For years gold & silver bulls have been proclaiming that inflation is right around the corner — coming next quarter or next year… well, it has arrived. The latest monthly reading in the U.S. was 8.5%., the highest in 41 years. The last time inflation was this high, silver hit the equivalent of ~$132/oz. in today’s dollars.

Some readers might not feel comfortable with the notion of an ATH inflation-adjusted silver price (from Feb. 1980) above $100/oz. However, consider the increases in both the timeframes & costs of [exploration, development & mining operations] over the past four decades. For example, Gasoline prices have nearly quadrupled.

Now consider the added costs of ESG mandates (consultants, time, lawyers, reports). Not to mention reclamation requirements that have become much more restrictive.

Junior Miner share prices have been decimated, should readers buy the dip?

If one agrees that the all-in cost/oz. for precious metal mining has likely tripled since the early 1980s, one can hopefully see that the silver price could easily triple from ~$21.8/oz. and not be far out of line with the long-term chart, or anywhere near that $132/oz. figure.

As I think about which precious metal companies to revisit, it strikes me that nothing can beat a current producer in a solid jurisdiction. While markets are in risk-off mode — the NASDAQ index is down 28.3% from its 52-week high, the VIX is quite elevated and Bitcoin is flirting with a 52-week low — but this could change at any time.

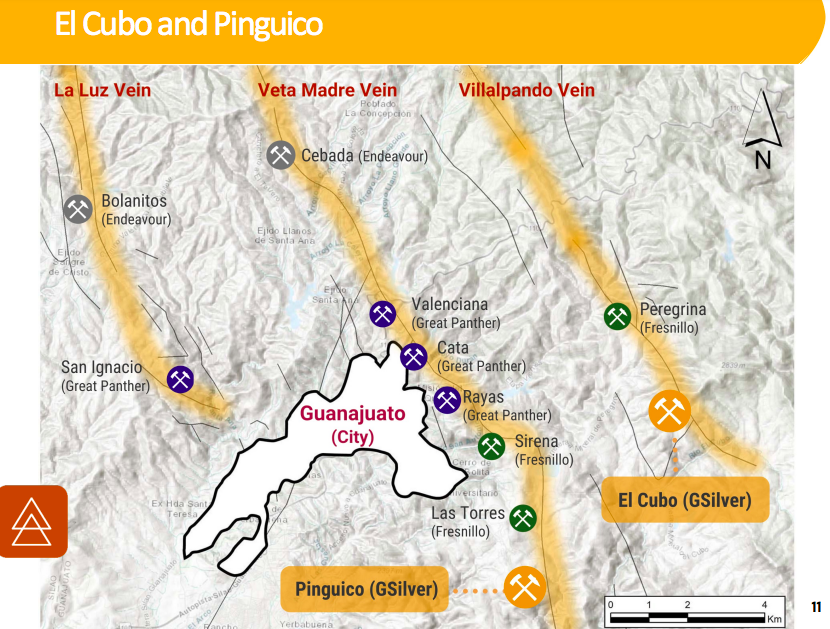

How about a company that’s growing faster than peers, with blue-sky exploration upside? Readers of my articles will not be surprised that I’m returning to Guanajuato Silver [G-Silver] (TSX-V: GSVR) / (OTCQX: GSVRF).

Since mid-April, the silver price is down by ~15.5%, but G-Siver is down 39%.

Shares under C$0.40 could represent a compelling entry point, a chance to buy the dip with the 52-week high at C$0.74. Note, this is not a Buy recommendation, G-Silver is highly speculative — it’s not suited for all investors, only those willing and able to make speculative bets.

Drill results continue to unlock valuable information on multiple orebodies

Management announced drill results on May 5th that included 2,988 g/t Ag Eq. over 0.35m (all figures are true widths). Before readers fret over the narrow intercepts, let me remind them that this is the nature of the vein systems in the district that have been mined for centuries.

One could think of the 2,988 g/t Ag Eq. figure as 1.05 m at 996 Ag Eq. [at spot prices, 996 g/t Ag Eq. = ~12.0 g/t Au Eq.]. Other strong intercepts include 647 g/t Ag Eq. over 0.30 m, 402 g/t over 0.30 m & 396 g/t over 0.60 m. Drill results from another eight holes are pending. According to CEO James Anderson,

“These results serve to build confidence in our understanding of geological controls of high-grade mineralization within the various veins and different zones of our Guanajuato mine holdings. Further, drilling at the El Cubo continues to identify mineralization that the Company can build into its near-term mining plans,”

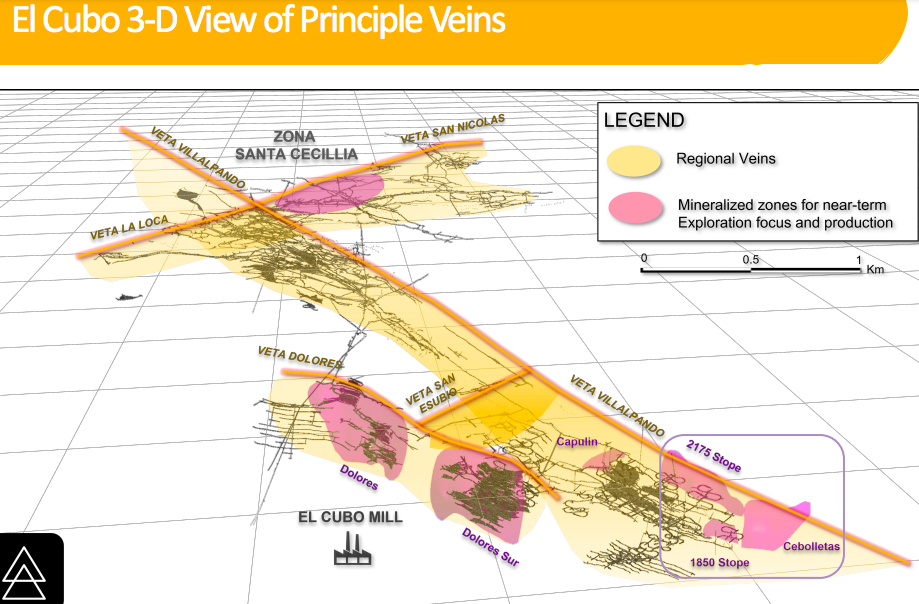

The Mexican-based team continues its infill & expansion drilling at the El Cubo Mine targeting the Villalpando, Asuncion, Tuberos & ‘680′ veins in the Villalpando & Santa Cecilia areas. G-Silver is also exploring El Pinguico’s Arroyo & Pinguico veins. In the first quarter, a total of 3,130 m in 14 holes was drilled.

Within about a month, CEO Anderson expects to begin drilling for the Mother Vein. This is something investors have been eagerly waiting for.

CEO Anderson, President/Dir. Ramón Dávila and the technical team are pleased with these results. Anderson explained to me that G-Silver can comfortably mine 1.0-meter veins, even down to 0.8 meters depending on metals pricing & operating conditions.

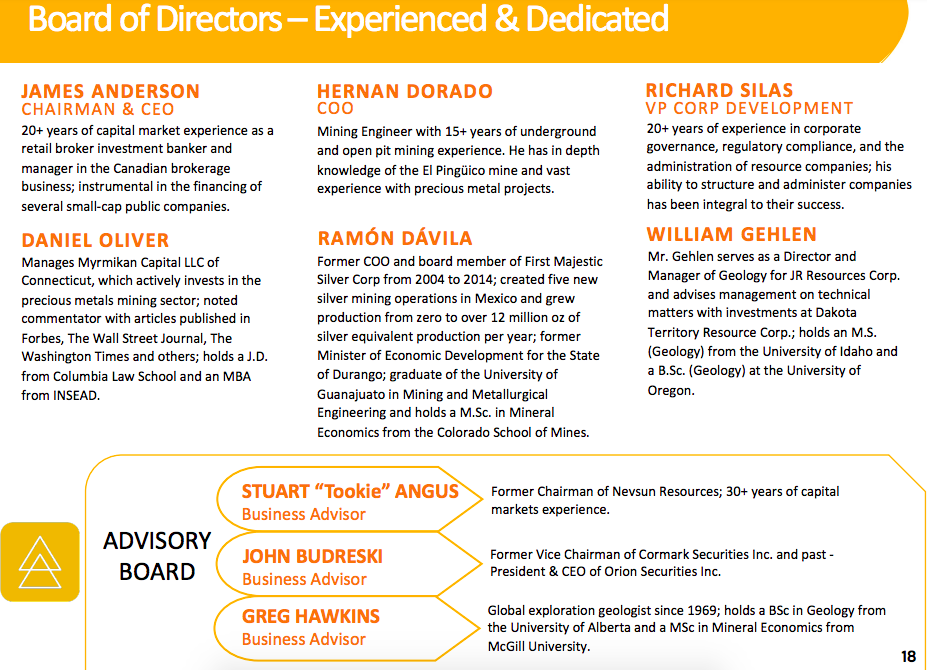

Ramón Dávila, one of Mexico’s most prominent mining execs, takes more active role as President

Having multiple sources of material gives the Company flexibility to mix lower & higher-grade ores. It’s very encouraging to see that Mr. Dávila has been appointed to the role of President following his ever-growing roles as technical advisor and then full board member.

As a reminder, Mr. Dávila was COO & Board member of First Majestic Silver from 2004 to 2014. Over that period he led a team that created five new silver mining operations in Mexico, taking the company from two to more than 4,000 employees, growing production from zero to > 12 million ounces Ag Eq.

In September 2016, Mr. Dávila was appointed Minister of Economic Development for the State of Durango, Mexico – a post he held until June-2020. Ramón graduated from the Univ. of Guanajuato with a degree in Mining & Metallurgical Engineering and a Master of Science degree in Mineral Economics from the Colorado School of Mines.

Importantly, economies of scale are going to make a modestly profitable operation quite lucrative. In 2023, G-Silver is poised to potentially go from producing roughly 1.7 (2022) to 3.0 million Ag Eq. ounces largely trough expansion of operations in the Ceballetas, Dolores, and Santa Cecilia mining areas.

Strong economics at 3.0M oz./yr. (2023) with an option on a BIG move in silver/gold

At a run-rate of 3.0 million ounces/yr., all-in-sustainable-cost (AISC) should fall under $16-$17/oz. Think about that for a moment…. in a highly inflationary world, G-Silver’s cost/oz. will be declining well into 2023. A C$10-$12/oz. profit margin on 3 million ounces next year would be great, especially for a company with an Enterprise Value {market cap + debt – cash} of ~C$104M.

Being in production NOW, vs. (possibly) reaching production in say 3 or 5 or 7 years, matters a lot if prices soar. Non-producers face exploration & development cost inflation, — with no offsetting cash flow — leading to repeated equity dilution.

Speaking of equity dilution, or lack thereof, the Company just announced a non-dilutive drawdown of US$7.5M from its silver & gold pre-payment facility. Having a strong balance sheet in today’s volatile times is incredibly important.

Therefore, unlike many junior mining peers, G-Silver does not have the immediate overhang of an equity offering at a time when its share price has been crushed.

Will G-Silver bounce back strongly with the silver price? I think it will

If/when silver rebounds, I truly believe that G-Silver’s share price will rise 2x-3x faster. If the price retraces to C$0.62 (where it was in mid-April), that would be a gain of +63% from here. I’m relying on a higher silver price, but presumably readers agree that precious metals are merely taking a break before resuming a bull market.

In addition to inflation, readers should note that the C$/US$ exchange rate now stands at 1.3:1.0. That’s good news for operations based in Canada & Mexico as precious metals trade in US$.

Guanajuato Silver (TSX-V: GSVR) / (OTCQX: GSVRF) offers the best of multiple worlds; it’s in a safe, prolific mining region, it’s in production & poised to benefit from high inflation, it has an excellent in-country mgmt. team & board. And, it has tremendous exploration potential.

Readers should seriously consider taking a closer look at G-Silver in this painful junior mining sell-off.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is a former advertiser on [ER]. [ER] hopes to get the Company back as a paid advertiser in June. Therefore, [ER] should be considered biased in its views.

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)