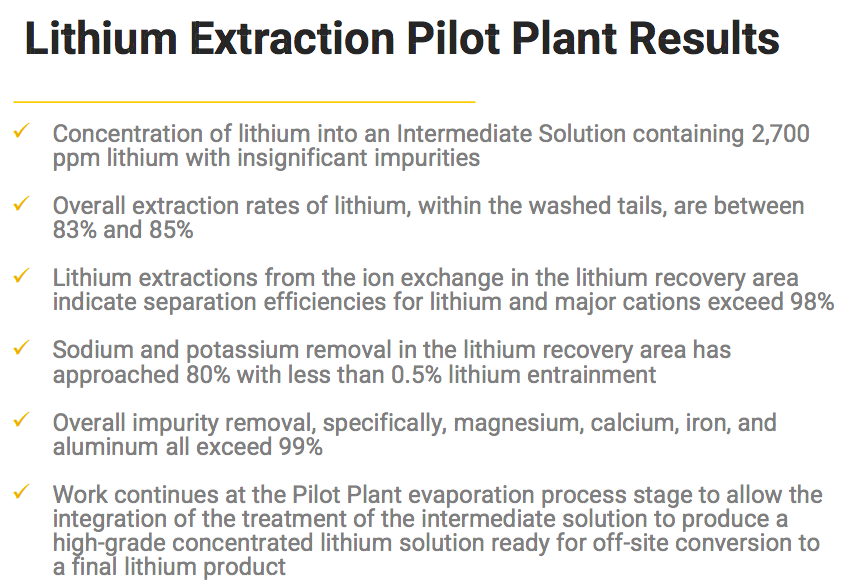

Investors had been eagerly awaiting pilot plant results for Cypress Development Corp.‘s [“CYP”]; (TSX-V: CYP) / (OTCQX: CYDVF) pilot plant in Nevada…. they were not disappointed. The main takeaway is that all key metrics are coming in within expectations. No red flags, although some delays.

For example, the Bank Feasibility Study (“BFS”) is now expected to be delivered by yearend (previously 3rd qtr.). That delay is not important to me, more critical is that the overall lithium (“Li”) recovery is coming in between 83%-85% vs. the 83% assumption in the Pre-Feasibility Study (“PFS”).

I believe the recovery rate could end up in the 85%-87% range by the time the plant is switched on. Management has years to continue enhancing & optimizing its flowsheet. After a bought-deal financing in early March, Cypress had a substantial $40M in cash in the bank.

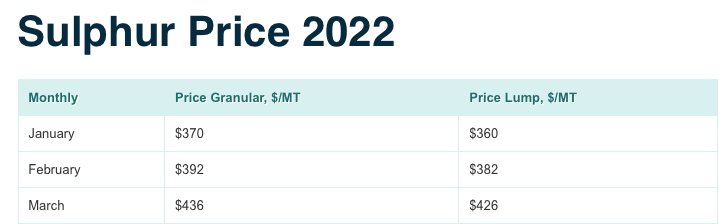

CEO Dr. Bill Willoughby mentioned the fact that elemental sulfur prices have soared. Cypress used a third-party derived US$100/t price assumption in its PFS, but quotes are now running up to 4x higher.

Even at US$100/t, the sulfur feedstock burned in a custom-built onsite sulfuric acid plant represented the single largest operating cost. Not to mention much higher trucking costs (diesel, labor, equipment, insurance) to transport > 800 tonnes/day of sulfur to the plant.

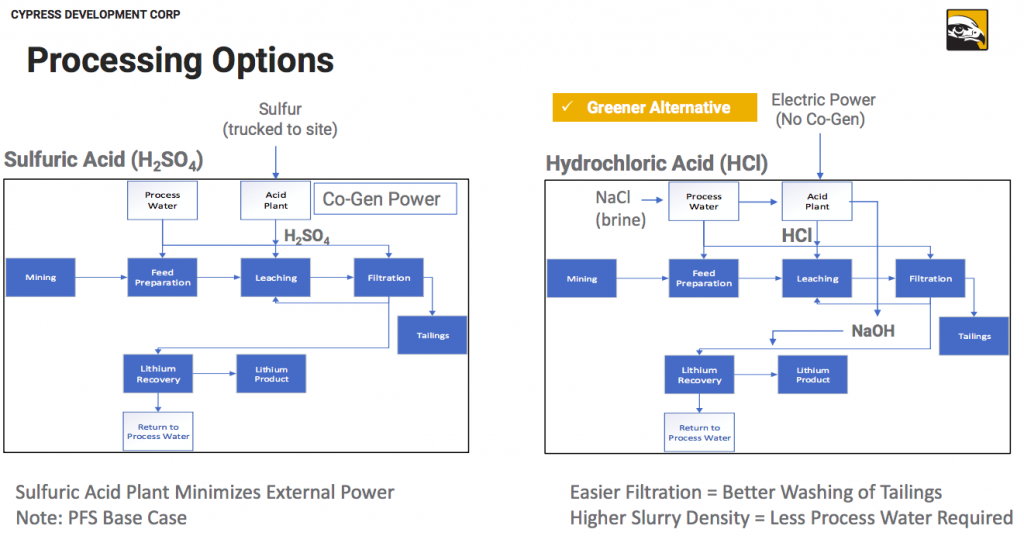

All the ESG benefits, the meaningful reduction in greenhouse gas emissions (from not having to truck sulfur), and simplified logistics — enabling the production of more Li hydroxide or carbonate/yr. — are in addition to the significant savings in op-ex (vs. a flowsheet featuring sulfur) in the upcoming BFS.

Make no mistake, op-ex & cap-ex costs are going up. That’s no surprise, inflation is impacting everyone & everything. However, Cypress is no longer facing sky-high sulfur prices. Moreover, its long-term energy costs (per kWh) might be more stable & lower than the cost of connecting to an electrical grid powered in part by nat gas or coal.

Although Cypress will be avoiding both the op-ex hit of sulfur and the US$110M+ cap-ex hit of a sulfuric acid plant, it will need to pay substantially more for power than envisioned in the PFS. That’s because waste heat from the acid plant was going to be used to generate electricity. Instead, the plan now is to use geothermal & solar energy.

I’m not overly concerned about rising costs given the incredible increase in Li prices since the release of the PFS. I believe that prices will remain = or > US$20k/t for the remainder of the decade vs. US$9.5k/t in CYP’s PFS. Although not the same as contract prices, the Li carbonate spot price in China is @ ~US$78k/t.

Dr. Willoughby stated on a March 30th investment call that, with the new ClorAlkali flowsheet, Cypress will have the flexibility to produce as much Li as it wants (annually), subject to water, tailings capacity & investment capital.

Of course, if the Company can partner with a certain giant, nearby Li company — it will have all the fresh & brine water it needs.

Readers are reminded that Cypress is facing a challenge to its water rights from an unnamed company. On the conference call the body language around this topic seemed to suggest that good news was pending this month.

Regarding water usage & the recycling of process water, management is pleased with the findings of the pilot plant. For example, the moisture level in the tailings has been cut to below 40%, which will enable dry-stacking.

Management made it clear that battery-quality Li hydroxide & carbonate HAD NOT BEEN achieved. However, the team remains confident that battery-quality Li is achievable, as soon as this qtr., once sufficient quantities of concentrated solution are produced and shipped to a third-party lab in Vancouver for upgrading.

There has been a delay in amassing the concentrated solution due to a faulty evaporator, but this incident has been known to the market for weeks. Dr. Willoughby explained that the third-party DLE technology they have licensed is working very well.

On the conference call, Willoughby was more upbeat & forthcoming than usual on the possibility of CYP’s one sq. mile geothermal lease being able to power [a portion of] the operations. That, and a solar farm. Nevada is one of the best places in N. America to tap clean, green solar & geothermal sources.

There were no red flags in the March 30th update, just a few frustrating but routine development-related delays. In my view, delays would be more painful if Li prices were weak or if CYP needed to raise cash in the next several months.

Why were Standard Lithium, Lithium Americas (“LAC”) & Piedmont Lithium up an average of 40% in the month of March? President Biden announced he will invoke the Defense Production Act to encourage domestic production of minerals needed for Li-ion batteries.

According to reports, this Act could, “help companies receive gov’t funding for feasibility studies on projects that extract battery materials, incl. lithium…” Shareholders are reaching out to management about this potential opportunity.

LAC’s Thacker Pass will be a poster boy of U.S. critical materials projects being put into production in a timely fashion. As I’ve said again & again, Cypress will learn a great deal about permitting (and obtaining other approvals / community support) by watching LAC’s & ioneer’s commercialization activities.

Finally, Willoughby mentioned government loan programs (without being asked). His team knows what needs to be done, but they’re determined to proceed in logical order. Applying for a gov’t loan for construction is a big deal, but key portions of the BFS work comes first.

There are a number of Li brine projects in Argentina that have locked into solar evaporation pond flowsheets (with ponds already built). Some teams would no doubt love to instead pursue up-and-coming DLE technologies. But, to switch now would cause years of delay and be quite costly.

Cypress Development Corp. (TSX-V: CYP) / (OTCQX: CYDVF) is the only sedimentary (clay-hosted) Li project in the world proposing to use hydrochloric acid to leach its lithium into solution. It appears to be the better mousetrap, or at least the optimal way to proceed for its particular geology.

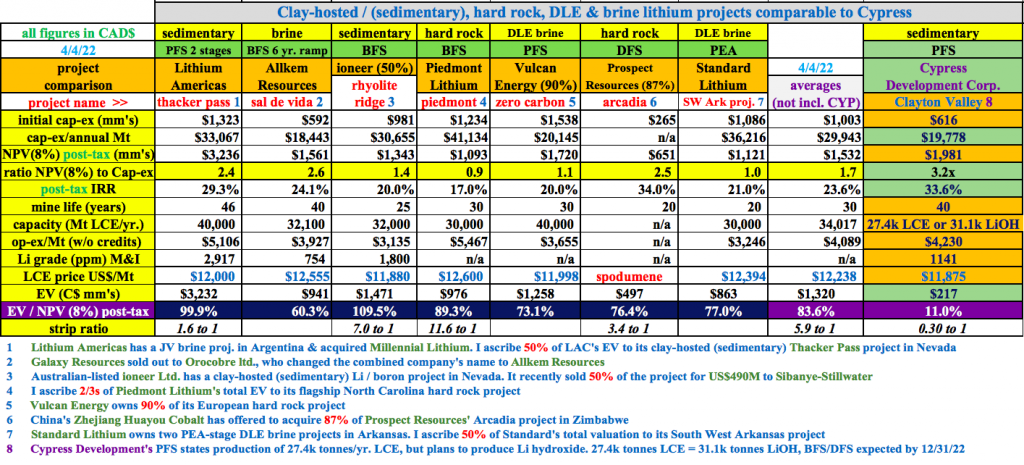

On a relative value basis, CYP’s project is trading at an 86.6% discount to the seven peer projects in the chart below. This is not sustainable over the long-term. Either peers will cheapen vs. Cypress, or Cypress will narrow the valuation gap.

With the Li sector so incredibly strong (Li spot prices at all-time highs — 11x higher than 2020 lows — EV penetration soaring), I think Li stocks will continue to move higher and CYP could be one of the top performers over 1-2 years.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CYPRESS DEVELOPMENT CORP, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CYPRESS DEVELOPMENT CORP are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, CYPRESS DEVELOPMENT CORP is a [former] advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)