Arianne Phosphate (TSX-V: DAN) / (OTCQB: DRRSF) provided a brief but powerful press release on November 3rd. In it, management updated investors on significant new developments at its 100%-owned Lac à Paul phosphate project in Québec, Canada. Arianne has been attracting the attention of a number of Li-ion battery & Electric Vehicle (“EV”) companies.

According to the press release, “following preliminary test work conducted in collaboration with several battery industry participants, the Company will now be sending out its high-purity phosphate concentrate for more detailed analysis.”

This is great news as it allows prospective off-take partners to test Arianne’s phosphate concentrate in high-end applications, most notably LFP batteries. The words battery industry participants suggests that management could be working with either battery or EV makers, or both. Exciting times!

In addition to Tesla & several Chinese OEMs, Volkswagen, Daimler, BMW, Kia, Ford, GM, Stellantis, Volvo & Hyundai have expressed interest in LFP technology. With battery / OEMs leading the charge, R&D into new LFP formulations & uses is sure to follow.

As a reminder, Arianne Phosphate already has long-term off-take agreements in place with a few fertilizer companies, but well under 50% of output is spoken for. New off-take deals might be for specialty products sold into the battery market that might command higher prices.

One of the reasons why LFP batteries are gaining traction is that they’re cheaper. Today, Arianne’s world-class phosphate concentrate would sell for ~US$210-$225/tonne into the fertilizer market. Due to Lac à Paul‘s high grade & low impurity profile, it’s valued ~40%-50% higher than benchmark prices.

Compare that figure, (a few hundred USD/tonne), to the cost of cobalt, lithium & nickel, each in the US$10s of thousands USD/tonne. This is critically important, it means phosphate concentrate prices will never be a serious constraint on Li-ion battery production.

Even though phosphate demand for LFPs will remain a small percentage of the total market, Arianne hopes to sell a meaningful portion of its concentrate to battery makers. LFP batteries were not even a thing when the Company’s BFS was completed in 2013. The blue-sky possibilities here are immense.

Also from the press release, “This next stage of testing has been designed to meet specs provided by a Major battery producer by way of a MOU, and through an independent facility that’s a producer of purified phosphoric acid.”

More great news, an independent testing facility and a Major battery maker will be working together with Arianne’s team to process, refine, optimize Lac à Paul‘s phosphate concentrate.

Since it’s a “Major,” I imagine it could be one of these nine; Panasonic, Samsung SDI, LG Energy Solution, CATL, SK Innovations, BYD, Envision AESC, BASF or Mitsubishi/GS Yuasa. I have no idea if it’s any of those, but soon the world’s battery, precursor & cathode producers will know Arianne’s name.

Getting materials qualified by endusers is a long, methodical process that can take 12-24 months. By starting down that path Arianne is addressing a key operational milestone.

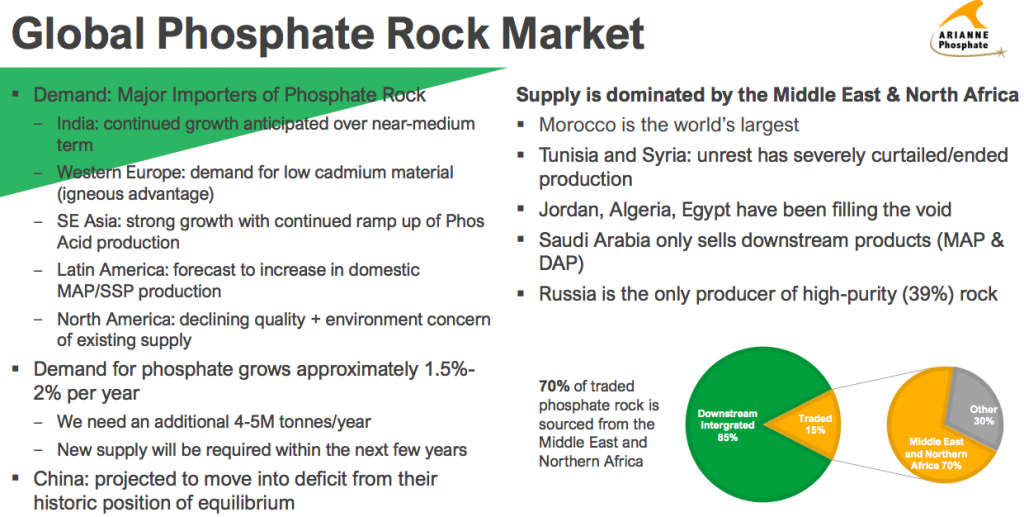

There are three huge developments in the otherwise boring phosphate rock market this year alone that should keep top-quality, clean phosphate concentrates in high demand for years to come. First, there’s the big news out of China, the #1 or #2 largest exporter of fertilizers into major markets incl. Brazil, India & the U.S.

China is tightening its control over fertilizer exports, especially those containing phosphate. Some are calling it a ban, on exports through June-2022. It’s actually more nuanced than that, but suffice it to say — endusers are nervous and prices are rising.

Will Chinese exports resume in July 2022? Might exports be suppressed again in 2023 or 2024? Note: {as I write, there are rumors on Twitter that Russia will soon be restricting some fertilizer exports}.

In other really big news, Tesla announced that a type of Lithium-ion battery used in small-sized EVs — the Lithium Iron Phosphate (“LFP”) battery — will be used in more of its models across more regions of the world. The third big development is the emergence of INFLATION, which is typically good for commodity prices & hard assets.

A year ago, LFP batteries were only in some low-end cars in China & Europe. With Tesla’s latest announcement, they will be rolled out in both small & medium-sized, plus low & medium-end models around the world. Instead of ~15% global LFP penetration in EV batteries, by 2030 LFP’s market share could be 30%+.

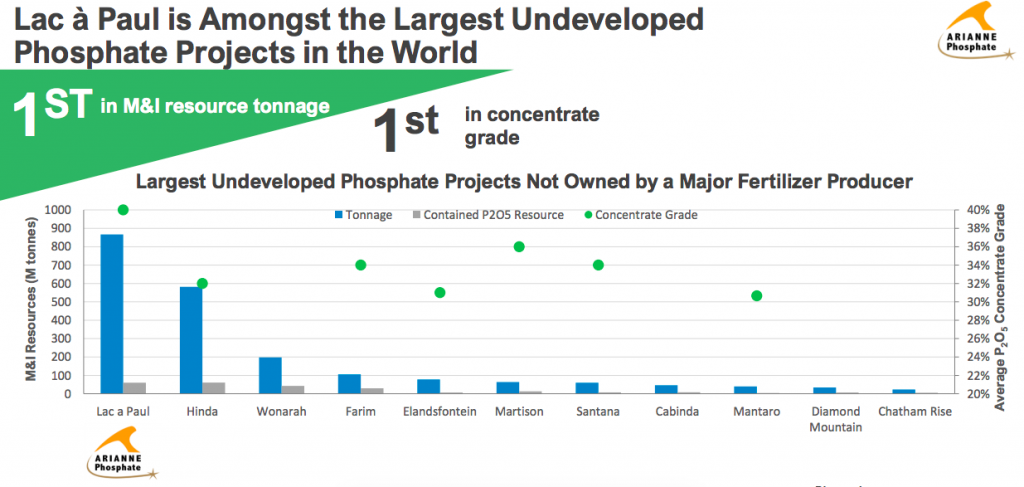

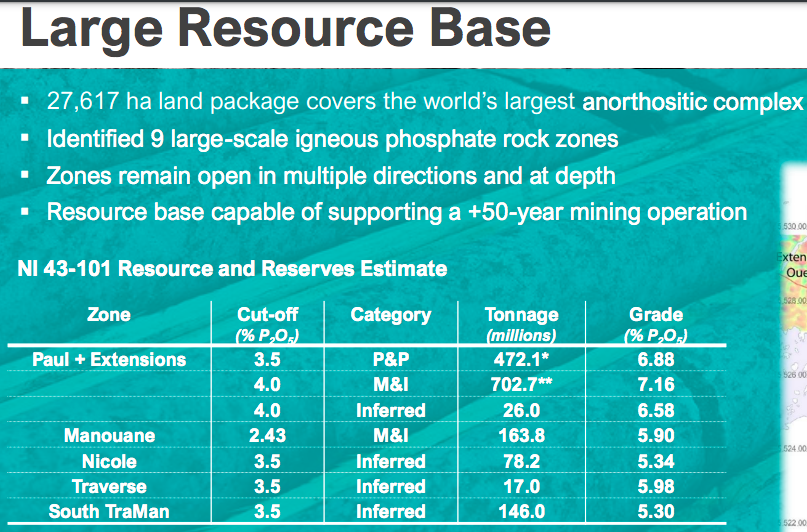

However, not all phosphate concentrates will make the battery grade. Arianne owns 100% of one of the largest, cleanest, highest grade phosphate projects in the world. Located in the province of Québec, it’s fully permitted & shovel-ready, awaiting additional off-take arrangements & then funding commitments.

In the above chart, Arianne’s 100%-owned Lac à Paul is the largest, and has the highest grade concentrate of any project not owned by a Major. It’s also one of the most advanced, with two long-term off-take agreements in place & good relations with local communities & First Nations.

Québec is well known for its collaboration with local investment funds, provincial agencies, First Nations & universities on wide-ranging R&D initiatives, plus funding packages for pre-revenue technology & mining companies.

Less well known, but well underway — Québec plans to be a significant regional EV & Li-ion battery manufacturing / recycling hub. For instance, there are a growing number of lithium projects in the province. Critical Elements has a DFS-stage hard rock Li project and a ~$336M valuation. It’s trading at ~46% of its NPV(8%).

Rock Teck has a PFS-stage Li project in Ontario and a hydroxide conversion plant project in Germany. The value of just the hard rock Li play is ~$226M, or ~79% of its NPV(8%). Piedmont Lithium has pre-construction, unfunded hard rock projects or interests in projects in the U.S., Canada & Africa. It’s trading at ~56% of its share of combined NPV(8%)s.

Despite Arianne’s project being fully-permitted, with off-take agreements in place for a portion of production, a robust DFS, and numerous operational enhancements made after the DFS was delivered — it’s trading at just 8% of its after-tax NPV(8%). Top quartile DFS-stage copper, gold, lithium & uranium projects routinely trade at ~40%-80% of NPV.

With Lac à Paul management proposes to produce & sell 3M tonnes/yr. of concentrate into a ~200M tonne market that’s growing by 1.5% 2.0%/yr. {perhaps 2.0% – 3.0%/yr. with LFP battery demand}.

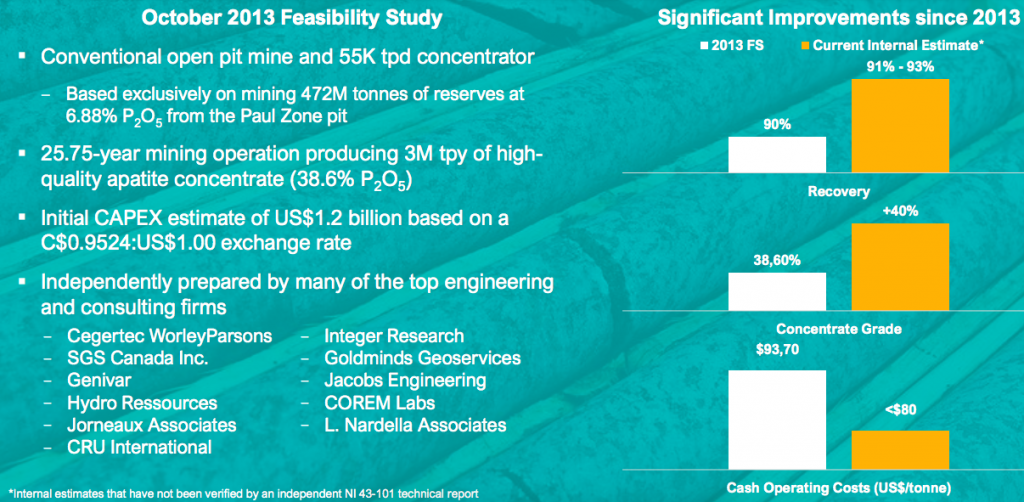

Arianne delivered a strong BFS in 2013, but the economics are meaningfully better today. Leaving pricing the same, recoveries are up to ~92% from 90%, the concentrate grade has been improved to ~40% from 38.6%, and op-ex is down by 15%.

That BFS, if updated today, would generate a notably higher NPV & IRR. For example, the US$/C$ exchange rate has moved significantly in the Project’s favor. Trucking logistics have been streamlined, reducing costs & transportation emissions.

Combined, these enhancements would increase the NPV by hundreds of millions of dollars with minimal increase in cap-ex. If a meaningful amount of higher margin specialty phosphate products could be incorporated into the financial model, all bets are off.

An extra US$25/t in pricing would be nothing for a Major fertilizer or battery maker, but it would be huge for Arianne. According to the DFS, “The sensitivity analysis showed that for each $1/t improvement in cash margin, either through higher price or lower operating cost, the pre-tax NPV(8%) increases by ~$17 million.”

Near-term catalysts include new off-take agreements, updates on the Company’s phosphate concentrate testing with battery industry participants, plus news on funding discussions (debt + royalty / streaming + vendor financing of mining equipment) & possible upfront payments for off-take.

Management believes that with the help of various groups in Québec, it can raise ~75% of total upfront cap-ex through non-equity sources. If true, Arianne could sell a minority interest in its 100%-owned Lac à Paul project to fully-fund its share of cap-ex, mitigating the need for large equity raises going forward.

It seems that a lot of the heavy lifting has been done. Several more de-risking milestones should be achieved over the next year, upon which time Arianne Phosphate’s valuation relative to its NPV could be a multiple of the current 8%.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Arianne Phosphate, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Arianne Phosphate are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Arianne Phosphate was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)