I’ve been invested in & writing about Portofino Resources (TSX-V: POR) / (OTCQB: PFFOF) for years. Back in the day it was a pure-play Lithium (“Li”) junior with several Argentinean brine properties.

Now, Portofino controls 100% of a single brine project in Argentina, and has picked up several gold properties (+ a hard rock Li/REE property) in Ontario, Canada.

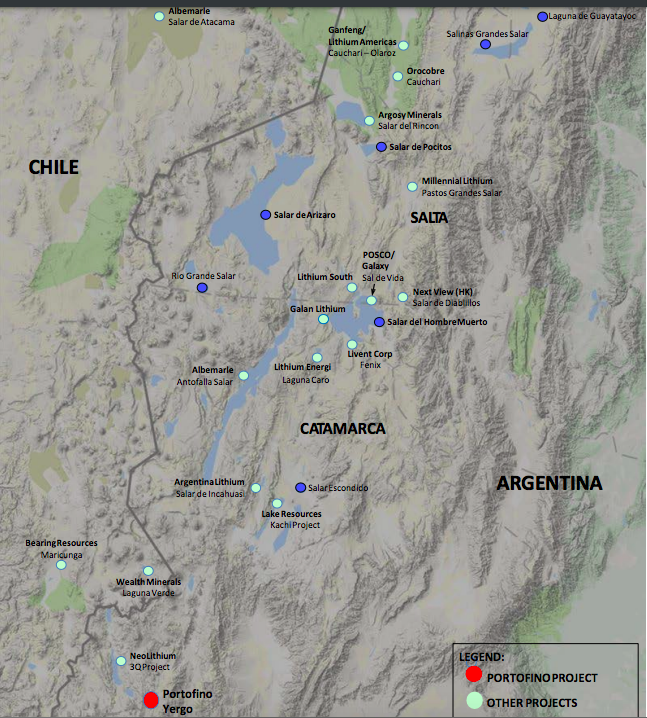

While investors should be excited about the Canadian Li/REE & gold plays, all eyes are on the 100%-controlled 2,932 hectare Yergo project in Catamarca province, Argentina. Drill permits are pending (they’ve taken longer than expected due to COVID-19, Christmas break & provincial elections).

In Mar. 2016 & Sept. 2017 the spot price of Li carbonate (in China) peaked at 171.5k & 171.0k yuan/tonne. Now look at it! Today’s level is comfortably more than double those twin peaks!

Inexplicably, Portofino’s market cap of C$11M (C$0.12/shr.) is valued below what it was in January 2018. Yet, the Company’s prospects are now much stronger, driven by global EV penetration growing from ~2% in 2018 to an expected ~10% in 2022.

If management can deliver reasonably good maiden drill results, Yergo alone could be worth C$10’s of millions. I will circle back to that estimate later.

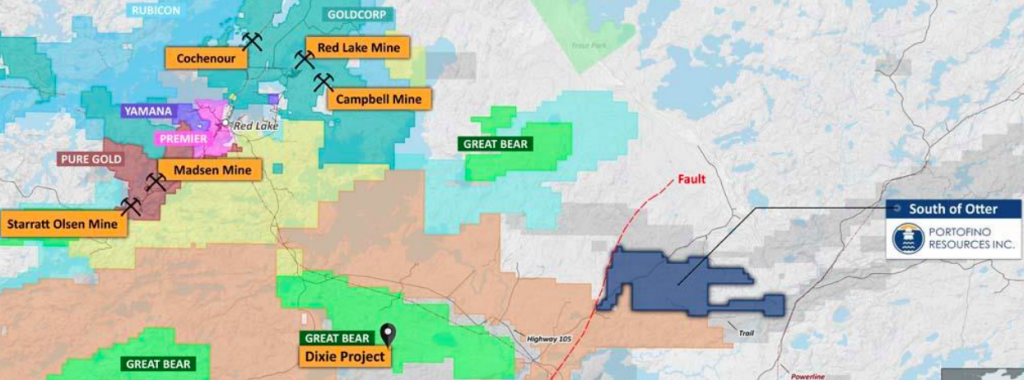

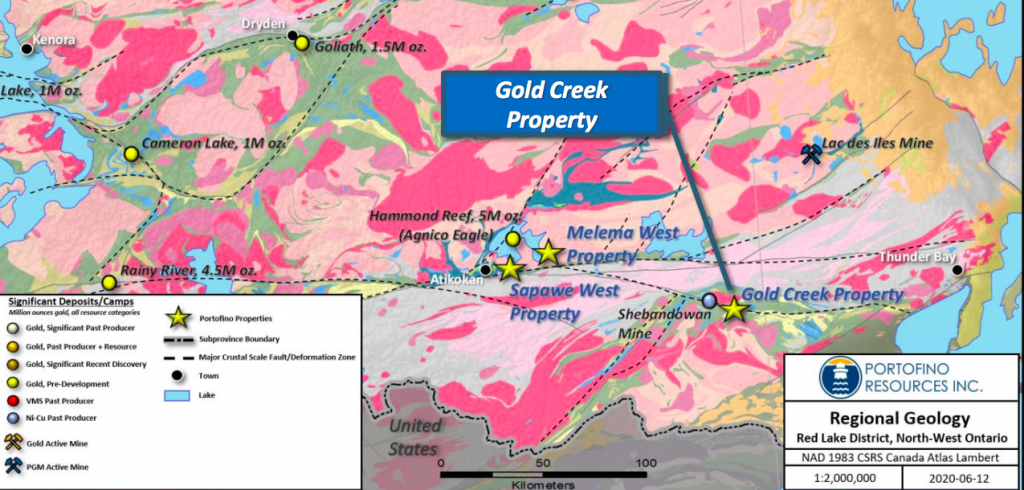

In northwestern Ontario, Portofino has five gold properties. The most advanced are South of Outer (“SOT”) & Gold Creek (“GC”). SOT is < 10 km east of Great Bear Resources’ [GBR] Dixie project in the Red Lake district.

Kinross Gold has offered to buy GBR for C$1.8 billion, an impressive bid given that GBR has yet to publish a maiden resource.

Historical work at SOT includes prospecting, sampling, geophysical surveying & drilling. In August 2020, management reported high-grade results from grab samples on two gold-bearing quartz veins. Samples included 18.0 g/t & 8.2 g/t gold.

Kinross joins Newmont, Yamana, Barrick, Evolution Mining, New Gold, & Alamos Gold — active in NW Ontario

At GC, historic work included multi-ounce grab samples + drill intercepts of [4.3 g/t gold over 41.0 m] & [4.4 g/t over 20.4 m]. A 1-tonne bulk sample in 2008 returned an average grade of 9.9 g/t gold. Collectively, multiple companies have done extensive exploration over the past several decades.

The gold price at $1,800/oz. is down ~$275/oz., ~13% from its August-2020 all-time high. Gold above $1,750/oz. is quite attractive for companies like Portofino who already have robust gold showings.

It shouldn’t take much drilling at SOT & GC to get an idea of what’s there and how to proceed.

Despite a strong price, gold juniors are out of favor. However, Li is in a world of its own, the spot price is up > +850%!! from its mid-2020 low, better than any other industrial commodity. To be fair, spot prices are not the same as contract prices, but they’re a good indicator of investment sentiment.

The spot price of 377,500 yuan/t equates to ~$59,300/t. Even if that price were to fall by 2/3s, it would still be ~$19,780/t, a tremendous long-term price for new projects, which brings us back to Yergo.

The Hombre Muerto salar is surrounded by at least six public companies; POSCO, Allkem, Livent, Galan Lithium, Lithium South Development & Alpha Lithium [Uranium One is investing in Alpha].

Yergo has an entire salar to itself, making it extremely attractive to a Li player, battery maker, auto OEM or miner like Zijin Mining. Zijin happens to be acquiring Neo Lithium, owner of one of the best brine projects in the world. And Yergo just happens to be 15 km from Neo’s project.

I can not overstate how close 15 km is in a country that’s 2.78M sq. km. in size. Astute readers are probably expecting me to now play the “close-ology” card. Yes, management believes there are meaningful similarities, but drill results in coming months will be key.

Since Zijin/Neo’s project is nearly certain to reach production, if Yergo is not large enough to be a standalone mine, it should still be able to send Li-bearing brine over to Zijin/Neo’s operations.

Yergo could become a valuable satellite deposit

By the end of the decade, satellite Li deposits will be commonplace in Argentina. There certainly won’t be a need for six brine processing facilities in and around Hombre Muerto!

Due to the deluge of DLE approaches, the blue-sky potential for Yergo remains intact. In the past, high grades + low impurities were an absolute necessity to advance brine operations, but with prices soaring and the promise new technologies, that’s changing.

A satellite deposit would still be a big win. If Yergo can be drilled & developed as a satellite deposit, it would save years & $100’s of millions in cap-ex, and would eliminate substantial development, funding, permitting, construction & operating risk.

Three years ago POSCO paid $280M for a pre-PEA resource, one that had low impurities & high grade. Besides Neo Lithium, most other brine stories languished — even as they delivered PEAs & Feasibility studies.

Fast forward to 2021-2022 — Rio Tinto has proposed a C$1 billion acquisition of a privately-owned project with a grade of 378 ppm Li, but with an in-house DLE technology solution attached.

Rio’s deal comes on the heals of Russia’s Uranium One planning to pay C$270M over a period of years for 50% (+100% of the off-take rights) of a pre-resource project!

How much might Yergo be worth? Arguably a lot if a company like POSCO, Rio, Zijin or Uranium One were to come over the top with a big bid. A big bid from Portofino’s point of view, a fraction of a drop in the bucket for the bidders. The project, at 2,932 ha, is large enough to host a multi-million tonne LCE resource.

How can I say that? Lithium South has delineated 561,000 tonnes LCE (so far, @ 750 ppm Li) on ~400 ha (of its 3,237 ha property). Argosy Minerals has a ~C$400M valuation for a 2,794 ha brine project in Argentina looking to start producing 2,000 tonnes LCE this year before ramping up to 10,000 tonnes. That project has an exploration target of 507k – 724k tonnes LCE.

Earlier-stage Arena Minerals is valued at ~C$160M. It has two brine projects in Argentina totaling 13,150 hectares (net to Arena). One of the projects is 35% owned by Ganfeng, and Lithium Americas owns 17.5% of that company.

Due to recent M&A & soaring Li prices, I believe that Yergo is worth > C$5M pre-drilling (call option value). And, if a few holes hit decent grade, then management is on to a real project, one that should (some day) be amenable to a DLE technology to be named later.

If CEO Tafel and team can delineate a NI 43-101 resource, each tonne of LCE should be worth at least C$50. Pre-PEA peers trade at ~C$70 – C$100+/t. So, 500k tonnes (if any are ever booked) could be worth at C$25M+.

Think about that for a moment. Tonnes of LCE in the ground, even if only in the Inferred category, worth < C$100/t when the spot price in China is > US$59k/t. Hardly a stretch!

Many much larger companies than C$11M Portofino Resources (TSX-V: POR) / (OTCQB: PFFOF) want to take shots on goal in the hottest Li jurisdiction in the world and could easily afford to pay C$25M or more for that opportunity.

Readers are reminded of the wide range of companies that would benefit from an Argentinean Li brine oasis. Chinese companies have been active in Argentina; a Korean conglomerate, a Russian uranium company, a Canadian development company…. Yet auto & Li-ion battery makers haven’t even shown up yet.

The possibilities are endless. Given what POSCO, Rio Tinto, Zijin & Uranium One are paying to enter the game, every Li hopeful, producer, or soon-to-be producer in Argentina should be all over Yergo’s 100% owned project / salar. Within months we will know a great deal more about this promising project.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)