It took six months, but I can now say with confidence that (spot) battery-quality Lithium (“Li“) prices in China have bottomed. Investing.com shows the price bouncing +43.5% from 165,500 yuan/tonne on April 25th to 237,500 yuan/t on May 17th.

The current level equates to ~US$33.9k/t. Anything in the US$30s-$40s thousands/t is incredibly strong compared to levels prior to mid-2021.

Pundits correctly point out that longer-term contract pricing — still in the US$40s to $50s thousands — is more representative of the overall market.

M&A activity is also showing strength with Albemarle trying to acquire Australia’s Liontown Resources and the announcement last week of a merger between Livent & Allkem. Liontown is up +82%! since Albemarle’s interest was revealed.

In February, Tesla was rumored to be mulling a takeover bid for Sigma Lithium. Sigma is up +40% even though no bids have emerged.

I find it interesting that Albemarle is up ~21% in conjunction with the turn in Li spot prices. That’s a serious move for a C$36B company. By contrast, most smaller players haven’t followed suit. For instance New Age Metals (TSX-v: NAM) / (OTCQX: NMTLF) is up just 10% from its one-month low.

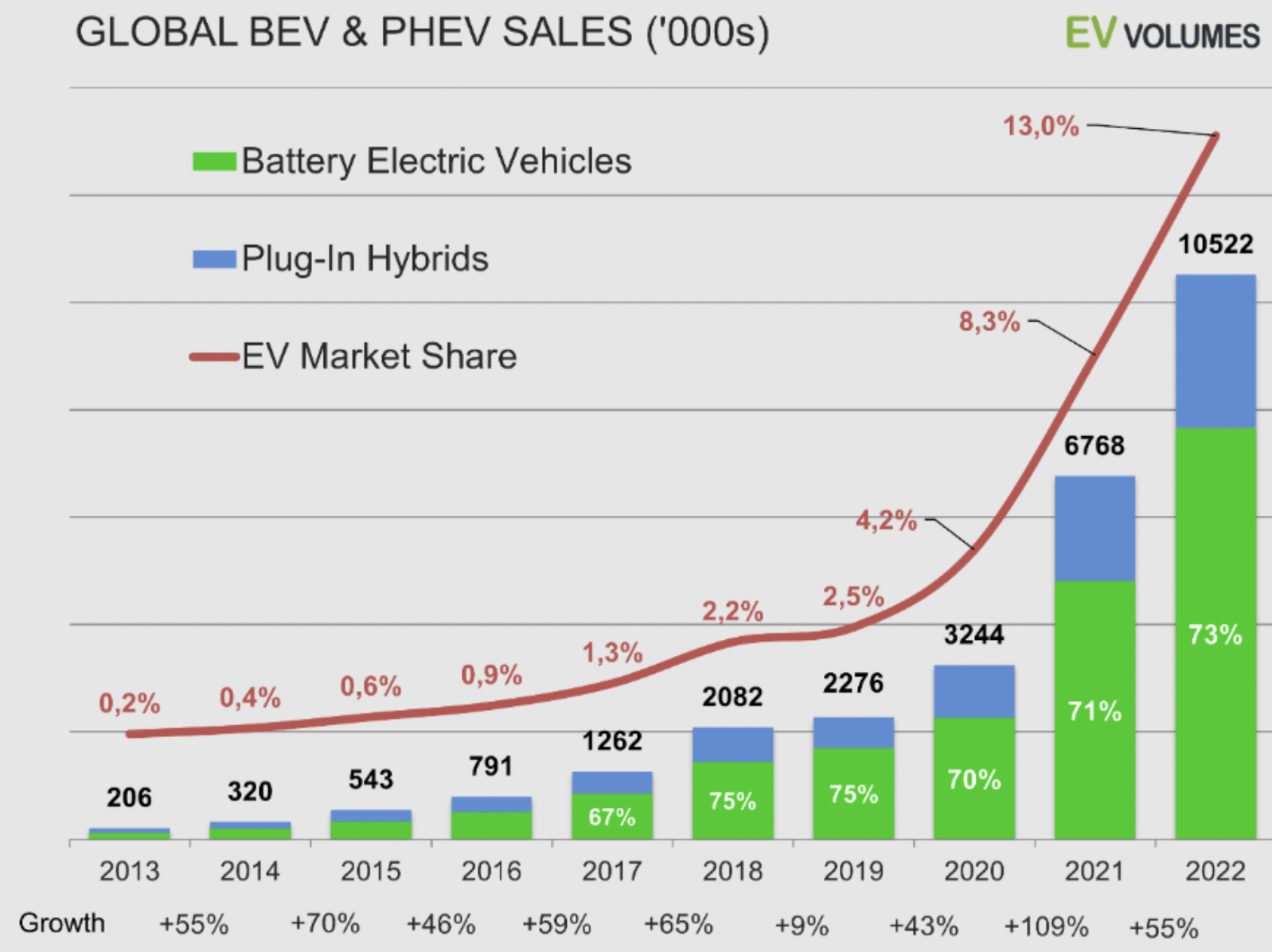

I believe sentiment for Li juniors should change with prices decisively on the rise, plus M&A news flow. In addition, EVvolumes.com, notes that global EV sales grew at a 3-yr. CAGR of 67% through 2022. Even COVID-19 could not deter the paradigm shift to EVs.

After a sluggish start in China & Europe, global EV sales picked up in March/April and are now on track to surpass 14M units (+35-40%) this year.

Issuing new shares to fund land acquisitions & exploration/development of junior mining projects remains difficult. Unlike the vast majority of peers, New Age has a strategic partner on nearly 30% of its 74,448 ha — the property portfolio in SE Manitoba — that Australian Li Major Mineral Resources (“MinRes“) has a farm-in agreement on.

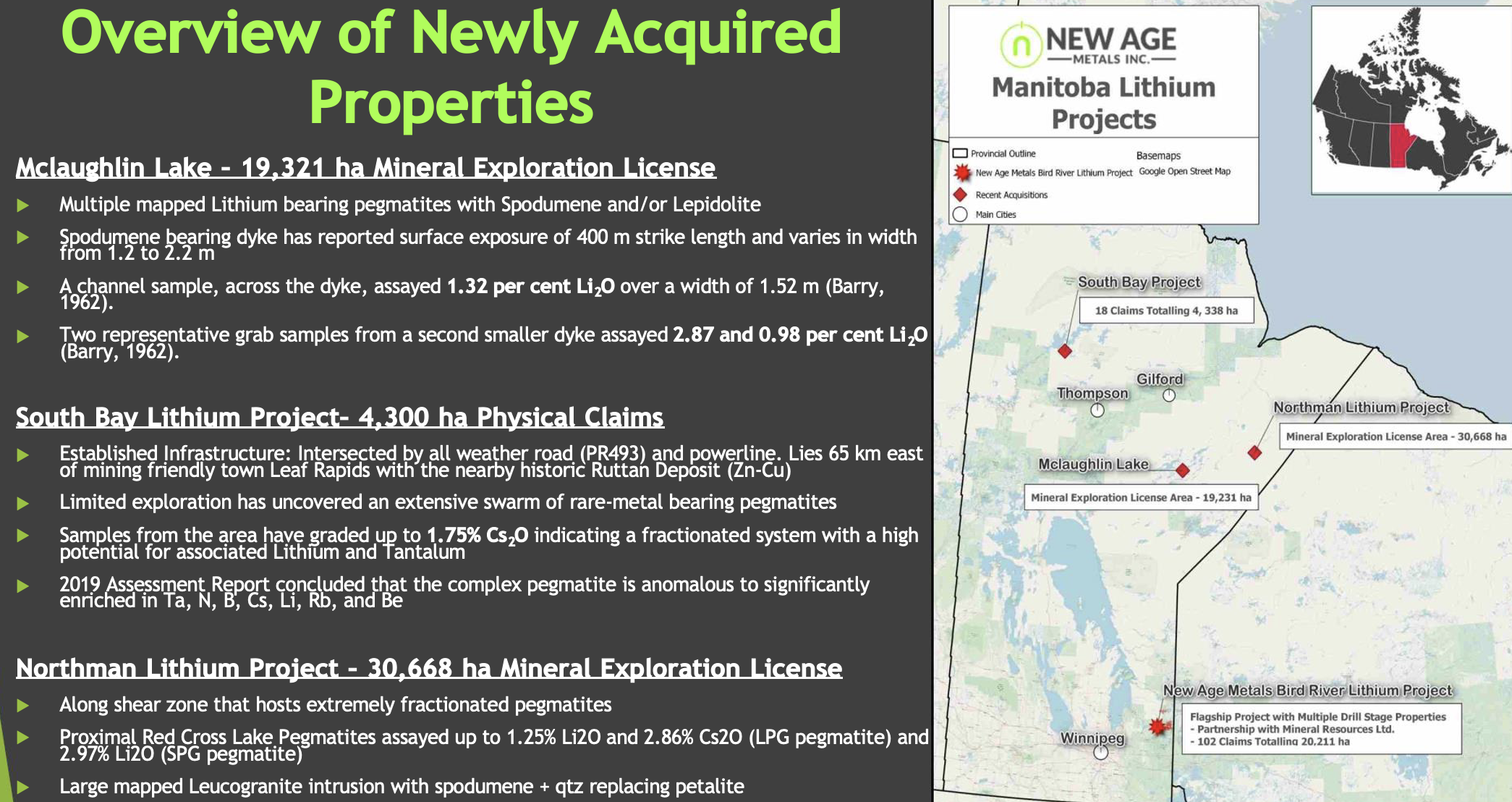

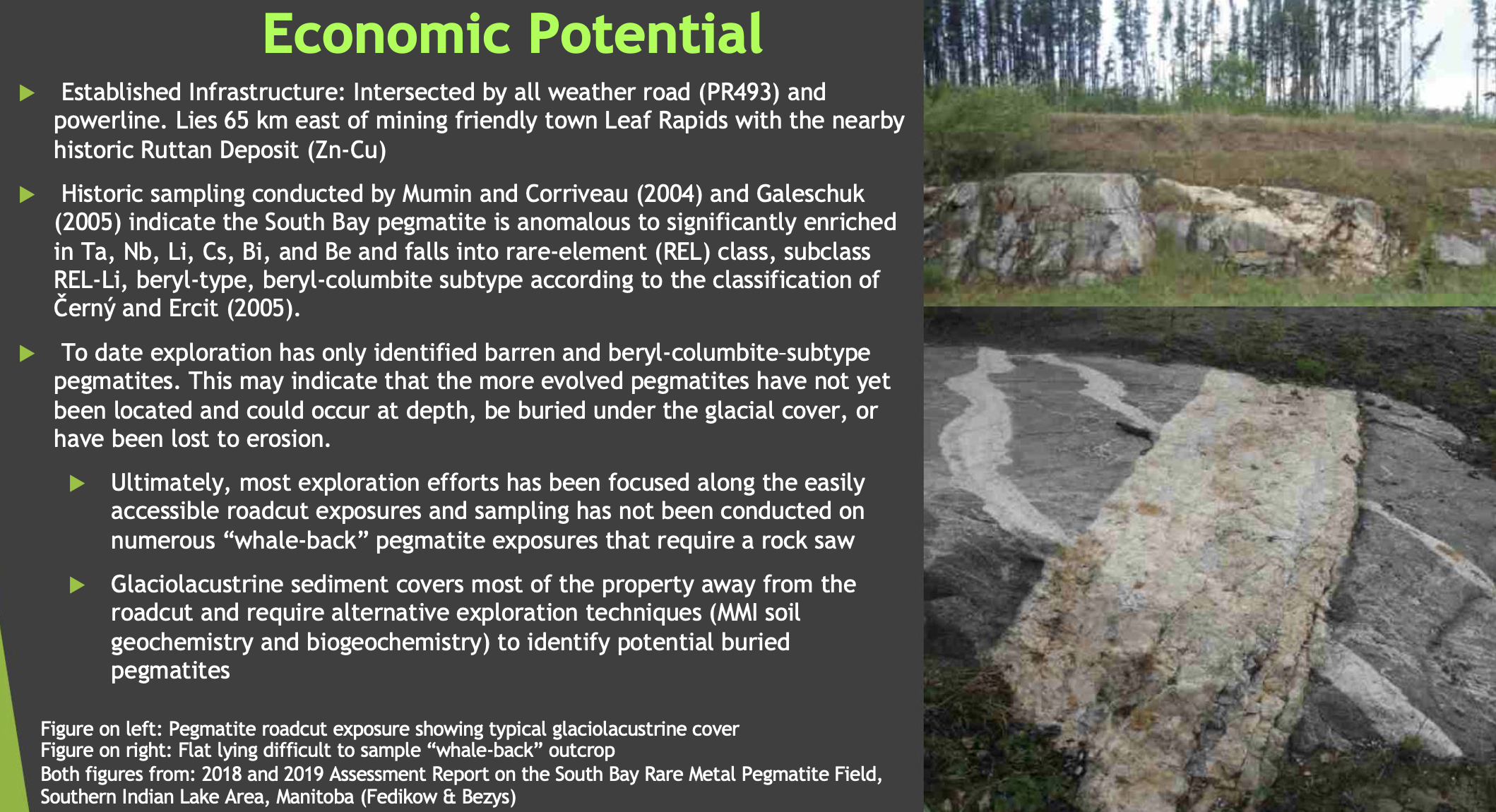

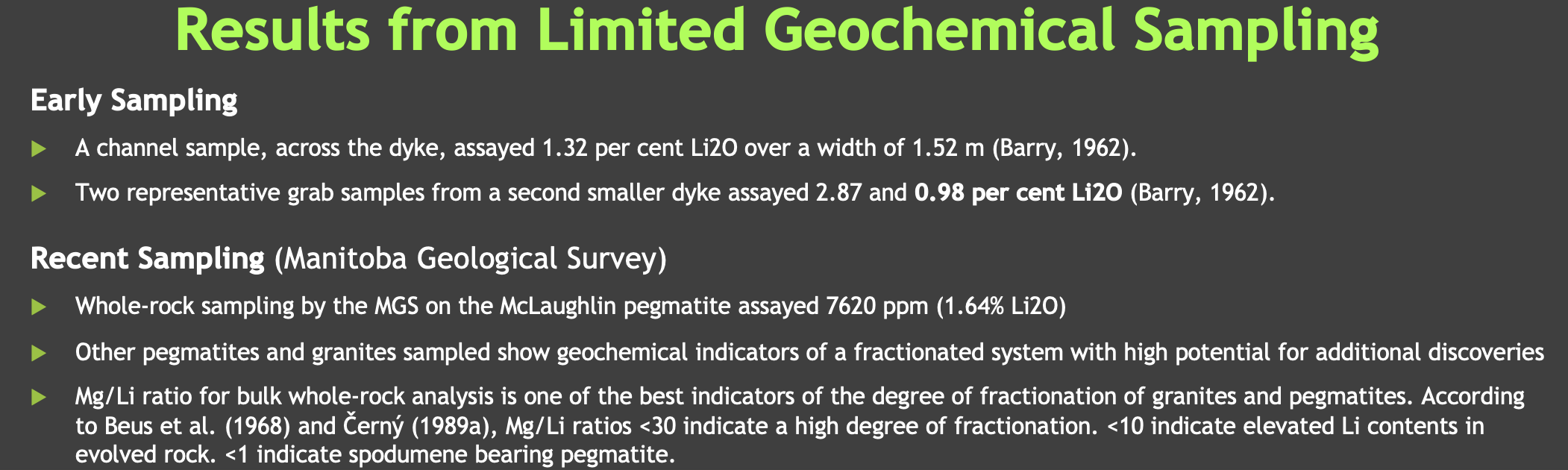

New Age recently secured 30,668 hectares at Red Cross Lake, its 3rd property acquisition of the year. The Northman Lithium project has 28 km of strike length surrounding a LCT pegmatite swarm with historical assays up to 1.25% Li2O & 2.86% Cs2O from lepidolite pegmatite and up to 2.97% Li2O from spodumene pegmatite.

Interest in hard rock lithium properties in Canada is very high. At March’s PDAC conference in Toronto, CEO Harry Barr’s team held meetings with five Major Li and/or auto and/or Li-ion battery players about its N. Manitoba properties.

CEO Barr continues to negotiate prospective farm outs of parts of the N. Manitoba portfolio. In addition to Majors spanning Canada there are 25+ Australian-listed juniors, plus private groups, that want into Canada.

Partnering with New Age is easier & more efficient than staking/acquiring ground, obtaining permits, doing environmental studies & building meaningful relationships with First Nations.

Australian-listed companies in Quebec & Ontario include Winsome Resources, Green Technology Metals, Critical Resources, Benz Mining, Cygnus Metals, Burley Minerals, Loyal Lithium, Patriot Lithium, Koba Resources, Cosmos Exploration, Battery Age Minerals and newly-listed Leeuwin Metals in Manitoba.

Importantly, New Age will soon announce the budget that MinRes plans to deploy in SE Manitoba for the year ending 6/30/24. Through 6/30/23 the budget is C$2.2M. I imagine the new figure will be higher, hopefully a lot higher.

As Major & mid-tier Li producers, EV & battery makers and commodity traders blanket Quebec & Ontario, it’s becoming harder to find large new projects to invest in. That’s why promising prospects in other provinces are rising to the top of investor lists.

The following Australian companies are known (or thought to be) looking in Canada; Wesfarmers, Pilbara Minerals, IGO Ltd., Liontown, Core Lithium & Sayona Mining. Sayona is already there…

Others include Rio Tinto, POSCO, Albemarle, SQM, Allkem (already there), Sibyane-Stillwater, Lithium Americas, Livent (already there) & Lithium Royalty Corp. (already there).

Add to that OEMs including; Volkswagen, BMW, Tesla, Ford, GM, Stellantis, Honda, Mercedes-Benz… and battery makers such as; Umicore, SK Innovation, LG Energy Solution, Panasonic, Samsung & BASF.

LG ES is rumored to be looking for more Li plays, having invested in at least two Canadian juniors so far. Regarding commodity traders, some are already partnering on Li projects or have announced plans to do so, names like; Glencore, Traxys Group, Sumitomo, Mitsui & Co., ITOCHU, Koch Minerals & Trading, Mitsubishi, Trafigura Group and Hanwa.

Even without a single Chinese strategic partner or acquirer there are dozens of companies trying to gain a foothold in Canada. Management is taking a prudent, risk-minimizing approach towards expansion in the Li space.

For those wondering about N. Manitoba being too remote, it’s no more remote than parts of northern Ontario or Quebec, and in some cases is less remote than parts of B.C., Saskatchewan, Yukon & the Northwest Territories.

Multi-billion dollar companies with long-term visions of building Canadian Li powerhouses are clearly interested in Quebec & Ontario hotspots. However, areas like the James Bay region of Quebec are increasingly difficult to enter in a meaningful way.

Other Canadian provinces will eventually develop a handful of Li mining/processing hubs. Having said that, New Age’s SE Manitoba portfolio is near the Ontario border.

Its assets could be commercialized alongside key regional projects. For example, readers are reminded that Canada’s only producing Li mine is in SE Manitoba.

Switching gears to talk about PGMs, the 3.9M oz., River Valley Palladium (“Pd“) project is New Age’s flagship (non-Li) asset. In 2019 a PEA showed an after-tax NPV of $187M. Management now plans to complete the River Valley project PFS as an updated, enhanced PEA instead.

In a world of tight Li supply, OEMs might be forced to double down on hybrids to sell more units. Palladium is a hedge against a shortage of Li. How likely is a shortage?

Albemarle is forecasting demand of 3.7M tonnes of Li carbonate equiv. (“LCE“) in 2030. That’s about 4x current run-rate production levels. Even 3.0M tonnes/yr. seven years from now feels like a stretch given the visible pipeline of hard rock, brine/DLE & clay-hosted Li projects.

Earlier this month management announced the results of Rhodium (“Rh“) studies. Rh is used in catalytic converters to clean vehicle emissions. The majority of Rh is produced as a by-product of platinum mining in S. Africa & Russia.

Since River Valley’s initial PEA, metallurgical work has been ongoing to improve recoveries & concentrate grades, extend mine life & improve production/recovery of Rh, with a spot price of US$7,100/oz., ~3.6x the price of gold.

The upcoming enhanced PEA will include optimization of the mine plan, production schedule, mineral processing and tailing storage facilities for a smaller operation with a reduced environmental footprint.

Back to Li, I think the planets are aligned for a bull market in juniors like New Age Metals, especially companies less reliant on raising equity capital. Management is in discussions (some reasonably advanced) with multiple parties to help develop its assets.

With the spot price in China up +43.5%, global EV sales surging again and M&A activity picking up, juniors in strong jurisdictions like Canada could bounce back handsomely this spring/summer.

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about New Age Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of New Age Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, New Age Metals is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)