All dollar figures US$ unless indicated otherwise. Ag = silver. Au = gold.

The outlook for silver & gold remains strong, but earlier forecasts of up to $40/oz. Ag & $2,500/oz. Au in 2023 or 2024 appear less likely. Goldman Sacks recently lowered its forecast to $1,950/oz., Citi is @ $2,000/oz. Silver is expected to be in the $22 to $28/oz. range. Make no mistake, these are great levels for companies already in production.

I believe there’s clear upside to prices — especially by 2024 — due to mining cost inflation running at (depending on jurisdiction) 10%-20%, lengthening timelines to bring on new production, and growing geopolitical tensions. The global debt to GDP ratio is over 300% with no reversal in that metric in sight.

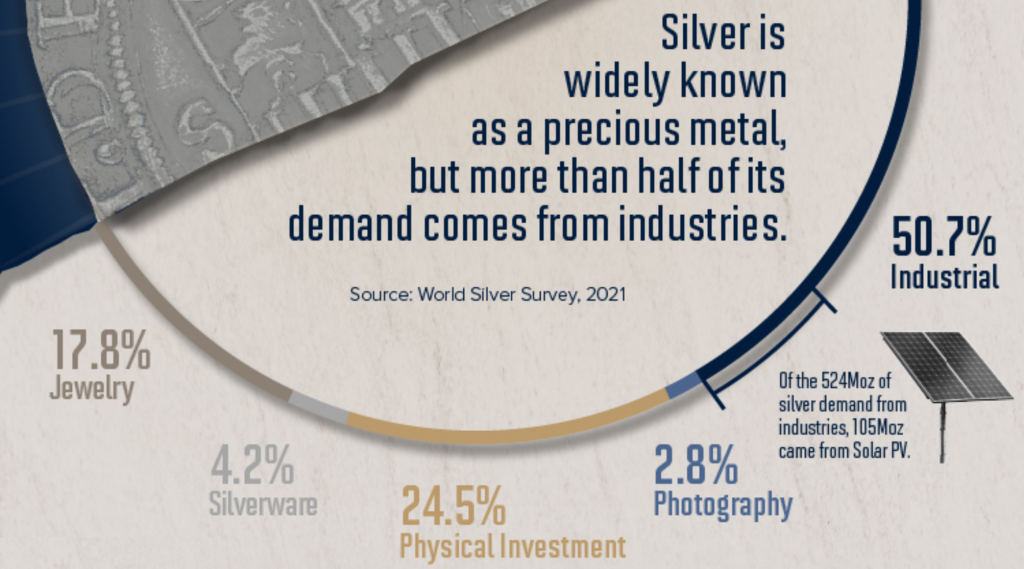

At the same time, demand for silver in industrial uses is set to expand as countries around the world try to exit weak GDP growth environments with aggressive stimulus spending on electric vehicles, decarbonization & renewable energy. Spoiler alert — both EVs & solar farms require substantial amounts of silver.

James Anderson, Chairman & CEO of Guanajuato Silver [G-Silver] (TSX-v: GSVR) / (OTCQB: GSVRF) recently penned this compelling piece on the dire need for Mexican silver in photovoltaic (solar) cells. Mexico is one of the best places on earth to harness the sun, but it gets just 5.4% of its electricity from solar.

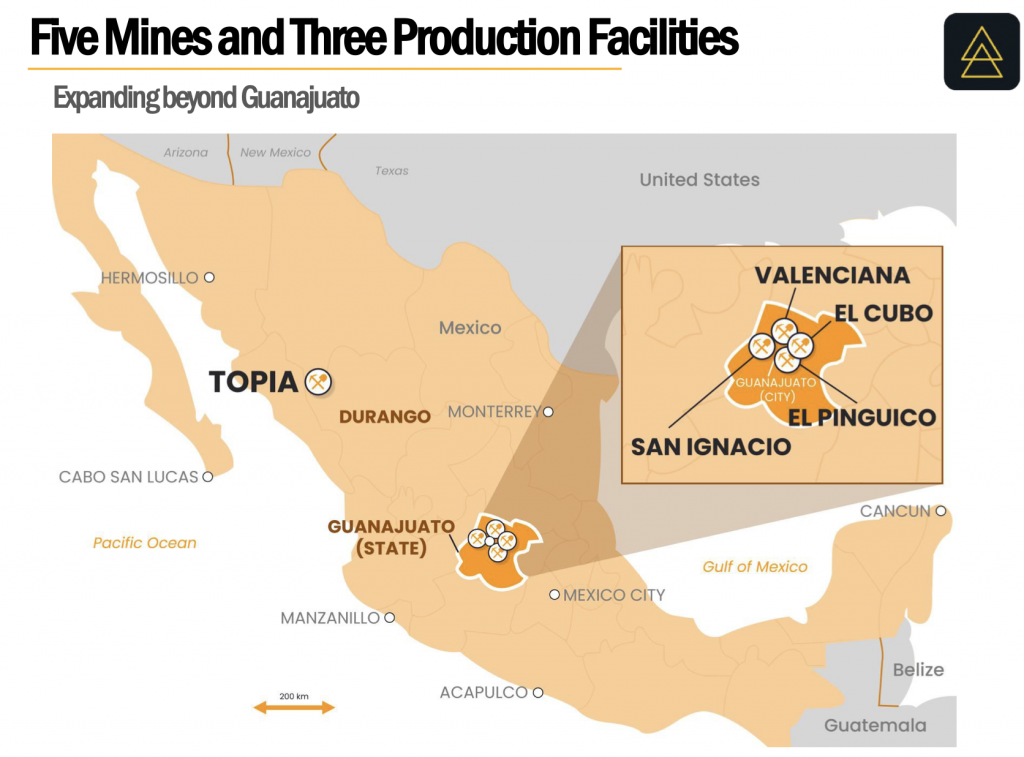

Speaking of G-Silver, Anderson and his expert Mexican national team recently expanded operations from two mines & one production facility to five mines plus three production facilities. {see new corporate presentation}

G-Silver acquired the Topia & San Ignacio mines, and the Valencia Mines Complex (“VMC”) from Great Panther. Four days of closing the acquisition, previously mined material from San Ignacio was delivered to El Cubo for processing and the mining of new material at San Ignacio began three days later.

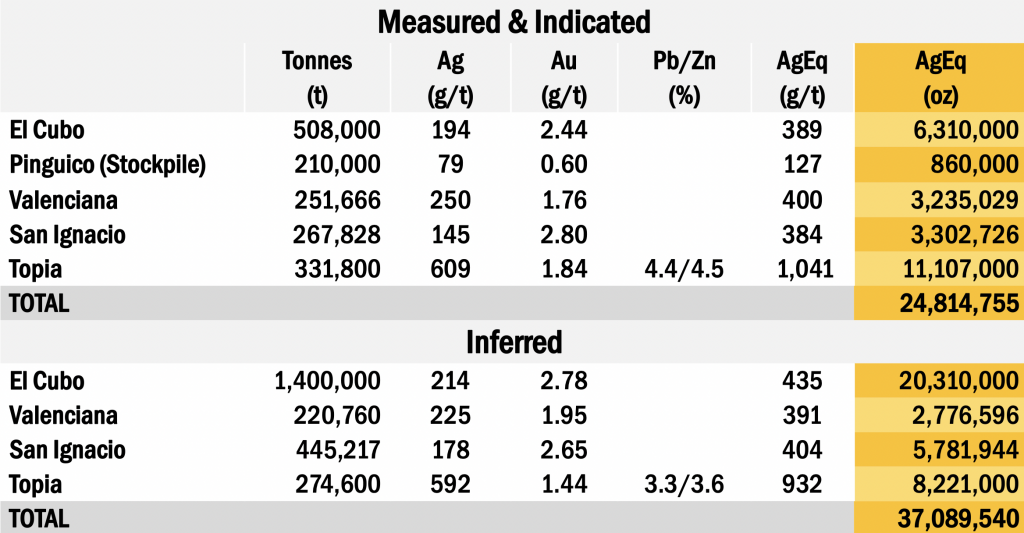

This second major acquisition by G-Silver is expected to increase run-rate Silver Equiv. (Ag Eq.) production to 6M ounces/yr. by the end of 2023. In addition, the acquisition added 25,000 hectares of highly prospective mineral claims plus 34.4M [Measured + Indicated + Inferred] Ag Eq. ounces.

Those 34.4M ozs. are worth a lot more to G-Silver than to a pre-production company as they can be mined this decade. The company-wide total Ag Eq. figure is now 61.9M ops. Importantly, there’s ample room to keep buying deposits, stock/waste piles, mills & tailings capacity across Guanajuato and in neighboring central Mexican states, including Durango.

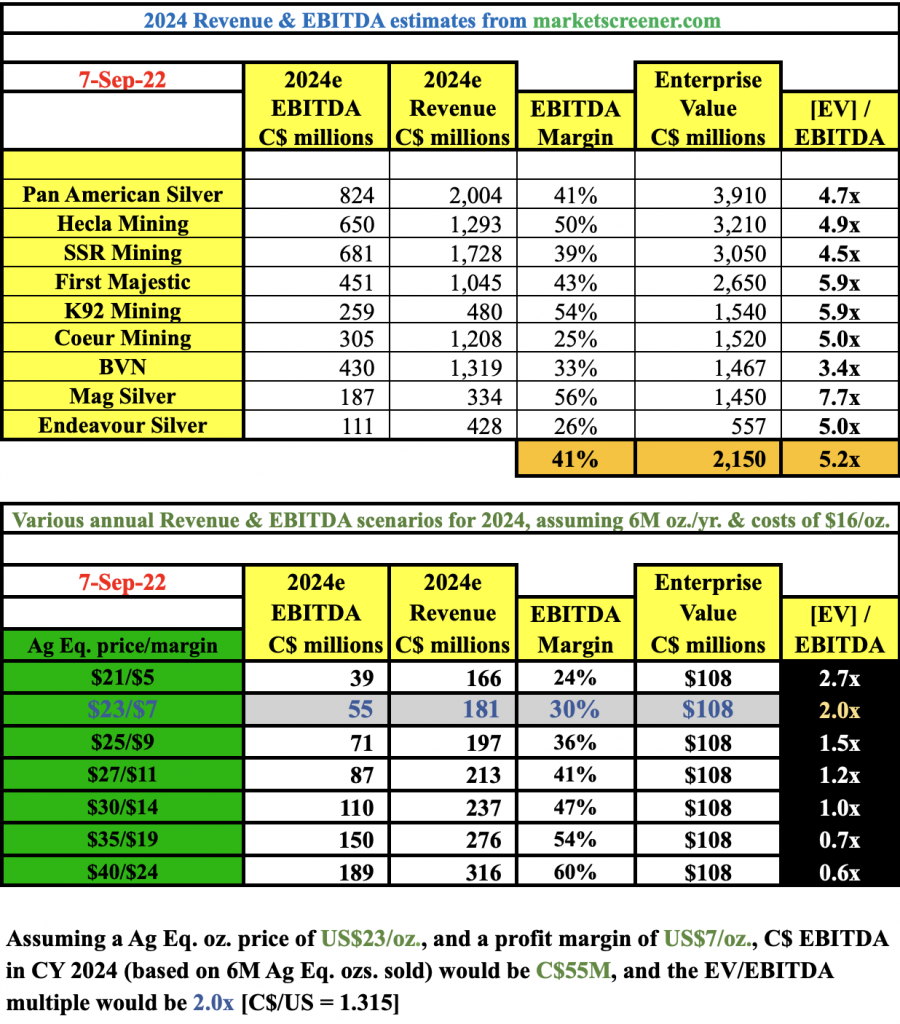

In my view, G-Silver has decades of operations ahead of it. Six million Ag Eq. ounces in 2024 would place G-Silver in the ranks of mid-tier producers like Coeur Mining & Endeavour Silver who are guiding towards 6.7M & 7.8M Ag Eq. ounces, respectively for 2022.

On September 1st G-Silver provided an impressive update on the integration of its El Cubo Complex with Topia in the state of Durango and San Ignacio & the VMC in Guanajuato.

CEO Anderson commented, “With mining operations well underway at both Topia & San Ignacio, the integration of our newly acquired mines from Great Panther is considerably ahead of schedule.“

Mineralized material from San Ignacio is being transported directly to El Cubo for processing and is expected to add ~5,000 to 6,000 tonnes/month over the remainder of the year.

The VMC includes five mines (Guanajuatito, Valenciana, Cata, Rayas-Los Pozos & Promontorio) that merged over time to form a single interconnected mine that has been in operation since the 1500’s. It comprises a strike length of > 4.2 km along the world-class Veta Madre or “Mother Vein.”

The VMC was one of the most significant silver mines in the world. At times near the end of the 18th century it accounted for nearly 40% of the world’s silver production.

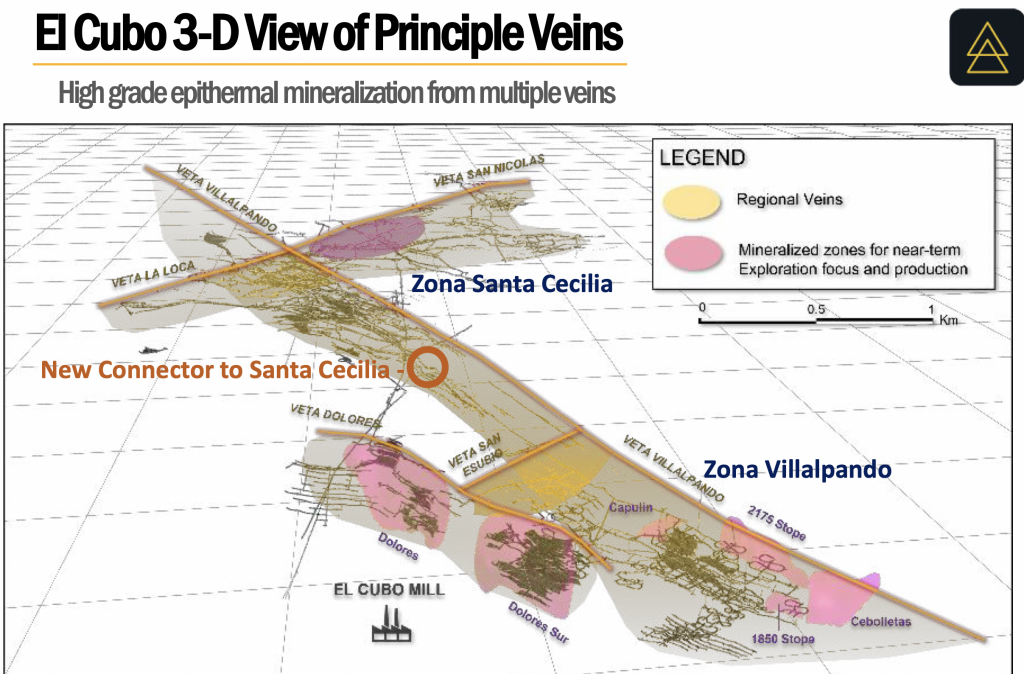

Readers are reminded that El Cubo comprises two main mine areas, Villalpando & Santa Cecilia. The main Villalpando vein structure frequently carries proportionally higher gold content. Because of the increasing importance of Santa Cecilia, the Company recently linked the two areas via a 150-meter tunnel & ramp.

This initiative significantly reduced the haulage distance (from 7.2 to 2.5 km), delivering an immediate boost to project economics from reduced fuel, road maintenance & equipment costs. Importantly, the new tunnel opens up higher-grade stope areas that had been largely inaccessible.

Located in north-eastern Durango, the polymetallic Topia Mine operated continuously since 2004 producing silver, lead, zinc & gold through a 7,500 tonnes/month flotation processing facility.

G-Silver has already sold 99.2 dry metric tonnes (“dmt”) of lead-Ag-Au concentrate to a division of Samsung Electronics Co Ltd., and 97.7 dmt of zinc-Ag concentrate to a division of Ocean Partners Ltd. (U.K.).

Commenting on Topia, G-Silver’s President Ramon Davila said,

“I’m very excited; as the former Econ. Minister for the State of Durango, based on my operating experience in the State, and after reviewing our current mining operations, I believe we have an opportunity to incorporate a hub & spoke mining strategy at Topia similar to the one we’re employing successfully with our Guanajuato assets.”

Management has greatly enhanced its operating flexibility from the newly combined mining + processing + exploration portfolio. If one believes as I do that silver & gold will rebound next year, if not sooner — G-Silver offers a tremendous opportunity at a pro forma Enterprise Value [EV] {market cap + debt – cash} of ~C$108M {share price = C$0.33}

$30/oz. Ag Eq. on a run-rate of 6M Ag Eq. ounces would generate ~C$110M/yr. in EBITDA, @ $27/oz.; ~C$87M, @ $23/oz.; ~C$55M. Obviously, much higher precious metal prices are not a sure thing… However, adjusted for inflation silver touched the equivalent of ~$64/oz. in April, 2011 and ~$136/oz. in January, 1980!

I believe there’s a meaningful chance that silver & gold could soar beyond consensus expectations. Today’s inflation rate in the U.S. hasn’t been this high since the early 1980s. Even if the Ag Eq. price doesn’t average $40/oz. for a full year anytime soon, it could certainly double or triple from today’s level of ~$18/oz. from time to time.

Mexico is (comfortably) the largest silver producing country on the planet. Geopolitical tensions make capital investment decisions in countries bordering China & Russia increasingly difficult. And, South America is suffering from left-leaning populist governments. Finally, Europe is plagued by sky-high energy costs, making mining quite expensive.

Guanajuato Silver (TSX-v: GSVR) / (OTCQB: GSVRF) is possibly the fastest growing precious metals producer in N. America. At a time when inflation is killing businesses around the world, G-Silver is offsetting cost pressures by expertly delivering operating improvements and from economies of scale.

Once up & running at 6M ounces/yr., G-Silver should become a keenly sought after takeout candidate. Or, investors could be looking at an attractive dividend profile down the road. At $25/oz. Ag Eq., C$71M in cash flow, a 33.33% payout ratio would equate to ~C$0.08/shr., equal to a 23.5% yield (based on 300M shares outstanding).

Management has executed well over the past 18 months, there’s a great deal of excitement among team members. Precious metal prices have sold off this year, but that only makes acquisitions of attractive assets all the more compelling. Who knows what additional transactions could possibly be in the works.

{see new corporate presentation}

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)