First it was COVID-19 supply disruptions expected to last months but stretching out years, then labor availability / retention issues. Next, Russia invaded Ukraine — another significant, long-term impact on the quantity & security of supply of several key commodities.

And, decades-high inflation. Mining costs are hitting margins in every commodity, in every jurisdiction. Anglo American saw unit costs rise 16% in 2022, BHP is expecting its coking coal operations to absorb 14.5% inflation in the year ending 6/30/23.

One company that’s not overly concerned about spiraling costs? Morien Resources Corp. (TSX-v: MOX) / (OTCQB: APMCF). It has a robust, long-term 2%-4% royalty based on coking coal sold at the Cline Group’s (“CG“) Donkin operations in Nova Scotia, Canada.

Morien has no equity interest in Donkin or the CG, but for the initial 500,000 tonnes sold in any quarter, Morien receives 2% of sales after transportation & handling costs. In addition, the Company is paid 4% of revenue on each quarterly tonne above 500,000.

Most Net Smelter Royalties (“NSRs“) can be “bought down” from 2-4% to 1%, Morien’s royalty has no buy down provision or production cap.

The CG is very experienced in underground mining with the ability & motivation to make yet another hugely successful, efficient & safe operation. The CG operated 4 of the top 10 most productive u/g coal mines in the U.S.

The mine has a 484M Indicated + Inferred tonne resource that ranks as a high-vol “B” semi-soft coking coal characterized by low ash, high vitrinite & fluidity, high crucible swell number and high energy (heat, Btu) value.

Periodically that high-Btu value makes it amenable for sale into thermal markets, but longer-term this is a valuable steelmaking coal.

For readers concerned about the four-letter word “coal”, please recognize the critical difference between the thermal & coking / metallurgical varieties. The use of thermal (energy) coal — burned to generate electricity — is in (long-term) decline.

Yet coking coal used in steelmaking, especially in the seaborne market delivered to Asia & Europe, will remain in widespread use for decades. If the world is serious about fighting climate change, steelmaking coals from Australia & Canada will remain critically important.

The chart below depicts trade flows in 2022 in which nearly 28M tonnes of coking coal poured out of Canada. The vast majority exited through the west coast to Japan & China. Donkin’s coking coal is well positioned to serve Europe, Brazil & India via the east coast of Canada.

Global decarbonization is impossible without tremendous amounts of new steel capacity to build the power plants, solar/wind farms, infrastructure, EVs & grid expansions required to power the, “electrification of everything“.

I wrote about Morien in August, 2022 (before production had recommenced ) when the stock was $0.59. Since then it has eased slightly to $0.57, even as the number of shares outstanding is shrinking via a buyback program. The stock’s performance is due largely to coal prices having declined.

Since my last article, the Donkin mine is now IN PRODUCTION. I believe the de-risking associated with ramping up operations offsets lower prices, which were expected to decline from ultra-high levels, but remain elevated.

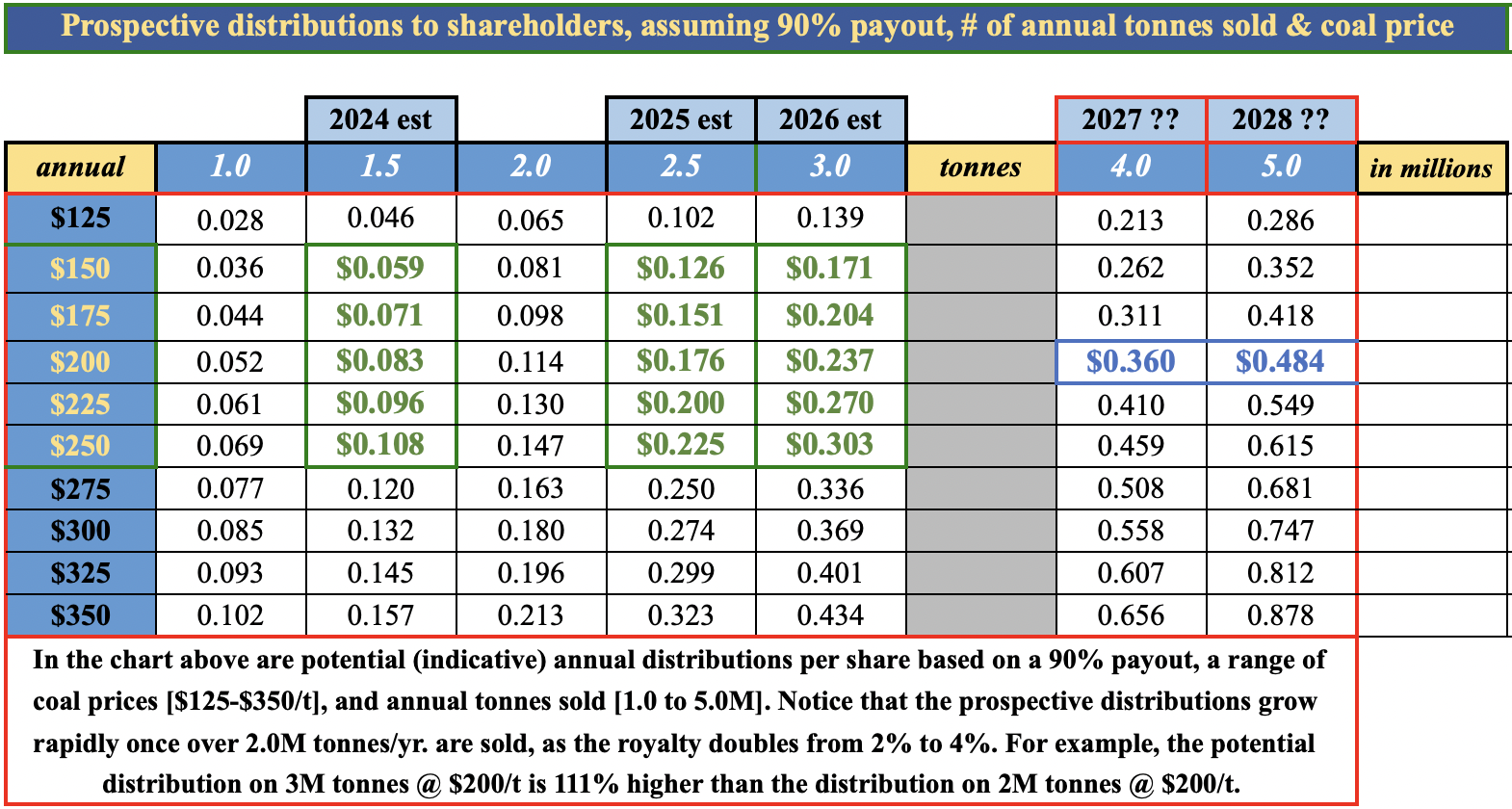

The crux of last year’s article is the following (updated) chart showing possible coal prices & production levels. Under 1M tonnes will be sold this year, so I’m now focused on 2024-26.

For CY 2024, I estimate a possible dividend distribution of $0.059-0.108/shr., based on a coal price of $150-$250/tonne, 1.5M tonnes sold & 90% of royalty income distributed to shareholders. For example, a $0.071 distribution in 2024 would be a 12.5% yield on the current level of $0.57.

I assume a 90% payout ratio to capture the full value of the royalty. Any funds retained on balance sheet will be used for shareholder friendly pursuits.

Production is ramping up prudently with safety the top priority. Morien’s board needs to collect cash before distributing it, which means they’re a quarter behind the Donkin mine ramp up in terms of distributions.

In my estimation (not necessarily that of management) an annualized run-rate of 3.0M tonnes/yr. should be reached in 2025.

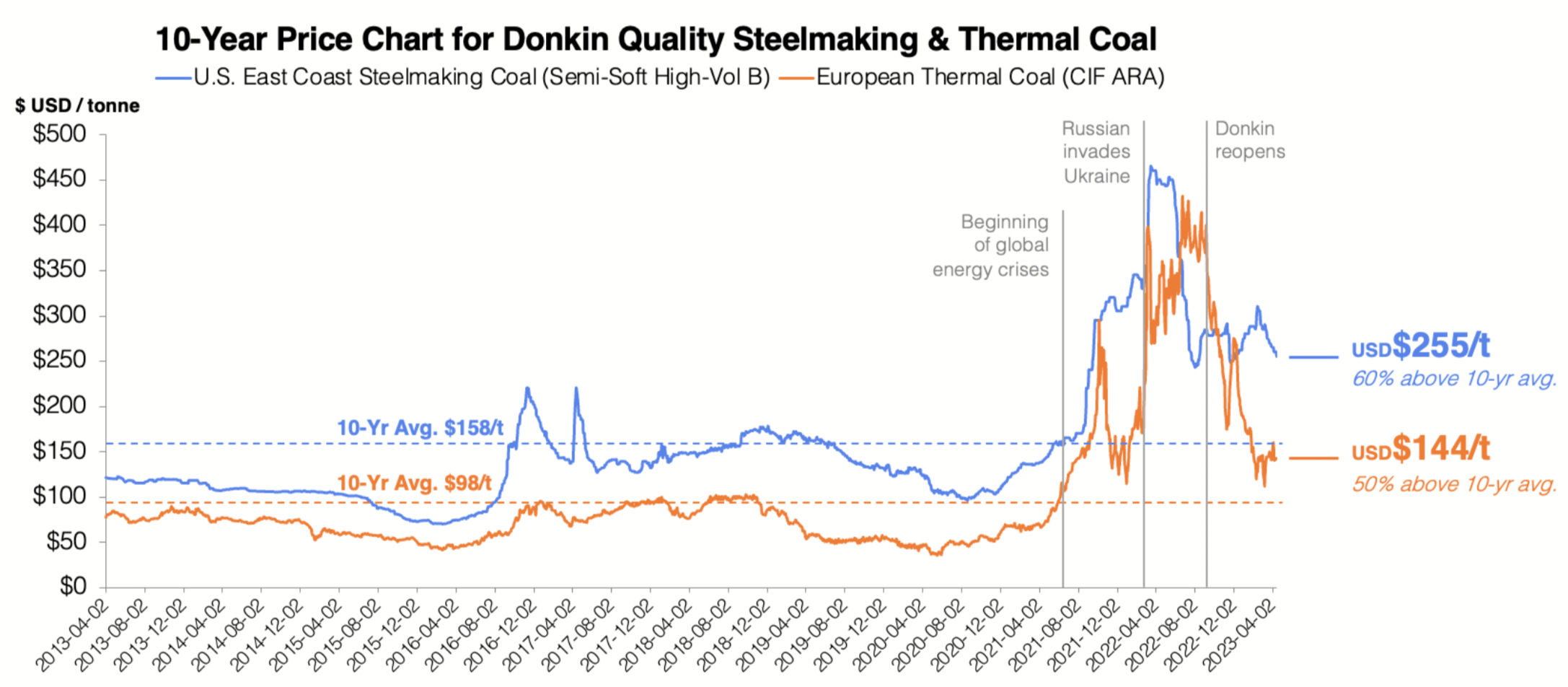

Therefore the CY 2025 payout could be $0.126-0.225/shr. based on $150-250/t and 2.5M tonnes sold. The current price of high-vol semi-soft coking coal in the eastern U.S. is US$255/t., vs. the 10-yr. average of $158/t.

Importantly, adjusted for inflation that 10-yr. avg. is ~$191/t.

Using the mid-point of $0.176 equates to a 2025e yield of 31%. Since there’s risk involved in achieving that 31% distribution, (timing, coal prices & operational challenges) buying shares is not a no-brainer. However, in my view the risk is more than countered by commencerate high return potential.

I think it’s reasonable to assume the payout in 2026 on a full 3.0M tonnes sold could be $0.171-0.303. Assuming the mid-point, that suggests a potential long-term annual distribution of $0.237, a 42% indicative (future) yield on today’s stock price.

If all goes well, by 2025 or 2026 a long-term yield of 10%-12% might be deemed acceptable to invest in Morien. In that case, the share price could eventually rise to ~$1.97–2.37 on that prospective (recurring) distribution.

Another way to value Morien is to consider Enterprise Value [“EV“] {market cap + debt – cash) / EBITDA multiples of other royalty players. For instance, precious metal royalty companies Franco-Nevada, Royal Gold & Wheaton Precious Metals trade at an average EV/EBITDA multiple of ~29x.

To be fair, those companies are well established and gold is a lot sexier than coking coal! Instead, compare the Company to industrial commodity royalty firms Altius Minerals & Labrador Iron Ore Royalty Corp., who have an average EV/EBITDA multiple of ~12x.

The latter is very similar to Morien because its value is derived from iron ore (also used in steelmaking). The distribution yield of Labrador Iron Ore is 9.6%.

Assuming an 8x multiple of 2026e EBITDA (and discounting that back three years at 12%/yr.) would result in an EV of $113M. Dividing that figure by shares outstanding generates an indicative stock price of $2.24.

A future $2+/shr. might seem aggressive, but remember that the Company is buying back shares, the outlook for seaborne coking coal is robust, and inflation is propping up commodities.

Readers might be wondering why I include prices up to $350/t and production up to 5M tonnes/yr. Prices were well above that level for a few months in 2022.

Regarding the 5M tonnes/yr., that’s based on talk around the CG installing a longwall mining operation (for which they are known experts). However, that probably wouldn’t happen before 2025-26.

Having said that, existing continuous mining methods, with or without a longwall, could be expanded to produce up to 5M tonnes/yr. before another shaft would need to be sunk for increased ventilation.

Although my commentary about distributions does not go beyond 3.0M tonnes/yr., the chart above shows some possibilities. 4-5M tonnes/yr. might not arrive before 2027 or 2028 (if ever), but the chances of really big payouts down the road shouldn’t be ignored.

Morien is an exciting opportunity because it works at current coking coal levels. In fact, today’s index price (Hampton Roads on the east coast of the U.S.) of US$255/t could fall to US$150/t and distributions would still be attractive as long as 3.0M tonnes/yr. are sold.

Importantly, I believe the days of $350+/t semi-soft coking coal are not behind us. ESG mandates, extreme weather and/or geopolitical considerations could send prices soaring again, even if for a quarter or two from time to time. But, higher pricing is icing on the cake.

A bet on Morien Resources (TSX-v: MOX) / (OTCQB: ATMCF) is a bet that high-vol, semi-soft coking [AND/OR (periodically) high-Btu thermal] prices remain strong, but by strong I don’t mean $250+/t, just $150+/t.

The past three years have proven that prices will probably be volatile. However, if one believes as I do that the lower bound of the range is around $125/t, then high volatility should be welcomed.

Readers can take a closer look at this opportunity by reviewing Morien’s Corporate Presentation.

Disclosures/Disclaimers: Peter Epstein of Epstein Research [ER] has no current or prior relationship with any management team or board member, and no current or prior dealings with Morien Resources. The views contained herein are solely those of [ER] and are based 100% on publicly available information such as sedar filings, the corp. presentation, conversations with mgmt. & peer company analysis. Since July 2022, Peter Epstein has owned shares of Morien Resources acquired in the open market.

Although [ER] is bullish on the prospects of Morien Resources, it’s possible that [ER] is wrong about the Company in one or more key respects. [ER] could be wrong about the ongoing, anticipated strong demand for seaborne coking coal in blast furnaces. [ER] could be wrong about coking coal prices remaining stronger for longer. [ER] could be wrong that Donkin’s high-Btu coal will continue to be sold into thermal coal markets (from time to time). Unplanned production curtailments at the Donkin mine will lower the amount of cash flow available for Morien Resources to distribute.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)