WOW! Guanajuato Silver [GSilver] (TSX-V: GSVR) / (OTCQX: GSVRF) is growing fast, even faster than most imagined. Last week management announced the acquisition of Great Panther’s Mexican assets. Importantly, these are NOT distressed assets, far from it, they simply became stranded as Great Panther ran out of tailings capacity.

Upon closing, GSilver’s operations will expand from two mines and one production facility to five mines and three production facilities. The acquisition will add 25,000 hectares of mineral claims plus 34.4 million [Measured + Indicated + Inferred] ounces of Silver Equiv. (Ag Eq.).

Therefore, GSilver is paying just $0.47/oz. of Ag Eq., and essentially getting 25,000 hectares, three mines, plus two production facilities for free! The 34.4M acquired ounces are worth a lot more to GSilver than they would be to a non-producing company or to a producer with constrained mill and/or tailings capacity.

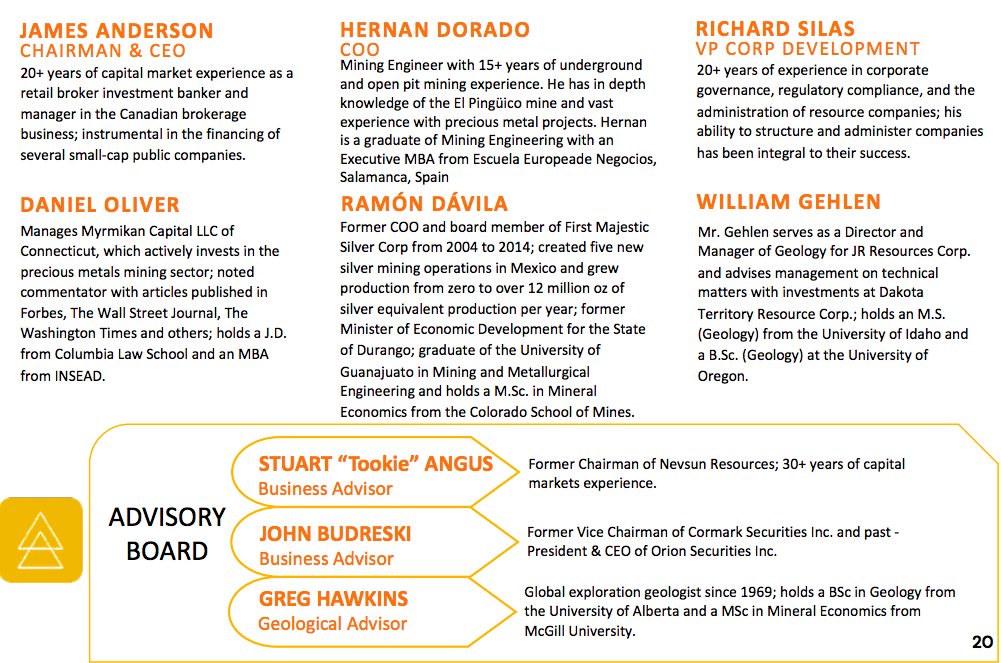

This is a major acquisition, can GSilver pull it off? When the acquisition of the El Cubo mine & mill complex from Endeavor Silver was announced in March 2021, some investors wondered what CEO James Anderson was smoking.

What made him & his Mexican-based team think they could run El Cubo better than the well-respected Endeavor team? Fast forward 17 months and we have some answers…

GSilver bought El Cubo for $15M, the same assets that were acquired by Endeavor for $200M in July of 2012 (~$254M in today’s dollars!). Over the years Endeavour invested another $40M+ in cap-ex and GSilver has deployed ~$6M more.

The main reason Endeavour sold was that the silver price was too low — making El Cubo unable to move the needle for Endeavour’s growing production profile & billion-dollar market cap. In the five years leading up to Endeavour putting the Complex on care & maintenance, silver averaged ~$16.4/oz.

When the Complex was purchased by Endeavour the silver price was ~$28/oz., (and that was down from ~$35/oz. four months prior). At $30+/oz., and meaningfully lower op-ex, (< $10/oz.) — El Cubo made tremendous sense and would have worked out just fine. At $16/oz., El Cubo was a non-core asset.

For GSilver, at < 5% the size of Endeavor, sitting on its own resource (El Pinguico) a few km away — near-term production of a few million ounces of Ag Eq./yr. would certainly move the needle. By all accounts, CEO Anderson’s Mexican-domiciled team executed well on integrating the assets & refurbishing the El Cubo mill.

In looking at the map of the immediate area, it was just a matter of time before GSilver would acquire assets from one or more of Great Panther, Fresnillo, or perhaps another Endeavour mine (Cebada?). When it became clear that Great Panther was running out of tailings capacity, GSilver pounced (pun intended).

This second major acquisition by GSilver stands to increase annual Ag Eq. production to 5M+ ounces as soon as next year. Perhaps as important is the greatly enhanced operating flexibility the combined mining + processing + exploration portfolio will have.

Having multiple deposits/resources, plus substantial exploration potential, plus multiple mills to process owned and third-party ores, makes GSilver a valuable Mexican producer. Since the GSilver team proved its skills in bringing El Cubo online, concerns about integrating Great Panther’s assets into the portfolio should be modest.

Importantly, there’s still room to buy additional deposits, stock/waste piles, mills & tailings capacity across Guanajuato and in the neighboring State of Durango. Additonal tuck-in acquisitions (and toll milling third-party ores) could increase annual production even more.

At a margin of say $5-$8/oz., that would be a strong recurring cash flow stream.

However, if one believes as I do that silver will rebound later this year to eventually trade above $25-$30/oz., and perhaps > $40+/oz. for much of the remainder of the decade — GSilver offers a tremendous opportunity at a pro forma Enterprise Value [EV] {market cap + debt – cash} of ~$110M.

$40/oz. Ag Eq. on 5M Ag Eq. ounces would generate ~C$163M/yr. in EBITDA, at $35/oz.; ~C$131M EBITDA, at $30/oz.; ~C$98M EBITDA, at $25/oz.; ~C$65M EBITDA. Obviously $40+/oz. silver is far from a sure thing in 2023 or 2024…

Why am I talking about $40+/oz. silver, what am I smoking?!? Adjusted for inflation the price touched ~$63/oz. in April, 2011 and ~$134/oz. in January, 1980. What else was happening back in the early 1980s? INFLATION. Yes, U.S. inflation hasn’t been this high in 40+ years.

Speaking of precious metal prices, one of the most bullish forecasts belongs to Goldman Sachs, calling for gold at $2,500/oz. by year end, which in my view would drive silver above $32/oz.

Readers should note that one of the purchased mines is located in the State of Durango, Mexico. This opens up an entirely new avenue of growth for the Company. GSilver’s President/Dir. Ramon Davila was COO and a member of the Board of Directors of First Majestic from 2004 to 2014.

Within that 10-year period, he led a team that created five new silver mining operations, taking that company from two to > 4,000 employees, growing First Majestic’s production in Mexico from zero to > 12M ounces Ag Eq./yr.

In September 2016 Mr. Davila was appointed Minister of Economic Development for the State of Durango – a post he held until June 2020. Needless to say, Mr. Davila has excellent connections and mining experience in both Durango & Guanajuato.

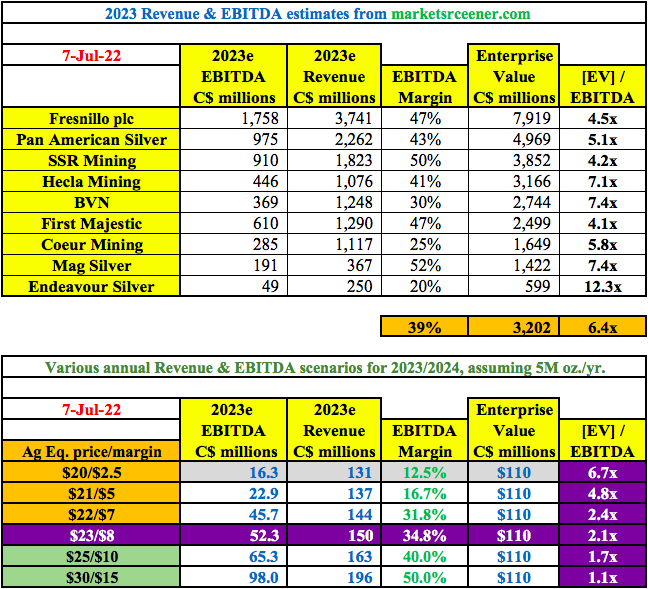

The average EV/EBITDA for CY 2023 of nine Ag-heavy peers is 6.4x. By contrast, I estimate that GSilver is trading at a pro forma multiple of about 2.1x-2.4x of its expected 2023 EBITDA.

Notice that at an assumed 2023 silver price of $23/oz. and an AISC of $15/oz., ($8/oz. = 34.8% margin), GSilver is valued at roughly a 2.2x multiple of next year’s cash flow. All of the GSilver scenarios are based on 5M Ag Eq. ounces. The current silver price is ~$19.5/oz.

Not on the chart is a Ag Eq. $40/oz. price & $25/oz. margin scenario in which GSilver would be valued at a 0.7x multiple.

Readers are cautioned not to make investment decisions based on highly bullish estimates such as silver @ $40/oz. I mention higher prices because I believe there’s a real chance (15%-20%?) of silver prices doubling. Even $30 per Ag Eq. oz. would be incredibly impactful as the average EV/EBITDA multiple of peers would increase substantially.

Another reason the possibility of $40+/oz. warrants consideration is that peers can only fully benefit from higher prices if they can bring on new production. However, it typically takes years & years for a company to meaningfully increase production, which makes a takeout of GSilver increasingly likely in a precious metal bull market.

If peer multiples of 2023 forecasted EBITDA were to rise by 50% to 9.6x, GSilver might be worth 5x-6x its EBITDA to players like BVN, First Majestic, Coeur Mining and MAG Silver. Readers are reminded that GSilver is growing faster than most, if not all, of its peers. Revenue/EBITDA growth (boosted by M&A) over the period 2022-2024 should be quite strong.

While most metals & mining companies are sitting on their hands in a brutal risk-off environment, Guanajuato Silver (TSX-V: GSVR) / (OTCQX: GSVRF) continues to make transformative moves, positioning the Company as a premier Mexican producer operated largely by Mexican nationals.

This is a company that can make even more acquisitions in the coming years or be acquired itself at a much higher valuation.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)