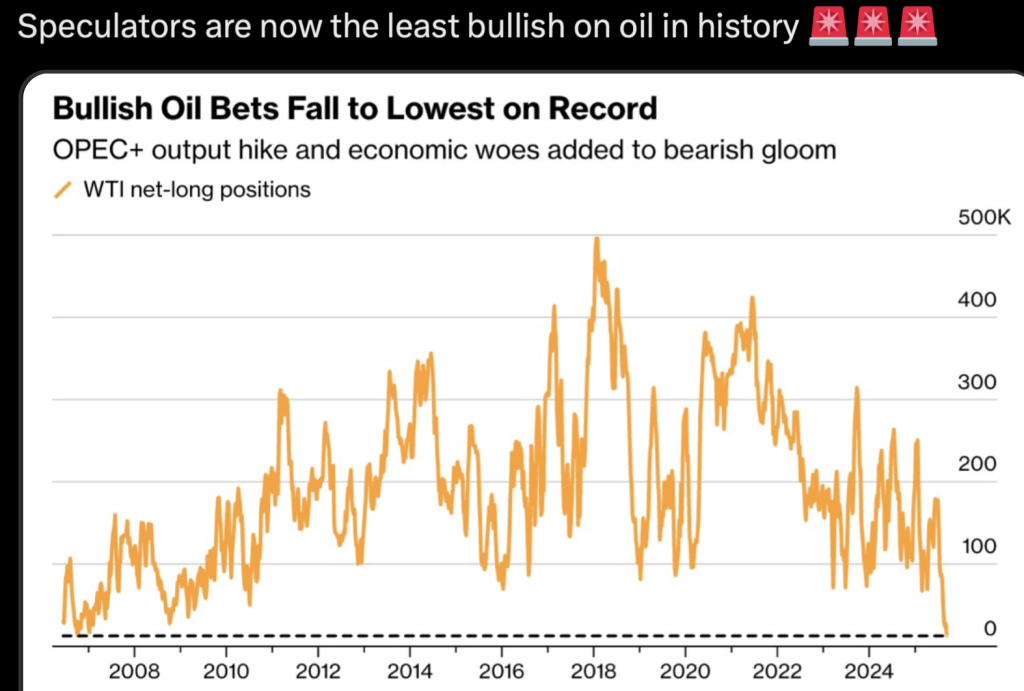

It seems all eyes are on #gold & #silver these days, but readers should continue to consider other sectors, especially oil & gas, which is out of favor at the moment. In fact, the following chart shows it to be VERY out of favor.

Is now a time to be selling E&P juniors or buying? For companies that are well funded, operating in prime formations, and growing rapidly –> now could be an ideal time to buy.

In the oil & gas business, execution on operating plans is (obviously) of paramount importance. And, while management teams like to talk about underpromising and overdelivering, Westgate Energy’s (TSX-v: WGT) / (OTCQB: WGTFF) team is killing it.

Essentially, the Company drilled three wells in a promising area expecting IP30 rates of 100-120 barrels of oil equivalent (“boe”) per day. However, in a press release dated September 17, 2025, management announced IP rates averaging 156 bbl/day.

NOTE: The 156 is barrels of oil/day as there’s no gas, this is great…

Even if one believes management was sandbagging, that they actually expected 120 boe/day, 156 is 30% higher than 120. I’ve been speaking with people at Westgate for months, I think results on these three wells was significantly above expectations.

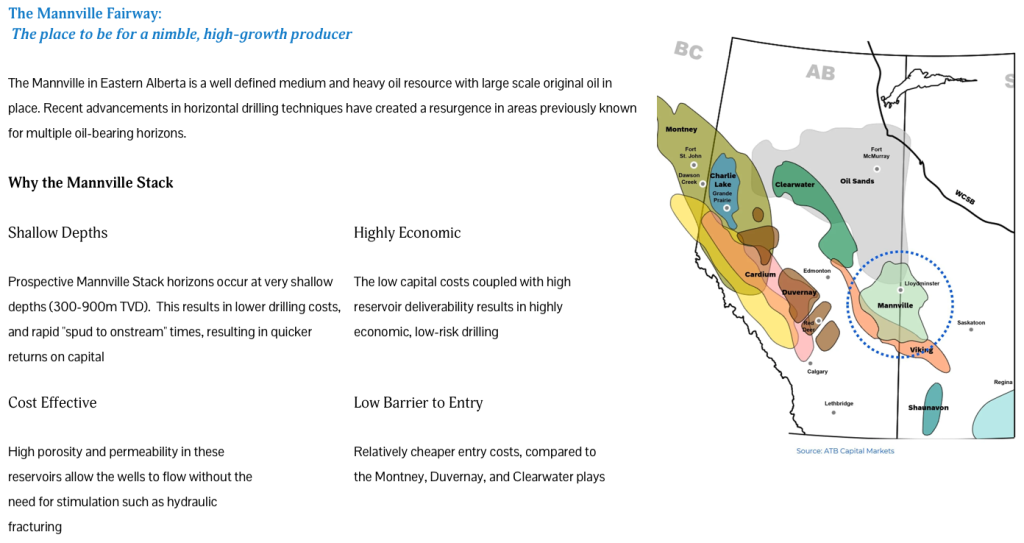

These wells are in the Mannville Stack, which hosts well defined medium & heavy oil resources. Three or four shallow horizons (~300-900 m depth), result in low drilling costs, low technical risk, and reduced “spud-to-on-stream” times, leading to rapid paybacks.

High porosity & permeability allow wells to flow without the need for stimulation such as hydraulic fracturing. Therefore, the Mannville Stack offers a cheaper entry than the Montney & Duvernay.

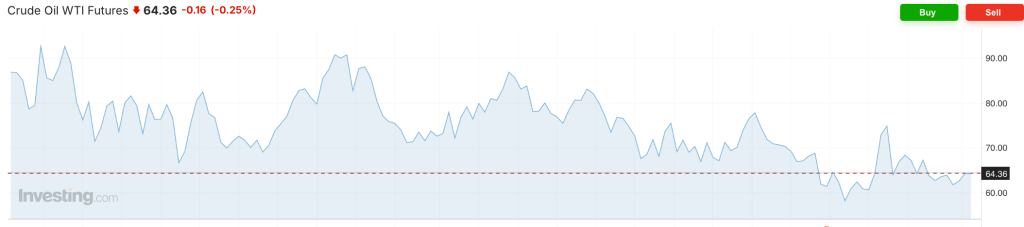

WTI crude at lower end of range…

Management, led by Founders Rick Grafton (Exec Chair) and Dan Brown (Pres. & CEO), has big ambitions. So far the team has advanced at a rapid, but prudent pace towards lofty long-term goals with no major setbacks.

This highly successful drill program involved a multi-well pad, drilling a stratigraphic test, and three horizontal wells targeting three distinct Mannville Stack horizons. The first targeted the McLaren zone and came in under budget.

The second & third targeted the Colony & General Petroleum horizon and were done on time, on budget. The first well was a multi-leg, fishbone-style horizontal. The other two were single-leg horizontals.

Ok, this news is on just three wells, does it really matter? YES, for numerous reasons! Firstly, hats off to the technical team for delivering these exceptional results.

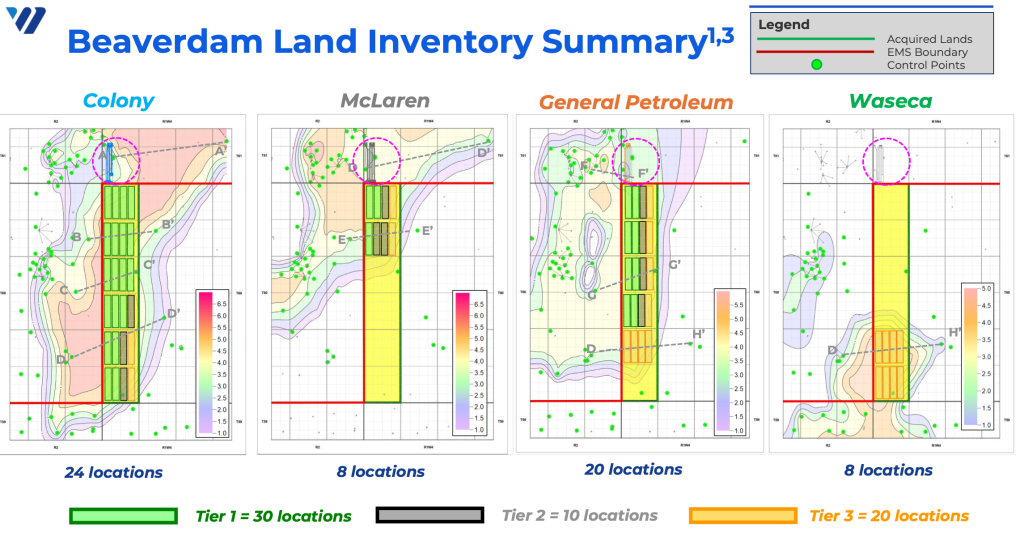

In prior articles on Westgate I made sure to explain the wells were low technical risk, but it was not a given that all three zones drilled would enjoy tier 1+ outcomes. This is very important to understand.

It means some locations modeled to be tier 3 might be tier 2, some tier 2s could be tier 1s. And, those 1s/2s could deliver 20%-30% higher IP rates than expected a few months ago.

60 well locations, 40 were tier 1/2, could it now be 90+? YES!

Areas where no wells were modeled may turn out to be prospective, and a tier 3 well might have flow rates 20%-30% higher, (or would that make it a tier 2?). This meaningfully de-risks AND upgrades the Company’s six sections & the total # of drill locations.

Readers are reminded that the team thought there might be 40 drill locations from a mix of tier 1 & 2 wells, not including tier 3s. Could there now be 60+ tier 1/2 locations? Yes, and perhaps 90+ tier 1,2 & 3 well locations, enough to drill for several years!

One reason why over 60 tier 1/2 locations are possible (subject to more analysis) is that Westgate’s stratigraphic test well pointed to newly identified potential zones (plural) being exploitable.

Please note, for competitive reasons the Company’s PR did NOT contain a lot of detail about how wells were drilled and proprietary reasons why flow rates are so strong. Armed with this knowledge, I can’t wait for the next drill program.

If three zones were (conservatively) thought to be good for 40 tier 1/2 drill locations, five zones would be significantly better, although not necessarily 67% better. What might this mean management’s goal of 1,000+ boe/day by 1Q/26?

That goal looks very achievable, they’re at 740 boe/day in mid-September. If they were to drill three wells next quarter, 740 + 486 = 1,226 boe/day. To be fair, there will be natural declines across the portfolio, and assuming 486 boe/day again might be aggressive.

Still, 1,100+ boe/day would be my best guess (not company guidance). Then if the Company followed up with 3-4 wells in 1Q/26 before Spring break-up, we could be looking at a run-rate of 1,500-1,600 boe/day by mid-2026.

If Westgate could reach 1,500+ boe in the next nine months, it might be the fastest growing, publicly-listed junior in N. America. Does anyone know of others that have, or will have, increased production this fast? I don’t, and I’ve been looking.

In my view, management now has a lot more than 40 well locations, it has enough operational runway on existing properties to drill for the next several years. Therefore, the pressure to secure more land is less intense.

The Company is in discussions on multiple attractive tuck-in acquisitions, and properties outside the immediate area, but nothing is imminent.

Management will be in Canada & the U.S. in Sept./Oct. to tell the new & improved Westgate Energy story. Importantly, there are precious few small cap oil producers that are well funded and growing rapidly.

This year’s blockbuster loan commitment is worth its weight in gold. Despite producing 259 boe/d in 1Q/25, and the Company having a market cap of ~C$10M, Westgate received a loan of up to US$25M = C$34M (US$10M drawn, maturing April 2029).

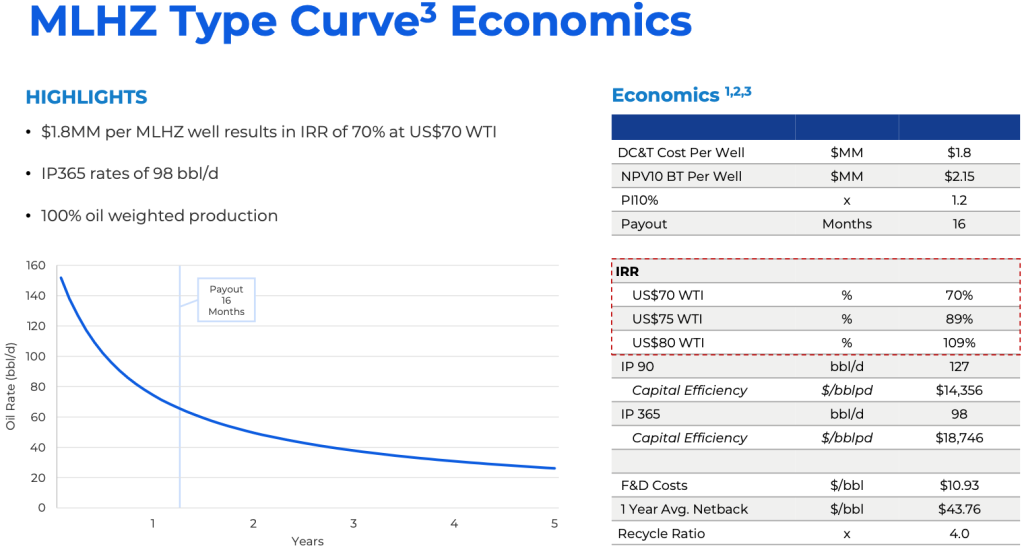

Westgate’s latest wells should flow above 98 boe/d (IP365)…

One can hardly imagine the hoops Westgate’s team had to jump through to obtain such a meaningful loan based on a few hundred boe/d!

Why should readers care about Westgate Energy? Led by a strong team, it’s in a great jurisdiction, is growing very rapidly, and is fully-funded (subject to ongoing, but expected, approvals from the lender) into at least 1H 2027.

It has enough drill locations to thrive without an urgent need to acquire new land, giving it time to negotiate better deals. This drilling success gives vendors of properties a lot more confidence they will receive future production royalties from Westgate.

Westgate Energy (TSX-v: WGT) / (OTCQB: WGTFF) just delivered excellent well productivity results and is one of the fastest growing publicly-listed producers in North America. Readers are encouraged to visit the website and view the corporate presentation. I believe Westgate offers a tremendous risk-adjusted investment proposition.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Westgate Energy, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Westgate Energy are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Westgate Energy was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply