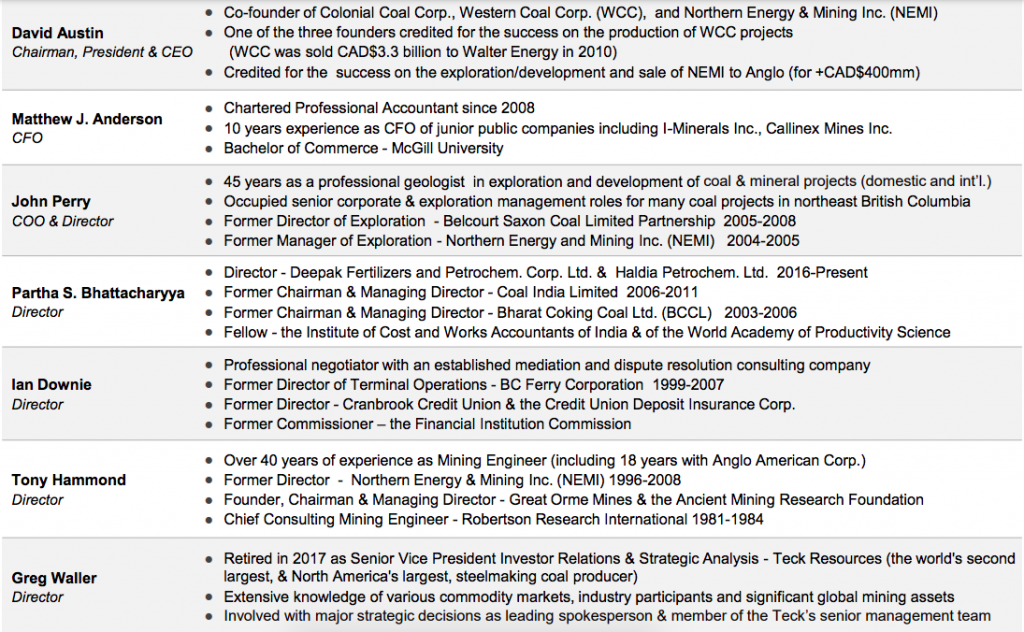

The management team, Board & advisors are deal makers, company founders, senior execs & mine operators with tremendous mining company experience and enviable track records, incl. in western Canada, incl. in met coal. The Company has ~C$4M in cash, enough to last into 2023.

David Austin (President, CEO & Chairman) co-founded & built Western Coal Corp., which was sold in 2010 for C$3.3 billion. He’s credited for the exploration, development & sale of Northern Energy & Mining Inc. to Anglo for C$400M+. See other key team member bios below.

Two years ago a decision was made to run a sales process to divest both projects — either together, or separately. Within months of the sales process getting underway, COVID-19 crippled the world economy.

Colonial is actively selling two valuable projects, but the sales process was impacted by COVID-19

When Colonial began its sales process, interest in the assets was strong. The team had made meaningful inroads with several groups. Understandably, COVID-19 slowed the process to a crawl, and most investors forgot all about Colonial Coal.

However, suitors are getting serious again on reviewing Colonial’s projects. Interested parties hail from most (or all, I don’t know) of these countries; Australia, India, Japan, Brazil, China, Korea, Canada, Indonesia, Russia & the U.S.

According to Fastmarkets, the average price of four seaborne coking coal indexes has more than tripled in the past year. Programs to stimulate economic recoveries are driving industrial commodity prices much stronger. Copper, oil, aluminum, nat gas, tin — have climbed dramatically. Yet, none have risen more than met coal.

Recently, interest in Colonial’s assets has taken off on the back of a surge in met coal pricing. At the same time, the financial wherewithal of prospective buyers has soared. For instance, Teck Resources’ share price hit C$8.15 in March, 2020, but has since rebounded to C$32.03, its EV is C$25 billion.

I estimate there are > 40 potentially interested parties, comprised of massive steel companies, mining giants (Rio Tinto, BHP, Anglo American), coal & iron ore players (Vale, Teck, Fortescue Metals), & commodity-trading firms (Glencore, Vitol, Mitsubishi, Mitsui).

I’m not suggesting that dozens of groups are aggressively pursuing Colonial right now, but the chances that a handful of parties are actively engaged, and considering making bids, seems high. Note: {mgmt. had no comment on the # of suitors or possible timing of a bid}.

Multi-billion $ steelmakers, miners & commodity traders watching — how many will bite?

All shareholders need is a few (or several) serious buyers to spark a healthy bidding war. Not a bidding war that sends valuations to the moon, (although that might happen), just a process with some competitive tension to ensure shareholders receive a fair price.

In speaking at length with CEO Austin, a top leader in the steel-making coal world — with decades of experience building companies and selling them for spectacular gains — a few things became clear.

First — we’re in a bull market as strong as anyone has ever seen, with M&A only slowed due to the COVID-19 pandemic. Interest has been picking up lately.

Second — giant steelmakers are killing it in this emerging infrastructure boom. They can comfortably afford to pay $1.25 to $2.50/mt. Even if a player doesn’t need met coal anytime soon, is it prudent to let a direct competitor gain a long-term cost advantage?

Each incremental $0.25/mt paid on 695M tonnes = C$221M, but ArcelorMittal has an EV of ~C$50 billion. It can borrow funds for 10 years at ~2.5% interest! Japanese steelmaker Nippon Steel has an EV of > C$45 billion. Korea’s POSCO has an EV of ~C$33 billion. Tata Steel, JSW, SAIL are valued in the tens of billions.

Anglo American [EV ~C$75B] has advanced-stage, pre-production projects on both sides of Colonial’s Huguenot project, {see map} making it a logical acquirer. Huguenot connects Anglo’s projects and more than doubles the resources of that company’s Belcourt & Saxon projects.

Note: {Don’t forget to check out Colonial’s corporate presentation}

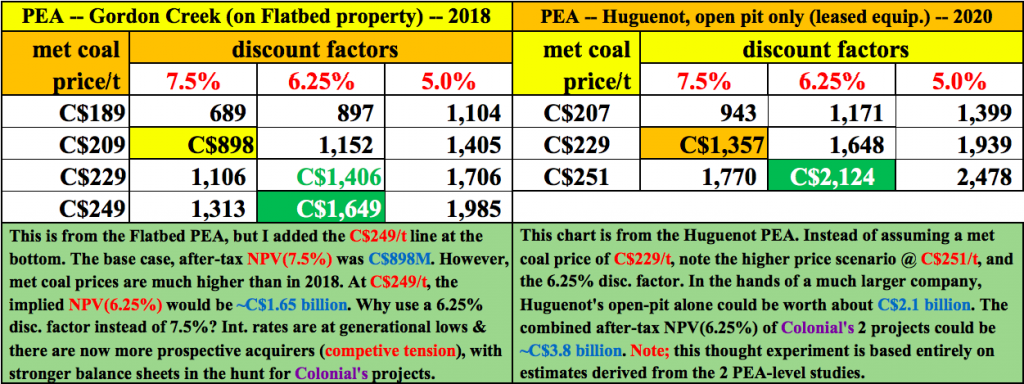

Third, while there are PEAs on both of Colonial’s projects, the true value, incl. surrounding land (with significant exploration upside), is higher than base case financial metrics suggest. If a major steel or mining company were to acquire the assets, they would discount project cash flows back at 5.0% instead of 7.5%.

Time is money, a major company could put the projects into production faster, with less development / funding risk. NPVs & IRRs can be increased by pulling forward production — producing the same # of total clean tonnes over a shorter mine life.

Colonial’s projects worth a lot more in the hands of a larger, well-funded company

The winning bidder(s) gain economies of scale, operational synergies, mine production (sequencing) flexibility & marketing prowess from an expanded suite of metallurgical offerings.

From the PEAs of Gordon Creek / (Flatbed) and Huguenot [open-pit only], base case assumptions of C$209 & C$229/mt, respectively, are too low. The combined after-tax NPV(7.5%) was C$898M + C$1,357M = C$2.25 billion.

However, at C$249/mt for Gordon Creek & C$251/mt for Huguenot, the combined after-tax NPV(6.25%) is ~C$3.8 billion. I switched to a 6.25% disc. factor from 7.5% to reflect much lower medium-to-long-term interest rates vs. three years ago and the balance sheets of the Majors.

Moreover, the universe of prospective buyers has increased, and the buyers’ ability to pay premium prices has also increased, due to their improved market valuations & balance sheets.

In my opinion, it’s a matter of when, not if, Mr. Austin and team sell Colonial’s projects. Timing was thrown off by COVID-19 — causing this event-driven investment opportunity to fall off investor radar screens for most of 2020 and half of 2021 — but interest is clearly returning.

Conclusion

The sale of one or both of Colonial Coal’s (TSX-V: CAD) / (OTCQB: CCARF) projects could happen (at any time), perhaps within the range of $1.25 – $2.50/mt, or [C$5-$11/share].

Those indicative levels are bolstered by all-time high prices & well-funded suitors anxious to lock-in long-term supply of key steelmaking materials (iron ore, coke, met coal) as trillions & trillions of dollars from stimulus packages are deployed this decade.

Hitting C$5+ per share would be yet another extraordinary win for Mr. Austin and team. At the current price of C$1.49, the risk / reward seems skewed in the right direction!

!! corporate presentation !!

Disclaimer: The author, Peter Epstein of Epstein Research [ER] has no current or prior business or personal connection with any mgmt. or board member of Colonial Coal, nor does he or [ER] have any prior or current business relationship with the Company. Mr. Epstein owns shares of Colonial, obtained in the U.S. market, via routine open market purchases. Mr. Epstein can buy or sell shares in the Company at any time.

Mr. Epstein is not currently, and never was, an investment advisor, stock broker, agent, legal advisor or investment professional of any kind. Nothing contained in the above article should be taken as advice or as an offer to buy or sell any security. All facts & figures, incl. commentary on indicative company valuations are believed to be somewhat accurate & reasonable, but might not be — therefore they are for illustrative purposes only. Facts & figures / calculations / valuations, etc. should not be relied upon without further investigation by investment professionals. Mr. Epstein is not providing any share price guidance or buy/sell recommendation. Mr. Epstein may or may not write about Colonial Coal in the future. He & [ER] are under no obligation to update readers going forward. The shares of Colonial Coal represent a high-risk investment opportunity that may, or may not, be suitable for readers. As such, readers are urged to consult with their own investment advisors before making investment decisions.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)