On August 23rd Portofino Resources (TSX-v: POR) / (OTCQB: PFFOF) announced that it had cleared the “final requirement” to receive a drill permit for its 100%-owned, 2,932-hectare Yergo lithium (Li) brine project in Catamarca Province, Argentina.

Shareholders have been waiting a long time for a permit, which has kept the company’s valuation depressed. The Enterprise Value [EV] {market cap + debt – cash} is just C$8.2M.

If/when issued, a four-hole drill program could commence in September. While four holes might not sound like a lot, for a brine target near well-established projects such as Neo Lithium’s high-grade 3Q (acquired by Zijin Mining), a few holes can deliver a substantial amount of info on the potential size & grade of a deposit.

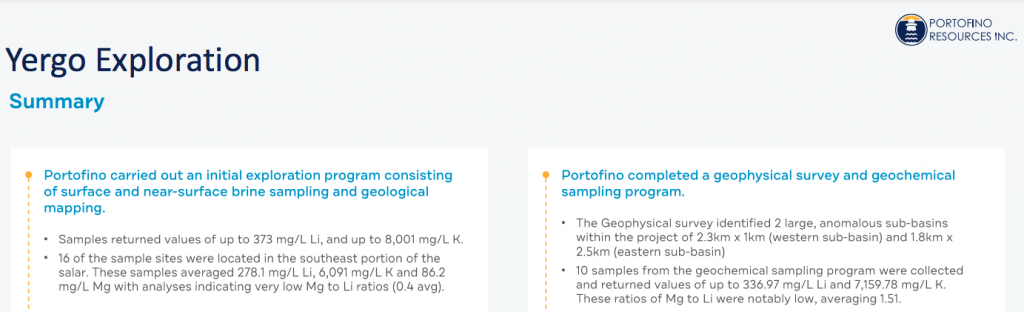

Portofino controls 100% of the salar, making it very attractive to potential acquirers. So far there have been two sampling programs + a geophysical survey. Surface samples returned values of up to 373 ppm Li. Management believes that Yergo is perhaps 18-24 months ahead of an unexplored, unpermitted greenfield property.

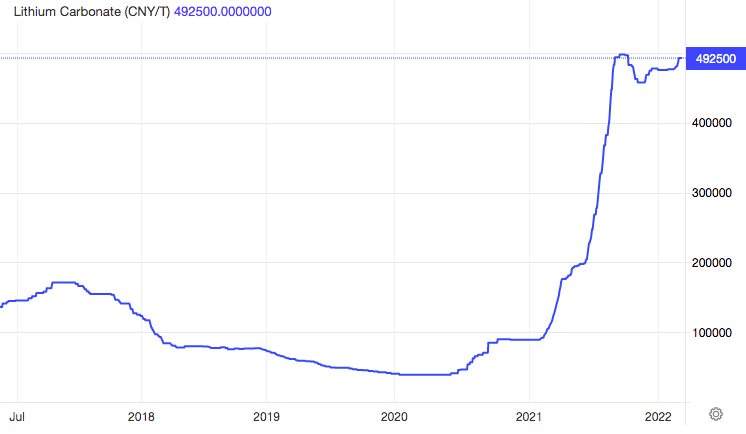

A few years ago 373 ppm Li would have been considered a mediocre grade. However, with the promise of Direct Lithium Extraction (DLE) technologies, grades as low as 100-200 ppm should be viable for two BIG reasons. DLE methods recover up to twice as much Li as conventional solar evaporation ponds, and Li prices have soared.

In the chart below, battery-quality lithium carbonate (spot) prices in China are shown over the past five years, 492.5k yuan = ~US$71,300/tonne.

How much is a Li brine asset worth in Argentina? Alpha Lithium just announced a 3.3 million tonne resource with an average [Indicated + Inferred] grade of 224 ppm Li. That project is valued in the market at ~C$130M. Could Yergo also host a multi-million-tonne resource? YES! Could Yergo’s grade be = or > 224 ppm? YES!

There’s nothing short of a Li brine investment frenzy in the provinces of Catamarca & Salta. Major mining companies there include $95B EV Rio Tinto, Zijin ($45B), Ganfeng ($26B), POSCO ($18B), Allkem ($5B), Livent ($5B), Eramet S.A. ($4B) & Lithium Americas [LAC] ($4B). The largest Li producer in the world, Albemarle ($35B), has a sizable early-stage project in northern Catamarca.

The reason I mention these miners is that for them, paying $10’s of millions to own an entire Li salar is a drop in the bucket, a rounding error. Yergo covers an entire salar with surface samples of up to 373 ppm Li and is only 15 km from Zijin’s 3Q project, expected to be in production by 1H 2024.

Yergo sits at an elevation of ~2,800 – 3,250 meters vs. better-known Argentinian projects at ~3,800 – 4,400 meters above sea level. An elevation advantage of roughly 1,000 meters makes a substantial difference in operational/logistical metrics.

POSCO, Ganfeng & Rio aren’t messing around. POSCO announced plans to invest US$4 billion to build a Li hydroxide complex that will eventually produce 100k tonnes/yr. Ganfeng recently announced the acquisition of privately-held Lithea for US$962M. It now owns all (or portions of) five projects in Argentina. Earlier this year Rio paid US$825M for the Rincon project.

In March, Portofino announced the signing of an MOU to greatly increase its lithium (Li) footprint (in Salta province) to > 16,000 ha. Portofino is partnering directly with state-owned REMSa. S.A. (Energy & Mining Resources of Salta). Management has secured an option (for two years after work starts on any property) to form a 70%/15%/15% JV with REMSa & private company Ronialem.

Portofino has no set obligations, only opportunities. How prospective are these properties? The Company is picking up a Yergo-sized (3,028-ha) footprint near the Hombre Muerto salar, close to Allkem’s advanced-stage Sal de Vida project & producer Livent‘s expanding Felix operations.

The Pastos Grandes (3,489 ha) concessions are close to LAC’s project of the same name. The Arizaro (8,500 ha) concessions are situated south of Rio’s Rincon project. If Portofino/Ronialem choose not to acquire a property that they explore, they are entitled to the GREATER of four times their exploration & evaluation expenditures OR 50% of the gross proceeds from the property’s sale.

A key part of the MOU is that there are no upfront or backend cash or share payments, and no work commitments. The timing & amount of exploration performed is entirely in management’s hands. All parties to this arrangement are on the same page, both REMSa & Ronialem are incentivized to help Portofino in any way they can.

How can REMSa help advance these properties? REMSa has a clearly stated goal of facilitating the development of mining projects in Salta province. To that end, it works with local communities, mining agencies, politicians, service providers, etc. — everyone. This is like an ESG team in Portofino’s back pocket.

In prior articles, I said that Yergo could be worth $10’s of millions — especially upon favorable drill results — increasing in value as the project progresses through a maiden mineral resource estimate and then possibly a Preliminary Economic Assessment (PEA). Or, the Project could be monetized as soon as this year to fund the new Salta opportunities.

With Li carbonate prices so incredibly strong, ~US$71,300/tonne (spot price in China), any project in Argentina not big enough to be a standalone mine, but reasonably near a production hub, should have considerable value as a satellite deposit. Yergo is just 15 km from Zijin’s project.

It’s not unusual for a brine deposit to host millions of tonnes of LCE. If longer-term Li carbonate prices are destined to be in the US$20-$40k/t range, it seems likely that undeveloped in-situ (in the ground) tonnes could be worth C$100/t or more.

The new Salta properties enjoy strong potential as satellite deposits as they’re in the same province as producers Livent & Allkem. Ganfeng’s & LAC’s world-class Cauchari-Olaroz project (in Jujuy, but near Salta) is slated to enter production later this year or early next.

Salta also hosts LAC’s Pastos Grandes project, Galan Lithium’s Hombre Muerto West & Candelas projects, and Allkem’s advanced development-stage Sal de Vida project, (in Catamarca, but near Salta).

Argosy Minerals is starting a small-scale (2,000 tonnes/yr.) operation later this year. Privately-held Pluspetrol owns six properties in Salta, and France’s Eramet has an advanced-stage project. Several smaller publicly-listed companies (see chart below) have one or more properties in Argentina.

The Salta/REMSa news is a true vote of confidence in Portofino’s team, incl. the Company’s local Argentinan group & its contacts in and around Salta. All it would take is one property with demonstrated blue-sky potential for a Chinese company to swoop in. Zijin acquired Neo Lithium’s world-class project, Ganfeng is active in Argentina, CATL was outbid for a Li project but is thought to be looking for new opportunities.

Steel giant Tsingshan invested $375M into Eramet’s project, and Chengxin Lithium is talking with Lithium Chile about its project in Salta. If not the Chinese, perhaps the Japanese trading houses… Not to mention dozens of electric vehicle OEMs & Li-ion battery makers from around the globe. Of course, the most likely partner would be another Li player.

Not only is Portofino one of the very cheapest ways to play the Li theme, it also has more blue-sky potential than most peers. It has an EV of C$8.2M, yet the Yergo project alone is possibly worth a multiple of that. If a few of its Salta properties are advanced to the maiden mineral resource stage, they too could be worth $10+ million.

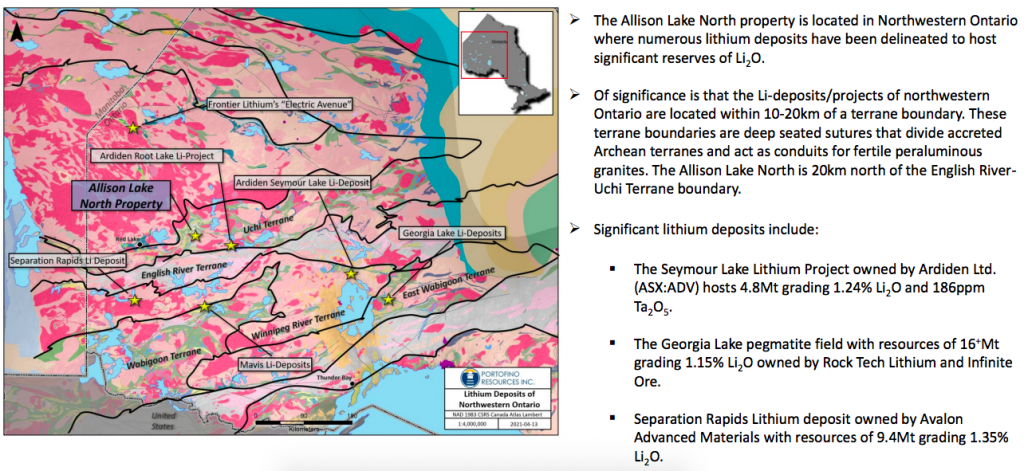

But wait, there’s MORE! In Canada, Portofino has a handful of gold & lithium projects. The 100%-owned Allison Lake North project is a hard rock Li target near several other Li juniors including Australian-listed Green Technology Metals, with a C$164M market cap.

Frontier Lithium’s PEA-stage PAK project, with a valuation of ~C$500M, is ~200 km to the northwest. Rock Teck’s PFS-stage Georgia Lake project is ~300 km to the east. Management is in discussions with a few groups about ways to collaborate on Allison Lake North.

Portofino Resources (TSX-v: POR) / (OTCQB: PFFOF) has not one, not two, but multiple properties/projects in two key Li provinces of Argentina and in gold/Li districts of Ontario, Canada. Several company-makers that could be worth C$10M+ each, yet the EV sits at C$8.2M.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)