Never will you catch me predicting which way the price of gold is headed next month or quarter. I don’t practice in the dark arts of technical analysis. However, if forced to choose between +10% to $1,830/oz., or -10% to $1,498/oz., I would choose the higher all day long.

The fundamentals that gold bugs have been screaming about for years haven’t changed. If anything they’ve grown stronger. Global deficit spending & monetary debasement? Yep, still major tailwinds.

One thing that’s new to the gold debate is the impact of Russia’s war on Ukraine. I believe (over time) it will propel gold higher for two simple reasons. First, the U.S. dollar’s reign as the world’s sole reserve currency is ending.

Geopolitical upheaval, deficit spending, monetary debasement — all are bullish for gold

China, Russia and other countries that don’t get along well with “the West” are forming their own trading block.

Think about this, China & Russia ranked #1 & #3, respectively in gold production last year. Those countries have a lot of leverage on the price.

A weaker dollar will be bullish for gold, although as I write this article the US$ is outperforming most currencies. Second, the paradigm shift underway concerning China/Russia will be geopolitically challenging. Gold is a safe haven in uncertain times.

Gold is down ~20% from its 52-week high of US$2,070/oz, silver & copper are down ~-30%. So, is now a good time to buy junior miners? On one hand, they have been under pressure for months.

On the other hand, those that have top managerial talent + access to investment capital can buy or option distressed assets at great valuations.

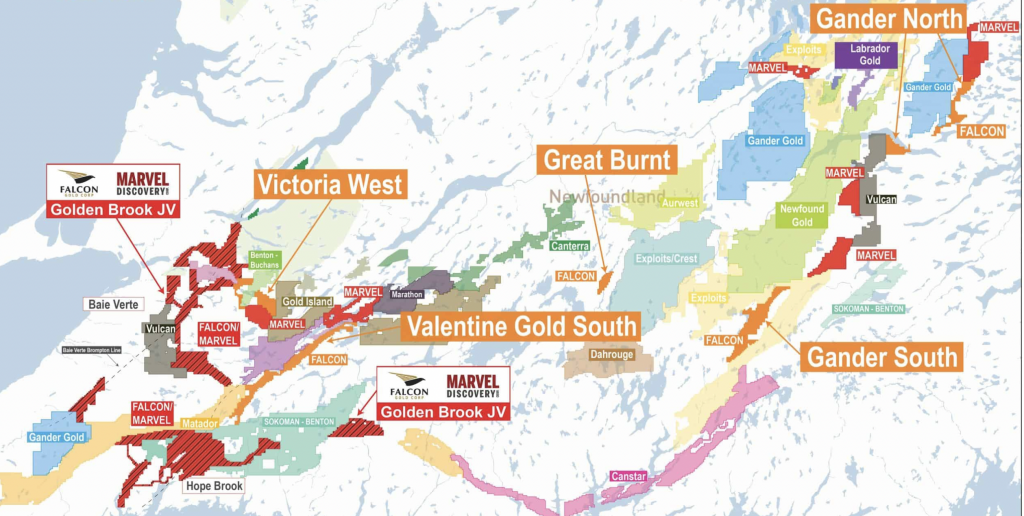

It’s a buyer’s market. That’s why I’m revisiting Falcon Gold (TSX-v: FG) / (OTCQB: FGLDF), a company with 13 properties/projects across Canada, and always on the lookout for more. {see latest corp. presentation}

Of course, owning/controlling a significant portfolio of mining assets is under-appreciated when the metals/mining sector is out of favor. Falcon has not been spared in this downdraft, but it has held up better than many peers.

While the Central Canada gold project in Ontario is one of the Company’s most promising, I’ve written a great deal about it in prior articles. Instead, I will touch upon other compelling opportunities.

CEO Karim Rayani is not missing a beat, he continues to seek M&A on well-positioned metals, in Canada’s top jurisdictions.

From time to time, when it makes sense, Karim will spinout an asset or two, which is what he’s doing with Falcon’s Argentina gold play.

The spinout allows wholly-owned subsidiary Latamark to focus exclusively on the activities required to exercise the option on the Esperanza project comprising seven exploration concessions covering 11,072 hectares (“ha”) in Argentina’s La Rioja province.

Falcon will transfer its interest in the Esperanza option agreement to Latamark in exchange for issuing to Falcon shareholders one share of Latamark for every 5.8 shares held in the Company. Latamark will issue 5,000,000 shares to Falcon.

Turning to central B.C., Gaspard comprises three mineral claims spanning 3,955 ha hosting promising stream sediment samples grading up to 5,210 ppb gold.

Gaspard has similar geology to the belt hosting Westhaven Gold’s Shovelnose project. A drill interval earlier this year at Shovelnose returned 23 meters of 37.2 g/t gold.

Also in B.C. is the 502-hectare high-grade Spitfire & Sunny Boy Property with sample grades as high as 168 g/t gold.

In Newfoundland, Falcon & Marvel Discovery Corp. (TSX-V: MARV) (OTCQB: MARVF) provided an update on their combined exploration focus for the Hope Brook Projects, contiguous to the Benton-Sokoman JV, and to a First Mining project optioned to Big Ridge Exploration.

In November Falcon & Marvel formed a strategic partnership that combined the Hope Brook & Baie Verte Brompton District properties — covering a total of 115,170 ha — to be explored on a 50-50 JV basis.

The Companies conducted a geophysical review & structural interpretation over Hope Brook in advance of further survey & surface work.

Notice in the map above that the combined land package straddles the eastern & western extents of recent land acquisitions by Benton-Sokoman.

Falcon-Marvel now controls areas of “considerable structural complexity, marked by large-scale fold & fault structures providing important traps for gold mineralization.”

These zones will be the focus of ongoing prospecting & till sampling to verify structures and determine mineralization potential.

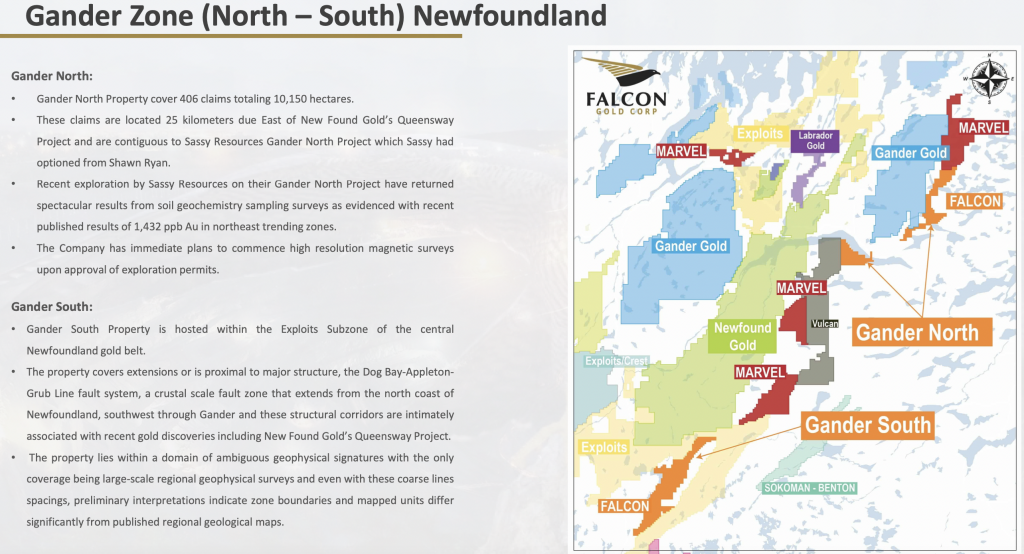

Given recent success in identifying anomalous gold, silver & copper at Gander North, the Companies have shifted exploration efforts to the Gander district.

In the past year Benton-Sokoman announced the first discovery [in Newfoundland] of high-grade lithium-bearing pegmatites.

Rayani notes that this discovery is < 10 km from the footprint held by Falcon & Marvel and appears to be on the same structural corridor.

Lithium is a hot commodity these days, so it’s tempting to get excited about Falcon’s lithium prospects. However, it’s still early days.

Importantly though, Benton-Sokoman could release lithium drill results at any time. Origen Resources has amassed a meaningful property position immediately East of Falcon & Marvel that’s prospective for lithium.

Lithium prices are incredibly strong, if robust results are found by anyone, Falcon will benefit.

Switching back to gold, Falcon & Marvel’s Properties cover extensions of, or are near, two major structures linked to (Cape Ray; Matador Mining) and (Hope Brook; First Mining).

Rock lithologies & structures on the Properties are said to be similar to Marathon Gold’s Valentine, Sokoman’s Moosehead and New Found Gold’s Queensway projects. Hundreds of thousands of meters of gold drilling are underway all around Falcon’s properties. New discoveries are likely.

Exploration is well underway at 100%-owned Gander North, with prospecting & till sampling identifying significant evidence of quartz veining. Surface samples returned values of up to 885 ppb gold.

Multiple geophysical targets identified earlier this year will be the focus of ongoing reconnaissance. Detailed work, including systematic sampling & geological mapping, will commence this Fall to better identify drill targets.

Investors seem unaware of the extensive land package that Falcon has assembled in Newfoundland. Including its half of the JV with Marvel, management reports holdings of roughly 140,000 ha. That makes Falcon a top-5 gold claims holder on the Island.

Investor sentiment is currently weak when it comes to gold & copper plays, but sentiment can change fairly quickly. Even a modest 5%-10% rebound in the gold price could do the trick.

Now’s the time to be looking into junior miners like Falcon Gold (TSX-v: FG) / (OTCQB: FGLDF) that offer tremendous bang-for-the-buck. Companies with properties/projects spanning multiple metals in safe places like Newfoundland, B.C., Quebec & Ontario. {see latest corp. presentation}

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Falcon Gold [and Marvel Discovery] were advertisers on [ER] and Peter Epstein owned shares in both companies.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)