Few metals & mining sectors are as out of favor as lithium (“Li“), the opposite of silver & gold. The top quartile of ~400 gold companies I track is up +525% from respective 52-week lows.

Why would anyone invest in a Li junior given the following chart? Yet, Li demand is widely expected to grow +10-15%/yr. How can demand be so strong, yet prices so weak?

Battery-quality Li carbonate in China, 73,550 yuan/t = US$10,325/t

Pricing is depressed due to China enabling and encouraging excess supply, but this is a temporary state of affairs. This year, demand is stronger than expected. Rho Motion reported EV sales up +25% YTD through August.

Meanwhile, led by China, stationary battery energy storage systems (“BESS“) are growing 50%+. I feel strongly Li prices will rebound above 150,000 Chinese yuan/tonne, (vs. the late-2022 high of ~600,000 yuan), within two years. Note, 150,000 yuan is US$21,060.

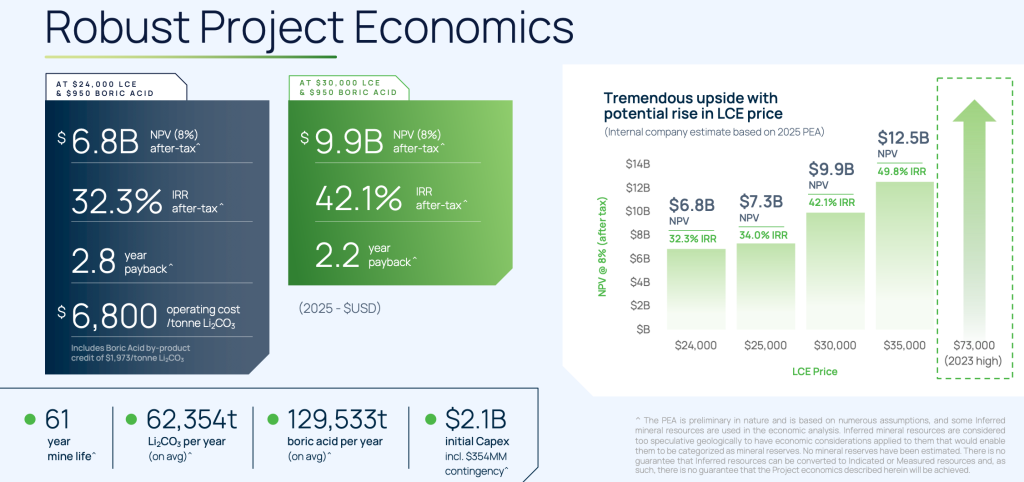

Is a rebound to just 25% of the late-2022 high aggressive? What gives me conviction? Most Li projects are not viable < $20,000/t. Many probably need $24,000/t due to meaningful cost inflation from PEA/PFS/BFS reports done in 2020-2024…

In the past four years, 20 Li studies used US$20,000-$30,513/tonne LCE, with a median of $24,000/t, driving a median post-tax IRR of +25.6%.

It would be nearly impossible to overstate the importance of Lithium Americas’ (LAC) share price gain in the past month of +180% on the news that the U.S. gov’t is getting a 5% equity stake + a 5% ownership in LAC’s JV with GM.

Despite weak pricing and most Li juniors in a world of pain, the following players — with U.S. projects — have tripled from 52-week lows. On average, Standard Lithium, Lithium Americas, ioneer ltd., American Lithium, Jindalee Resources, and Anson Resources are up +225%.

LAC’s Thacker Pass project [“TP“] (its sole asset) is valued at roughly C$4 billion on a 100% basis (assuming LAC retains a pro forma 56% [direct + indirect] economic interest, GM 36% and the U.S. gov’t 8%).

This LAC news is a clear signal that permitting for TP should go fairly smoothly, leading to production in 2H/27. Investors are speculating that other U.S. projects will get a thumbs up, and perhaps receive direct gov’t involvement (a critical stamp of approval).

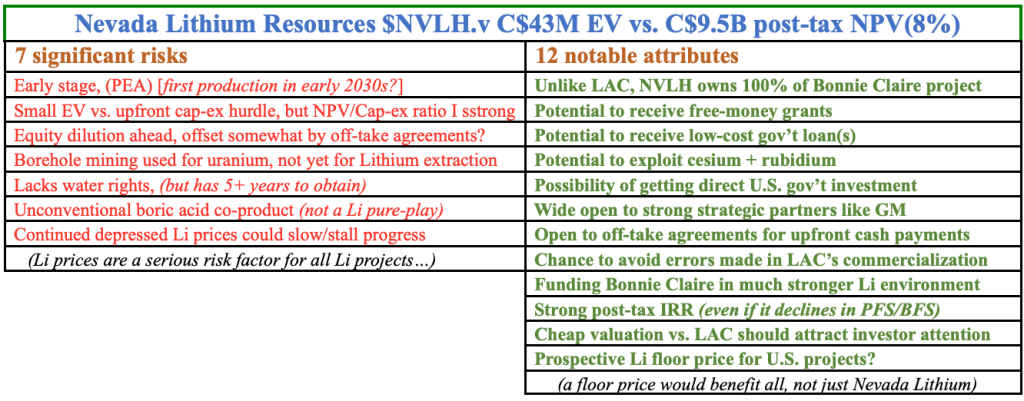

Flying under the radar is Nevada Lithium Resources {TSX-v: NVLH} {OTCQB: NVLHF}, valued at C$43M (C$0.17/shr). Like LAC it has a promising project in Nevada, albeit much earlier stage.

LAC is +170% since its news on Sept. 24th, but Nevada Lithium is only +24%, despite it recently having delivered a strong PEA, announced the *potential* to extract cesium & rubidium byproducts — and a relationship with Korean Li producer Hydro Lithium to explore technologies to do so.

Nevada peer ioneer is benefiting from the LAC news as well. It has a BFS-stage project and is valued at ~C$620M. Like Nevada Lithium, ioneer’s Rhyolite Ridge proposes to produce Li + boric acid.

Just because LAC, ioneer & others with U.S. projects are soaring doesn’t guarantee that Nevada Lithium will, but the odds of it attracting strategic investors, off-take partners, and/or acquirers have meaningfully improved.

On a relative value basis, I believe Nevada Lithium is cheap vs. LAC, as 100% of TP is valued at ~93x that of Nevada Lithium. Note, I don’t think TP is overvalued.

Below are seven significant risk factors, but management has 5+ years to work through them. In my view, none are insurmountable if the Company is able to prudently follow in the footsteps of LAC.

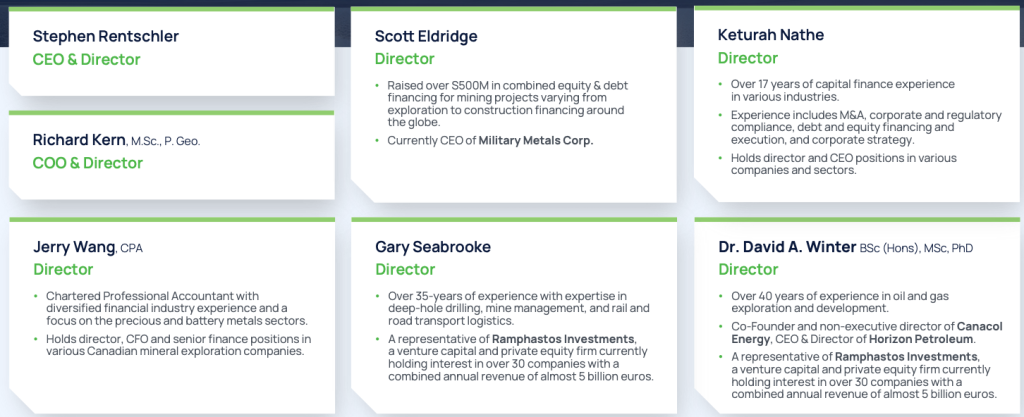

The following CEO interview of Stephen Rentschler provides insights into the Li world, especially in Nevada & the U.S. Nevada Lithium is under-appreciated, but with Lithium Americas blazing a path forward, Nevada Lithium has a real chance of success at a tiny fraction of LAC’s valuation.

Stephen, please give readers the very latest snapshot of Nevada Lithium Resources.

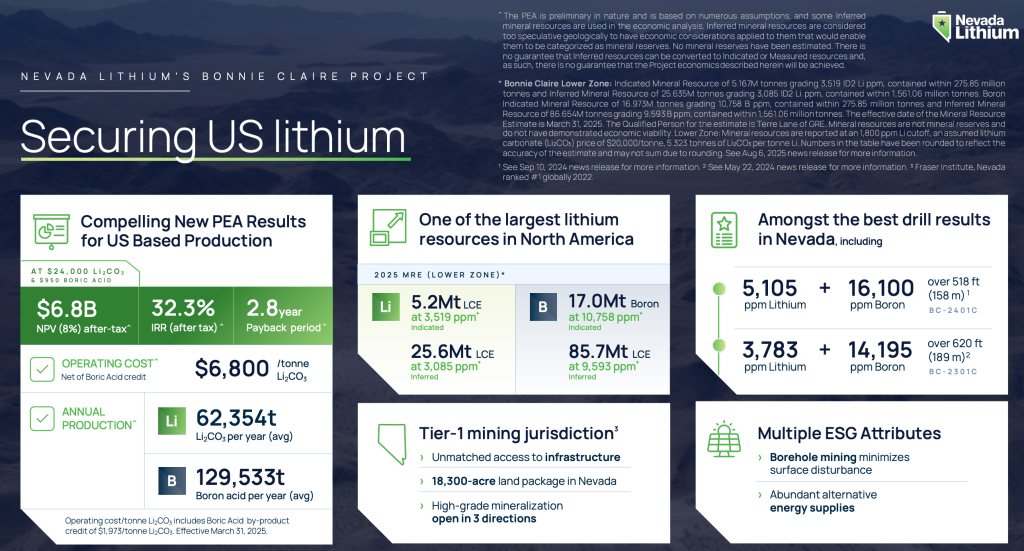

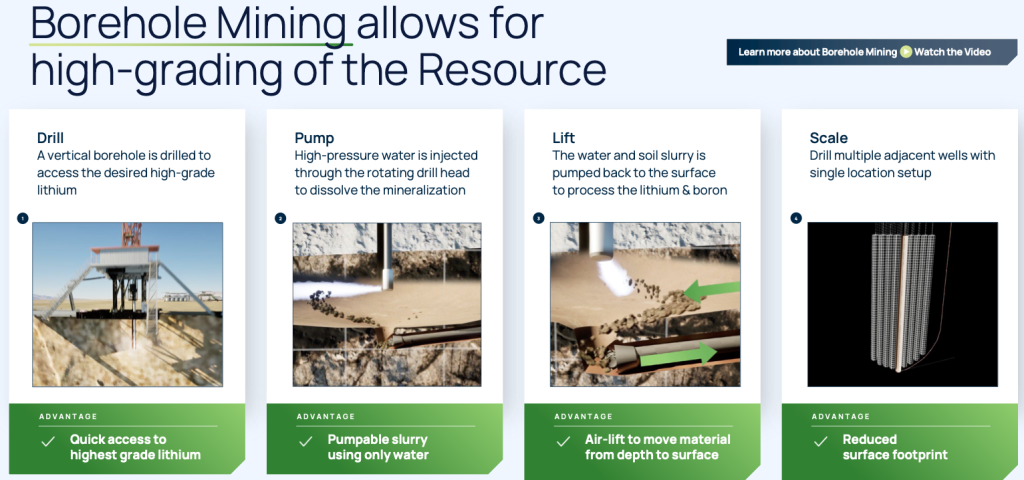

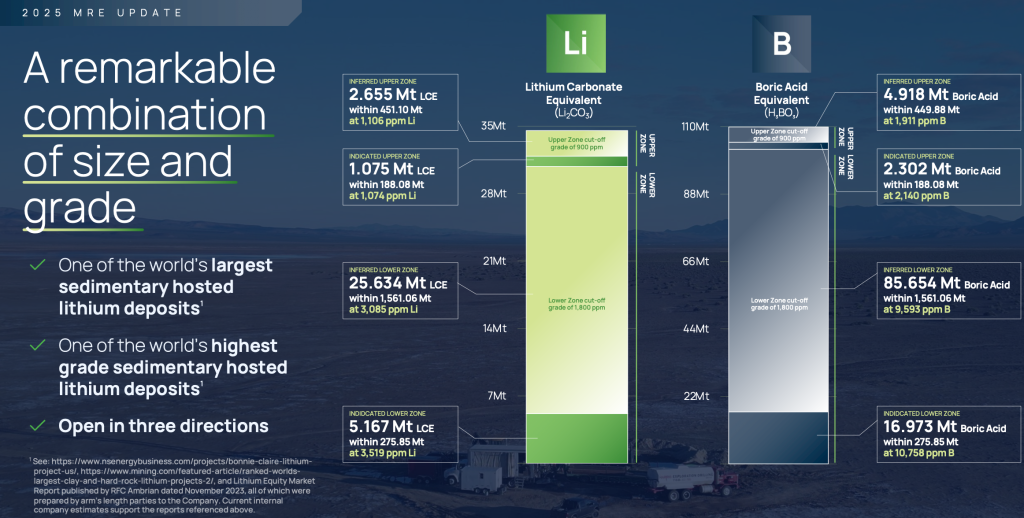

Nevada Lithium is developing the Bonnie Claire Li/boron project in Nye County, Nevada – three hours NW of Las Vegas. The project is massive, larger than Manhattan Island. It has the second largest Li resource in the U.S., trailing only Lithium Americas’ Thacker Pass.

A defining characteristic of our resource is the combination of high grade (for a clay-hosted resource) + high tonnage. We’re not finished with exploration, either. The resource remains open in three directions for substantial distances.

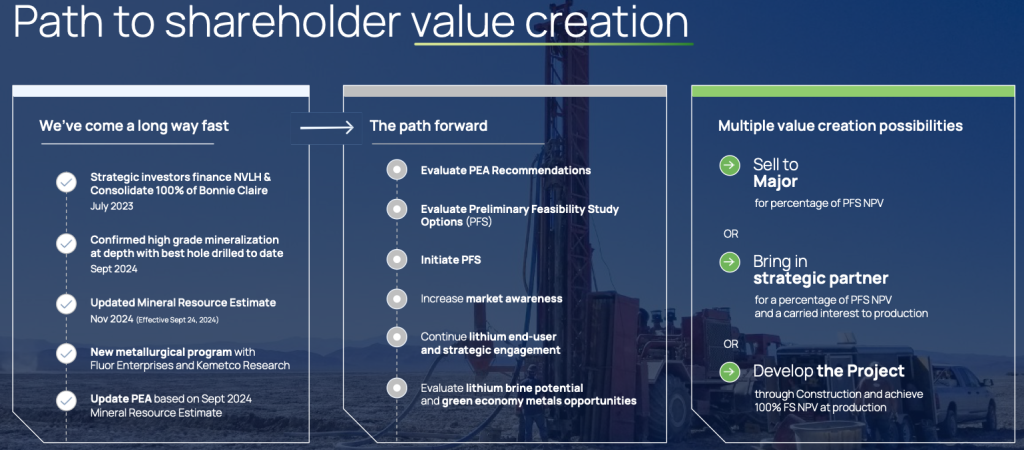

We think the opportunity to make this resource larger, should we want to, is real and straightforward. A few months ago, Nevada Lithium completed a Preliminary Economic Assessment (“PEA“) on Bonnie Claire.

The outcome was superb, with robust investment metrics generated from a 61 year mine life, forecast to produce over 62,000 tonnes of Li carbonate and 129,000 tonnes of boric acid annually. Other headline numbers are; a US$6.8 billion after-tax NPV(8%), a +32.3% post-tax IRR, and a 2.8 year payback period.

In my opinion, these metrics, coupled with a strong NPV/Cap-ex ratio, low capital intensity, and very favorable mining jurisdiction present a tremendous investment opportunity. We recently began examining the potential to generate additional revenue from Bonnie Claire.

This could occur through the recovery of other materials on the U.S. critical minerals list. We know that cesium & rubidium exist not only in our ore, but in our pregnant leach solution, which we believe is a strong indicator of potential recovery.

We entered into a relationship with Hydro Lithium, an established Korean Li producer with technology that might be able to unlock further value in Nevada via the economic recovery of additional elements like cesium & rubidium. There’s a decent chance this relationship could grow substantially.

Battery-quality Li carbonate & hydroxide prices need to double to get the vast majority of pre-construction projects into production. What are your thoughts on pricing?

I agree with your assessment. Despite volatility in individual demand components for Li, the forecast in 2030 is for 2.5 to 3.5M tonnes of LCE. Based on Nevada’s geological endowment, and it being a perennial top mining jurisdiction, Nevada’s clay projects should become the centerpiece of U.S. production.

If you believe in the need for additional sources of Li, and that Nevada will play a meaningful part in providing that production, looking at assumed pricing from technical reports of peer projects provides excellent information

Over the past four years, the average & median price assumption is ~$24,000/t. It is understandable that investors want to apply current pricing (around $10,325/t) to development projects to ascertain project viability.

However, I believe this approach is only valid for mature sectors. For a nascent industry like Li, current prices are not illustrative of the future, particularly as robust demand growth seems all but certain.

Current pricing is the result of short-term oversupply, and Chinese price manipulation to protect its producers. China’s actions are not new in the natural resources world.

Boron won’t make/break Bonnie Claire, but a nice by-product…

If the we want to transition to EVs, distributed energy solutions, and AI data centers, prices must be high enough to generate the risk-adjusted returns necessary to attract investment.

In my opinion, long-term prices must be at least $25,000/t. In that pricing environment I am willing to stack up Bonnie Claire’s metrics against any project in Nevada, and against many low-grade western Canadian DLE/brine projects- but that’s a discussion for another day.

Year in and year out, Nevada is ranked among the best three places in the world to develop a mine. The importance of this can’t be overstated.

Big news in September caused Lithium Americas’ (LAC) share price to triple. Its market cap is now ~C$2.8B! How relevant is LAC’s news to Nevada Lithium?

The LAC news is tremendous for us and other companies with U.S. natural resource projects. Everyone’s counting on Thacker Pass to deliver proof of concept in Nevada-based Li clay projects, and it should happen within just 2-3 years.

There remains an element of “show me” by investors with regard to Nevada-based projects. From my first day as CEO at Nevada Lithium, I have maintained that the lack of clay-based Li production is not a function of technical difficulty, clay-based production wasn’t needed.

The increasing global adoption of EVs & stationary battery energy storage systems (“BESS“) is changing that. Initially, S. American brine projects, and hard rock producers in Australia & Canada, then DLE projects were viewed as the logical providers of incremental supply.

However, many end-users regard DLE as a panacea for massively increasing demand, it’s not. Proponents of DLE have as much “show me” to provide as Thacker Pass, and similar projects like ours.

Although projects in Nevada are unique, Thacker Pass will be a de-risking event for certain facets of every project – perhaps aspects of metallurgical recovery, or the ability to build a workforce, or logical, reasonable steps to facilitate permitting.

Perhaps most importantly, the LAC news shows the keen interest the U.S. government now has in its domestic Li industry.

Federal involvement with Thacker Pass, and hopefully other Nevada projects, will certainly help infrastructure get built, which will benefit us all.

Given Bonnie Claire’s lithium price assumption in its PEA, which is the same or very close to most peer projects, how is the post-tax IRR so much higher than others?

I believe the key to our superior economics is the high grade of the Li resource. Not only do we have the second largest clay-hosted Li resource in the U.S., we have the highest grade of any clay project that we’re aware of.

We have hundreds of feet of ore with Li grades approaching the lower end hard rock Li grades. However, our tonnage is an order of magnitude larger than most hard rock projects.

This helps illustrate the interaction of scale and grade at Bonnie Claire, why it is such a unique and valuable asset with superior investment metrics.

The high grade contributes to our very high IRR in a few ways, but a way to think about it is that we are able to spread most of our capital costs, mining costs, and some recovery costs over more pounds of Li per ton of dirt mined & processed.

Our project is designed for 8,000 tpd of material at > 4,000 ppm Li. That gives us a tremendous advantage over clay-hosted Li peers working with significantly lower grade material. This advantage shows up as a very large Li production rate for our size.

This is illustrated by our low capital intensity ratio. On a dollar per lb. of production, the cap-ex required to build Bonnie Claire is much lower than almost all Nevada-based clay peers.

Because our Li production is so high for the given rate of mining & processing, Bonnie Claire is forecast to generate about a billion dollars a year in EBITDA over a 61 year mine life.

This results in a rapid payback of capital, a very high after tax NPV, and excellent IRR of 32.3%. We should not overlook the positive contribution from our boric acid by-product which drives a cost reduction of almost $2,000/t of Li carbonate.

On a revenue basis, the overall contribution comes overwhelmingly from Li at ~94% of total revenue, but boric acid helps separate us from the pack.

Please explain the importance of the non-binding LOI with Korean-based Hydro Lithium Inc.

I am very excited about our relationship with Hydro Lithium. Hopefully, our LOI is the beginning of a journey that could provide significant value for Nevada Lithium in a number of ways.

The relationship also highlights increasing global awareness of the potential significance of our project, and the potential for evolving technology to make additional contributions to our already strong PEA economics.

I am impressed with the thinking and background of my counterpart, Dr. Chon. His tenure with POSCO, the largest Korean steelmaker and a Li producer, was marked by great success.

Dr. Chon is credited with developing the Li extraction process used by POSCO and holds numerous patents. The hope is that a variant of his developed process could contribute to additional positive economics through a reduction of costs, or additional revenue streams at Bonnie Claire.

It is not lost on either of us that the Republic of Korea has committed to significant investment in the U.S. The application of Korean-developed technology on a world class U.S. asset, would significantly increase the chances of our bringing Korean industry or government involvement to Bonnie Claire.

DISCLOSURES — Peter Epstein of Epstein Research [ER] owns no shares of Nevada Lithium Resources, but might acquire some in the open market in the future. [ER] has no existing or prior business relationship with Nevada Lithium or its management team/board/advisors. However, Mr. Epstein / [ER] hopes to retain Nevada Lithium as a paying advertising client in the near future. Mr. Epstein is therefore biased in favor of Nevada Lithium, and this article/interview should be read with that in mind.

Readers are highly encouraged to carefully read the seven significant risk factors above in the table (4th image from top of page) along with the Company’s attributes. I believe these risks are manageable, but anything can happen with junior mining companies like this one. If Li prices do not recover in the next year or two, all bets are off!

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply