In the following interview of President & Director Brian Ostroff, I revisit Arianne Phosphate’s world-class shovel-ready project in Quebec, Canada. It’s hard to imagine a better scenario for global phosphate rock demand then what we’re seeing today. The benchmark price just hit a 9-yr. high and Russia’s war on Ukraine is making security of supply critically important.

The market was tight even before inflaton started to takeoff and prior to Russia’s invasion. Neither inflation nor the war in Europe is likely to go away anytime soon. Rising food/fertilizer prices will be front & center in the news for at least the next year.

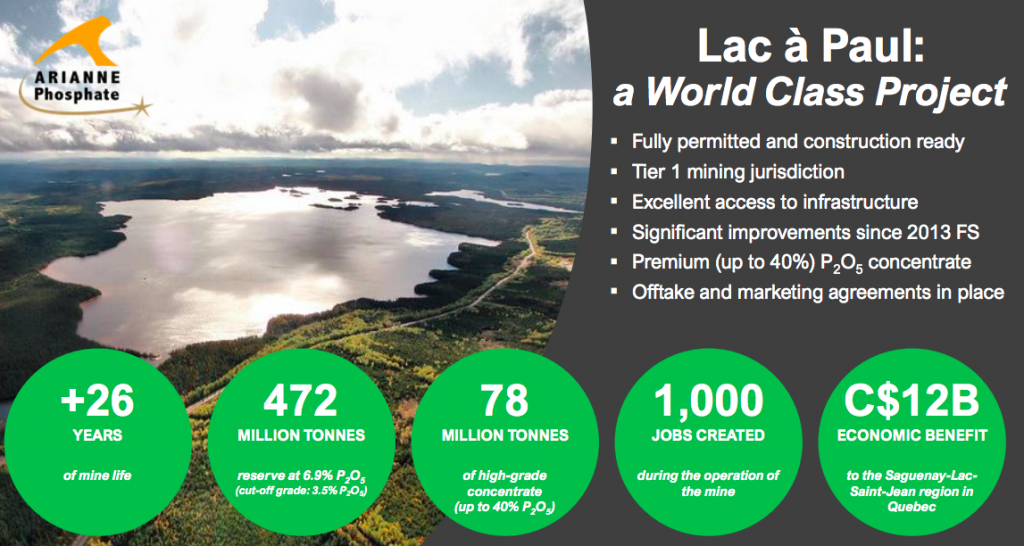

There are not many ways to play the phosphate narrative, Arianne Phosphate (TSX-V: DAN) (OTCQB: DRRSF) is one of the best. 2022 is poised to be a big year for the Company with a number of key project developments that will derisk the story further.

PE: Hi Brian, I imagine things remain very busy for you and your team, and the macro backdrop seems to be getting better for Arianne…

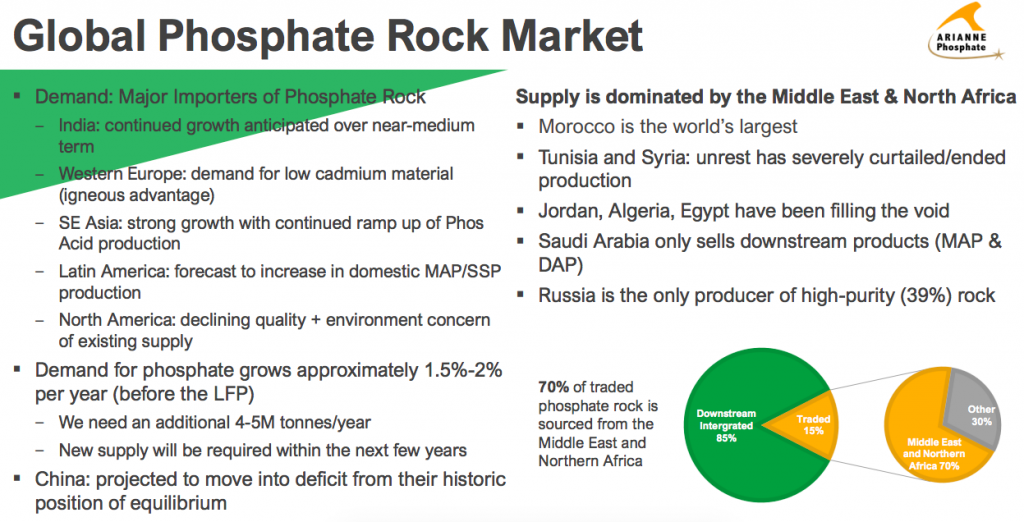

BO: Yes, fundamentals are quite strong. Phosphate rock was in a 7-year downtrend until two years ago when it reversed course and is now up about 250% from $70.75 to $249.50/tonne. [Morocco benchmark 70% BPL]. An inability to move projects forward and taking supply for granted has caught up with us. China’s export halt of phosphate fertilizers through at least June 30th and Russia’s invasion of Ukraine support the makings of a multi-year bull market.

PE: In Arianne’s Feasibility Study (FS), the long-term price assumption was $213/tonne. What’s the price today (adjusted for Arianne’s superior qualities)?

BO: Today the price for our high-purity concentrate would be north of $300/t. Unlike say gold or copper, phosphate does not trade on an exchange. Deals are done with contracts (offtake agreements), so pricing is opaque. We’re looking to produce three million tonnes a year. At $90/t higher than what’s in our FS, that would deliver substantially more cash flow to the bottom line.

PE: Arianne’s project is large-scale and comes with an upfront cap-ex estimate of $1.2 billion. How does that get financed?

BO: Good question, it’s a significant cap-ex number. That said, it’s important for investors to not only look at the cost but also at revenue & profitability. Just eyeballing it, our revenues would be $900 million/yr. and we would be very profitable, really strong margins.

With these types of numbers we think a substantial amount of our construction costs could come by way of debt, somewhere in the neighborhood of 70%. We’re also looking at royalty/streaming transactions, equipment financing, pre-payments for future offtake, with the remaining be equity.

Lastly, there’s the possibility of bringing in a partner to fund some or all of our equity commitment in exchange for a direct stake at the project level.

PE: How does Arianne tie down this funding package, and from whom?

BO. Arianne continues to have conversations with lenders and there’s a lot of interest in our project. Prospective lenders include traditional mining finance banks, Export Credit Agencies and equipment financing companies. As a very important development project in Quebec, the provincial government has indicated that they want to be part of the process.

What’s needed to unlock the financing is a few more signed offtake agreements. Basically, the banks have said they’re comfortable with the project’s specs, they just need to see customers.

PE. You already announced a couple of offtake deals, perhaps you can discuss those, and how many more are needed.

BO. Yes, Arianne met with good success when it went out looking for offtake agreements in late-2018, even though we were six years into a pricing downtrend. I think issues such as quality, jurisdiction & security of supply were important elements that separated us from the pack. Unfortunately, COVID-19 hit in March-2020 and a lot of our discussions were put on hold.

As 2021 got underway, the phosphate macro narrative had completely changed. For seven years, producers were both unwilling & unable to increase supply, yet demand continued to grow. In the past year discussions with potential offtake partners have accelerated. Our hope would be to secure the last of our required agreements by year-end.

Adding to the tightness of the market are big changes in the world’s geopolitical framework. Particularly, as it affects phosphate, China halted exports of phosphate fertilizer and Russia’s war on Ukraine has largely removed both countries from the export market. Needless to say, phosphate from a stable jurisdiction is now very much in demand.

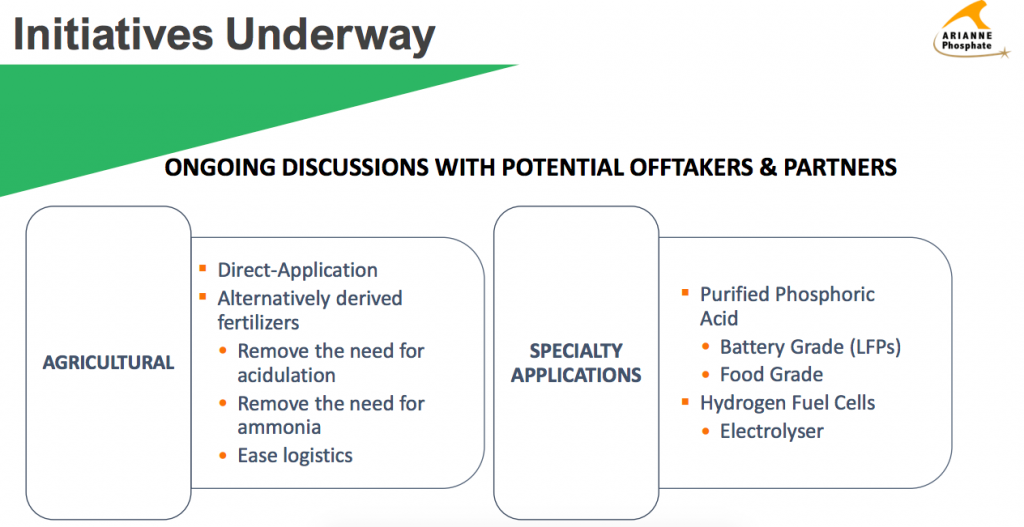

Another important catalyst is the advent of lithium-iron-phosphate (“LFP”) batteries for electric vehicles. We now have an entirely new industry looking to source premium-quality phosphate concentrate.

PE. Yes, LFP batteries could be a big deal for Arianne. Can you please give us the latest on the potential increase in phosphate demand from LFP batteries?

BO. I think it’s fair to say that the LFP battery has been established as “the” battery for most standard-range electric vehicles, (low & medium-priced sedans). In addition to Tesla announcing ever-expanding use in its models, other major OEMs such as Volkswagen, Ford, GM, BYD, BMW, Stellantis & Rivian Automotive are actively pursuing the LFP platform.

Beyond autos, LFP is making serious inroads into home energy and grid-scale energy storage systems.

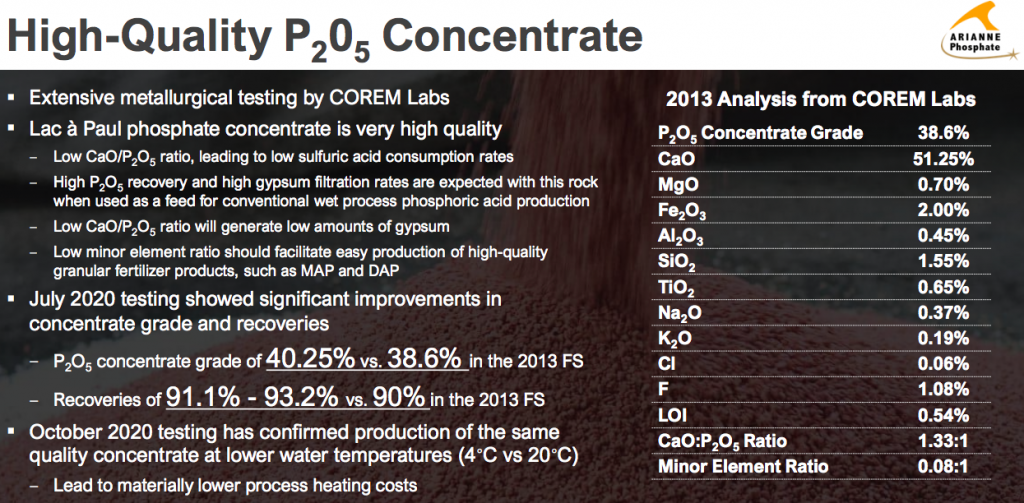

LFP batteries require high-purity phosphoric acid. The most efficient way to get high-purity acid is to begin with a high-purity concentrate. Our concentrate is among the world’s purest, free of deleterious elements that would be problematic for battery acid production.

Many producers are concerned about supply chains as the bulk of LFP battery production comes from China. Given geopolitical unrest and the fracturing of traditional trading blocks, western companies are trying to secure critical inputs regionally.

These two factors; product quality & security of supply, have made Arianne’s phosphate rock project in Quebec, Canada an ideal opportunity. Arianne has been approached by several battery & automotive players looking for ways to collaborate.

PE. I see Arianne is working on a new breed of greener fertilizers using organic waste mixed with your concentrate. Could we get an update on that front?

BO. Yes, of course. Arianne announced a couple of initiatives regarding alternatively-derived organic fertilizers involving adding our high-purity concentrate to organic waste [compost] to create fertilizers that farmers can apply directly to their fields. This is extremely exciting for a number of reasons.

Currently, the process of making fertilizers (MAP & DAP) involves adding phosphate concentrate to acid, (usually sulphuric) and producing phosphoric acid before adding ammonia to make finished products. Formulating fertilizers that do not need to be acidulated would cut out the middleman while delivering an attractive organic fertilizer directly to end-users.

Another exciting element of this proposed fertilizer line is that it would eliminate the need for added ammonia, which instead would be derived from the contained (decomposing) organic waste. This is especially important as ammonia is primarily produced with natural gas. Natural gas prices have soared, especially in Europe.

Underlying all of this is Arianne’s high-purity/low-contaminant phosphate rock. Farmers do not want to apply phosphates that have radioactive elements or heavy metals. Our alternatively-derived organic fertilizers could potentially become a high-margin segment.

PE: Of the proposed 3M tonnes/yr., where do you see those sales going, and at what kind of pricing levels?

BO: The reality is that we need more offtake agreements to secure our financing, but the banks don’t care if our customers are fertilizer or battery companies so long as they’re creditworthy counterparties.

In terms of pricing, as mentioned, our concentrate would likely trade at north of $300/t today. Might a battery player pay more to lock up a long-term, reliable supply? Maybe, but we have to see how our discussions progress. Even a 5% premium would be meaningful for Arianne.

PE: Lastly, on partnership discussions, can you tell us more?

BO: I think there are several avenues to pursue. Having a partner would be a big plus, it would go a long way towards addressing our funding needs. It would also give the “street” a higher level of confidence that our project will get built.

A partnership could work in a few ways. At the project level, a partner figures rather than sign an offtake for X tonnes/yr., why not just buy into the Project to secure the tonnage needed. It would assure long-term supply and lock in a price.

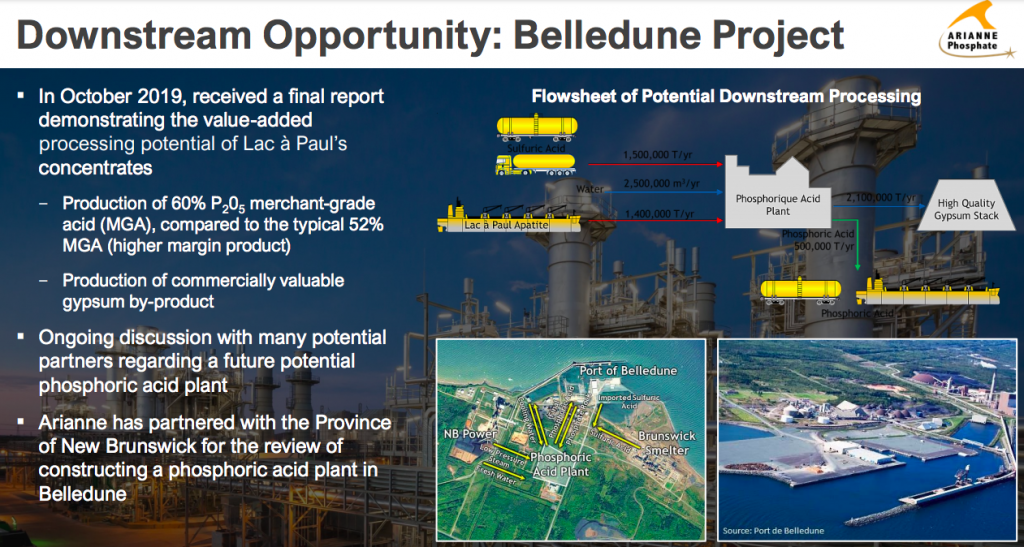

Another opportunity could come from downstream. Perhaps because of the nature of our concentrate, a producer of battery-grade acid might want to partner with us to build a phosphoric acid plant. This would deliver a customer for Arianne’s concentrate, and allow us to share in the economics of the downstream asset.

PE. This is all very exciting. Thank you again for sharing your valuable time with my readers. Before I let you go, is there anything we didn’t cover?

BO. Phosphate is a much-needed commodity whether to power your body through food or your car through a LFP battery. Until recently, it has been taken for granted as few truly understood its importance or the threat to its supply.

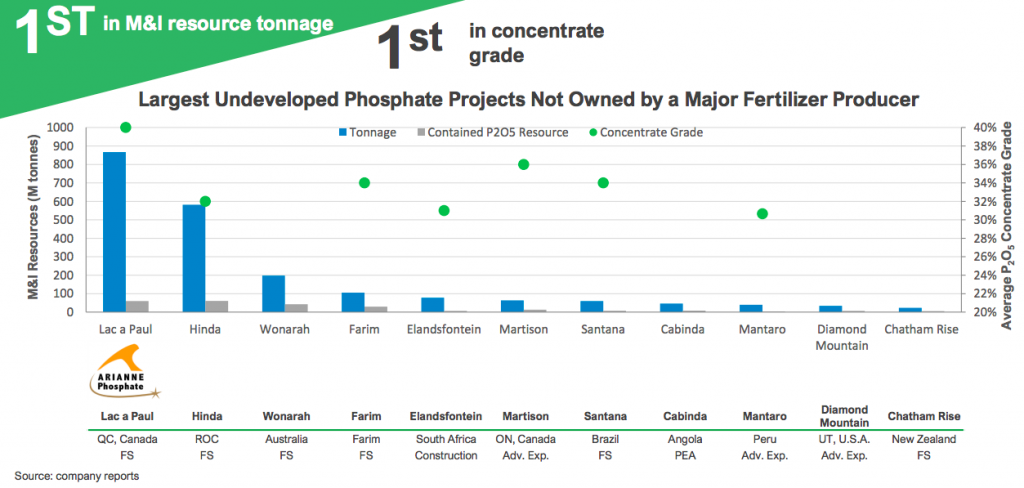

Arianne alone is not an answer to the world’s problems, but we’re a good start. While no one cared, Arianne advanced its project to be the world’s largest, purest, greenest, safest, shovel-ready project.

We have a $72M market cap, which is under 5% of the pre-tax NPV(8%) from our FS. Compared to most companies advancing battery material projects (lithium, cobalt, nickel, etc.), Arianne is well advanced with permits in hand. Peer juniors at similar stages are valued at about 30%-60% of pre-tax NPV.

Disclosures / Disclaimers: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Arianne Phosphate, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Arianne Phosphate are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Arianne Phosphate was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)