There are larger lithium (“Li”) producing countries like Australia, Chile, China & Argentina, but Canada is rapidly emerging as a world-class Li & electric vehicle/battery components market.

Established Li jurisdictions face serious issues. Labor shortages in western Australia, water use & unproven DLE technologies in S. America. And, China is becoming a no-go for Western countries.

Canada is ideally positioned to capture EV sales in the U.S., and it has one of the greenest, cheapest & most reliable power grids on the planet (mostly hydroelectric power). The age of on-shoring to establish security-of-supply, ESG credentials & optimal/cost effective logistics is upon us.

Federal & provincial governments are embracing critical metals via grants, equity investments, low interest rate loans & R&D collaborations. Yesterday, E3 Lithium received a C$27M investment from Canada’s Innovation, Science & Economic Development’s Strategic Innovation Fund.

There’s more where that came from! Canada has earmarked C$3.8B + meaningful tax credits to support critical minerals. Moreover, new initiatives have been advanced to streamline permitting processes.

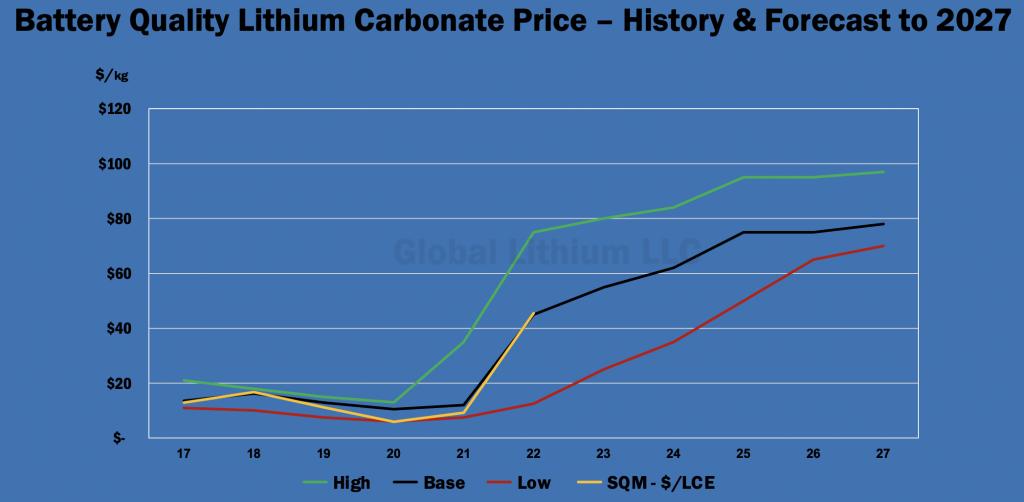

Note: {As per investing.com, the battery-quality Li carbonate (China spot price) is down 3.3% from its all-time high… 577,500 Chinese yuan = ~US$80,600/mt as of 11/29}.

The world is noticing, Canada has announced > C$15B in investments into the Country this year in mining/processing & battery components/EV manufacturing.

Canadian companies are encouraged to participate in U.S. initiatives. The U.S. military is talking directly to Canadian juniors about funding opportunities. Readers have no doubt heard of the U.S. Inflation Reduction Act, suffice it to say that the U.S. DoE & DoD are willing & able to write checks.

Li players are flocking to Canada. Australian-listed Sayona Mining can’t get enough, neither can U.S. based Livent Corp. Sayona announced a significant bolt-on acquisition in Canada, Livent recently said its Canadian operations could surpass its prominent Li brine position in Argentina.

Allkem, Piedmont Lithium & Mineral Resources also have footprints in Canada. New entrants might want a piece of the action, companies like Albemarle, SQM, Sigma Lithium, Lithium Americas and Australian-listed Pilbara Minerals.

Battery component makers LG Energy Solution, Samsung, POSCO, Umicore & BASF are expanding into Canada. OEMs Stellantis, GM, Ford, Volkswagen, BMW, Mercedes-Benz, Honda & Toyota are making bold moves, and Tesla is expected to announce Big plans in Quebec.

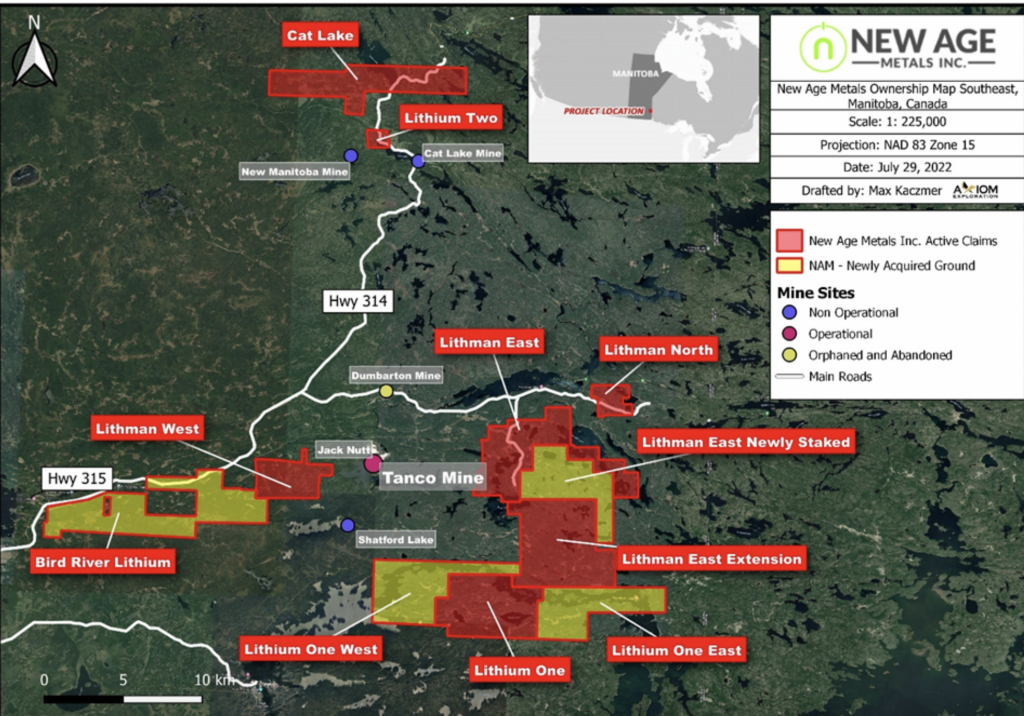

While Quebec & Ontario are leading the Li/EV/battery components charge, Manitoba is looking to bridge the gap. SE Manitoba juniors are close to the U.S. border and to Ontario’s budding Li/EV/battery component hubs.

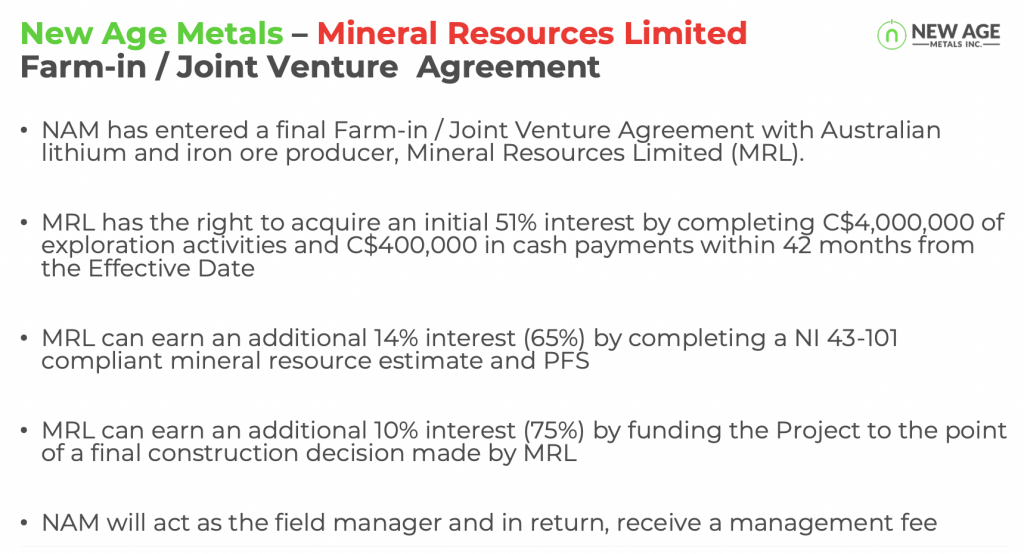

Top-5 global Li producer Mineral Resources ltd. (“MinRes“), valued at ~C$14B, recently teamed up with Canada’s New Age Metals (TSX-v: NAM) / (OTCQX: NMTLF) by agreeing to earn up to 75% of New Age’s Li portfolio.

New Age owns valuable claims surrounding Canada’s only active Li mine, Tanco. Importantly, the claims are along strike of Tanco’s prodigious pegmatites. Yet, the Company’s Enterprise Value {market cap + debt – cash} is just C$6.2M {C$0.05/shr. on 11/29}.

Tanco is an ultra high-grade, (> 2.5% Li2O) + cesium + tantalum (“LCT“) operation. Wikipedia describes it as the only Li producer in Canada and one of the largest cesium producers in the world.

Comparable pre-maiden resource juniors in Ontario include Critical Resources & Power Metals. In Quebec; Li-FT Power, Winsome Resources, Arbor Metals, Benz Mining, Brunswick Exploration & Cygnus Gold. In Manitoba; Snow Lake Resources.

The average valuation of those companies’ flagship projects is ~C$75M. Except for Snow Lake, none of the other eight have secured strategic investors or off-take agreements.

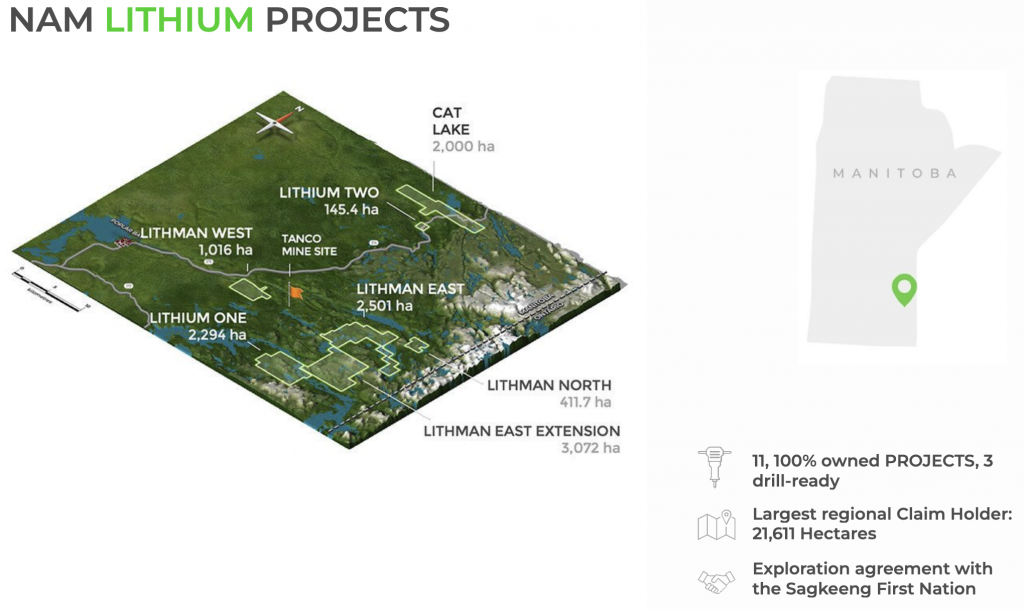

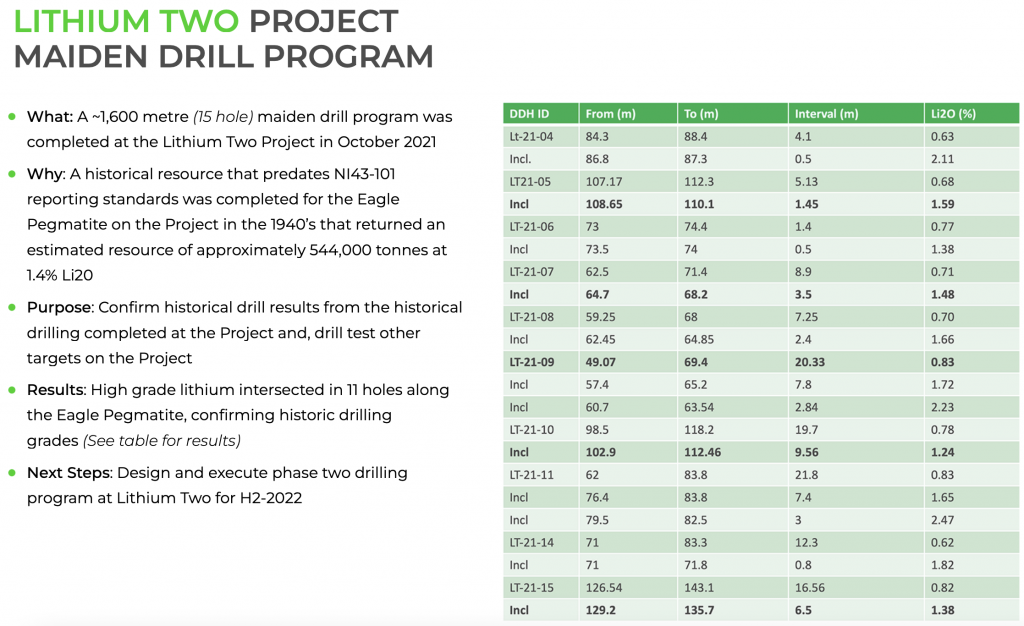

New Age’s assets include 11 properties covering 21,611 hectares — with surface grab samples as high as 4.1% Li2O. One of the properties has a small, historical (non NI 43-101 compliant) resource grading 1.4% Li2O.

The Company’s upcoming Jan./Feb. drill program will be near the historic resource. Drill intervals grading > 0.85% Li2O are considered noteworthy.

Rock Tech & Critical Elements have PFS & BFS-stage projects, respectively, each grading 0.93% Li2O, with their primary projects valued at an average of ~C$275M.

New Age is MinRes’ only Li investment in Canada. CEO Harry Barr prudently negotiated a 100 km area of interest around New Age’s SE Manitoba Li assets.

New Age’s holdings are likely to grow via staking/leasing. In addition, management is pursuing new opportunities in northern Manitoba near Snow Lake.

Earlier this year the Company reported a drill interval of 7.8 meters @ 1.72% Li20, which is a Li Carbonate Equiv. (“LCE“) grade of 4.25%.

The battery-quality Li carbonate (spot) price in China is ~US$80,600/metric tonne (“mt“). Therefore, 4.25% LCE equates to ~$3,425/mt rock — equiv. to a gold interval of ~61 g/t.

Global Lithium LLC base case battery-quality Li Carbonate price at nearly $80,000/mt in 2027

No one knows how long Li prices will remain incredibly strong, but in September Li expert Joe Lowry of Global Lithium LLC published the graph above.

How much is a 25% free-carried interest in New Age’s Li portfolio worth? Green Technology Metals has an EV of C$195M based not on its JORC-compliant resource estimate of 9.9M tonnes at 1.04%, but on a conceptual exploration target of “50-60M tonnes” with an estimated grade of “0.80 to 1.50% Li2O.”

Likewise, Winsome is valued at C$133M off of a conceptual exploration target of “15-25M tonnes at 1.0-2.0% Li2O.”

Before I dive deeper into New Age’s Li prospects, I will briefly describe two other 100%-owned assets; the 3.9M oz., PEA-stage River Valley Palladium (“RVP“) (+ platinum, gold, rhodium) project and the earlier-stage Genesis PGM/Battery metals project.

The after-tax NPV in the RVP project’s 2019 PEA came in at C$187M with an assumed Pd price of $1,200/oz. {based on the prevailing 2-yr. trailing avg.}.

Today’s 2-yr. trailing average is $1,000/oz. higher, greatly enhancing the economics in the upcoming 1Q 2023 PFS. However, op-ex & cap-ex will also be higher. If New Age can deliver an IRR above 15%, that would attract more attention.

Since the PEA, metallurgical work is ongoing to improve recoveries & concentrate grades, extend mine life, lower the strip ratio & increase production/recovery of high-priced rhodium {see chart below}. The resource remains wide open at depth.

I ascribe a C$25M value to this out-of-favor project, ~13.5% of the PEA-derived NPV. An increase in the Pd price, a robust PFS, and/or securing a strategic partner would boost that C$25M figure.

New Age also has the earlier-stage Genesis PGM/Battery metals project in Alaska. Management is looking for a partner on Genesis as well. A number of Canadian & U.S. funding mechanisms have appeared since COVID-19 hit in 2020. These incentives could be a big deal for the RVP & Genesis projects.

If a partner is found, Genesis could be valued at C$5M (low, yes but the Pd price is -20% from early October). Therefore, before assessing Li prospects, New Age is arguably worth upwards of C$30M vs. the Company’s EV of C$6.2M.

Turning back to lithium, five pre-PEA companies with hard rock projects in Canada [Winsome, Green Technology Metals, Patriot Battery Metals, Snow Lake Resources & Imagine Lithium] have an average ratio of EV/mt LCE in the ground of ~C$180/t.

If MinRes/New Age could book 10M / 20M / 40M tonnes at 1.00% Li2O, and assuming C$180/t, that would be worth ~C$44.5M / C$89M / C$178M, and New Age’s 25% free-carried stake ~C$11.1M / C$22.2M / C$44.5M.

In order for MinRes to consolidate from 75% to 100% ownership, it would presumably have to pay a premium. Fast forward to 2024-25, New Age’s share of 20M tonnes at 1.00% Li2O might be worth [C$22.2M x a 35% premium = C$30M].

However, that indicative C$30M figure could be conservative. Peer valuations will likely grow and MinRes/New Age will be advancing through the major de-risking of a PEA, PFS & BFS.

Might this 25% stake be worth C$45-$90M in three years (assuming 20M tonnes @ 1.00% Li2O) ? Yes, it could. Even better, there should be modest equity dilution between now and then compared to peers who are not free-carried.

Extensive drilling lies ahead, but MinRes is a Major Li producer and experienced hard rock miner. It wouldn’t waste time on a tiny footprint or partner with New Age without completing significant due diligence on the mining claims.

Will management spin-off its Li assets into a new company? I believe that move alone could unlock tremendous value.

Sayona, Livent, Allkem, Patriot, Critical Elements & Frontier Lithium will be standalone Li producers in Quebec/Ontario. MinRes is poised to (potentially) become an important player in Manitoba.

If MinRes/New Age strike it BIG, New Age Metals (TSX-v: NAM) / (OTCQX: NMTLF) shareholders will enjoy the free-carried ride of a lifetime.

With Canada a Li hotspot, New Age’s land package is getting more valuable by the day. Management has C$5M in cash and is looking for more properties and strategic partners on their PGM projects.

New Age’s RVP Pd project is arguably worth C$25M, but with positive catalysts like the 1Q23 PFS it has upside. In the meantime, all eyes are on New Age’s Li properties that are potentially worth C$10s of millions. Why is this Company’s entire EV just C$6.2M?

Disclosures/disclaimers: Peter Epstein of Epstein Research [ER] has no prior or current business relationship with any mgmt. team, board member of New Age Metals or to the Company or to any predecessor companies. Mr. Epstein owns shares of New Age purchased in the open market. Mr. Epstein is encouraging the Company to become an advertiser starting in 1Q 2023. Therefore, Mr. Epstein’s views on New Age should be considered biased.

New Age Metals is a highly speculative, small cap, low-priced security. The above article attaches a lot of weight to the fact that C$14B Australian-listed Mineral Resources picked New Age’s SE Manitoba properties to explore for lithium. I consider this a strong vote of confidence. Although there has been some drilling success in the lithium segment, a lot more drilling is needed to prove out a meaningful mineral resource. There are no assurances that the [grade x volume] of Li mineralization across New Age’s 21,611 hectares will result in an economic resource.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)