No country is safe when it comes to exploring & developing mining projects. No matter how robust a country’s permitting protocols are, local opposition ALWAYS poses a threat. That, or hints of resource nationalism like what we’re seeing in Chile & Mexico for lithium.

At any given time there are jurisdictions where things slow to a crawl. I recently spoke with the founder of a leading Argentinian copper (“Cu“) developer who lamented the fact that inflation is running at nearly 100%.

In Ecuador, the spread of illegal mining led the government to declare it a threat to national security after identifying direct links to other criminal activity such as money laundering, drugs & arms trafficking.

Chile is by far the world’s largest Cu producer, but concern over water usage is growing as lithium increasingly competes with Cu projects. And, that’s not where the competition ends, driving costs higher for highly-skilled executives & critical services.

Many operations are forced to desalinate seawater. Very significant energy is required to run desalination plans, build pipelines & pump huge quantities of water 80+ km and up thousands of meters into the mountains.

Of the two main categories of problems; 1) local / political / social vs. 2) environmental / water usage & logistical issues due to remoteness and/or ultra-high elevations, the former can be tackled with robust community outreach.

Project economics can be more equitably shared and environments can be prudently protected. Yet only heavy spending & long timelines can alleviate water scarcity and mitigate the challenges of operating at 4,000+ meters.

In Peru there are some operations at very high elevations, but aside from those areas the main challenges come from local opposition, often in the form of political protests, that block major mines for days/weeks at a time.

Despite the risks of S. America — that’s where the Cu is! Chile & Peru will remain major producers for decades to come and newcomers in Peru like Element 29 Resources (TSX-v: ECU) / (OTCQX: EMTRF) can benefit by avoiding (as best they can) legacy issues & mistakes.

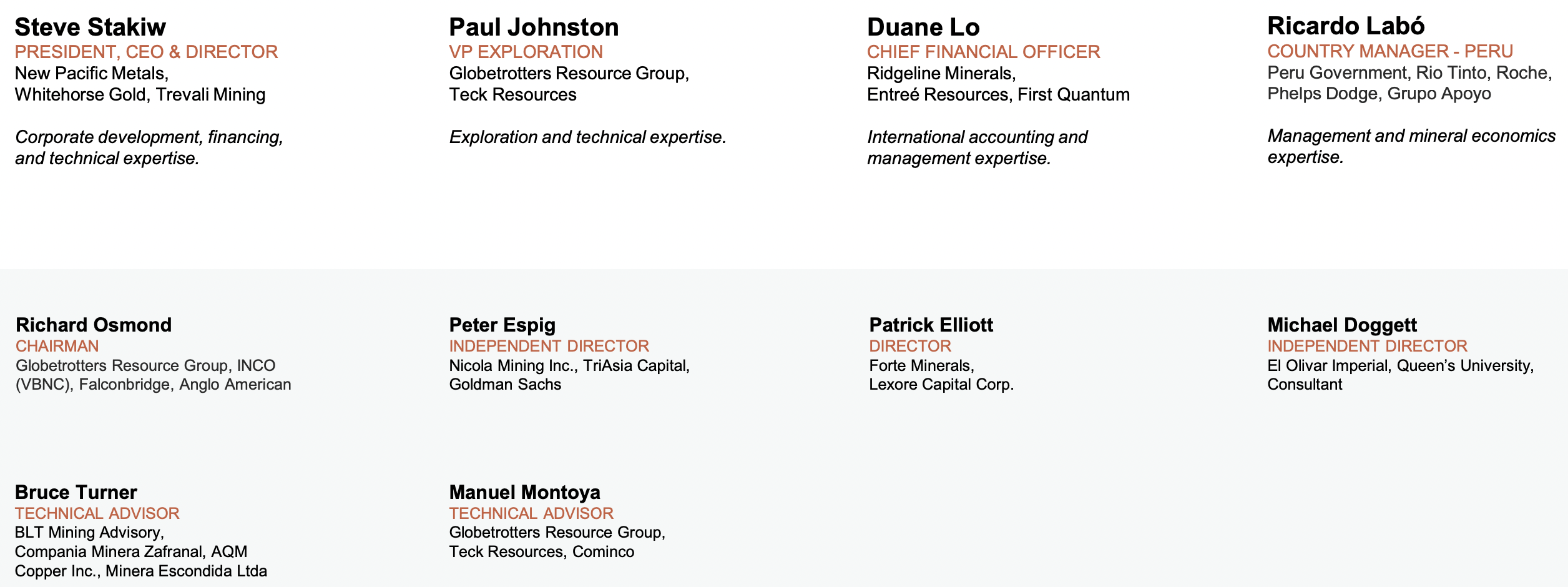

The following map of Peru captures Element 29’s compelling opportunity in several key respects. First, the Company’s two main projects Elida & Flor de Cobre (“FdC“) are clearly in excellent locations near medium-sized, large & very large mines.

That means they’re near critical infrastructure. Notice that many of the red circles are to the right (east) of Elina & FdC — they’re farther from coastal ports than Element 29’s projects.

Some of the red dots sit at ultra-high elevations of 4,000+ meters. Peru hosts the world’s highest mines, up to 5,000 meters above sea level.

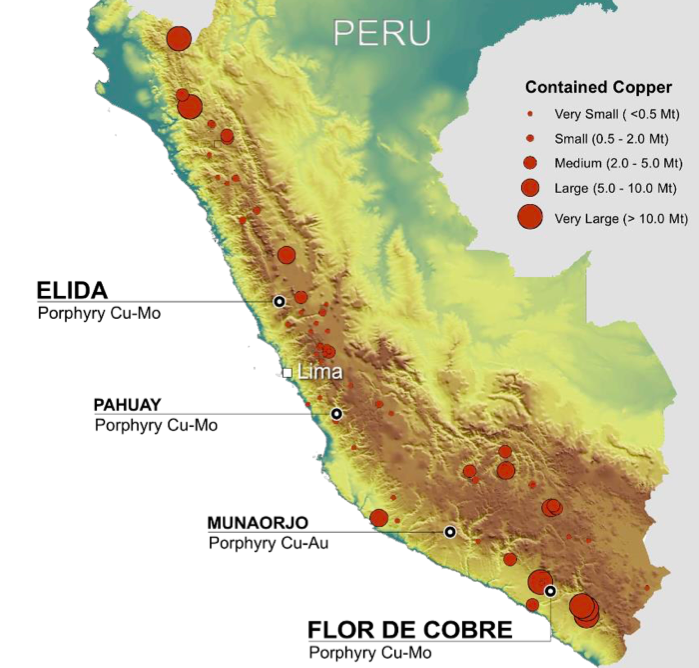

With a capable management team, board & advisors it’s possible to achieve great success in difficult locations. The twin paradigm shifts regarding the electrification of everything & decarbonization rely most heavily on just a few metals. At the top of the list is Cu.

Many of the world’s largest Cu mines are very old. Some point out the ages to highlight falling head-grades & deeper open pits leading to rising op-ex.

When I think about elderly mines, I think of how much lower upfront cap-ex was, how much faster paths to production were and the minimal ESG hurdles. That’s why new production in Peru will require both scale & grade.

For a quick snapshot of Cu fundamentals, Goldman Sachs projects a global shortage of visible inventories by September and major metal trader Trafigura expects Cu to hit a record high later this year as China emerges from strict COVID-19 restrictions.

Most everyone knows that demand for Cu will be strong, yet supply from Chile has been declining.

According to Cochilco, annual Cu production in Chile fell 5.4% in 2022, while Codelco suffered a 10.6% fall. The world’s second largest Cu mine, Collahuasi, a JV between Anglo American & Glencore, reported a 9.4% decline in 2022.

Bloomberg recently reported that Codelco is expecting a further drop of ~7% this year.

A third of the world’s newly mined Cu came from; Chile (23.6%) & Peru (10.0%). Another third from six countries; the DRC, China, Russia, Indonesia, Zambia & Kazakhstan. In my opinion, Peru is less risky than those six!

Element 29 is a pre-PEA junior with two exciting projects in Peru, Elida in west-central Peru is the more advanced. It has a 322M tonne Inferred resource, equal to 2.24 billion pounds of Cu.

Surprisingly, 2.24B pounds is not that big compared to dozens of mines & development projects across S. America. However, the deposit has room to grow. The resource is on just one of five identified porphyry centers. A larger company could be much more aggressive in drilling.

Moreover, it’s just 85 km from the coast, has a low anticipated strip ratio and no elevation, water or power issues. The Cu grade at 0.32% is decent, but porphyry projects have by-product metals like, gold, silver and/or molybdenum (“Mo“).

For Elida, I highlight the Mo content at 0.029% because its price has increased to US$33.6/lb. from a 10-yr. average of ~US$12.7. The IEA projects Mo demand to grow at a 5.5% CAGR through 2040.

Note: All relative value commentary & interpretations are my own, not necessarily the views of management. Management does not assume that the current very strong Mo price is sustainable longer-term.

At spot prices the value of Elida’s Cu is ~US$28.2/t and the Mo ~US$21.5/t. In looking at peer development projects/mines around the world, a 0.029% Mo credit is quite attractive. For example, Los Andes’ giant Chilean project has a 0.014% Mo credit, Lundin Mining’s Caserones is 0.011% Mo & Cerro Verde has 0.01% Mo.

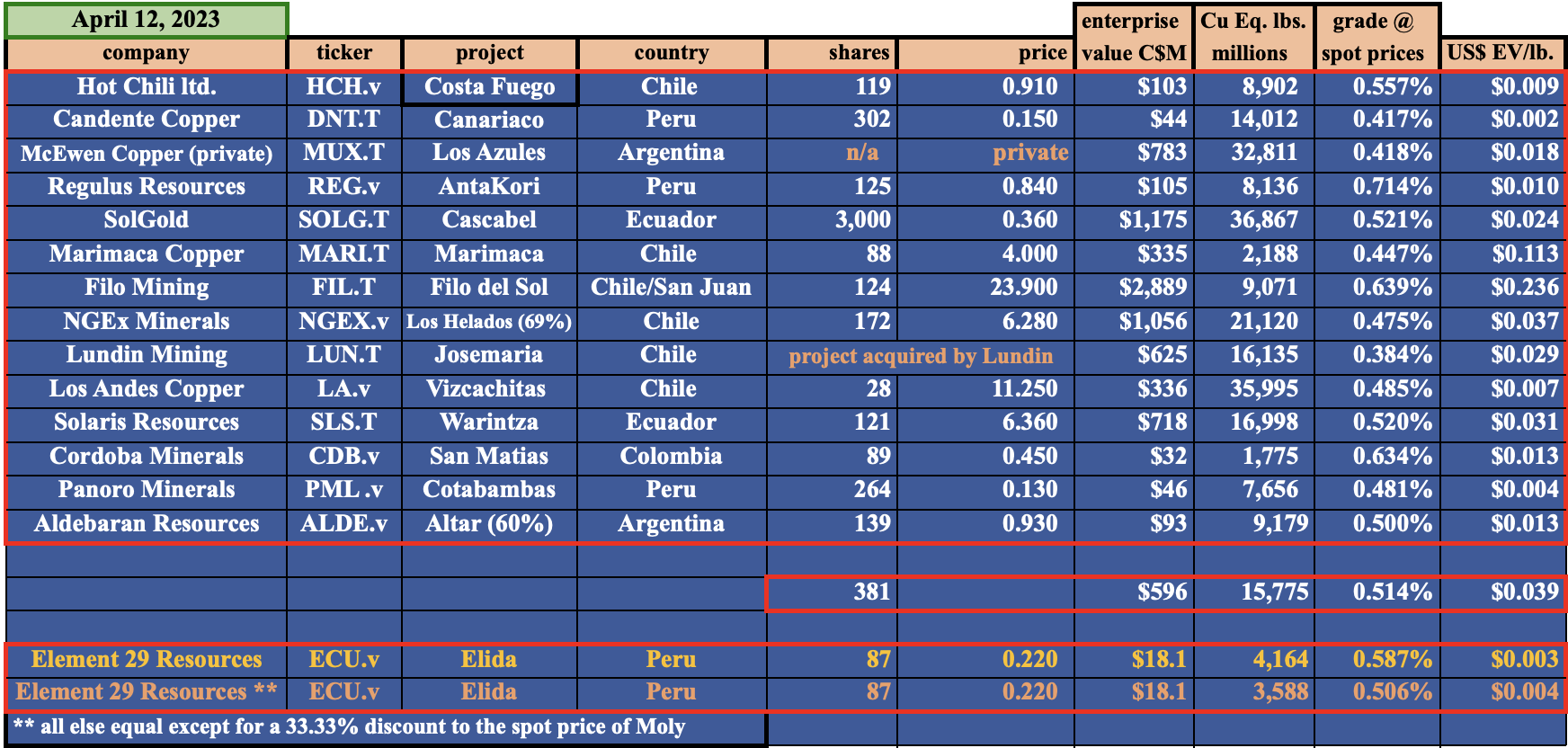

Note: My Cu Eq. grades use US$4.00/lb. Cu, US$2,000/oz. gold, US$25.00/oz. silver & US$33.57/lb. Mo. However, assuming a 33.33% discount to the spot price of Mo, it would be US$22.38/lb., and the Cu Eq. grade at Elida would be 0.506%. The average monthly Mo price on tradingeconomics.com over the past 24 months is US$21.75/lb. Recoveries are assumed to be 100%, grades are uncut. {see chart above}

A near-surface subset of the mineral resource contains 34.1M Inferred tonnes at 0.55% Cu & 0.037% Mo, a Cu Eq. grade of 0.86% (at today’s prices). If one’s willing to give the Company credit for the much higher Mo price, prior drill holes can be viewed in an even more favorable light.

A drill hole at Elida in early 2022 returned 909 m at 0.39% Cu + 0.035% Mo, a Cu Eq. grade of 0.68% over nearly a km! Included in that long interval was 340 m at a Cu Eq. 0.80%.

Another hole returned 384 m of 0.54% Cu + 0.035% Mo, a Cu Eq. of 0.83%. A third hole had an interval of 183 m of 0.47% Cu + 0.047% Mo for a Cu Eq. grade of 0.86%.

Adjusted for spot pricing, Elida’s Cu Eq. grade at 0.587% is higher than the corresponding adjusted grades of key projects & mines owned by Anglo American (Los Bronces & Quellaveco), Southern Copper (Toquepala), Codelco (Radomiro Tomic, Salvador & Chuquicamata), Teck Resources (Quebrada Blanca), Freeport (Cerro Verde), Antofagasta Minerals (Centinela, Antucoya, Los Volcanes, Zaldívar & Polo Sur), Candente Copper, McEwen Mining, NGEx Minerals, Lundin Mining (Josemaria, Chapada, Caserones & Candelaria), KGHM South32 (Sierra Gorda), SolGold, First Quantum (Taca Taca & Haquira), Los Andes, Hudbay Minerals (Constancia), Solaris Resources, Marimaca Copper, Sibyane-Stillwater/Aldebaran Resources, Hot Chili & Panoro Minerals.

On March 6th management announced an interval of 404.5 m of 0.45% Cu + 0.032% Mo, for a Cu Eq. grade of 0.72%. Importantly, the mineralization didn’t end at the bottom of this hole. The last 13.4 m returned a robust 0.75% Cu / 1.02% Cu Eq. Compare Element 29’s Cu Eq. grades to mines in western Canada operating at under 0.30% Cu Eq.

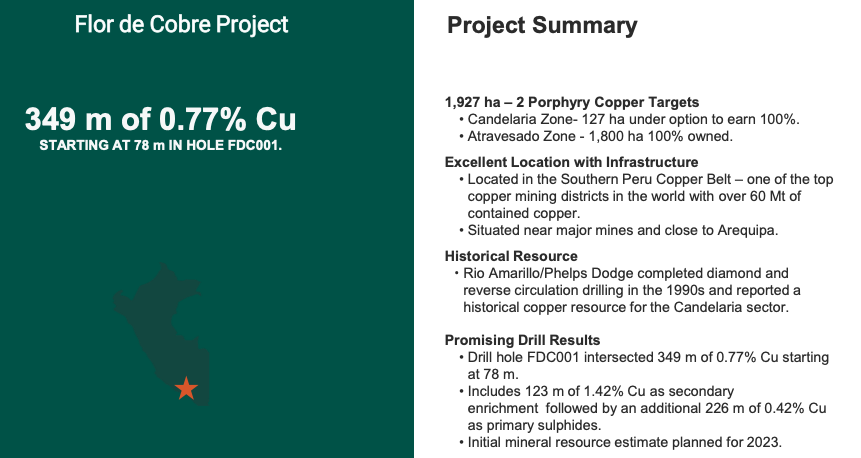

Flor de Cobre is in the Southern Peru Copper Belt ~30 km southeast of Freeport McMoran’s Cerro Verde mine. It hosts two Cu porphyry targets; an option to earn 100% of the past-producing Candelaria project, and 100%-owned Atravesado, a large 1.5 x 1.6 km area of interest. Last year the Company completed a 4,532 m / 12-hole drill program at Candelaria.

The top drill result was 349 m of 0.77% Cu, (from 78 m) incl. 123 m of 1.42% Cu. Nine holes twinned historical drilling and three tested the primary Cu sulphide mineralization potential to > 500 m depth.

At spot pricing Element 29 Resources (TSX-v: ECU) / (OTCQX: EMTRF is trading at just US$0.003/lb. Cu Eq. This compares to an average of US$0.02/lb. for other S. American projects (some more advanced, some a lot larger, but most lower grade at spot pricing).

Note: {see chart above}, I exclude the two highest EV/lb. figures to reach the average US$0.02/lb. value.

Long before Element 29’s projects reach production they will likely be acquired by one of several dozen developers/producers (I mentioned 24 prospective suitors so far).

Here are 14 more in S. America; Rio Tinto, Barrick Gold, Newmont Gold, Vale S.A., BHP, Fortescue Metals, Grupo Mexico/Southern Copper, Zijin Mining, Sumitomo Metal, Mitsubishi Corp., Buenaventura S.A.A, MMG Ltd., Capstone Mining & JECO. In total that’s three dozen companies that should care about Element 29.

Make no mistake, management is in no rush to sell. Not as long as they continue to find more high-grade Cu & Mo! In my view, the Cu Eq. resource could double by the end of next year with the addition of a Flor de Cobre resource, plus ongoing drilling at Elida.

Seven billion pounds Cu Eq. at just US$0.01/lb. would be worth ~C$94M vs. today’s enterprise value {market cap + debt – cash} of ~C$18M.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Element 29 Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Element 29 Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Element 29 Resources was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)